Inflows Grow to Highest on Record in Q1

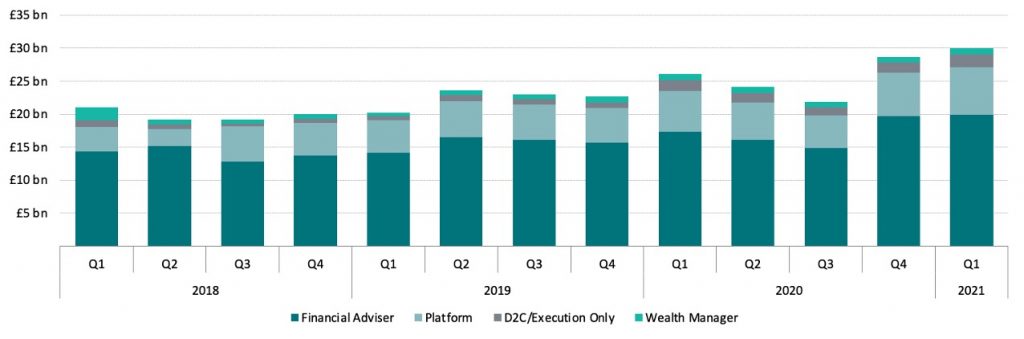

The announcement of effective Covid-19 vaccines in November last year spurred a lot of optimism among investors because the message was clear: there is light at the end of this tunnel. Stock markets jumped after the news broke and retail investors poured record sums of money into funds. In the last three months of the year, platform inflows increased to £30.3bn, with £19.6bn coming through financial advisers. Q4’s quarterly inflow record did not stand for long though, as the first quarter of 2021 saw inflows increase by 5% to £31.7bn. Sales through financial advisers that quarter rose to £19.9bn, accounting for 63% of all platform inflows. Clearly, UK investors are bought into the belief that we are moving towards the end of this pandemic, and they are eager to maximise their exposure to the strong economic recovery that economists forecast in 2021.

The sense of optimism surrounding 2021’s economic growth prospects has increased significantly as vaccination campaigns have progressed. This has benefited a lot of fund sectors that haven’t done very well since the start of the pandemic, such as those for cyclical stocks and small to mid-sized companies. Meanwhile, the sectors that performed well for most of last year, tech stocks, for example, aren’t delivering the same return in 2021. One reason for this is the growing nervousness about inflation. New variants of the coronavirus, the progress of vaccination campaigns, and the actions of central banks will be key determinants for the investment approaches of UK savers in 2021. This will offer fund managers a lot of opportunities to attract investors as we move into the next stage of the pandemic.

*In Financial Clarity’s M07 release, we improved the platform channel intermediary level fund flow data for 2021H1. This change means that platform inflows in Q1 and Q2 are expected to be higher.

