In Act 1: To ESG or Not we are challenged to consider how investor preferences are forming alongside the evolution of environmental, social and governance (ESG) investing and the active-passive drama. With flows diverging significantly for non-ESG active strategies compared to active ESG, passive ESG and passive non-ESG strategies our examination left us wondering what was behind this dramatic but non-binary divergence. Picking up on this thread in Act 2, our examination will centre on the what and the who of ESG fund buying behaviour.

What is in a (ESG) fund name?

Fund naming is arguably the bluntest of client communication tools that fund managers have. This bluntness, however, may mean that it is in fact the best place to start when looking for clues regarding investor preferences. Who after all has not picked up, if not purchased a book based on the cover or title? Correlations between flows and fund names is therefore the starting place for Act 2.

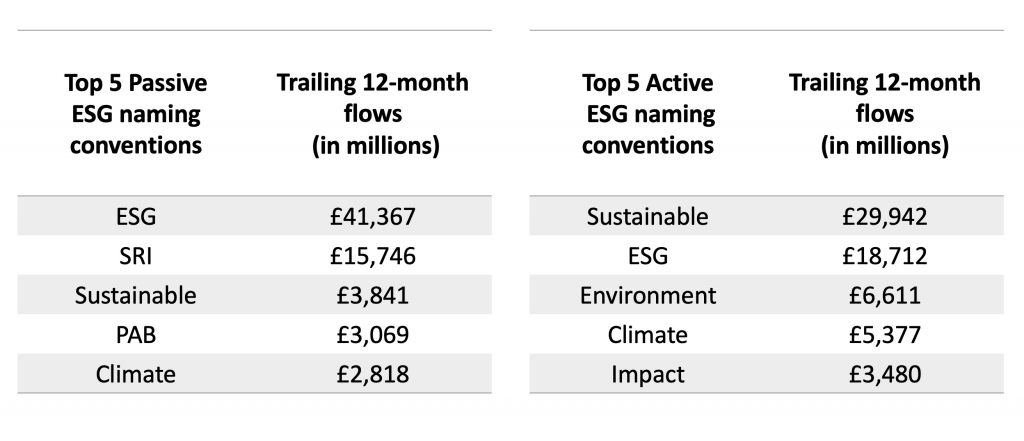

From ethical to Social Responsible Investing (SRI) to ESG to green to blue to Sustainable Development Goals (SDG) to climate to Paris Aligned Benchmark (PAB), the list of naming conventions for ESG is ever expanding and evolving. It should be kept in mind that fund names reflect the environment in which they are created and do not necessarily age well–an observation that shines through when fund vintages are taken into consideration. In disaggregating flows by fund naming convention, three observations pop out for Irish and Luxembourg domiciled funds.

Figure 1: Trailing 12-month flows (in billions) by retail share class type for funds using the sustainable name convention – July 2022

Source: ISS Market Intelligence Simfund. Funds containing multiple naming conventions will have their flows assigned to each category.

1. Demand is highest for broad based ESG strategies

With ESG-, SRI- and sustainable-named funds attracting by far the greatest share of flows, demand appears highest for funds that consider the E, S and G. An observation slightly at odds with the airtime that climate change receives compared to other ESG topics. This is not to downplay the importance of climate to investors, as climate-specific strategies appear to be the most significant driver of flows after more broad-based strategies. It is merely a reminder that investors are open to, and in fact may demand, more comprehensive ESG and sustainability messaging.

2. ESG was #1

No single naming convention was more tied to positive flows than the naming convention “ESG” over the past 12 months. And, arguably, no term has a greater weight to it these days in the investment community. In fact, there is likely a close relationship between ESG becoming the buzzword to describe this type of investing and the use of the convention in fund names. Fund flows for ESG-named funds have been driven predominately by funds launched since 2019, with the 2021 vintage year responsible for roughly a quarter of flows.

