The rise of 5G development and digital data has created growing demand for data centers. Data centers are a type of industrial computing service infrastructure. Data centers house computer systems and their associated components: storage devices, power supplies, communication devices, and security devices. These centers have become essential to support a wide range of applications and services, from telecommunications, social media, and e-commerce to scientific research and cloud computing.

Growing digitalization and the uptake of artificial intelligence (AI) has accelerated investments in new data centers. Much of this investment is concentrated in the United States, where annual investment in data center construction has doubled in just the past two years. Other major economies, such as China and the European Union, are also experiencing increased investment.

The rapid expansion of data centers has resulted in a notable increase in energy usage. According to the International Energy Agency (IEA), data centers consumed about 460 TWh in 2022, or about 2 percent of global energy consumption. The demand is growing dramatically: with the increased use of AI and cryptocurrency, data center electricity consumption is expected to approximately double in the next few years, reaching about 945 TWh (roughly equal to the total electricity consumption of Japan) by 2030. In the United States alone, the power needs of data centers are expected to grow as much as about 3 times higher than current capacity and to reach as high as 11-12 percent of total U.S. power demand by 2030.

Global power infrastructure faces substantial constraints to meet data centers’ voracious need for power: limitations on reliable power sources, the sustainability/ecological impact of the power source, upstream infrastructure construction for power access, and power equipment requirements within data centers. Data centers also raise ecological concerns about water use requirements, environmental risks such as emissions, and the possible physical risks associated with increasing infrastructure. To meet global demand effectively and sustainably, companies that own and operate data centers may need to focus on energy efficiency measures; reduce consumption through energy-efficient hardware, heat management systems, and efficient cooling; and invest in both on-site and off-site renewable energy projects.

The following case study of 395 companies within the ESG Corporate Rating universe that own data centers shows that most companies score poorly on energy efficiency and renewable energy use and tend to be laggards on adopting energy efficiency strategies. Companies that are leaders in these areas, though, also tend to perform well on power-usage-effectiveness metrics for data centers.

Energy Efficiency and Strategies for Companies with Data Center Operations

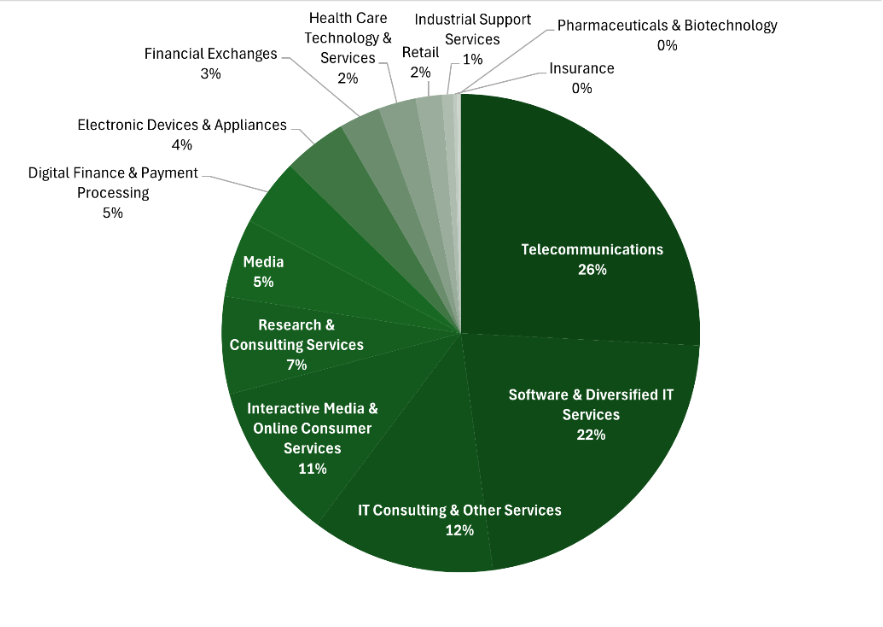

The energy efficiency strategies of 395 public companies that own or operate data centers were analyzed. These companies are part of the ESG Corporate Rating universe and represent a diverse set of industries in which the companies own data centers as part of their operations: Telecommunications, Software & Diversified IT Services, IT Consulting & Other Services, Interactive Media & Online Consumer Services, Digital Finance & Payment Processing, and Healthcare Technology & Services, among others. Figure 1 illustrates the industry-wise breakdown of these entities.

