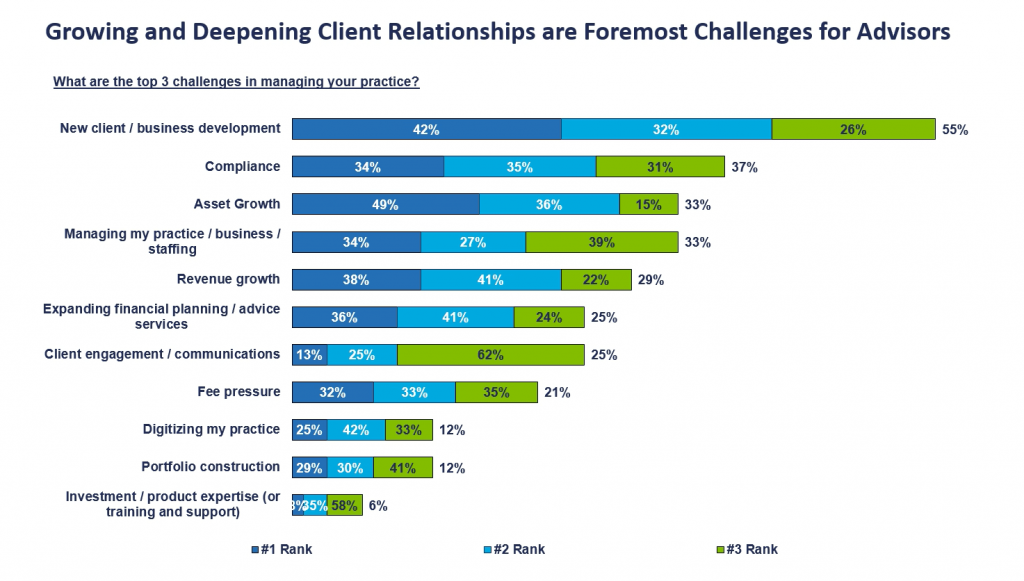

Financial advisors and asset managers face the same dilemma—how best to expand and deepen relationships with clients. More than half (55%) of advisors overall ranked new client/business development as one of their top 3 challenges in 2023, making it the most frequently cited concern. Day-to-day tasks also compete for advisors’ time and attention—one-third or more of advisors identified compliance (37%) and managing their practice/business/staffing (33%) among their top 3 challenges.

Asset managers report that it is more difficult than ever before for wholesalers to get through to advisors and have the in-person interactions and substantive conversations fundamental to building and nurturing relationships. Advisors are inundated by outreach and content from asset managers and other providers, and they need a compelling reason to engage.

For managers and other value-add providers, investing in these programs promises to help open doors to advisors. As one surveyed advisor put it, they are looking for “ideas for growth and prospecting.” Value-add programs are, by design, not product focused. Value-add content is distinct from, though sometimes understandably conflated with, investment thought leadership, which is more economic and capital markets-centric. There are four core areas of value-add programs: practice management, portfolio construction, goals-based planning, and wealth management. We assert that value-add programs will remain a mainstay of advisor engagement strategy in the future.

Source: ISS MI Market Metrics 2023 March

This paper explores data and insights from the ISS Market Intelligence Pulse survey of 823 advisors on the topic of value-add programs. Our analysis examines whether these programs generate meaningful return on investment (R.O.I.) for asset managers and other providers, which types of content most resonates with advisors, and why most advisors are only moderately satisfied with this programming and content even as many find these programs valuable. We also look at the power of value-add programs to open doors to new advisors and revive relationships post-pandemic. We conclude with best practices for creating and maintaining best-in-class value-add programming.

Do Value-Add Programs Earn Their Keep?

Collectively, the industry has invested substantial resources in value-add content year after year, and so one would expect that firms are seeing a R.O.I. from these programs. Yet many asset management executives have shared that they haven’t been able to reliably measure the R.O.I. from their value-add programs. In the absence of more undisputable evidence, one of the chief justifications for asset managers investing in these programs is that their broker-dealer partners seek this support as a component of their strategic partnerships.