This contrasts with SRI, a term that has previously been used to signify broad-based ESG strategies, often exclusion-focused, where two thirds of flows are from funds with a vintage of 2018 or earlier. Whether the differential in flows is due to the nuances of the fund strategies for each convention or simply to perception, is a question fund managers need to ask when building, updating and naming their products. If an SRI strategy adds ESG factor tilts, will anyone see it? In examining the investment objectives and policies (IOP) of the best-selling SRI funds, this reader could not identify a significant difference between many SRI- and ESG-named funds. Both can include ESG factor tilts and/or an exclusion framework.

3. Sustainable was the convention of choice for active investors

Beyond being a product of their time, naming conventions can also evoke different emotions across different distribution channels. This insight may explain why the sustainable naming convention attracted such high inflows for active but not so for passive funds. If active sustainable fund flows are split between ETFs, institutional share classes and retail share classes, it becomes apparent that retail investors are driving the flows into sustainably named funds. Again, the question left begging is whether this is due to identifiable differences in IOPs or rather a greater appreciation amongst retail investors and advisers for what sustainability means.

Figure 2: Trailing 12-month flows (in billions) by retail share class type for funds using the sustainable name convention – July 2022

Source: ISS MI Simfund

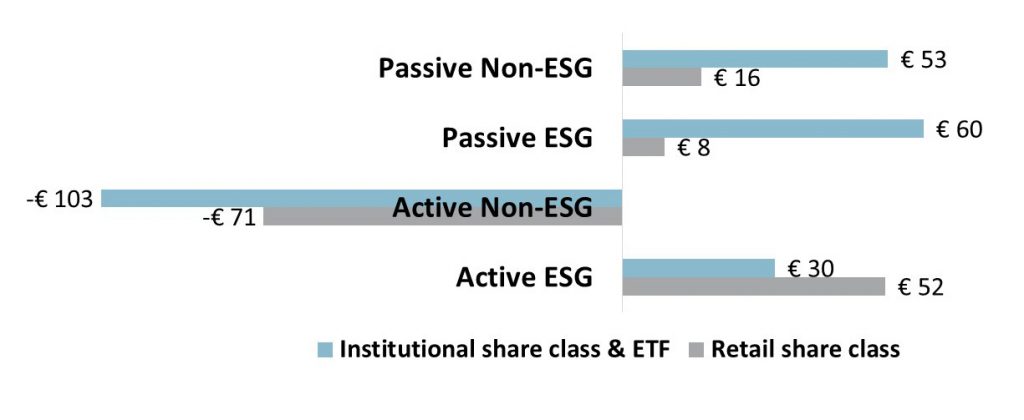

Retail investors in general were the drivers of active ESG flows over the past 12 months. Of the over €82 billion of flows into active ESG funds, €53 billion flowed through retail share classes. This contrasts with only €8 billion flowing into passive ESG strategies, a tally which also failed to match the nearly €14 billion of inflows into non-ESG named passive strategies.

Figure 3: Trailing 12-month flows (in billions) by active-passive and share class type – July 2022

Source: ISS MI Simfund

ETF and institutional share class flows meanwhile favoured passive strategies. In terms of ESG-centred strategies, €60 billion flowed to passive ESG strategies and €30 billion to active ESG strategies in the trailing 12 months. Non-ESG passive ETFs and institutional share classes, however, recorded the highest inflows among ETFs and institutional share classes, notching €60 billion. The story then is not a simple case of active versus passive or ESG versus non-ESG but likely of investors matching different objectives to different funds.

The above analysis has highlighted what ESG demand looked like yesterday, with demand for broad-based ESG solutions being high across all investor types. Differences in demand were also noted across retail and institutional investors. The reason for the differences, whether for ESG- vs sustainable-named funds or for active versus passive, however, remains elusive. Left to be answered is the question of whether differences in active and passive ESG preferences among retail and institutional investors are a result of previously held assumptions on active-passive or are in fact a judgement on the merits of various ESG strategies.

Winning tomorrow’s next fund sale will require what it always has, an ability to craft a value narrative that aligns one’s products with customer’s preferences and objectives. A narrative will start by answering, what’s in a name?

Want to know how learn more about how your funds compare on ESG characteristics and fund flows?

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence