As the U.S. and countries around the globe attempt to control the Coronavirus pandemic, investors continue to experience meaningful recoveries from securities-related class action settlements.

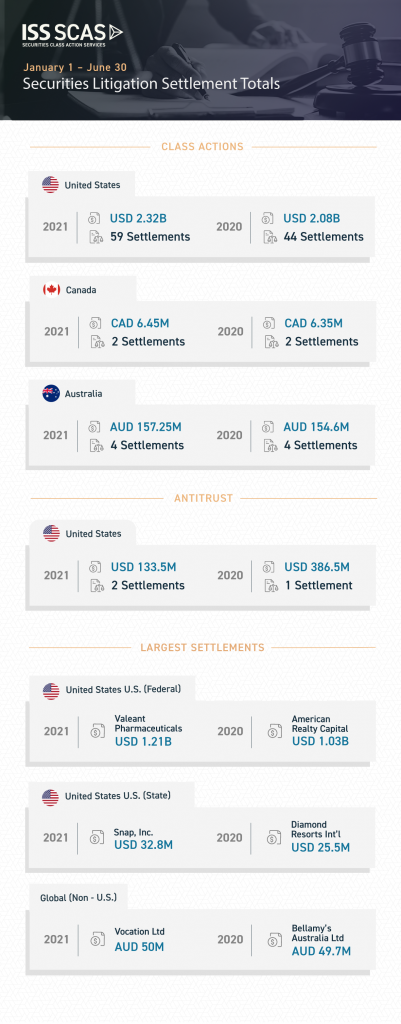

In the first half of 2021 (January 1 – June 30), U.S. class action settlements totaled $2.32 billion, an increase of 11.5% over the same period in 2020. More impressively, a total of 59 cases settled during the first six months of 2021, an increase of 34.1% over the same period in 2020. The average value of settlements, however, dropped by 16.9% ($39.3 million in 2021 vs $47.3 million in 2020).

The total settlement dollars from the first six months of 2020 and 2021 were each driven, in part, by one mega-settlement…

- 2020 – American Realty Capital ($1,025,000,000)

- 2021 – Valeant Pharmaceuticals ($1,210,000,000)

Looking outside the United States, securities related class action settlements in Australia and Canada remained steady. Coincidentally, the quantity of first half settlements remained the same at four and two, respectively, for both countries. In Australia, the first half of 2021 settlement amounts increased by 1.7%, while in Canada, the first half of 2021 settlement amounts increased by 1.6%.

During the first half of 2021 and 2020, there were no European or Asian shareholder class action settlements (in fact, no investor actions have settled since mid-2018). However, recent announcements bring potentially good news for shareholders. A tentative settlement was reached between investors and Steinhoff International, for those that previously purchased or acquired the stock in Germany or South Africa. The final settlement is not expected to occur until late 2021 – or early 2022; the amount is likely to exceed €480 million.

In terms of antitrust related settlements, the settlement dollars dropped in the first half of the current year, from $386.5 million in 2020 to $133.5 million in 2021 (the 2020 amount was from one action, GSE Bonds, where 16 big banks agreed to end allegations of artificially inflating bond prices). Note: the antitrust values will soon increase for the second half of 2021, as a few additional actions have scheduled settlement dates in the coming months.

While the increased settlement amounts bring good news to investors, there are potential areas of concern shareholders need to be aware of. Specifically, the quantity of newly filed shareholder class actions continue to decline.

After a record number of new complaints were filed in U.S. Federal courts from 2017 through 2019, ISS Securities Class Action Services previously reported a drop of greater than 22% in 2020. The cause of this decline was almost certainly COVID related, plus numbers showed a dramatically lower quantity of merger-objection cases. The drop in newly filed cases continued into the first half of 2021, though at a greater rate than 2020 vs. 2019. ISS Securities Class Action Services is working to finalize all key statistics, however initial figures from the first six months of 2021 show 110 newly filed complaints in Federal courts and 39 newly filed

The drop in newly filed cases continued into the first half of 2021, though at a greater rate than 2020 vs. 2019. ISS Securities Class Action Services is working to finalize all key statistics, however initial figures from the first six months of 2021 show 110 newly filed complaints in Federal courts and 39 newly filed complaints in State courts. These totals demonstrate a decline exceeding 40% and 20%, respectively, from the same period in 2020. As expected, the most popular court venue in Federal court remains the Southern District of New York, while the most popular court venue in State court remains the Delaware Court of Chancery.

ISS Securities Class Action Services will continue to update its clients with key industry trends, developments, and statistics.

By Jeff Lubitz, Executive Director, ISS Securities Class Action Services