Figure 1: Companies with Data Centre Operations

Source: ESG Corporate Rating, as of July 25, 2025

Many of these companies that own or operate data centers are incorporated across different countries. The five countries that account for the largest percentages of companies with data centers are the United States (31%), followed by France (6%), Germany (6%), Japan (6%), and the United Kingdom (4%). The rest of the world accounts for the remaining 47% of companies, which are incorporated in smaller numbers across different countries (although in many cases the actual physical location of company data centers is not disclosed). Also, many of the companies that own or operate data centers are Large Cap (40%) and Mid-Cap (35%) entities.

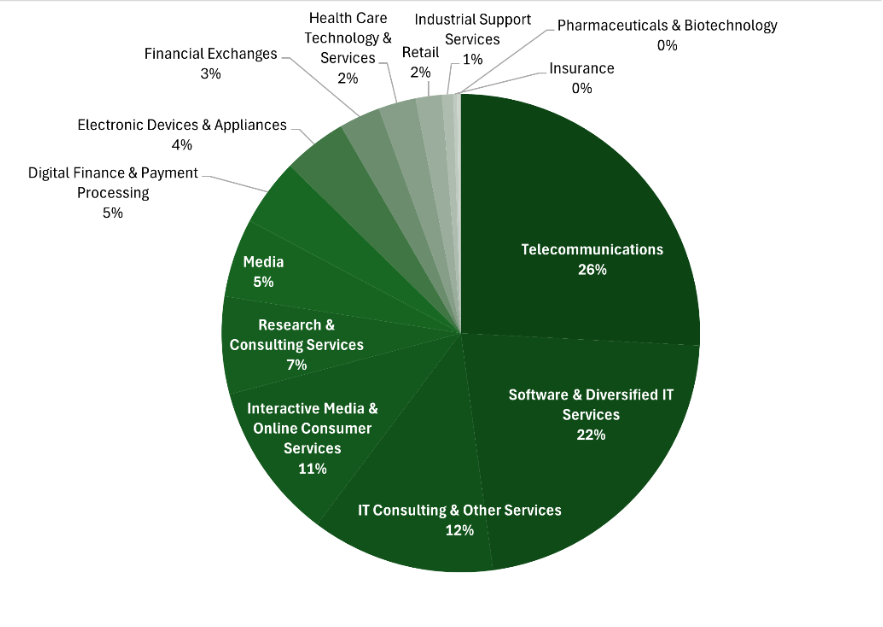

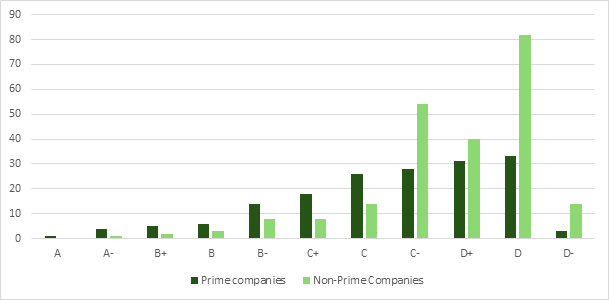

An analysis of the indicator assessing company strategies on energy efficiency and renewable energy use in data centers highlights low scores (C or below) for the majority of companies (Figure 2).

Figure 2: Data Centre Energy Efficiency Strategy Indicator Scores

Note: Data is recorded on a scale from A (best performance) to D- (worst performance). Companies are awarded Prime Status if the overall ESG Corporate Rating letter grade meets or exceeds the industry-specific Prime threshold defined by the Industry Classification Matrix. The Prime threshold reflects the overall magnitude of an industry’s risk exposure and footprint. The indicator here assesses the energy efficiency measures and use of renewable energy in owned data centers as well as implementation of related strategies, which could include relevant targets, progress reports, and phases of measures.

