Zero- and low-alcohol drinks have increasingly featured at Christmas and New Year gatherings with each passing holiday season. Indeed, media coverage throughout 2021 has reported that the zero- and low-alcohol beverages market is booming. According to the 2021 IWSR Drinks Market Analysis, consumption of zero-alcohol beverages, defined as containing ≤0.5% alcohol by volume (ABV), is expected to increase by 31% by 2024 across 10 markets: Australia, Brazil, Canada, Francis, Germany, Japan, South Korea, Spain, the UK, and the US.

For Australia alone, IWSR projects a 16% growth from 2020 to 2024, reflecting a trend of declining alcohol consumption among younger demographics. Endeavour Group, the parent company of major Australian liquor chains BWS and Dan Murphy’s, has reported that sales of non-alcoholic drinks have almost doubled in the past year, and represent one of their fastest growing product categories. According to the Australia-based Foundation for Alcohol Education and Research (FARE), non-alcoholic beer sales alone have increased by 57 percent to $35.5 million over the last five years in the local market.

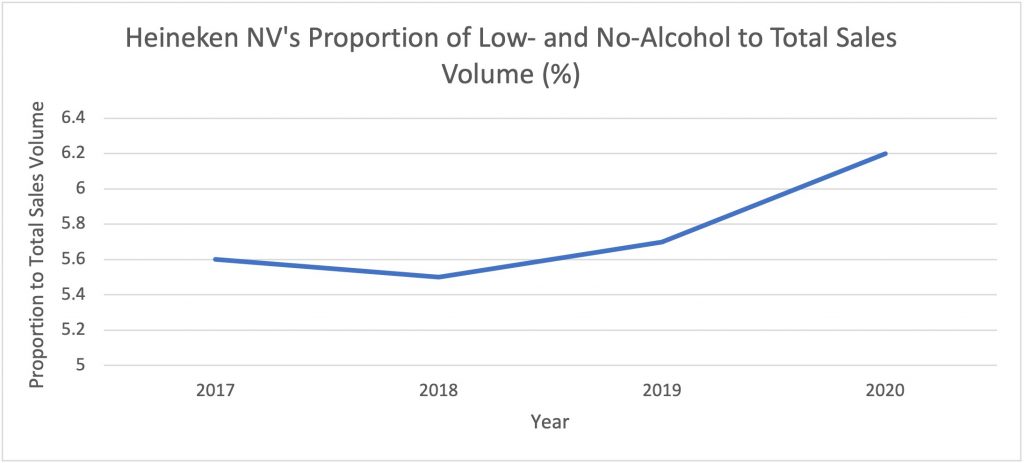

Source: Heineken NV annual reports 2017-2020

There are still sustainability issues to be considered for this industry, however, particularly regarding the marketing of certain zero-alcoholic beverages that belong to market-dominant alcoholic beverage brands.

Advertising Vehicle for Existing Alcohol ‘Masterbrands’

A journal article published in the Drug and Alcohol Review by the Menzies School of Health Research and The George Institute for Global Health in June 2021 argues that zero-alcohol products provide an additional advertising channel for well-known alcoholic beverage brands. The logos, branding, packaging and labelling of these zero-alcohol drinks are frequently very similar to their more popular parent alcohol portfolio or their ‘masterbrands’.

This can lead to the criticism that major alcohol companies are effectively promoting their existing ‘masterbrands’ in supermarkets via the presence of their zero-alcohol products. These drinks have been the subject of complaints to the Alcohol Beverages Advertising Code (ABAC) scheme in Australia, a quasi-regulatory alcohol advertising watchdog that involves significant industry input.

Some ABAC cases involve complaints about advertisements for these products that feature videos of individuals performing high-risk activities, such as jet skiing, swimming and race car driving. The complainants made the case that marketing for zero-alcohol products that is associated with a major alcoholic beverage brand should not feature an activity that requires a high degree of alertness and physical coordination. While the ABAC panel ultimately ruled in favour of allowing these advertisements to remain, the adjudication panel stated that these zero-alcohol products are indeed extensions of alcoholic beverage brands, and would thus fall under its jurisdiction.