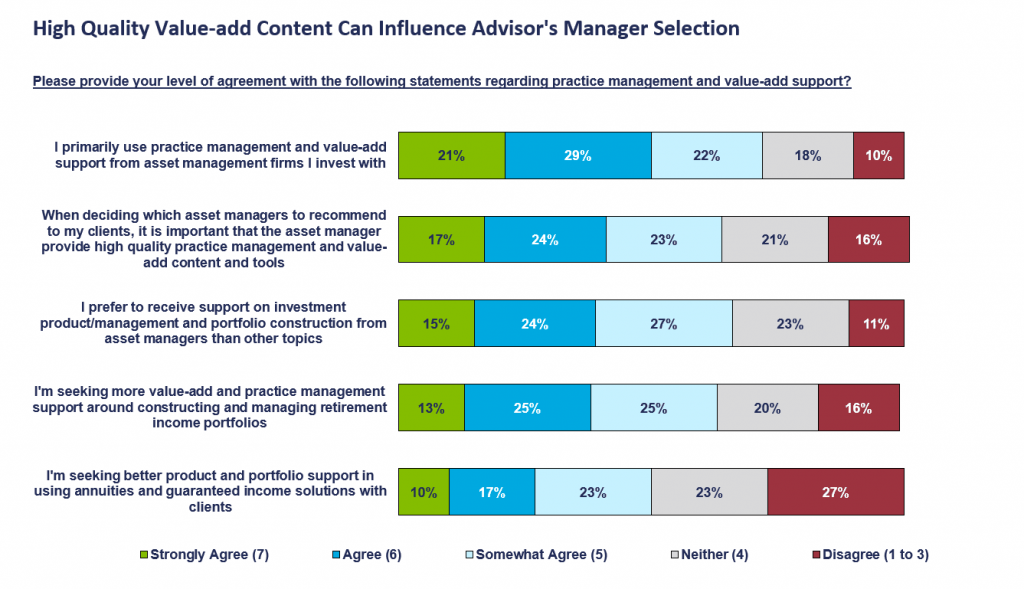

While it is difficult to measure precisely how much an asset manager’s commitment to providing high quality value-add support shapes a broker dealer’s or an advisor’s decision to work with a manager, it is often a meaningful factor in the equation. When we asked advisors about their level of agreement with the statement “When deciding which asset managers to recommend to my clients, it is important that the asset manager provide high quality practice management and value-add content and tools,” most advisors (64%) expressed some level of agreement, with 17% of advisors strongly agreeing with this statement.

Source: ISS MI Market Metrics 2023 March

Asset managers’ commitment to generating value-add content varies meaningfully. Of course, larger firms generally have the most expansive offerings in this area. There is also a cohort of firms that dismiss (or downplay) the impact of value-add programs and don’t invest in them. Some firms that offer value-add content acknowledge that they get the short shrift in terms of resources and attention.

With concerns about the lingering storm clouds of volatile markets, ongoing pressure from low-fee passive products grabbing market share, and the ongoing demand for resources for other initiatives (including costly website upgrades and expanded sales force coverage to target RIAs, and other initiatives), advocates of value-add programs sometimes meet with skepticism from senior management when they request resources for these programs. Moreover, advisor feedback on value-add content is often lukewarm.

