The EU Taxonomy is a classification system created by the European Commission to “provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable.” To achieve its objectives, the EU Taxonomy must be a meaningful tool for steering capital flows towards sustainable activities. Both institutional and retail investors must be able to analyze all possible investments against the Taxonomy Framework.

Investors currently face a large discrepancy, however, between the availability of data reported by investee companies and the granularity of data required by investors to fulfill their own Taxonomy reporting obligations. Modelled data can be used to bridge both this gap and the gaps created by the staggered implementation of EU Taxonomy requirements. ISS ESG’s EU Taxonomy Alignment Solution, which uses both modelled and reported data, can help investors as they try to align their investments with the Taxonomy.

The EU Taxonomy: Its Regulations and Who They Apply To

The EU Taxonomy Regulation establishes six environmental objectives: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, the transition to a circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems. The first two objectives, climate change mitigation and climate change adaptation, were adopted through Delegated Acts by the European Commission in June 2021, with reporting by financial market participants being mandated from January 2022. The criteria for the remaining four environmental objectives are set to be released later in 2023.

According to the Taxonomy Regulation, economic activities that substantially contribute to one of the six objectives and ‘do no significant harm’ (DNSH) to any of the other objectives can be considered environmentally sustainable, provided that the entity carrying out the activity complies with minimum social safeguards. The EU Taxonomy Regulation mandates disclosure at both the entity level and the financial product level.

At the entity level, Taxonomy reporting began to apply to companies subject to the Non-Financial Reporting Directive (NFRD) from January 2022. This requirement is to report only on the percentage of economic activities that are eligible under the Taxonomy Framework. Starting from January 2023, non-financial companies are required to disclose both involvement in Taxonomy-eligible activities and the percentage of those economic activities that are aligned with the Taxonomy criteria.

From January 2022, financial companies such as Asset Managers, Banks, and Insurers are required to report on Taxonomy eligibility only, with requirements to report on full Taxonomy indicators entering into force from January 2024. Financial companies have different disclosure requirements, to account for the distinctions among their economic activities.

At the financial product level, requirements for disclosure using specific disclosure templates under the Regulatory Technical Standard (RTS) of the Sustainable Finance Disclosures Regulation (SFDR) came into force from January 2023. The templates required both pre-contractual and periodic disclosure for financial products that promote environmental or social characteristics (SFDR Article 8) or have a sustainable investment objective (SFDR Article 9). These disclosure templates contain fields on alignment of the financial product with the Taxonomy framework.

The European Commission estimates that, from 2024, the Corporate Sustainability Reporting Directive (CSRD) will broaden the scope of issuers reporting on the EU Taxonomy to approximately 50,000 companies, with the first reporting due in 2025. Even once CSRD enters into force, however, many companies still will not report directly on Taxonomy metrics. This situation will leave gaps in key information needed to create true transparency on the environmental sustainability of investments.

Filling the Data Gaps: Use of Estimates and Equivalent Data

To determine the proportion of their investments in environmentally sustainable activities, investors may take into consideration the revenue, as well as both the capital expenditure (Capex) and operating expenditure (Opex), of investee companies that are aligned with Taxonomy requirements.

There still is a large discrepancy between the availability of data reported by investee companies and the granularity of data required by investors to fulfill their own Taxonomy reporting obligations. The European Commission therefore re-emphasized in a recent Q&A document that financial market participants can use estimates for preparing their Taxonomy-alignment reports under Articles 5 and 6 (product level) as well as Article 8 (entity level) of the EU Taxonomy Regulation when there is limited availability of reported Taxonomy-alignment data from investee companies.

For entity-level disclosures, the Delegated Act supplementing Article 8 of the Taxonomy regulation requires financial undertakings to use data directly reported by companies that fall under EU-reporting obligations (NFRD and, from 2024, CSRD) for mandatory disclosures. Also, Article 7(7) of the Act stipulates that financial undertakings may use estimates to assess their investments in investee companies domiciled outside the EU that are not subject to NFRD and hence do not have to disclose under Article 8 of the Taxonomy Regulation. These additional disclosures must be separate from mandatory Key Performance Indicators (KPIs), however, and financial undertakings must be able to ‘demonstrate compliance’ with all criteria, except DNSH compliance, which may be estimated.

For product-level disclosures, the RTS introduces the concept of using ‘equivalent information.’ The RTS states that using equivalent information is acceptable for Articles 8 and 9 product disclosures, to disclose information on how and to what extent the investments within a financial product are associated with economic activities that qualify as environmentally sustainable under the Taxonomy framework. The RTS mentions that “where information relating to the taxonomy alignment of investments is not readily available from public disclosures by investee companies, details of how equivalent information was obtained directly from investee companies or from third party providers shall be provided.”

