Below is an excerpt from ISS ESG’s thought leadership paper: ESG Performance and Enterprise Value: Do Firms with Stronger ESG Performance Have Higher Valuation Ratios? The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

Key Takeaways

- This report investigates the relationship between the ISS ESG Performance Score (a normalized version of the ISS ESG Corporate Rating) and two valuation ratios from the ISS Economic Value Added (EVA) framework. Notable features of the research design include:

- A large global sample of companies observed over a five-year window (2017-2022); and

- The use of regression analysis to control for a company’s size and other factors which may affect both ESG performance and enterprise value.

- Controlling for a company’s size, industry, and country of domicile, the study finds a positive relationship between the ESG Performance Score and the two valuation ratios.

- This relationship remains positive when additional controls for profitability and balance sheet strength are considered.

- The positive relationship also holds in the specific context of the year 2022.

When studying the relationship between valuation ratios and ESG performance, it is important to control for the effects of firm size, industry, and country on valuation ratios. This can be done using multiple linear regression, which is a statistical technique that uses several explanatory variables to predict the outcome of a response variable. In this analysis, the response variable is a valuation ratio, the main explanatory variable is ESG Performance Score, and the other explanatory variables are called controls.

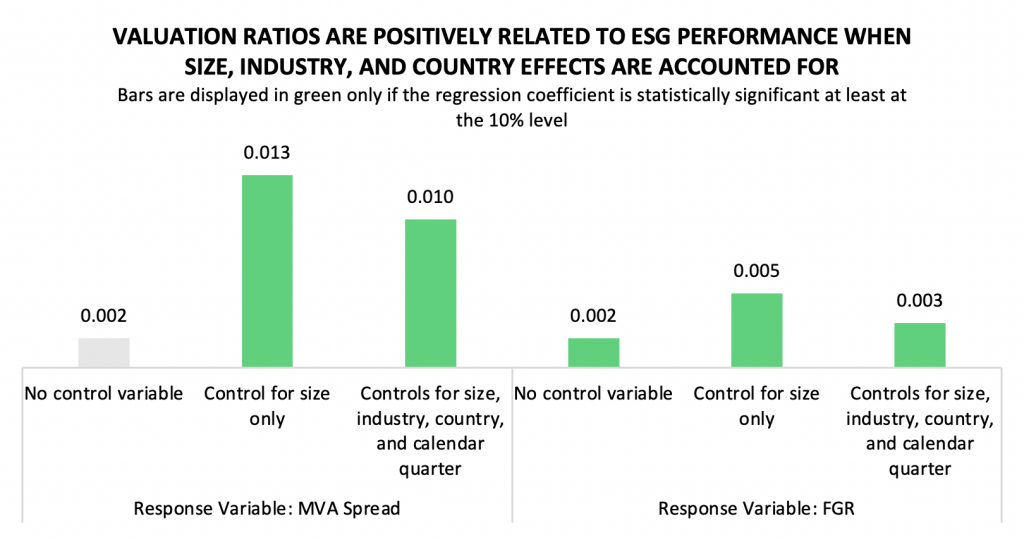

The figure shows the effects of ESG Performance Score on valuation ratios estimated using different regression models. First, the relationship between the ESG Performance Score and Market Value Added (MVA) Spread is analyzed without considering any control variable. Second, a control for firm size (Total Assets) is added to the model. Third, additional controls for firm industry (based on 6-digit GICS codes), country of domicile, and calendar quarter are included in the model. Then, the same analysis is repeated using Future Growth Reliance (FGR) as the response variable. When no controls are included in the MVA Spread regression, the effect of the ESG Performance Score on the valuation ratio is not statistically significant (i.e., the hypothesis that there is no relationship between the two variables cannot be rejected). A positive and statistically significant effect emerges once a control for firm size is included in the model, and this effect is robust to the inclusion of additional controls for industry, country, and calendar quarter, though the estimated effect is slightly lower.

Figure 1: Estimated Effects of ESG Performance Score on Valuation Ratios (Regression Coefficients) Considering Different Sets of Control Variables

Sources: ISS ESG Corporate Rating and ISS EVA.

Notes: This figure presents estimates of the regression coefficient (β) for ESG Performance Score from the following model:

Valuation Ratioi,t = β ESG Performance Scorei,t + γ Controlsi,t + εi,t. Statistical significance is assessed based on t-statistics using robust standard errors, double clustered at the firm and date levels.

A company’s ISS ESG Corporate Rating may help explain an additional level of premium or discount to contemporary EVA-centric valuation ratios. Given these ratios, high-ESG-scoring companies were trading at a premium during the 2017-2022 period compared to low-ESG-scoring firms, after accounting for characteristics such as company size, industry, and country.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the F in ESGF using the ISS EVA solution.

By: Arnaud Cavé, CFA, ESG Methodology Lead – Governance, Finance, and Quantitative Research, ISS ESG

Karsten Greye, ESG Methodology Lead – Corporate ESG-F Ratings and Controversies, ISS ESG

Roberto Lampl, ESG Sector Head – Financials and Real Estate, ISS ESG

Casey Lea, Global Head of Quantitative Research, ISS ESG