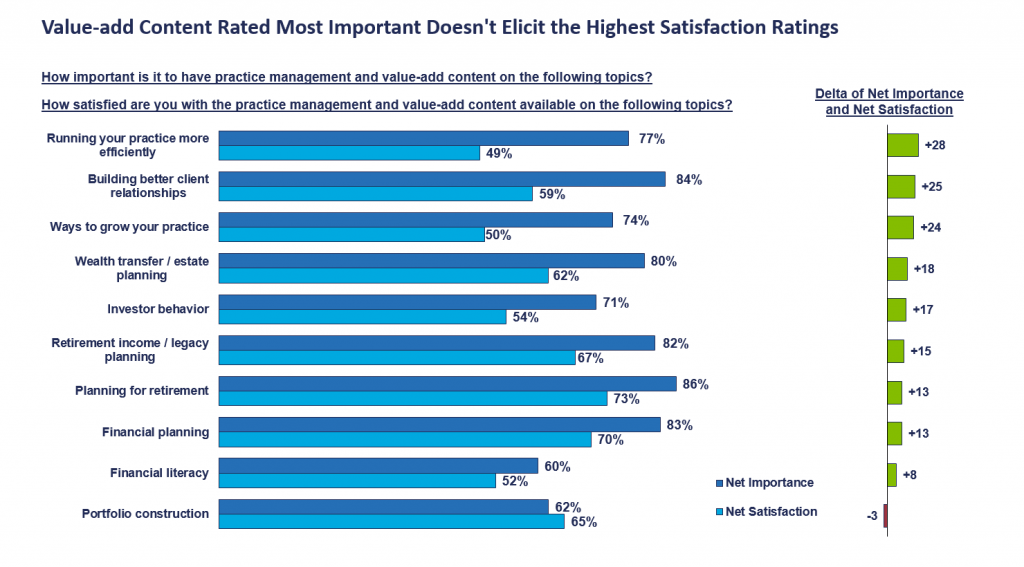

Many advisors have shown less than enthusiastic satisfaction for the current slate of value-add programs, with more than half of advisors stating they were only somewhat satisfied, neutral, or dissatisfied with current programming. That said, we do not view this feedback as an indictment of value-add programs but rather a reflection of inconsistent quality among these programs. There are various factors conspiring to mellow enthusiasm including too much generic or stale content, insufficient depth and expertise, programing that is not sufficiently prescriptive, and lack of exposure to certain content (i.e., advisors may not be aware the content exists). Simply put, there is abundant opportunity to optimize and improve value-add programming.

Moreover, most of the surveyed value-add topics elicited a satisfied or extremely satisfied response from advisors. It is notable that portfolio construction—which is a very hands-on, customized endeavor facilitated by portfolio construction specialists— received the highest satisfaction ranking among topics ranked by advisors. It was additionally the only topic where advisors were more likely to say they were satisfied with a program than they were to rate it important.

Source: ISS MI Market Metrics 2023 March

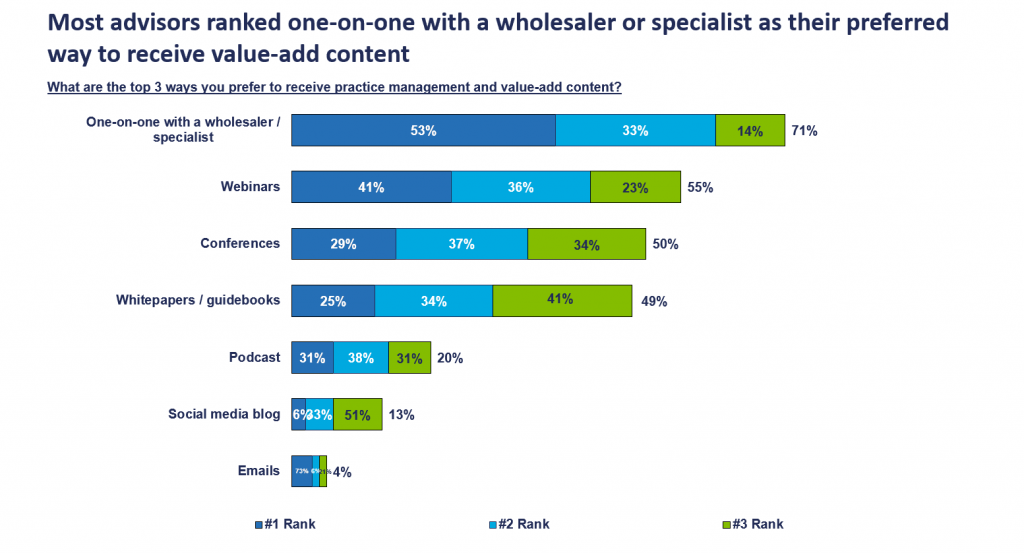

Value-add programs are a tool in managers’ toolboxes that do not depend on fund performance. During 2022 when many traditional long-only fund managers grappled with underperformance and persistent outflows, and it seemed that nothing was working, value-add programs were one way to sustain and nurture relationships until things turned around. When receiving practice management and value-added content, advisors favor one-on-one in-person delivery.

