Introduction

Inconsistent Greenhouse Gas (GHG) accounting can lead to incompatible metrics across companies in a given market or sector, and this poses a huge risk for investors’ understanding of climate exposure and target settings. The precise measurement and transparent disclosure of GHG emissions allows the quantification of risks and opportunities. In this analysis we provide an insight into the variations observed on GHG accounting in the reported numbers for the Oil & Gas (O&G) exploration and production industries, and how these can impact the target setting discussion. The analysis provides a comparative view of different emission accounting approaches and then discusses the key question: How can investors interpret these variations in emissions and Net-Zero targets? The ISS ESG Climate Solutions team will release its latest emission data set at the end of December 2021.

GHG Accounting

While there are generally well-established GHG accounting practices for corporates, a few topics keep evolving and as a result can be open to interpretation. This poses a problem for investors if companies do not clearly communicate the assumptions and boundary settings that go into their emissions accounting.

The GHG Protocol Corporate Accounting and Reporting Standard is the most widely followed GHG accounting standard by corporates. The standard provides guidance for companies and other organizations preparing a GHG emissions inventory.

Global businesses use various organizational structures including subsidiaries, joint ventures, associate entities, and others. Companies need to account for the GHG emissions from various reporting business units with different organizational boundaries. The GHG protocol suggests using two broad approaches to consolidate GHG emission data at group level:

- Equity Share.

- Control.

Equity Share Approach

Under the Equity Share approach, a company accounts for its GHG emissions according to the proportion of economic interest it has in its various operating entities, including wholly owned subsidiaries, joint ventures, associate entities and so on. This approach reflects risks and rewards from operations in line with economic interest or ownership like financial accounting practices.

Control Approach

The Control approach is based on the type of control applied by the company, and is further classified into:

| Financial Control | Operational Control |

| In the Financial Control approach, GHG emissions are fully consolidated if the company has the ability to direct the financial and operating policies of the operating entity to gain economic rewards. Under this criterion, the economic element of the relationship between the company and the operating unit takes precedence over legal ownership. For example, a company may have financial control over the operational unit even if it has less than a 50% ownership interest in that operation. | In the Operational Control approach, the company fully accounts for an entity’s GHG emissions where it has complete authority to introduce and implement its operating policies at the level of the operating entity, even though it may not have majority equity control over the entity or facility. This criterion is consistent with the current accounting and reporting practices of many companies that report on emissions from operating facilities. |

GHG Accounting – Oil & Gas Sector

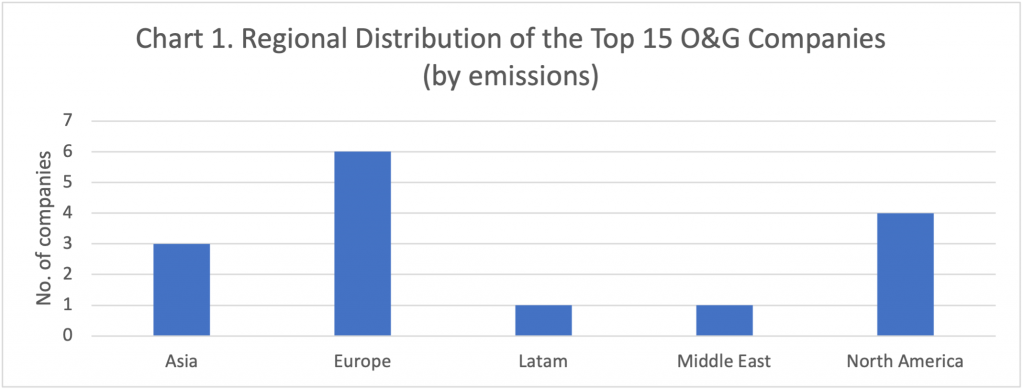

The GHG accounting details of the top 15 emitters in the global Oil & Gas sector were examined for this analysis.