The RTS makes no distinction between ‘equivalent information’ and ‘estimates,’ and in a recent consultation paper the European Supervisory Authorities (ESAs) suggest aligning the wording and using the term ‘estimates’ only. This is in line with the EU Platform on Sustainable Finance’s recommendation in its Data and Usability Report to align the treatment of data that does not stem from mandatory disclosures.

The European Supervisory Authorities (ESAs) provide guidelines in their Q&A Document on the practical application of ‘equivalent information.’ The main guideline requirement is to use only data which provides the same content and level of granularity as that provided through companies’ Taxonomy disclosures.

ISS ESG’s EU Taxonomy Alignment Solution offers this granularity, as it is closely aligned with Taxonomy-reporting templates. This solution provides outcomes for all activities and assessment steps defined by the Taxonomy regulation and attempts to cover all activities defined as eligible under the Taxonomy Delegated Acts.

The EU Taxonomy Alignment Solution is based on both modelled data and reported data. Modelled data includes information on Taxonomy-eligible and -aligned Revenue and Capex, while reported data includes information on Taxonomy-eligible and -aligned Revenue, Capex, and Opex.

The solution’s model primarily leverages ISS ESG Corporate Rating indicators, as well as the SDG Solutions Assessment, to determine compliance with activity-specific substantial contribution criteria. Data and assessments from these solutions are based on reported data from company disclosures. The model then follows a two-step approach in determining compliance with DNSH requirements. First, assessments are made to determine alignment with activity-specific DNSH criteria. Second, and as an additional safeguard, the assessment is downgraded if the company is involved in relevant controversies.

Equivalent or Not? Comparing ISS ESG Modelled Data to Reported Taxonomy Data

As required by the Taxonomy, companies subject to NFRD disclosed data on Taxonomy eligibility in 2022. In the first year of required disclosure, it was mandatory for both financial and non-financial companies subject to NFRD to report KPIs based on Taxonomy eligibility.

Also in 2022, ISS ESG screened over 2,000 companies and collected company-reported Taxonomy data for approximately 1,000 companies. ISS ESG conducted an analysis of the Taxonomy data reported by the companies and compared it with the data generated through ISS ESG’s EU Taxonomy Alignment model for the same companies, focusing the analysis on Taxonomy-eligible revenue shares.

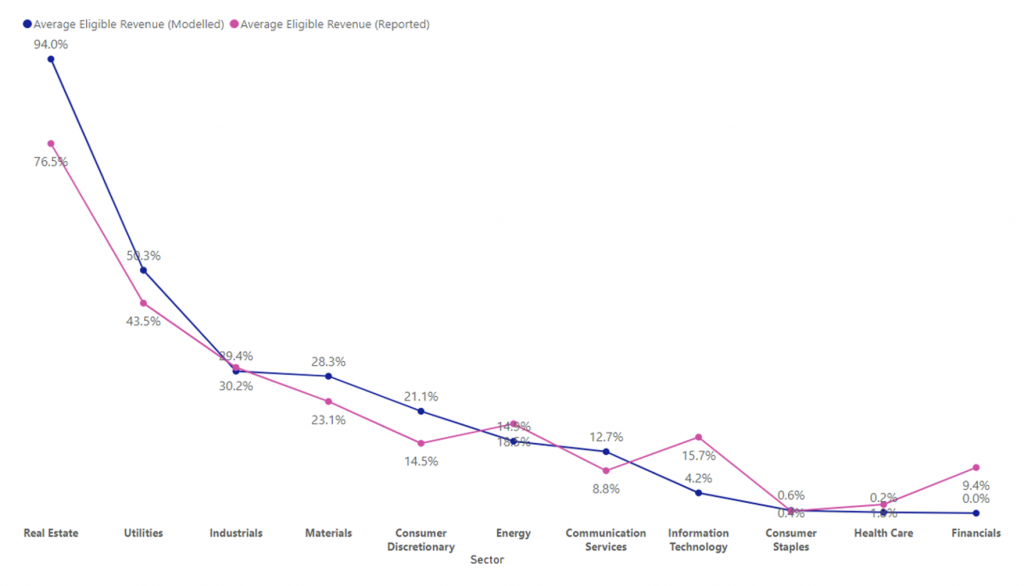

Figure 1: Average Eligible Revenue Shares across GICS Sectors: ISS ESG Modelled Data and Company Reported Data

Source: ISS ESG

In Figure 1, the average Taxonomy-eligible revenue for sectors is presented. The pink line represents the average reported Taxonomy-eligible revenue per sector, and the blue line represents the average modelled Taxonomy-eligible revenue per sector. The average Taxonomy-eligibility data from the model and average reported data for the sectors show a very high correlation.

Company-reported data and ISS ESG-modelled data both show the Real Estate and Utilities sectors as leading in their average Taxonomy revenue eligibility, while revenue eligibility is low for the Health Care and Consumer Staples sectors.

