In 2010, ISS ESG’s head of Climate Solutions Max Horster started one of the first companies to measure the impact of climate change on investments. From investment carbon footprinting to climate scenario analysis, from climate-linked proxy voting to climate neutral investments via offsets: over the years, the team pioneered a wide range of today’s leading methodologies and approaches across all asset classes. In 2017, Max and his team joined ISS ESG to form the first climate specialist unit of a global ESG service provider. Today, they cover over 25,000 issuers on up to 600 individual climate-linked data points and have screened over USD 4 trillion of AUM on their climate risks and impact. On the occasion of its 10th anniversary, the ISS ESG Climate Team shares 10 lessons from 10 years of helping investors to tackle climate change.

Lesson 8: Net Zero: Thanks for NOTHING

All of a sudden, Net Zero seems to be everywhere. Over 100 countries, including China, the U.S. and the EU, have pledged to become Net Zero. Further, over 100 local governments, nearly 1000 cities and 2000 businesses pledged to operate at Net Zero. Net Zero is now also the trillion dollar challenge for investors. The Net Zero Asset Owner Alliance and the Net Zero Investment Framework have embarked to build Net Zero portfolios.

Professed Net Zero investment portfolios face significant pitfalls, however, as even one of the most high profile climate advocates had to learn the hard way. Mark Carney – former Governor of the Bank of England and midwife to the Task Force on Climate Related Financial Disclosure (TCFD) – was forced to row back after claiming that his new home Brookfield was Net Zero. An outraged group of scientists and NGOs accused him of greenwashing by the use of carbon accounting tricks.

Net Zero Requirements

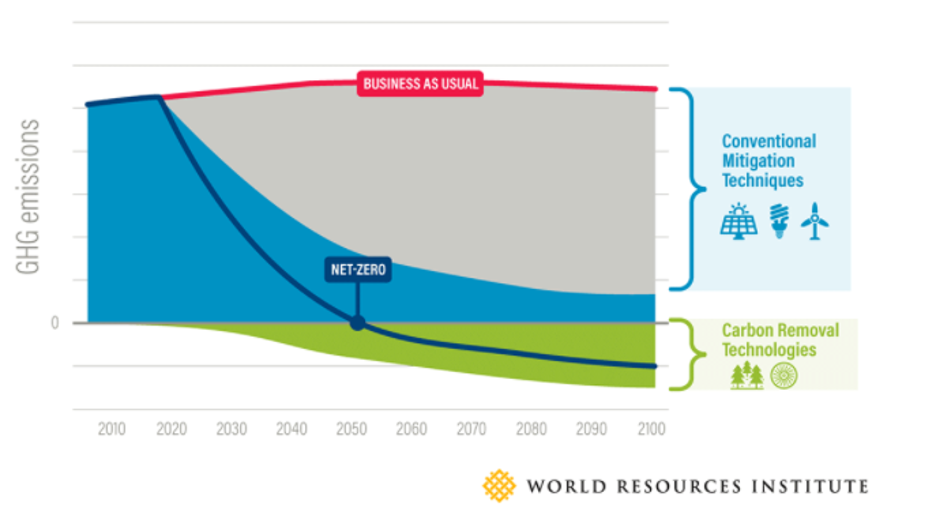

Most investors still fail to embrace the Net Zero challenge as they don’t always see its full scope. Our Net Zero future leans on emission reductions relying on non-existing policies in combination with emission removals relying on non-existing technologies.

Net Zero is a term used interchangeably with “Paris aligned” and “climate neutral”. It is often falsely described as reducing human-caused (anthropogenic) greenhouse gas emissions to zero. Such reduction to zero is, however, practically impossible. Even if we get rid of all fossil electricity and light our homes with a candle instead, we are still emitting greenhouse gases.

What Net Zero really means is captured in the “NETTING” concept. Net Zero means to not emit any NET emissions anymore at a certain point in the future, with the intention of limiting global warming to 1.5 degrees Celsius versus pre-industrial levels. Yes, Net Zero requires bringing down our emissions as much as possible – much more than current and stated policies require to date. At the same time – and largely overlooked – it also requires investing in taking the remaining greenhouse gas emissions out of the atmosphere by rapidly developing and scaling carbon removal technologies. This part of the equation, the sequestration of greenhouse gas emissions, sees very little investor attention.

