Australia is among the top producers of most global commodities, including iron ore, zinc, gold, and cobalt, and in 2023 was the top global producer of lithium. As discussed in Critical Minerals: ESG Risks and Implications, the country is likely to play a key role in supplying the minerals and raw materials needed to meet demand for the clean energy transition. These same materials will likely play a role in the expansion of AI.

An important pillar of the Australian mining industry is the JORC Code, a professional code of practice set by the Australasian Joint Ore Reserves Committee (JORC). The Code establishes minimum public reporting standards for mining companies trading on the Australian Securities Exchange (ASX), New Zealand’s Stock Exchange (NSX), and Papua New Guinea’s National Stock Exchange (PNGX). Regarded as an industry leader, the JORC code informs regulations in other markets, as well as international industry standards such as the International Council on Mining and Metals (ICMM) guidelines.

In recent years, high-profile cancellations and costly remediation payments in the mining industry have impacted investor confidence. Exploration allocations in Australia have fallen, with reported drillholes down 29% between 2022 and 2023. The JORC responded in early 2024 by proposing updates to the Code, including mandatory ESG reporting across all stages of a mining project, from discovery to closure.

What are the implications of such broad ESG reporting from mining companies under the JORC Code? Drawing upon the ISS ESG Corporate Rating and Norm-Based Research solutions, this article details the specific risks faced by mining companies in the exploration and development stage. The article also explores how early-stage ESG evaluation can help investors to better assess relevant risks and opportunities.

ESG Risks for Mining Companies

The mining sector generally consists of companies with three distinct business models:

- Miners already operating productive sites and looking to explore and develop new projects.

- Companies solely involved in exploring and developing sites to then sell.

- Early-stage companies involved in exploration and development of projects, which they then intend to operate.

ASX-listed mining companies exhibit relatively low environmental and social performance scores (Figure 1). Low scores are correlated with higher risk potential in these areas for investors.

Figure 1: Corporate Rating Scores for ASX-Listed Mining Companies

Source: ISS ESG Corporate Rating

Note: Values for <3% are not displayed. A score greater than 50 identifies Prime-rated issuers. The figure covers all ASX-listed mining companies covered by ISS ESG Corporate Rating.

In recent years, multiple high-profile mining projects were cancelled due to political concerns over social or environmental impacts. These cancellations were driven both by new regulations and an increasing political will to enforce existing ones. This trend suggests that the evaluation of environmental and social risks in the exploration and development phase can be an indicator of long-term viability.

Among social factors, contractor health and safety management can be a significant risk for exploration and development companies, as their workforces usually consist mostly of contractors rather than direct employees, especially in the pre-revenue phase.

Alignment with human rights standards is also an important factor. Respect for indigenous communities, including a commitment to obtaining Free, Prior, and Informed Consent (FPIC), can particularly impact viability. For example, one Australian mining project was halted following political intervention, as its tailings dam was planned on an Indigenous Heritage site. Another mine’s lease was not renewed due to both environmental concerns and failure to acquire a social license to operate.

In the environmental sphere, topics to consider in the exploration and development stages are biodiversity and tailings management frameworks, as well as site closure planning and policies toward protected areas. The ‘nature positive’ movement is putting increasing pressure on mining companies and new projects through recently adopted standards such as the TNFD Recommendations, the new ICMM nature-positive commitments, and the Australian government’s plan to progress to stage 2 of the Nature Positive law reforms.

Early-stage biodiversity risk and impact assessments disclosure may limit large capital investments into projects that risk being halted. Disclosures regarding the operating environment of any unexploited reserves, as well as the environmental, political, and social risks related to the development and production of such reserves are particularly important. For instance, in 2023, a number of coal projects were cancelled due to inadequate prior environmental impact assessments, and a proposal for a large coal mining project was withdrawn after the Environment Protection Authority expressed concerns over the development’s failure to abate GHG emissions.