Grooming the Next Generation of Drinkers?

Given the often virtually indistinguishable branding and product packaging between alcohol and zero-alcohol products, there is a reasonable argument to be made that zero-alcohol products that retain the trademark name and branding of popular alcohol brands could lead to increased recognition and awareness of alcohol brands among younger demographics. This would especially apply to children who are unable to distinguish between alcoholic and non-alcoholic variants. This increased brand exposure and fostering of brand allegiance could lead to early initiation into alcohol use. A semi-structured focus group study on university students aged 20-24 years in Thailand confirmed that zero-alcohol products that shared branding with their parent alcohol brands (produced by dominant Thai alcohol companies) increased brand familiarity of alcohol brands among this age group.

Michael Thorn, the then-Chief Executive of FARE, criticized an advertisement in Australia’s Herald Sun newspaper which displayed photos of a celebrity Australian Football League (AFL) figure consuming the product and stating: “This is for beer lovers like me”; and: “You really can’t tell the difference – it tastes great.” Thorn states that the use of the celebrity as the product’s brand ambassador would very likely target young people, given the sport’s popularity among this demographic. In addition, Thorn further stated that the constant linking of zero-alcohol to their ‘masterbrands’ through their similarities in taste and branding “is a veiled push to market alcohol brands to kids”, and was effectively a strategy to “groom the next generation of drinkers”.

Given that zero-alcohol products are not consistently regulated, their positioning and marketing within supermarkets and liquor stores are often left to the company. Endeavour Group has taken the position that purchasers of zero-alcohol products at its BWS and Dan Murphy’s bottleshops should be age-verified. However, according to this industry media outlet, the requirement for ID checks on customers and restrictions on the positioning of zero-alcohol products is not consistently applied in other supermarket retailers and grocery chains, leading to the worrying possibility that they could be purchased by children and young people. This lack of uniformity in regulation and resulting increased visibility and accessibility of ‘masterbranded’ zero-alcohol products may pose a risk of normalizing alcohol brands and therefore drinking among youths.

Harm Reduction or Trigger for At-Risk Individuals?

Given that zero-alcohol products are often advertised as replicating the look, taste and smell of alcoholic beverages, there are also concerns that such products represent a dangerous trigger point for at-risk individuals who are struggling with or recovering from alcohol use disorder. This risk of relapse is well documented by advocacy and charitable organization Sober in the Country, and also by addiction treatment centres.

According to one treatment centre, zero-alcohol products can trigger a condition called euphoric recall, which is a form of selective memory whereby a recovering addict glamorizes the active phase of their addiction whilst ignoring the negative effects. This condition is amplified for individuals with extreme cravings. Thus, any characterization of zero-alcohol products as part of a wider corporate approach of embracing alcohol ‘harm-reduction’ may overlook the very real risks posed to vulnerable groups.

Considerations for Responsible Investors

While market reports unanimously point to a high-growth market, especially in Australia, responsible investors should be mindful of the ethical concerns arising from the marketing of zero-alcohol products. To the extent that they serve as an advertising platform for dominant alcohol brands, there are risks associated with the early initiation of alcohol use among young people, and the potential to trigger a relapse for individuals suffering from alcohol use disorder.

Complaints brought before the ABAC adjudication panel regarding the advertising of these products should also ring alarm bells for responsible investors. While there is a demonstrated increase in the proportion of revenue that alcohol companies are generating from zero-alcohol versions of their products, there is likely to be increasing regulatory scrutiny on the industry. Zero-alcohol products may offer societal and health benefits for the consumer, but as with many other ethical issues, it can pay to delve a little more deeply into the issue.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By Jayshendra Karunakaren, Analyst, ISS ESG.