Addressing climate change requires reducing greenhouse gas (GHG) emissions, especially carbon dioxide (CO2) emissions, which are the primary cause of global warming. The goal of reducing GHG emissions makes moving away from fossil fuels to renewable energy sources essential.

Hydrogen-based technologies offer the possibility of a clean energy source for transportation, electricity generation, and industry. Governments are developing regulations for hydrogen technologies and have adopted policies to encourage renewable hydrogen development.

Many businesses, especially in the energy sector, are similarly investing in green hydrogen technologies. ISS ESG services, such as the ISS ESG Corporate Rating, can assist investors in tracking corporate performance on green hydrogen and other hydrogen-based technologies.

Green Hydrogen in the Transition to a Sustainable Energy Future

Unlike fossil fuels, which are finite and contribute to pollution and climate change, renewable energy sources such as solar, wind, tidal, and geothermal heat are sustainable and have minimal environmental impact. As renewable energy generation is not consistent, addressing sudden spikes in energy demand is challenging. Energy storage and hydrogen technologies may offer solutions to this problem.

A region with a highly renewable grid requires short-term bursts of power, such as those generated by hydropower or batteries. Hydrogen can address storage requirements to cover periods, ranging from a few hours to a few days, when wind and solar are not accessible, and hydropower and batteries are depleted.

Hydrogen, which is colorless and odorless in a pure gaseous state, is the most common chemical element in the universe. Despite its abundance, it is difficult to access and purify it, partly because natural hydrogen frequently occurs in subaerial and undersea environments such as mid-ocean ridges. Though the potential of natural hydrogen cannot be dismissed, significant research is needed to capitalize on this source.

As the purity of the hydrogen is an important factor in its end-use applications, hydrogen is often produced rather than extracted. Hydrogen can be produced through different methods. The most common types of hydrogen, and their methods of production, are as follows:

- Grey Hydrogen: Generated by steam reforming of natural gas or methane, a process that brings together natural gas and heated water as steam. This process produces CO2 as a by-product.

- Blue Hydrogen: Generated by the same steam reforming process as grey hydrogen, but with the addition of carbon capture, utilization, and storage (CCUS) to trap the CO2.

- Green Hydrogen: Produced by water electrolysis using renewable energy sources.

Other types of hydrogen include turquoise hydrogen, made by methane pyrolysis; pink hydrogen, produced by electrolysis using nuclear power; and brown/black hydrogen, produced through coal gasification.

Among these types, green hydrogen is the cleanest, although it is also water intensive: according to the International Energy Agency, production of a kilogram of green hydrogen requires nine liters of water. Blue hydrogen is also considered low-carbon hydrogen due to the inclusion of CCUS. The IEA reports that grey hydrogen is currently still the predominant type. Reaching the Net Zero Emissions by 2050 (NZE) scenario will likely require scaling up green hydrogen, though.

Creating a Green Hydrogen Ecosystem: Production, Applications, and Incentives

Production and Storage

Green hydrogen can be produced through a variety of methods such as electrolysis (using tools such as a polymer electrolyte membrane [PEM] electrolyzer or alkaline electrolyzer), photoelectrochemical (PEC) water splitting, biological production, thermochemical water splitting, wind-to-hydrogen, solar-to-hydrogen, and geothermal hydrogen.

Hydrogen storage technologies also have various types, each with its advantages and limitations. Compressed, liquid, metal hydride, chemical, carbon-based materials, and underground storage are the main storage types. The storage choice depends on factors such as application requirements, cost, safety, and infrastructure availability.

Hydrogen fuel cells are currently popular among major automakers. A hydrogen fuel cell is a type of energy storage that turns hydrogen and oxygen into power through an electrochemical reaction. It works like a battery but does not need to be charged again and again; instead, the hydrogen fuel cell keeps making energy as long as fuel (hydrogen) is available. Ongoing research aims to improve the technology, making it lower cost, more efficient, and more durable, which could facilitate the transition to a hydrogen-based energy economy.

Applications

Transport

Hydrogen vehicles use hydrogen fuel for power and come in different forms, such as those using fuel cells or those using hydrogen internal combustion. A passenger train powered by a hydrogen fuel cell is in commercial service in Germany, though battery-powered trains are currently more economical. Technological innovations, government incentives, and scaling up may bring down the costs.

The growing presence of hydrogen refueling stations (HRSs) can enable hydrogen vehicles to refill. Hydrogen can be transferred from hydrogen plants to these charging stations or converted onsite from electricity. The joint optimization of hydrogen and electricity systems under the latter approach is a promising development, as such an integrated system can be more operationally efficient and thus cheaper. Significant investment is required to establish the HRS infrastructure, however.