In an era when it is exceedingly difficult to connect with advisors over the phone or in person, value-add can open doors to a conversation. More than 70% of surveyed advisors overall prefer to receive value-add materials from a one-on-one interaction with their wholesaler or specialists rather than digital or other means including webinars, conferences, emails, and white papers. RIAs are the exception, with 74% preferring to receive practice management via a webinar.

These findings do not diminish the importance of other modes of communication. Webinars and other means are more scalable than in-person delivery and are highly effective communication tools for certain content that can be accessed 24/7. Franklin Templeton, which positions its value-add programming under “The Academy” moniker, offers a wide array of value-add support, much of which is available “on demand.”

Source: ISS MI Market Metrics 2023 March

Advisors are looking for innovative ideas, timely market updates, tips on how to engage clients and ways to deepen and expand their number of client relationships. American Funds and First Trust top the leaderboard of highly regarded value-add providers. 16% of wirehouse advisors, and 10% of advisors overall, rated American Funds as best at providing value-add content. First Trust was rated the top manager by 10% of advisors. One advisor we interviewed explained that “[First Trust] are in touch with me on a weekly or sometimes a few times a week basis either by phone or email and has many conferences with portfolio managers or strategists.”

Getting to the Door First: Standing Apart from Competitors

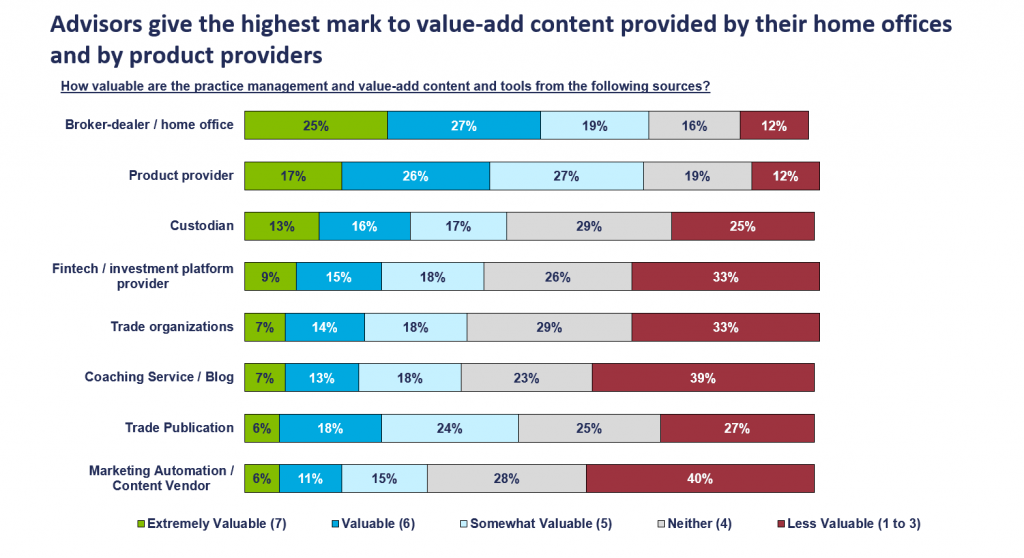

Asset managers aren’t the only ones offering value-add support to advisors. Indeed, 25% of overall advisors consider broker-dealer/home office value-add content to be extremely valuable compared to 17% of overall advisors that deem providers value-add content to be extremely valuable. Custodians enjoy high marks for their value-add content, with 23% of RIAs rating their value-add support as extremely valuable. When advisors were asked which firms are best at providing value-add and practice management content, Morningstar, Schwab, Envestnet and Salesforce landed in the top ten firms cited.

