A good transition

Net Zero seems a relatively simple concept, but there are underlying complexities that can make it hard to understand. Actually getting there will be even harder. The most important drivers, political will and ambition, are currently in short supply, giving stakeholders a limited foundation on which to build their strategies. In this environment, how can corporations and investors set credible and realistic Net Zero targets in 2021? And will the attendees at COP26 be able to deliver the much-needed outcomes to match their ambition? This is the $23 trillion question.

The pledges from companies, countries and investors are multiplying, but the challenge lies in assessing their credibility. How, for example, do you weigh a detailed target relying heavily on non-existing technologies against a less well defined one that takes a more pragmatic approach to current policy ambiguities?

Key characteristics of a Net Zero transition plan

While the specifics of a business’ Net Zero commitments will vary from firm to firm, there are three characteristics that will help proponents to deliver a good quality Net Zero transition plan:

- Pragmatism: Hitting a global Net Zero target requires a whole-of-economy technological shift at hitherto unimaginable speeds. Investors need to ensure they understand the political and technological assumptions required to reach a given target and be prepared with alternative pathways in case things don’t work out as hoped.

- Decarbonization: Net Zero is about one thing and one thing only: Net Zero emissions. This means that the most important thing is decarbonization. Investors should be laser-focused on genuine reductions in the amount of carbon dioxide and equivalent gases being released into the atmosphere, and less on accounting strategies to ‘net’ emissions via the use of offsets or shorting tactics.

- Immediacy: Most realistic Net Zero by 2050 pathways require major greenhouse gas emission reductions within the next decade, with the reduction rate becoming flatter in the decades after. This is due to the imperative of reducing total emissions going into the atmosphere – the longer it takes to implement reductions, the more greenhouse gases emitted in total, with significant implications for the overall global carbon budget.

How do the current crop of plans shape up?

As demonstrated above, reaching Net Zero will be hard. Investors should applaud corporate pledges while at the same time managing expectations around the achievement of climate targets.

Despite strong overarching corporate commitments, too often emission reduction plans contemplate moderate reductions in the next decade followed by more drastic reduction trajectories from 2030 and 2040 onwards. Will such plans eventually lead to Net Zero by 2050? Absolutely. It is still a recipe for potentially missing overall climate targets, however. Why? Because the overall climate target depends on staying within a constrained carbon budget. Reaching climate targets requires not only Net Zero emissions, but also that attention is paid to how much is emitted in the meantime. A target needs to be agile, and a target that relies too much on future action will not be able to adapt to a rapidly changing future.

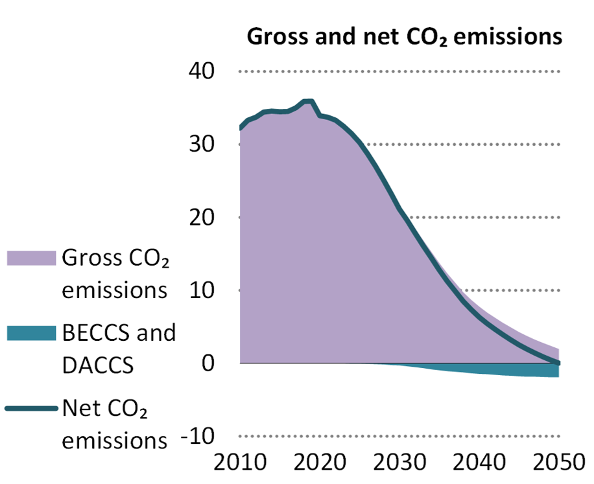

Let’s have a look at a graph (Figure 1 below) showing the emission reduction pathways as outlined by one prominent net zero scenario, the International Energy Agency’s Net Zero by 2050 roadmap. Emissions are being reduced very rapidly in the coming decade, with reduction rates being slower thereafter.

Figure 1:

