There has been recent media commentary suggesting that ESG ratings don’t capture contributions and progress towards the UN Sustainable Development Goals (SDGs). Comments included the suggestion that developed nations have stalled on progress towards the SDGs, and real contributions originate largely from within emerging markets. There is an alleged inherent wealth bias in these scorings.

The arguments are valid to some extent. Developed sovereigns have stalled on progress since many sub-targets for the SDGs are either irrelevant to developed nations or these low-hanging fruits have already been harvested (for example targeting poverty and hunger). And countries that ARE making progress appear underscored in some ESG ratings systems, since governance and social topics are weighted very highly in some methodologies.

One can make an alternative argument, however, that SDG-alignment in sovereign ESG ratings is primarily a function of decisions around the calibration of specific factors, subject to the intention of the product and its normative stance. A recent World Bank study comparing different sovereign ESG data providers, for example, has found that “ISS appears more focused on SDG-related materiality”. Why is that?

ISS ESG Country Ratings are a comprehensive measure of 108 individual factors relevant to sovereign issuers. The standard weighing scenario is 50% on environmental factors, 35% on governance factors and just 15% on social factors. This is driven by the belief, shared by many investors, that nature is fundamental to long-term sustainability, and therefore natural capital factors are placed at the heart of the rating.

As many environmental factors have minimal impact on the short-term pricing of sovereign bonds, they tend to be underrepresented in ESG rating models that are focused on financial materiality rather than a broader understanding of double materiality. Many emerging markets and developing countries have considerably smaller environmental footprints than established economies, however, and would therefore before better if this was recognized in the ESG score.

Furthermore, governance factors in many models are limited to quantitative factors and composite indices measuring the state of the rule of law and center on government effectiveness. While these are not irrelevant factors, they do not present a timely picture of the state of democratic, human and political rights in a given country – values which are backed by international norms and are absolute for each country.

ISS ESG’s Country Ratings include qualitative and forward-looking human rights assessments, bringing into balance what could otherwise result in a wealth-driven governance bias. The risks here are illustrated in examples such as sovereign ESG funds that funnel sustainability dollars into controversial countries like Saudi Arabia.