Source: ISS MI Market Metrics 2023 March

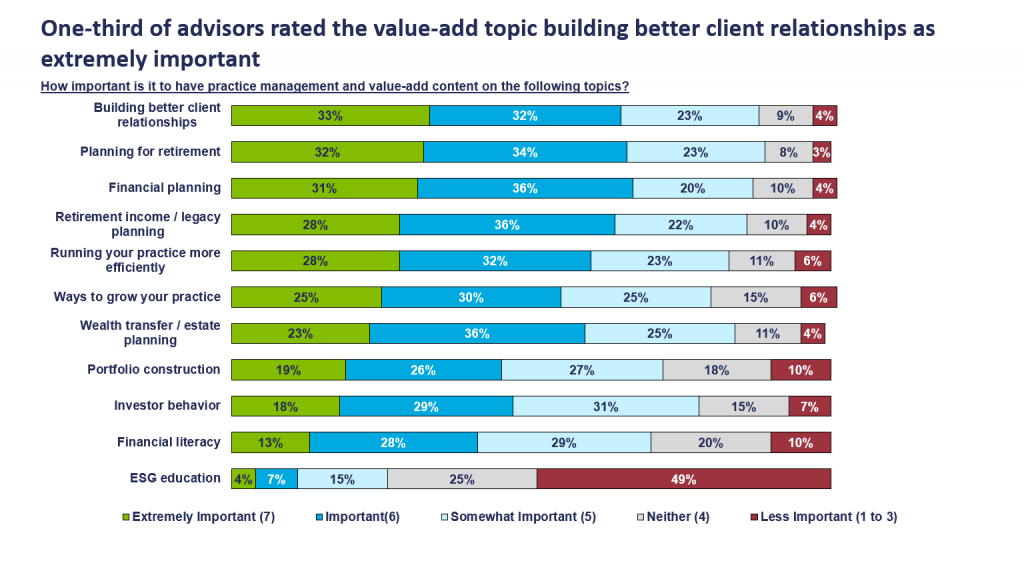

As mentioned, value-add programs broadly fall under a variety of categories including practice management, portfolio construction, goals-based planning, and wealth management. Practice management has been a staple of these programs for a long time but the sort of practice management programs that advisors currently prize the most are tied to building better client relationships and growing their practice. Nearly 90% of advisors assigned some level of importance to building better relationships, with 33% of all advisors rating this topic as extremely important.

Unsurprisingly as the arc of baby boomers nearing or in retirement ascends, advisors need help helping their clients navigate Social Security and Medicare and other retirement topics. Both planning for retirement and retirement income/legacy planning ranked among the top four most important value-add topics. 38% of advisors agreed (including 13% who strongly agreed) with the statement “I’m seeking more value-add and practice management support around constructing and managing retirement income portfolios.”

Source: ISS MI Market Metrics 2023 March

Advisors with larger practices (AUM of $500MM+), including RIAs, have somewhat different priorities tied to value-add and practice management topics. While they also prioritize practice management support tied to “new client/business development,” these advisors, who often operate like small business owners, are even more eager for assistance running their businesses. Nearly 60% of these advisors with larger practices rated the topic “running your practice more effectively” as extremely important or important. This is underscored by the data indicating that nearly half of advisors with AUM of $500MM+ ranked “managing my business/practice/staffing” as a top 3 challenge, including 31% of this elite group of advisors that ranked this as their #1 challenge.