Grid Resilience

A coupling between hydrogen and electricity systems can improve grid flexibility, while identifying critical nodes and installing hydrogen systems will enhance grid resilience. During an extreme event, hydrogen can provide an emergency power supply, thereby reducing chain reactions, avoiding larger power outages, and helping in the recovery of critical loads. Hydrogen-powered fuel cells can operate independently and reduce grid dependence for organizations that are unable to afford interruptions in their power supply.

Industry

The steel industry accounts for 7% of global GHG emissions. Hydrogen can be integrated into various steelmaking processes to reduce carbon emissions. It can be used as a clean fuel in heating furnaces and injected into blast furnaces as a reducing agent. In addition, hydrogen can be used as a primary reducing agent in the direct reduction of iron ores.

Hydrogen is used in many ways in the fertilizer business, but mostly to make ammonia, which is an important part of nitrogen-based fertilizers. Methanol, which is a building block for some nitrogen-based fertilizers, is also made with hydrogen. In addition, hydrogen is mostly used in oil refining to remove sulphur.

Government Incentives

Policy Measures and Monetary Support

Governments are deploying hydrogen technology, but policies to boost demand for low-emission hydrogen are under-developed. Many governments are embracing technology deployment plans and objectives. As per the IEA, 32 governments have hydrogen strategies as of the end of 2022. Policy implementation is lacking, though: relatively few targets have been set to increase demand for low-emission hydrogen in industries such as steelmaking and fertilizer manufacturing.

Europe and the United States are ahead in R&D support for renewable hydrogen generation, storage, and distribution. The EU launched the Clean Hydrogen Partnership, and, in the United States, the government has introduced tax credits, investment credits, and grant financing for low-emission hydrogen production. Also, in September 2022, the U.S. Department of Energy launched a $7 billion program for regional clean hydrogen centers. At the same time, the governments of the United Kingdom, Germany, and Japan (to name a few) introduced funding initiatives for the development of green hydrogen infrastructure.

Standardization and Certification

The International Partnership for Hydrogen and Fuel Cells in the Economy released its Methodology for Determining the Greenhouse Gas Emissions Associated with the Production of Hydrogen in 2023. This methodology will serve as the basis for the International Organization for Standardization (ISO) to develop a draft international standard by the end of 2024.

Parallel to this, governments are creating regulatory frameworks and certification programs such as the Australian Guarantee of Origin certification and two delegated acts by the European Commission regarding the definition of renewable hydrogen. Meanwhile, France is developing hydrogen category certification procedures, and the United Kingdom published a Low Carbon Hydrogen Standard and began a consultation on the certification scheme in February 2023. In September 2022, the U.S. Department of Energy proposed a Clean Hydrogen Production Standard and is developing methodological details for its use in supporting schemes such as the IRA Clean Hydrogen Production Tax Credit.

Ongoing Developments in the Hydrogen Ecosystem: A Brief Analysis

National-level hydrogen road maps are focused on low-cost generation, storage, transportation, and adoption of green hydrogen. As green hydrogen is not expected to be competitive until 2030, hydrocarbon-rich countries may opt both to support the green hydrogen value chain and also support low-emission blue hydrogen production in the short-to-medium term. Supporting blue hydrogen involves investment in CCUS, as this provides an outlet for hydrocarbon reserves and helps in competitive scaling of low-emission hydrogen instead of currently predominant grey hydrogen.

The green hydrogen industry is still in its early stages and has yet to be widely accepted. However, with the development of new technologies and the emergence of more companies with clean hydrogen goals, costs are decreasing, indicating potential.

Some companies have already established themselves as industry leaders by being early movers. Many businesses worldwide are investing significantly in environmentally friendly hydrogen technologies and infrastructure.