Implications of Broader ESG Reporting

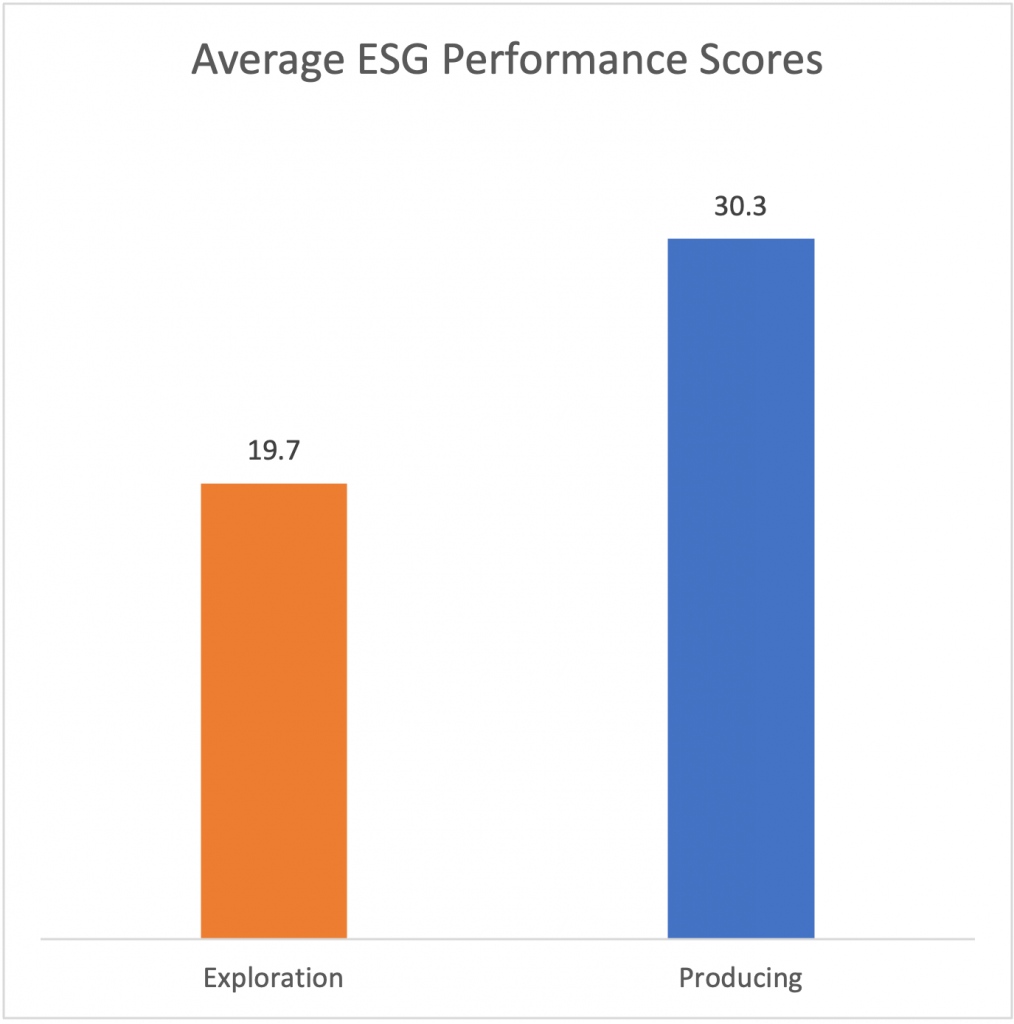

Publicly available data on key environmental and social risk areas for exploration and development companies is currently lacking. The difference in average ESG scores between already-producing and exploration companies based in Australia is notable (Figure 2). This difference is due to the limited scope of disclosures by exploration companies, which tend to lack sufficient quantifiable risk data.

Figure 2: Average ISS ESG Corporate Rating Scores for Australia-Based Mining Companies

Source: ISS ESG Corporate Rating

Note: This figure covers 57 companies.

However, with quickly developing standards and regulations for exploration projects, more data may become available very soon, especially if the JORC changes are adopted. This information will be captured by investors directly or through quantifiable solutions, such as the ISS ESG Corporate Rating.

