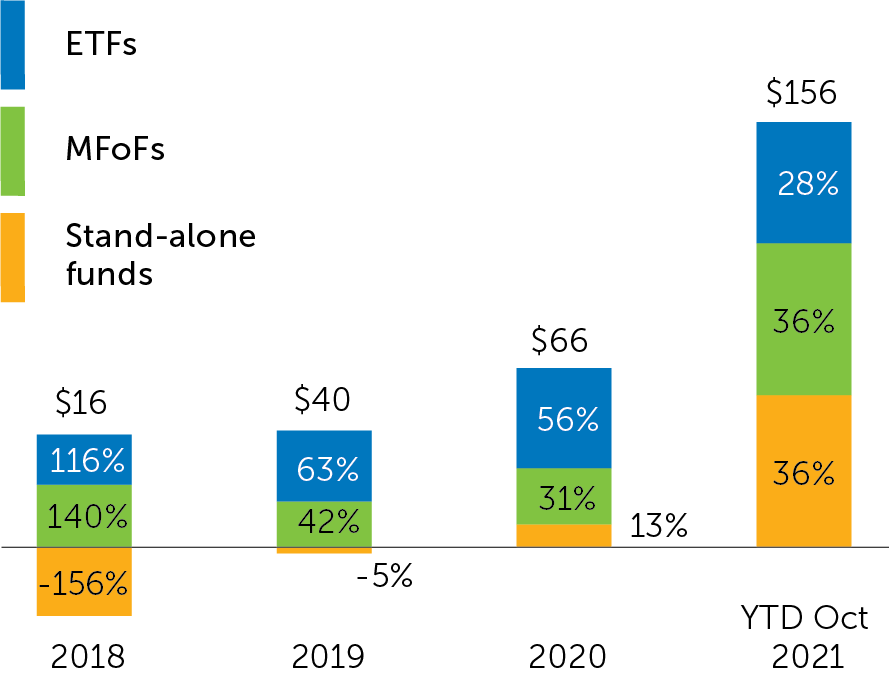

“A record-shattering year for Canadian investment funds were led by C$111.6 billion in net inflows into mutual funds for the year-to-date October 2021 period. Canadian-listed ETFs also surpassed any previous yearly record and generated C$44.0 billion in net creations.”

Below is an excerpt from Investor Economics’ (part of ISS Market Intelligence) recently released Insight feature story “Fund sales in 2021: Like a shot in the arm”. The full report is available for download on Investor Economics’ online library. For more information about this report or other IE offerings, please contact us.

Canadian Investment Fund Sales More than Double the Previous Annual Record

Long-term net flows in billions of dollars

All figures reported using the fund administration view (an assets under administration view) and including ETFs

Sources: The Investment Funds Institute Canada (IFIC) and Investor Economics

Key Takeaways from the feature story

- Against a backdrop of roaring global equity markets, Canadian household savings quickly changed direction from favouring cash allocations toward market-sensitive assets. Investment fund sales would ride this wave throughout the year to highs that more than doubled previous records.

- Stand-alone mutual funds were evenly matched against the sales of mutual fund of funds, each product structure generated net inflows of C$56.0 billion and C$55.6 billion, respectively, throughout YTD October 2021.

- Across the board, sponsor categories generated considerable positive sales throughout the period as the entire industry rode the influx of capital flowing into long-term mutual funds. The favourable market conditions brought stand-alone mutual funds back to the forefront for each category’s product offerings.

- Investors across Canada looking for exposure to equities over the first 10 months of 2021 allocated half of net flows over the period through ETFs as their preferred investment vehicle. In aggregate, ETFs with equity mandates reported net creations of $33.0 billion, with the international equity mandates representing the best-selling sub-asset class at $15.7 billion in net creations.

- Among the factors that have led to the 2020-2021 renaissance of Canadian segregated fund sales were the growing preference for downside risk protection of an aging demographic, a decline in fees, and innovative product offerings, including the rise of ESG-focused segregated funds.

The Trendlines article explores the landscape of Canadian cryptocurrency ETFs, in light of the launch of the first ETF in this space in the U.S.

Key Takeaways from Trendlines

- The October launch of the first U.S. Bitcoin ETF, where the U.S. restricted approval to only futures-based funds, served to highlight the different regulatory approach taken in Canada, where a total of 13 ETFs were already listed on the TSX and primarily physical-backed. The Canadian Securities Administrators (CSA) required only that a futures market need to exist for an underlying cryptocurrency.

- In contrast, the SEC has made it clear for the last eight years that approval will be restricted to only futures-backed funds, where funds based on direct holdings of cryptocurrencies have been rejected. The SEC has also added to their prohibitions by notifying all firms planning an inverse futures-based ETF will need to withdraw their filings.

By Carlos Cardone, Senior Managing Director, ISS MI. Vladislav Bardalez, Analyst, ISS MI. Ana Chumak, Analyst, ISS MI. Eddy Eng, Associate Vice President, ISS MI.