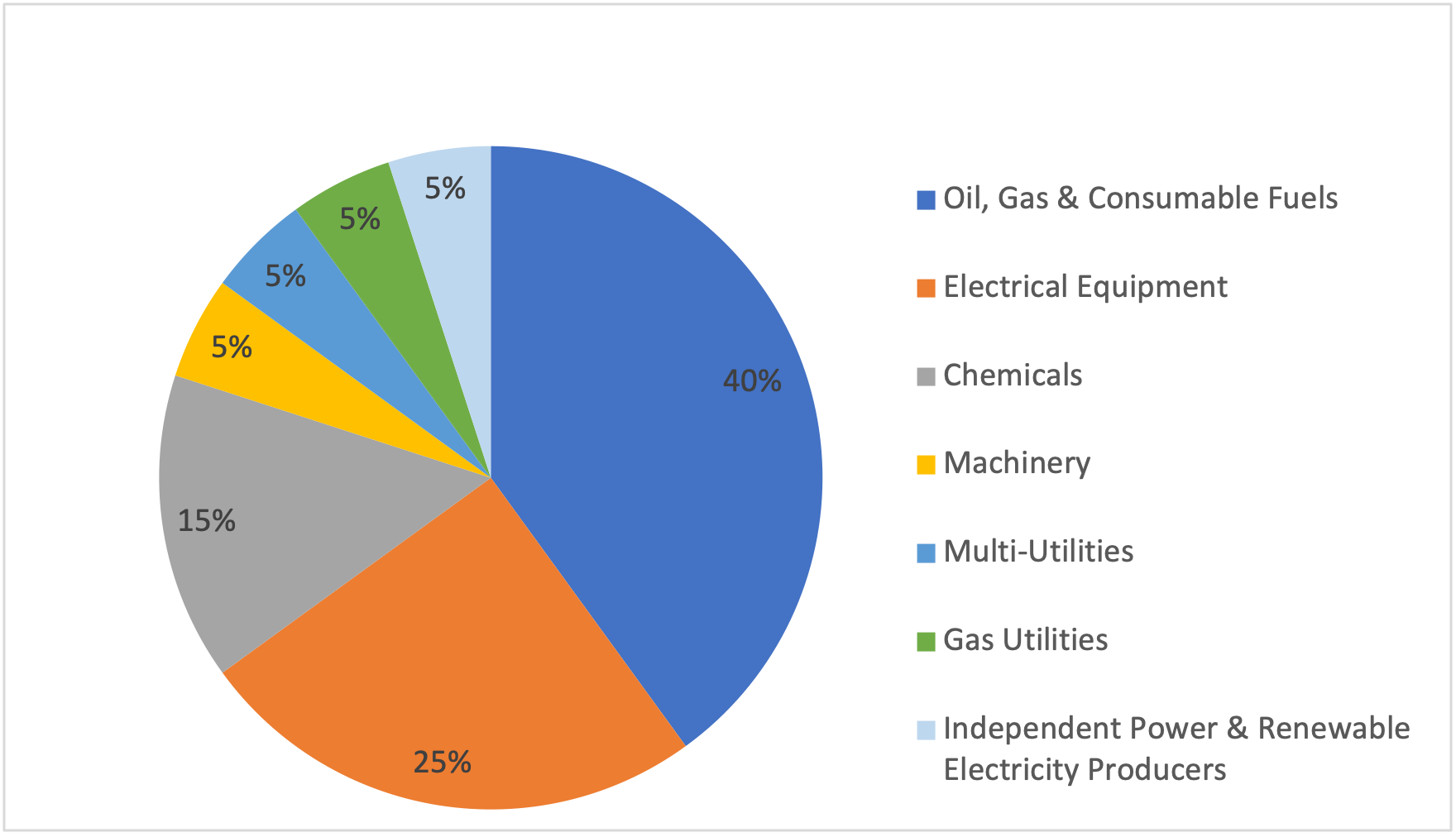

An assessment of the ISS ESG Corporate Rating universe shows that 20 companies are pioneering in the green hydrogen value chain. Of these 20 companies, the largest number of them belong to the oil and gas industry, followed by electrical equipment manufacturers (Figure 1). According to the ISS methodology, more than half of these companies investing in environmentally friendly hydrogen technologies and infrastructure are considered “Prime” in their respective industries.

Figure 1: Distribution of Pioneer Firms in the Green Hydrogen Value Chain, by Industry

Note: The ESG Corporate Rating universe of pioneer firms in the green hydrogen value chain covers 20 companies.

Source: ISS ESG

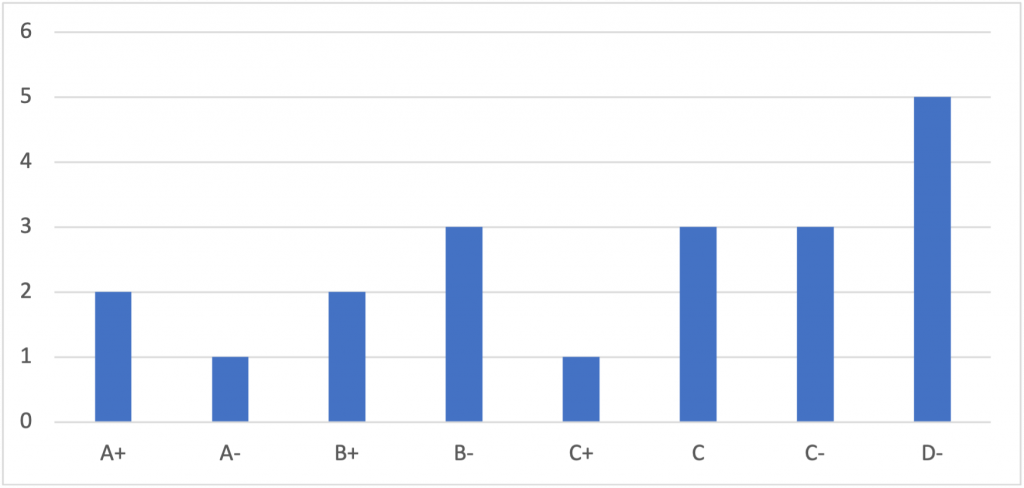

However, more than half of the pioneering companies in the green hydrogen value chain have eco-efficiency ratings below C+ (Figure 2). The companies below this threshold predominantly belong to either the oil and gas or electrical equipment sector.