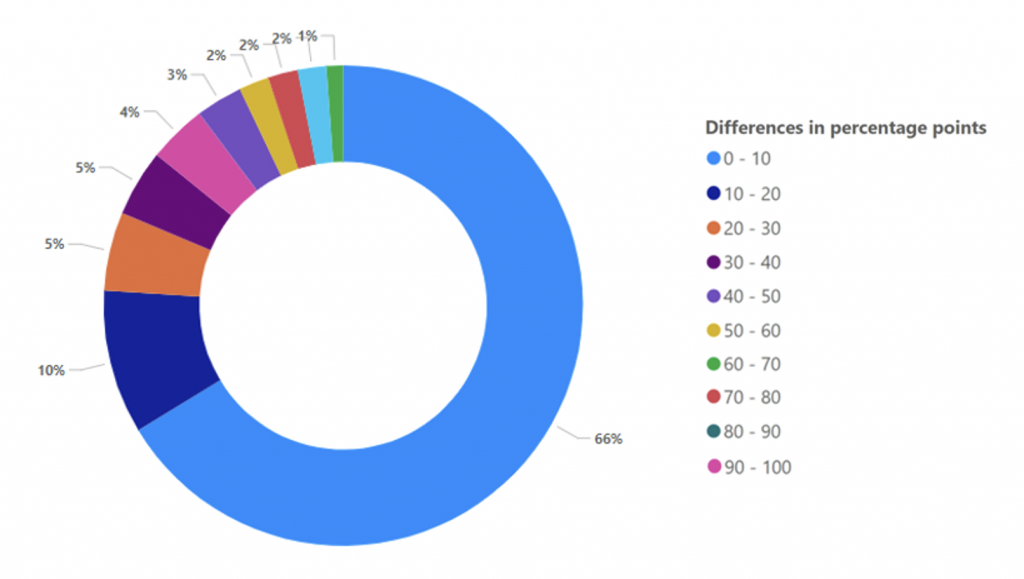

To further investigate how ISS ESG’s modelled data compares to reported data, ISS ESG calculated the percentage-point difference of reported versus modelled eligible revenue shares per issuer. The analysis shows that for more than 65 percent of companies the percentage-point difference between ISS ESG-modelled data and company-reported data is within about 10 percent, while for more than 75 percent of companies it is less than approximately 20 percent (Figure 2).

Figure 2: Eligible Revenue Shares: ISS ESG-Modelled Data vs. Company-Reported Data – Differences in Percentage Points for Companies

Source: ISS ESG

Explaining Data Divergence

ISS ESG conducted a sample analysis to investigate companies where significant divergence is observed between modelled and reported data. While it was not possible to reach a conclusion for all companies included in the sample, because the reported data lacked granularity, three recurring explanations emerged.

1: Inconsistencies in the reported taxonomy data

ISS ESG found that companies in the sample had often disclosed their taxonomy data in a way that was inconsistent with the Taxonomy framework. Such inconsistencies included the following scenarios:

- Several companies appeared to have reported their Taxonomy-aligned revenue share as the Taxonomy-eligible revenue share. As a result, these companies’ eligibility figures are likely understated.

- Several companies appear to have considered substantial contribution criteria (meant to determine Taxonomy alignment) as part of determining Taxonomy eligibility.

- Some companies reported their Taxonomy-aligned share but failed to report on taxonomy eligibility separately.

- Other companies reported on their involvement in Taxonomy-eligible activities but did not disclose the percentage of eligible revenue in their reporting.

2: Lack of proxy data on niche activities

Some economic activities included in the taxonomy framework are niche (e.g., data-driven solutions for GHG emissions, pre-commercial stages of advanced technologies to produce energy from nuclear processes, etc). These activities are not commonly captured through the data sets that serve as an input to ISS ESG’s EU Taxonomy model. As a result, discrepancies emerge in these situations, where companies derive significant revenues from niche activities.

3: Lack of granular segment reporting from companies

ISS ESG’s EU Taxonomy model relies on business segment reporting provided by companies in their annual reports. If a company does not offer detailed reporting in its annual reports, modelling the company’s Taxonomy eligibility will be challenging, and modelled outcomes may diverge from reported figures as a result.

Conclusions

The above analysis shows that ISS ESG’s modelled data is closely aligned with reported data and can be a reliable source of information for investors and other stakeholders who want to assess a company’s Taxonomy alignment. ISS ESG’s modelled data is derived through a rigorous process that includes multiple data sources and robust quality control measures and can be relied upon by financial market participants and other stakeholders as a reliable source of information in the absence of reported data.

The availability of modeled data provides greater transparency across the market and will be key to bridging the gaps in company reporting required for the EU Taxonomy to both meet its objectives and achieve its full potential for steering capital towards environmentally sustainable economic activities.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

Authored by:

Kumar Gaurav, Analyst, Research, ISS ESG

William Cowper, ESG Product Manager, ISS ESG

Rupali Goyal, Analyst, Research, ISS ESG