Source: ISS ESG

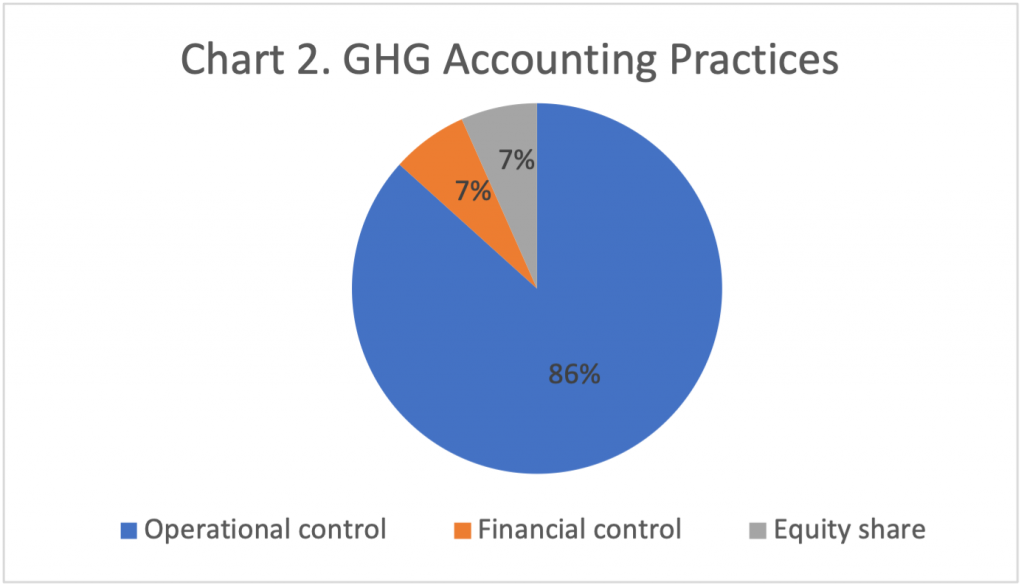

86% of the companies reported GHG emission based on an Operational Control approach and 7% based on the Financial Control and the Equity Share approach respectively (See Chart 2 below).

Source: ISS ESG

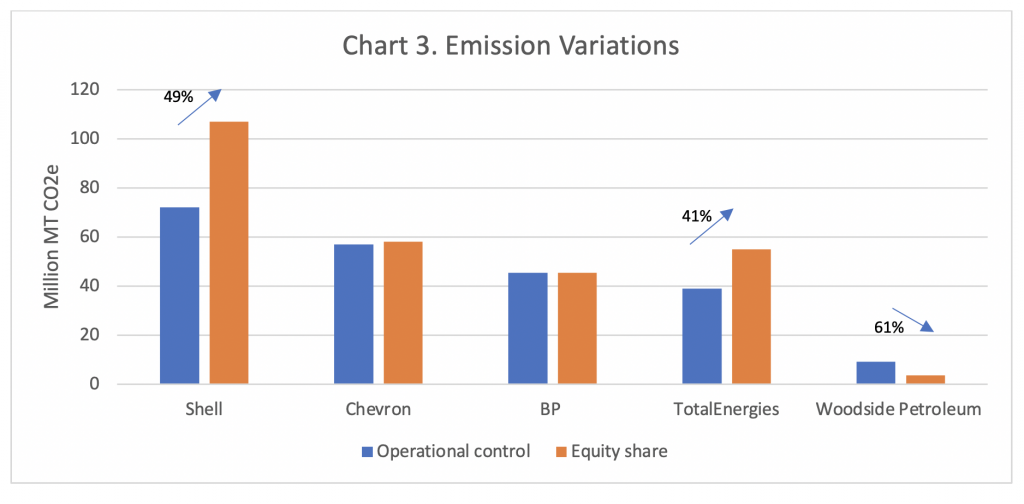

A few companies reported GHG emissions based on both an Operational Control and an Equity Share approach. It is interesting to note large variations in emissions between these two approaches as shown in Chart 3. Only 7 of these 15 companies report on their Scope 3 emissions as part of their 2020 emission reporting.