Figure 2: Eco-efficiency Ratings of Pioneer Firms in the Green Hydrogen Value Chain

Note: The ESG Corporate Rating universe of pioneer firms in the green hydrogen value chain covers 20 companies.

Source: ISS ESG

The prevalence of poor eco-efficiency ratings highlights the opportunity for investments in pollution prevention equipment and associated research, especially in CCUS for oil and gas companies. Such research could help reduce emissions from carbon-intensive industries, enhance energy security, and facilitate carbon removal through Direct Air Capture (DAC) technologies.

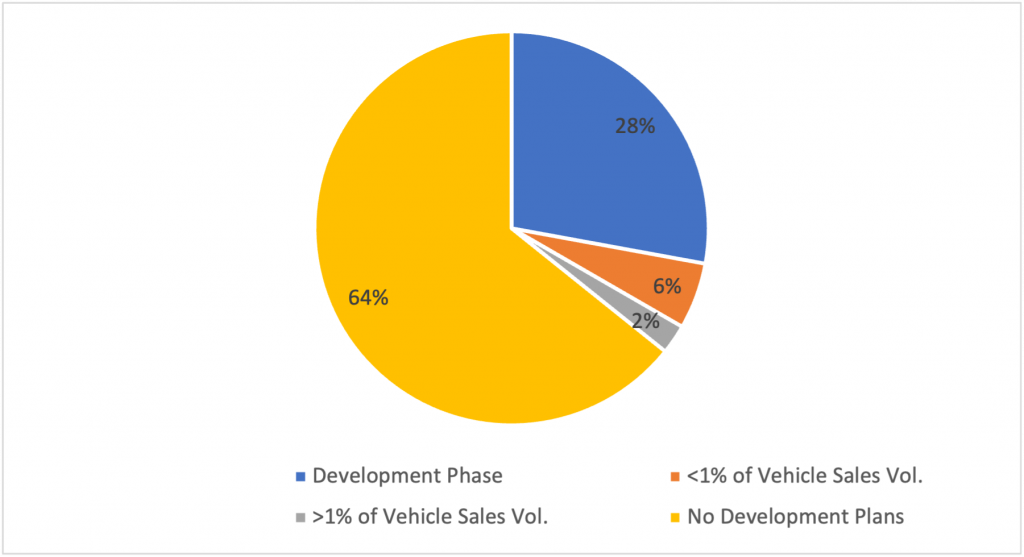

Nevertheless, some companies in the electric vehicle industry have already adopted hydrogen drive. Out of a universe of 164 companies, the development phase of this transition is underway in 28% of the companies. The sales volume of hydrogen-powered vehicles is less than 1% for 6% of the companies and slightly over 1% for 2% of the companies (Figure 3).

Figure 3: Companies Transitioning to Hydrogen Vehicles

Note: The ESG Corporate Rating universe of companies in the electric vehicle industry adopting hydrogen drive covers 164 companies.

Source: ISS ESG

Enterprises globally are strategically positioning themselves to take advantage of the opportunities hydrogen-based technologies may present in the near future. In alignment with this transformative trend, ISS ESG is elevating its evaluation methodologies to encompass businesses’ commitment to sustainable transitions within their operational frameworks.

Future research on this subject will involve a more detailed incorporation of additional metrics that encompass operational efficiency, ESG risks and impacts, and the financial viability of these groundbreaking advancements. The ISS ESG Corporate Rating can assist investors as they investigate companies’ pursuit of hydrogen-based technologies. The ISS ESG Country Rating can help in evaluating the ESG performance of countries investing in and incentivizing these technologies. To assess freshwater access risks for green hydrogen production companies in water-stressed areas, investors can make use of the ISS ESG Water Risk Rating tool.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating.

- Access a holistic assessment of companies’ exposure to freshwater-related risks using the ISS ESG Water Risk Rating.

By:

Jhanavee Sheth, Vice President, Head of Energy, Materials, & Utilities, ISS ESG

Arushi Sharma, Analyst, Utilities, ISS ESG

Vaishak Kamireddy, Associate, Metals & Mining, ISS ESG