Equilend and four big banks – JPMorgan, Morgan Stanley, Goldman Sachs, and UBS– have agreed to a $499 million settlement to resolve allegations that they conspired to thwart the modernization of the stock loan market in violation of the antitrust laws. The suit accused the banks of preventing all-electronic trading systems that match stock lenders and borrowers in order to preserve the banks’ privileged role as prime broker on every trade.

Stock lending transactions are used primarily to facilitate the short selling of stocks and have grown into a trillion-dollar market. Despite its size, the lawsuit has described the stock loan market as an inefficient and antiquated “dark pool” dominated by large dealer banks who act as intermediaries between lenders and borrowers on each transaction. For their “match-making services,” the big banks allegedly reaped “massive” fees – approximately 65% of annual industry gross revenues or more than $9 billion a year.

To protect their position as prime broker intermediaries, the banks allegedly conspired to boycott new market entrants from offering solutions to enhance price transparency. Financial technology companies allegedly introduced electronic trading and clearing platforms in the stock loan market since the early 2000s but were shut down by the prime broker defendants. The complaint further alleges the following:

- Recognizing the threat posed by all-to-all electronic trading, the big banks organized themselves into a cartel and formed a company called Equilend to protect their interests.

- When Quadriserv/AQS and SL-x both developed electronic trading platforms, the big banks led by Morgan Stanley and Goldman Sachs organized a boycott of their services, including pressuring their clients to not use the platforms.

- Through their coordinated actions, the prime broker defendants “decimated” the platforms and used their influence over Equilend to acquire them, shut them down, and shelve their technology.

- The prime broker defendants used similar methods to prevent Data Explorers, which offered real-time pricing data to borrowers and lenders from gaining a foothold in the market.

- The prime broker defendants used a variety of forums and channels including EquiLend emails, private dinners and phone conversations to carry out the conspiracy, referring to themselves as the “five families.”

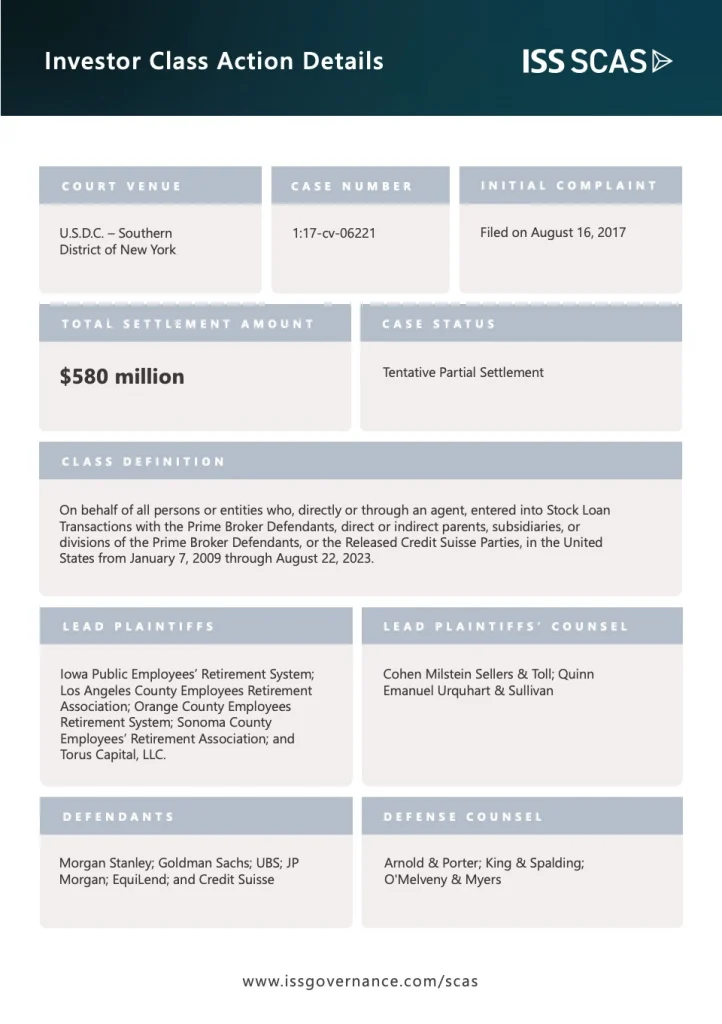

The settlement reached with the banks comes while U.S. District Judge Katherine Polk Failla’s decision to adopt the magistrate judge’s recommendation to certify the class remained pending.

The $499 million settlement, if approved, will add to the $81 million previously agreed to with Credit Suisse, adding to a total of $580 million. Bank of America Corp. now remains as the only named defendant to not yet reach a settlement.

In addition to the cash payment, the settlement also includes corporate governance reforms to be implemented by Equilend, such as: limitations on who can access commercially sensitive information, a compliance training and monitoring program, and mandatory rotation of board members and outside antitrust counsel. Plaintiffs believe the equitable relief they negotiated for “will help align EquiLend to the best practices and guidelines for anti-cartel and collaborations among competitors.”

The $580 million payout reached with the six banks thus far will become the fifth largest antitrust settlement of all time behind these four mega-settlements:

| Case Name | # of Settling Defendants | Settlement Amount |

| Foreign Exchange Benchmark Rates | 25 | $2,310,275,000 |

| Credit Default Swaps Antitrust Litigation | 18 | $1,864,650,000 |

| Relevant LIBOR-Based Financial Instruments (U.S. Dollar) | 38 | $873,149,000 |

| Euro Interbank Offered Rate | 14 | $651,500,000 |

ISS SCAS will continue to monitor and file claims for this high-profile antitrust action and others, if and when, they progress toward an official settlement.

By: Jarett Sena, Esq., Director of Litigation Analysis, ISS Securities Class Action Services