Source: ESG Corporate Rating, as of July 25, 2025

Many of these companies have achieved the ISS Sustainability “Prime” status, which is granted to companies that have a demonstrated ability to adequately manage material ESG risks, mitigate negative and generate positive social and environmental impacts, and capitalize on opportunities offered by transformation towards sustainable development. However, despite being Prime-rated companies, most do not exhibit comprehensive strategies on data center energy efficiency and renewable energy use. This analysis has identified a significant gap in companies’ practices to address various aspects of the growing energy demands for data centers.

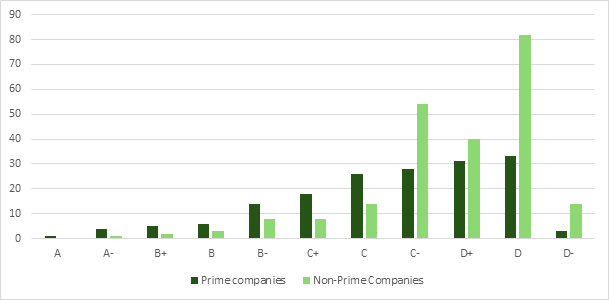

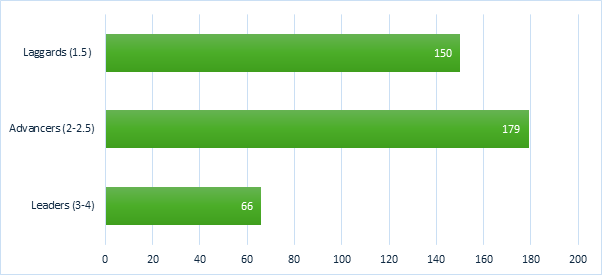

A numeric scale, with 4 being excellent performance and 1 representing poor performance, was used to assess the company’s strategies to increase energy efficiency and renewable energy in data centers. Figure 3 indicates that most companies have limited disclosures on the subject, such as a general commitment (laggards) or some measures/strategy but no information on implementation (advancers); this implies that both these categories lack comprehensive disclosures.

Only some companies are leaders in this area, meaning they have detailed strategies covering energy-efficient IT equipment, airflow management, optimization of cooling, and use of renewable energy, along with information on implementation of these strategies.

Figure 3: Data Centre Energy Efficiency Strategies among Companies with Own Data Centers

Companies categorized as leaders generally fell into the following key industries: Telecommunications, Software & Diversified IT Services; followed by IT Consulting & Other Services; and Interactive Media & Online Consumer Services. All these are industries where data centers could play a large role in the success of their operations.

The analysis of ESG Corporate Rating data also illustrates that companies with cutting-edge energy efficiency and renewable energy use practices also have optimum power usage effectiveness (PUE) scores, a ratio that describes how efficiently a data center uses energy. In other words, companies with higher grades for the indicator assessing strategies on energy efficiency and renewable energy use in data centers also generally have better ratios for the PUE indicator.

Conclusion

For investors, it’s important to recognize that data centers are a foundational component of modern infrastructure, serving a wide range of industries across the globe. Their critical role in supporting the operations of large and mid-cap companies makes them increasingly indispensable. As demand for data centers continues to rise, so too does the need for reliable and sustainable energy sources. Power outages and strain on the energy grid pose significant risks, and mitigating these through resilient energy solutions is essential.

Investors may benefit from assessing their portfolio companies’ activities dedicated to ensuring energy risk management. Such activities may be helpful in achieving longer-term operational stability in this rapidly growing sector.

Explore ISS STOXX solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ESG Corporate Rating.

By:

Harish Srivatsava, Sustainability Research, Sector Head, ISS STOXX

Amber Daniels, Managing Director, Sustainability Research, Global Multi Sector Head, ISS STOXX

Avleen Kaur, Sustainability Research, Sector Head, ISS STOXX