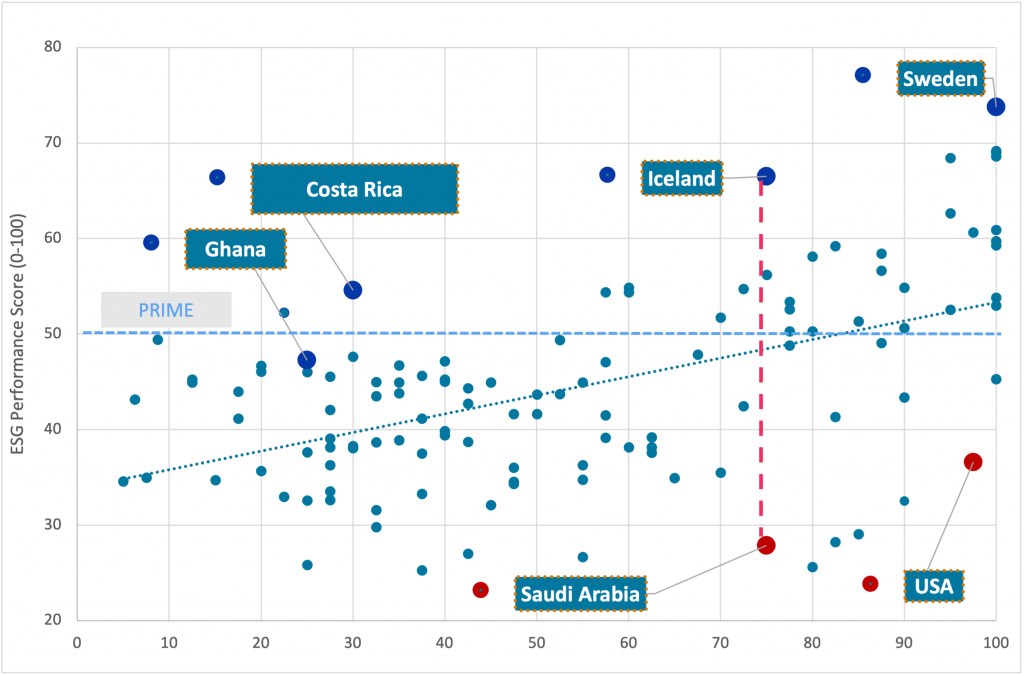

So rather than constructing ESG scores focused primarily upon financial materiality, raising the risk of effectively double counting the financial risks, responsible investors should use ESG ratings complementarily. This enables the user to manage ESG risks, as illustrated below by the ESG-gap between Iceland and Saudi Arabia. It also helps to identify sovereigns with a higher impact and better progress towards E, S and G (e.g. Costa Rica, Ghana), even when their credit ratings and country wealth lag behind.

Prevent Tail Risks – Identify Opportunities

Comparing credit ratings to the ISS ESG Country Rating

Sovereign Credit Rating on a numerical scale (0-100), average of Moody’s & S&P

Source: ISS ESG Country Rating, various sovereign credit ratings agencies

Removing the sovereign wealth bias by looking through a simple SDG lens may result in dubious outcomes, however.

As noted in the article referenced at the start of this paper, the Impact Cubed model suggests China stands out in progress versus the UK, Japan and the United States. While this may be the case when looking exclusively at SDG-related indicators, the end result is that responsible investors invest more into China – despite that country’s increasingly pugnacious foreign policy position, conflict over political rights in Hong Kong, as well as allegations of domestic human rights problems.

While the SDGs are an extremely important set of targets for countries to aspire to, they do not necessarily capture all ESG-related risks. They are themselves the result of international political collaboration, omitting some of the more contentious aspects of international norms for the sake of international compromise.

This doesn’t mean that responsible sovereign investors should ignore the potential for impact in their portfolios, it just means that they would be better served by looking into a sovereign’s performance on individual SDG factors. ISS ESG’S Custom Rating function gives clients the ability to create single-SDG sovereign ratings, based on existing sovereign factors. The below is an example of a ranking for SDG 15 – Life on Land.

| Issuer | SDG 15 – Custom Score | Ooverall Performance Score | Decile Rank |

| Government of Zambia | 72.67 | 43.16 | 6 |

| Government of Sweden | 71.58 | 73.95 | 1 |

| Government of Finland | 69.58 | 68.66 | 1 |

| Government of Estonia | 68.58 | 58.62 | 1 |

| Government of Luxembourg | 68.58 | 60.32 | 1 |

| Government of Slovakia | 68.00 | 50.24 | 3 |

| Government of Venezuela | 66.50 | 38.37 | 7 |

| Government of Latvia | 66.50 | 56.17 | 2 |

| Government of Gabon | 64.00 | 46.68 | 4 |

| Government of Austria | 63.00 | 62.26 | 1 |

This illustrates that while some usual suspects are identified, there are several outliers where their positive progress towards SDGs and related risk factors can be identified, despite their nature as emerging or even developing economies.

Not all sovereign ESG ratings allow a wealth gap to result in misalignment with the SDGs. In their efforts to focus on the SDGs and promoting less wealthy countries, however, investors should not forget to incorporate international norms which are absolute in nature and valid for developed and emerging markets alike. Moreover, rather than aggregating all SDGs into a single score it might prove useful to concentrate on specific SDGs in order to identify sustainability-linked investment opportunities.

Explore ISS ESG solutions mentioned in this report:

- Extend your ESG policies to your fixed income portfolio with ISS ESG Country Rating.

By Janina Magdanz, Country Rating Analyst, ISS ESG. Hendrik Leue, Head of Bespoke and Advisory Research, ISS ESG.