Source: ISS ESG

Shell and TotalEnergies reported significantly higher emissions based on an Equity Share approach versus an Operational Control approach, to the tune of approximately 49% and 41% respectively. This suggests that these companies have more investment in oil and gas exploration and production facilities which are operated by other companies. In contrast, Woodside Petroleum has 61% lower emissions using an Equity Share approach, because it has operational control over facilities where it has only a minority equity share. For Chevron and BP emissions are almost the same in both approaches.

How can Investors interpret these variations?

If investors wish to base decisions on emissions data, they do so either on the basis of absolute emissions or on intensity metrics. From the perspective of investors, the variations noted above pose the following questions:

Risk Exposure – From a climate risk perspective, high emissions can generally be associated with high risk exposure. To understand overall risk on the invested value, it is crucial to quantify the corresponding risk from carbon exposure. In cases where companies report lower numbers under an Equity Share approach versus an Operational Control approach, the difference is likely to be due to the Equity Share approach not covering the risks related to facilities under direct operational control of the company. In cases where companies report lower numbers under an Operational Control approach, then the risk from assets that they do not control but make revenue from are quantified more accurately under an Equity Share approach. O&G companies should ideally report the results of both Equity Share and Operational Control approaches, allowing investors to interpret the complete risk profile themselves.

All GHG emission accounting provides an insight into a company’s carbon risk profile. From an investor’s perspective, the prudent approach would be to use the higher of the Equity Share and Operational Control numbers for their screening and decision-making process. The ISS ESG Climate Solutions team applies this logic and uses the higher of the reported emission numbers for O&G companies for its annual data release.

Reductions and Targets – Investors are increasingly interested in a company’s alignment with Net Zero Targets, and in particular the measures which are in place to achieve those targets. This raises the question of which GHG accounting approach is better for establishing baseline and target emissions settings. Which of the GHG accounting approaches best enables the company to align its responsibility, exposure, and targets – Equity Share, Operational Control or both? And who is then responsible for the remaining emissions? For example, let’s assume Company A operates Facility X with 30% ownership and full operational control, whereas Company B has 70% ownership in Facility X with no operational control. If Company A reports using the Equity Share approach, then only 30% of the emissions from Facility X are included in its target setting. On the other hand, if Company B uses the Operational Control approach it would skip Facility X completely from its emission accounting. In this case, who should be held responsible for the missing 70% of emissions?

In the following table, Shell and Woodside report under both the Equity Share and Operational Control approaches and use the lower of the two reported values for their Net Zero target setting (as per their reporting for FY 2020).

| Shell | Woodside |

| Reported Emissions (2020) – Scope 1 + Scope 2 Equity Share approach – 107,000,000 tCO2e Operational Control approach – 72,000,000 tCO2e Net Zero Target – Net Zero by 2050 50% reduction in absolute emissions by 2030 for Scope 1 and Scope 2 Emissions only Net Zero baseline – Operational control (2016 emissions) | Reported Emissions (2020) – Scope 1 + Scope 2 Equity Share approach – 3,608,000 Operational Control approach – 9,180,000 tCO2e Net Zero Target – Net Zero by 2050 30% reduction by 2030 for Scope 1 and Scope 2 Emissions only Net Zero baseline – Equity Share (Average of 2016 – 2020 emissions) |

As Net Zero initiatives gain momentum and guidelines on target setting are being developed, the following questions must be addressed:

- Which approach is better for target setting?

- Should all O&G industries follow uniform approach for target setting?

The Science-Based Targets Initiative (SBTi) is expected to release their target setting guidance for the O&G industry in 2022, which should provide further clarity.

Conclusion

As more investors take on Net Zero commitments, the difference in GHG emission accounting approaches and the implications that arise from these variations will pose important challenges.

In the current circumstances ISS ESG prefers to use a more conservative approach, taking the higher value reported from the various GHG accounting approaches for its Climate Core and Climate Impact data sets. These data points further feed into Climate Impact Report solutions from ISS ESG Climate Solutions. When it comes to target setting, the key question remains: Which approach is better for baseline and target setting for the O&G industry?

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By Harshpreet Singh, Head of Climate Research, ISS ESG. Amitkumar Vyawahare, Head of Climate Research – India, ISS ESG.