Carbon Removals: An Untapped Opportunity

Carbon removals come in many forms and shapes. So called Negative Emission Technologies (NET) include:

- Natural removals such as by forestation or alternative land use;

- Oceanic removals such as the use of macroalgae (seaweed); and

- Technological removals resulting in carbon capture and storage – although there are voices that make the case for Carbon Capture and Storage not being a “true” removal.

The challenges are known. First: we need to remove 10 gigatons of greenhouse gas emissions by 2050 – more than what the US emits – per year! Second: none of today’s known approaches are able to absorb this amount. Take natural removals, for instance, still the only concrete carbon removal measure taken up by corporate Net Zero pledges: for the Net Zero plan of Shell alone, an afforestation the size of Brazil would be needed.

This should bring investors flocking to the table. A huge challenge and no solutions – isn’t that a great investment opportunity into new technologies? After all, as august a body as the International Energy Agency believes that “there is ample potential for cost reductions – the experience of wind and solar highlights what is possible – but, as with renewable energy, realizing this potential will require (…) deployment.” While there are some specialist investment outfits popping up on the topic, and companies like Stripe and Microsoft are leading the way to replace classic carbon offsetting with carbon removals, the necessary technologies remain overlooked by investors and dramatically underfunded, despite providing a trillion dollar opportunity.

The silence from the investor community on the carbon removal side of the equation is remarkable in the face of tailwinds like the $500 million earmarked for carbon removal in the U.S. stimulus package from December 2020. Even the Net Zero Asset Owner Alliance fails to properly explore this. In its 80 page Target Setting Protocol, the primary focus is on emission reductions, a few pages are on investing into green projects (“financing the transition targets”), but carbon sequestration received only a vague half sentence. The Institutional Investors Group on Climate Change’s Implementation Guide for Net Zero portfolios mentions the topic in only one bullet point, and without further explanation that Net Zero portfolios should rely on negative emission technologies. There are, however, notable exceptions emerging, such as asset manager Aviva that has as part of its Net Zero strategy the financing of carbon removals.

Neither corporates nor investors seem to have a clear view of the future they are committing to with today’s Net Zero pledge. None of the currently emerging Net Zero strategies present what they expect the world to look like by 2050. Fossil fuel companies, for example, don’t take a stand on what the expected fossil fuel consumption will be at a specific point in time, their production levels and their expected market share in their Net Zero pledges, nor do they discuss how much Carbon Capture, Utilization and Storage (CCUS) is feasible and what it will cost. Without such context, it is impossible to judge if the pledged financial commitment in each case is sufficient or too little.

Is Removal The New Offsetting?

A new debate is emerging around carbon removals versus carbon offsets. Carbon offsetting in its purest form is not the sequestration of emissions from the atmosphere, it means reducing emissions by replacing a climate harming process with a less harming one. This is paid for through the carbon markets, where tonnes of avoided greenhouse gas emissions are typically converted into carbon certificates that can be traded.

When Mark Carney claimed Net Zero for Brookfield, he used the logic that their renewable energy investments offset the emissions from their other investments. Aviva, on the other hand, went on the record to state “Net Zero means only carbon removals count; no offsets, reductions or avoided emissions”. Both are right and wrong at the same time: Net Zero does need both emission reductions and avoided emissions – but these alone are not enough. Nor are carbon removals enough as a standalone measure. Opponents to carbon removals have argued that without meaningful reductions, they might be seen by companies as carte blanche to conduct business as usual. Offsetting and removal are not competing alternatives – rather they complement each other.

Net Zero can’t rely on carbon removal alone. Likewise, carbon removal can’t rely just on planting trees – it requires the full toolbox of emerging oceanic and technology solutions. We need every means available to achieve Zero. Otherwise, we will achieve… nothing.

By Dr. Maximilian Horster, Head of Climate Solutions, ISS ESG

This article received input from the ISS ESG Head of R&D Climate Fredrik Lundin.