Below is an excerpt from ISS ESG’s thought leadership paper: Challenges to the Crypto Sector: Governance and Climate Impacts. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- The cryptocurrency industry’s once-rapid growth has slowed, partly because of rising interest rates and significant industry setbacks.

- Investors may wish to consider two key areas of risk for crypto-related businesses: governance and climate impacts.

- Crypto businesses have been resistant to the kind of regulation applied to traditional finance players. Following the recent collapse of the FTX network, however, attitudes on this topic may be changing.

- Climate change remains a challenge for the sector. The use of renewable energy to power cryptocurrency ‘mining’ carries a risk of crowding out other needs for renewable energy and associated resources. Moving from a proof of work to a proof of stake paradigm is an essential first step for the industry.

- While a lack of transparency makes ISS ESG analysis of the crypto industry challenging, listed companies do participate in the industry in different ways and investors may assess risk exposure.

- ISS ESG’s Corporate Rating and Country Rating can help investors evaluate the risks and opportunities posed by the crypto sector.

Introduction

Factors such as rising interest rates and the collapse of FTX have lessened some of the enthusiasm for cryptocurrency. Investors may wish to consider carefully the crypto sector’s risks and opportunities. Two notable challenges facing crypto are a lack of regulation to protect investors’ assets and the sector’s significant energy demand.

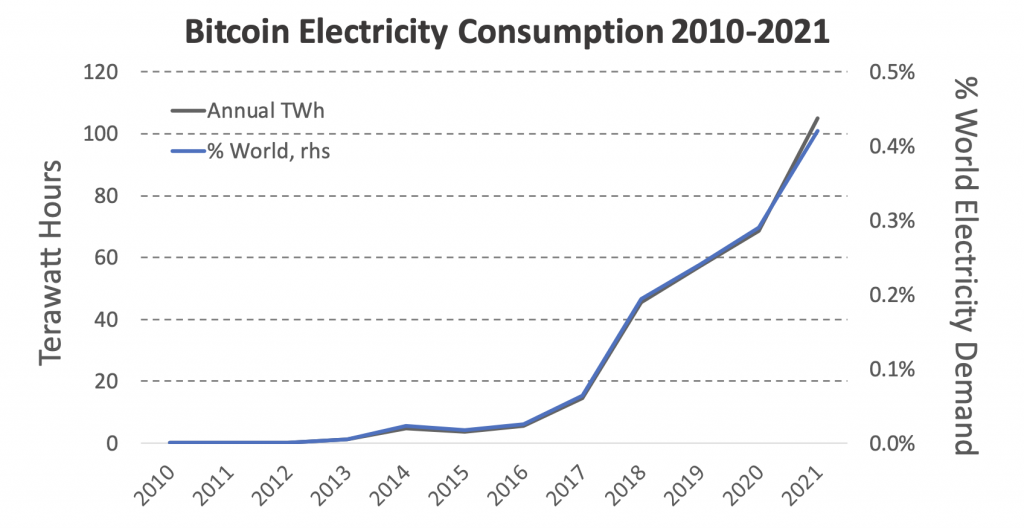

Regarding crypto energy consumption, the U.S. Office of Science and Technology Policy reported:

“As of August 2022, published estimates of the total global electricity usage for crypto-assets are between 120 and 240 billion kilowatt-hours per year, a range that exceeds the total annual electricity usage of many individual countries, such as Argentina or Australia.”

This paper seeks to shed light on these obstacles as well as to explore ways in which crypto could better protect investors while reducing its carbon footprint. Adopting regulation or a proof of stake algorithm may make a positive difference in the sector.

Figure 1: Bitcoin Alone Consumed Over 100 TWh of Electricity in 2021

Source: Cambridge University, IEA, ISS ESG

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By: Joseph Arns, CFA, Sector Head, Technology, Media & Telecom, ISS ESG

Roberto Lampl, Sector Head, Financials & Real Estate, ISS ESG

Duncan Paterson, Head of ESG Thought Leadership Program

Nicolaj Sebrell, CFA, Sector Head, Energy, Materials, & Utilities, ISS ESG