Source: Net Zero by 2050, International Energy Agency

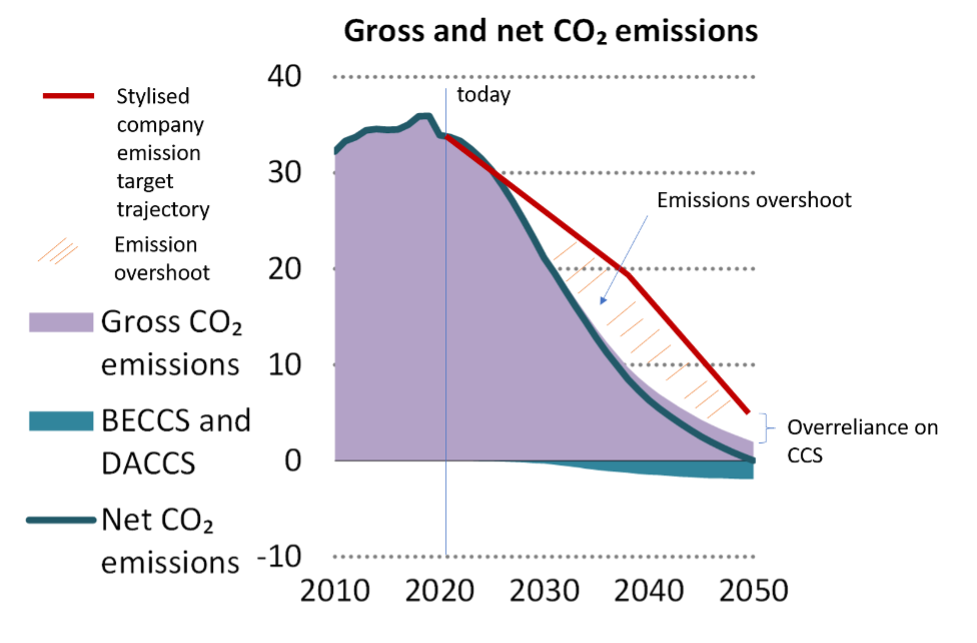

Unfortunately a significant proportion of corporate emissions targets describe the exact opposite trajectory. They assume more moderate emissions in the near-term, with more ambitious reductions starting after 2030. These more ambitious reductions tend to rely on technologies that either don’t exist yet, are not commercially viable, or lack a pathway to be scaled to a sufficient degree. A key example of this is carbon capture and storage (CCS) technology.

Taken together, the timing of planned emission reductions can lead to alarming discrepancies between the Net Zero targets that are pledged and the capacity of the steps taken to collectively deliver on global greenhouse gas emission reduction ambitions. Figure 2 illustrates the considerable differences in the overall absolute emissions emitted that arise from different decisions taken around the topic of urgency – slow starts will lead to an overshoot of the carbon budget!

Figure 2:

Source: Net Zero by 2050, International Energy Agency, ISS ESG

What is to be done?

Given the order of magnitude of the challenge, the uncertainty around technologies, the question marks that exist all around when it comes to not only setting but also acting on Net Zero targets – what is an investor to do? One key objective must be the establishment of clear expectations around investee company transparency, including:

- A clear Net Zero ambition, the more detailed the better.

- Specific targets, both interim and long term, that cover all relevant emissions.

- Detailed decarbonization strategies with quantified steps of how the targets are to be met.

- A focus on decarbonization based on known and proven measures, such as changing power supply or existing technologies, as a means to reach the targets.

- Ambitious decarbonization strategies should not rely on CCS technologies, and to the extent that they do, investors should confirm that alternative roadmaps on how to reach those targets are in place should the technology prove not to be viable.

- Targets should be adaptable. As scenarios are updated, as new technologies are developed or discarded, investee corporations should be prepared to amend their targets accordingly.

Don’t fear the unknown. Be open about it.

The finance sector is used to assessing and managing risk. Given the uncertainties around the Net Zero trajectories of many listed companies, there needs to be an increased tolerance for open questions.

It must be acknowledged that at the present time, there is no established transition pathway to Net Zero for a large number of corporations. In such an environment, investors are best served by transparency about what they can achieve, at the same time as acknowledging the many unknowns.

Developing a Net Zero transition plan that focuses on Pragmatism, Decarbonization, and Immediacy, as set out above, will allow investors to assess where they truly stand with respect to critical climate targets, and focus on the gaps that need to be addressed.

ISS ESG’s Net Zero Solutions

ISS ESG is launching a Net Zero Solutions service to complement our existing Climate Impact Report. The methodology behind the report has been developed with inputs from market leaders and based around current reporting frameworks. The analysis and accompanying data set looks at approximately 120 metrics to assess the Net Zero status of issuers and portfolios, with a focus on the quality of issuer target-setting.

The service helps investors answer the underlying questions around the level of disclosure and target setting they can expect from an issuer today, and what that tells them about their level of Net Zero Alignment. The analysis includes metrics on Net Zero ambitions, potential emissions trajectories, revenues associated with fossil fuels, climate mitigating activities, and most importantly Net Zero Alignment status.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By Viola Lutz, Head of Climate Solutions, ISS ESG Fredrik Lundin, Head of R&D Climate, ISS ESG