Volatility Managed Funds See Big Influx in Sales

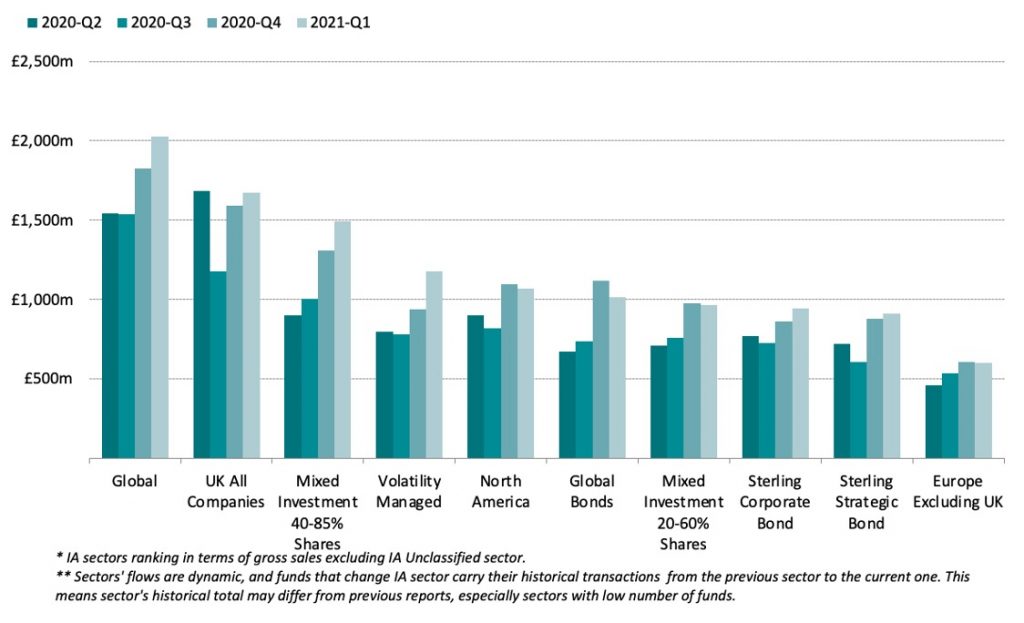

The sector with the highest financial adviser inflows in Q1 was IA Global, a position it’s held for three consecutive quarters now. This signals that many investors are looking to maximise their exposure to the global economic recovery. IA Volatility Managed saw its quarterly inflows increase by 26% (£240m) from Q4 to Q1 and as a result, moved from being the seventh most popular sector by inflows to the fourth. IA Global Bonds on the other hand saw a 9% decline in flows from Q4 (-£99m) and fell from the fourth biggest sector by inflows to the sixth.

From 2018 to the second quarter of 2020, IA UK All Companies was the sector that saw the highest financial adviser platform inflows. The UK’s handling of the virus in the early months of the pandemic coupled with the then-mounting risk of a no-deal Brexit caused many investors to wind down their exposure to UK stocks and funds. These concerns have now been alleviated as the UK has formalised its new trade agreement with the EU and the vaccine rollout has thus far been one of the world’s most effective. One might have expected the appetite among retail investors for UK funds to grow substantially because of these developments, but that doesn’t seem to have happened. Though inflows to IA UK All Companies increased from Q4 to Q1 by 5% (£82m), quarterly inflows still fall short of 2020Q2’s figure (£1.68bn).

West Midlands Sees Highest Growth in Inflows

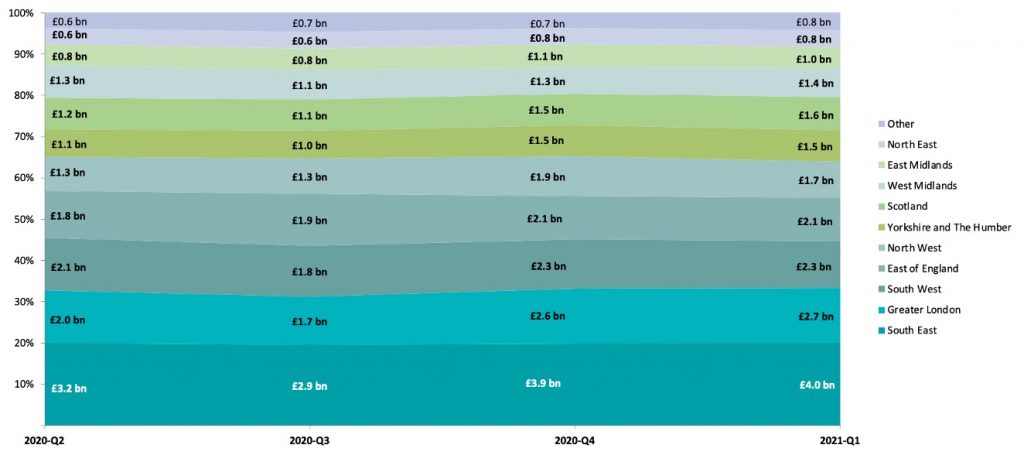

The South East maintained its position as the region with the highest financial adviser inflows in Q1 by amounting to £4.0bn over the quarter. The region that saw the highest nominal and percentage increase in quarterly inflows is the West Midlands (£135m and +10.8%) followed by Scotland (£126m and +8.5%). The North West saw the greatest nominal and relative decline in financial adviser inflows from Q4 (-£159m and -8.3%). The order of the regions with the highest inflows did not change from last quarter.

Report Scope

Financial Adviser Highlights data includes OEICs, SICAVs, ETFs & Unit Trusts’, transactions via UK platforms.

L&P Product Types were excluded.

Some transactions were reported against firms’ headquarters and may distort locations’ authenticity. Ongoing enhancements to data collection & accuracy may result in slight changes in overall figures compared to previous reports.

By Kevin O’neill