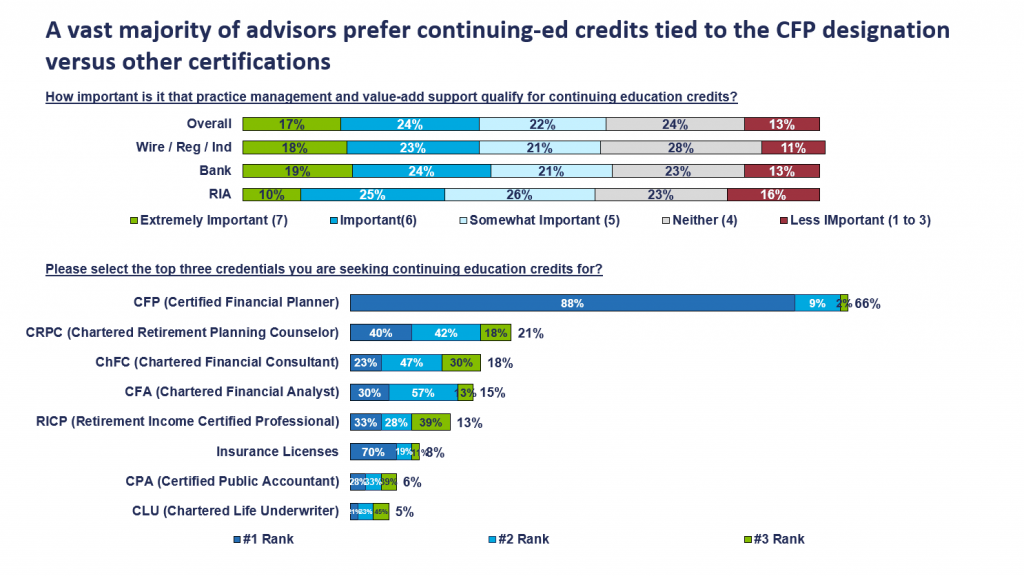

Most advisors also appreciate opportunities to earn continuing education (CE) credits. Over 60% of advisors think it is important that value-add programs qualify for CE credits. Notably, continuing-ed credits hold less sway among RIAs, with just 10% of RIAs rating these credits to be extremely important (compared to 18% of wirehouse advisors). Advisors also value support for client events, including financial sponsorship. When asked how asset managers can help them build their business and engage with clients and prospects, advisor’s comments included “help with marketing events”, and “help financially with seminars to clients.”

Source: ISS MI Market Metrics 2023 March

Optimize, Integrate, Measure: Best Practices

Some mid-size and smaller asset managers shy away from developing value-add content because they don’t think they have the requisite resources to compete, and for some managers it is the right decision. That said, value-add programs don’t have to be expansive to be effective and gain traction among advisors. More isn’t necessarily better. We believe that managers can optimize advisor engagement by operating a single value-add program (e.g., around retirement income or tax management)—if it is best-in-class and differentiated.

The resources required to develop and maintain value-add programs vary substantially depending on the type of program and implementation. For example, portfolio construction value-add programs generally require a bigger investment than practice management, financial planning, or wealth management content. Even among portfolio construction service providers, the scope of these programs varies considerably. Some firms employ just one or two portfolio construction specialists while others have 15 or more, and some asset managers offer increasingly sophisticated self-service software tools.

ISS Market Intelligence counsels asset management firms and other value-add providers to consider these best practices when developing and improving value add programs and content.

Retire stale content. Maintaining generic, seldom used value-add content diverts attention and resources away from robust and prescriptive value-add content that captures advisors’ attention.

Study competitors. Assess competitive value-add offerings. Understand how firms are evolving their offerings. Play with their interactive tools. Identify opportunities to differentiate.

Segment your Advisors. Target difficult-to-engage advisors. Identify topics likely to resonate. Offer CE credits where suitable, and financial support for seminars where justified.

Aim for best-in-class. Steer clear of maintaining a run-of-the-mill value-add program. If your firm hasn’t committed sufficient resources or expertise to produce a best-in-class value-add offering, then reconsider.

Embrace complex subjects. Advisors need the most help with weighty topics. Where appropriate, consider leveraging outside expertise or selectively employing specialists.

Align with brand. Content that dovetails with a manager’s distribution strategy and rooted in its brand is more likely to resonate and be remembered. Clear-cut website presentation of the content is also impactful.

Measure ROI. Calculating the return on investment isn’t a precise science. Maintain an ongoing system for tracking advisor engagement with value-add content (e.g., did the content open a new door, sales/engagement before and after interaction and post-delivery surveys of advisors). Tracking these metrics consistently is tedious (hint: it typically requires senior management to mandate it).

To learn more about ISS MI’s offerings, visit https://www.issgovernance.com/market-intelligence/market-metrics-advisory-research/.

By: Cindy Zarker, Associate Director, ISS Market Intelligence