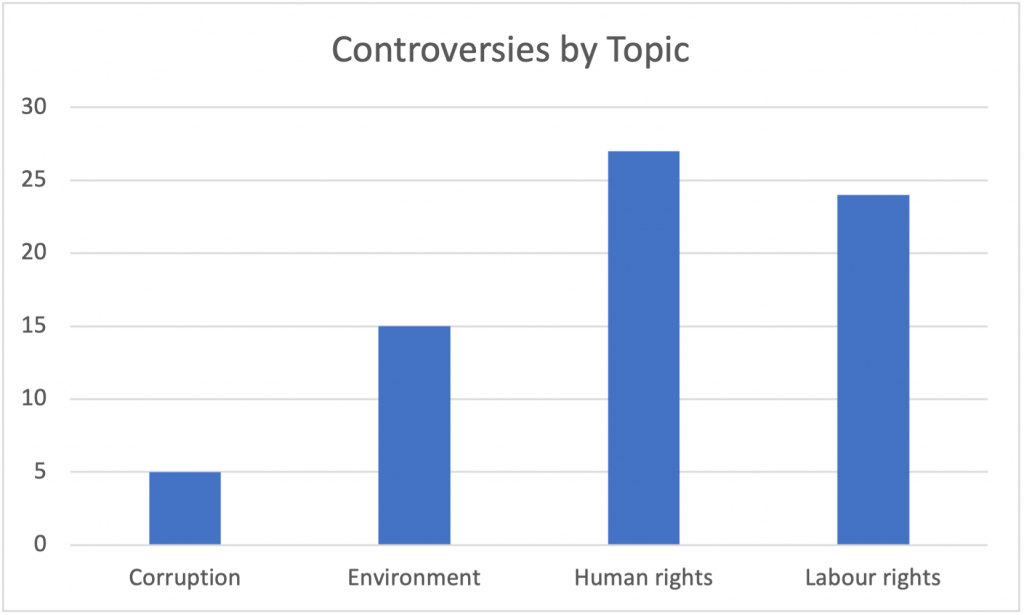

In the meantime, exploration companies that have already incorporated ESG into the design of their projects may face fewer risks. Human rights management, including acquiring a social license to operate through Free, Prior, and Informed Consent (FPIC), is one of the main challenges mining companies face throughout the production cycle (Figure 3).

Figure 3: Controversies by Topic Related to ASX-Listed Mining Companies

Source: ISS ESG’s Norm-Based Research database

Note: The figure covers all controversies in Australia, New Zealand, and Papua New Guinea associated with ASX-listed mining companies in the ISS ESG universe.

Poor early-stage management can have financial implications later in the productive cycle due to the compounding costs of remediation efforts that could have been mitigated in the design stage.

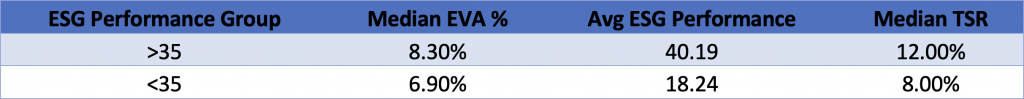

For ASX-listed producing companies in ISS ESG coverage, companies with low ESG Performance scores have been more likely to generate a lower EVA margin, which implies a greater risk of destroying value, based on past performance (Figure 4).

Figure 4: Average EVA Margin by ESG Performance Score

Source: ISS Stoxx, DataDesk, Investor Express

Note: EVA margin and TSR over the last 5 years were considered.

In contrast, higher ESG-performing producing companies have been more likely to deliver a higher Economic Value Added (EVA) margin and Total Shareholder Returns (TSR). This may be the result, in part, of such companies having better risk management practices due to their higher sustainability ambition.

Conclusion

Mining projects can experience serious setbacks if they are seen as not complying with ESG standards. Further, many ASX-listed mining companies have low environmental and social scores. These companies may find themselves disadvantaged as investors increasingly prioritize ESG considerations in their decision-making processes, especially as the (relatively low percentage of) higher ESG performing companies may also deliver a higher EVA margin.

If adopted, the proposed ESG reporting requirements for the JORC will set a new standard in Australia, New Zealand, and Papua New Guinea regarding the evaluation of risk over the time horizons of a full project life-cycle. The resulting ESG reporting may improve investor confidence and reduce information asymmetries between companies and investors.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the F in ESGF using the ISS EVA solution.

By:

Arthur Kearney, Associate, Metals & Mining, ISS ESG

Filip Veintimilla Ivanov, Associate, Metals & Mining, ISS ESG