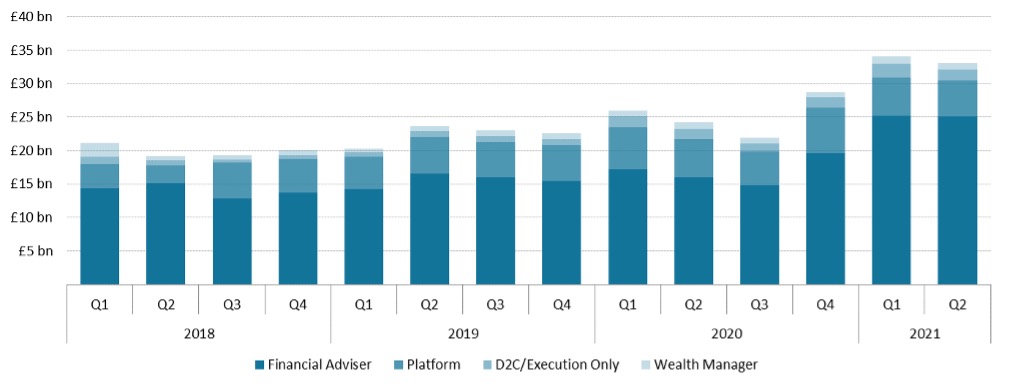

Financial Adviser Inflows Plateaued in Q2 as Net Flows Surge

The times, they are a-changin’. It’s a statement that holds true for the world’s post-pandemic return to normality, and for the fortunes of companies today. Some of the strong performers last year were growth stocks, often big multi-national technology, or pharmaceutical companies. As the global economy has opened back up in 2021, we’ve seen a shift towards smaller value stocks that weren’t able to thrive in the lockdown conditions of 2020. Value stocks have had a rough run of it in recent years compared to growth stocks, but it seems that this could be changing. As stock pickers have been looking to maximise the ‘reopening’ trade, retail investors have been rebalancing their holdings to ensure that they are well positioned for the global economic recovery. A lot of the money that retail investors have been saving up during the course of the pandemic is being moved into funds, as we see inflows through financial advisers surge in the first half of the year.

Inflows reached a peak in 2021 Q1, and they dropped marginally in the second quarter of the year relative to Q1 (-0.4% or £104m), despite this, Q2 net flows increased by £978m (+34%). Inflows directly from platforms saw a £345m decline over the same period and yet net flows increased by £410m. By breaking down financial adviser platform flows by month, we find some other interesting trends. Despite inflows being relatively consistent in April, May, and June, April’s net flows account for 46% of the quarter’s total net flows. We see that retail investors are pouring more money into funds, but their choice of funds has changed over the course of the pandemic too, we explore this in the next section.

*In Financial Clarity’s M07 release, we improved the platform channel intermediary level fund flow data for 2021H1. This change means that platform inflows in Q1 and Q2 are expected to be higher.

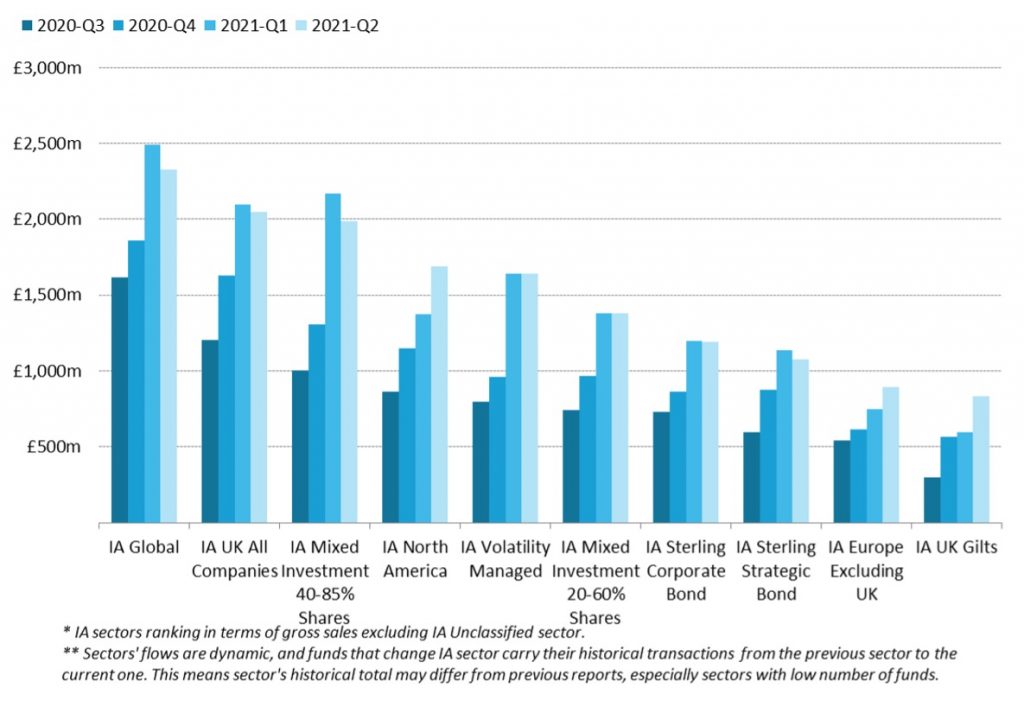

IA Global Cements its Position as the Most Popular Fund Sector

The second quarter of 2021 marks the fourth consecutive quarter that IA Global attracted the highest financial adviser inflows among all sectors. Prior to the third quarter in 2020, the sector that reigned as the most popular among retail investors was IA UK All Companies. IA Global’s rise to this position signals the shift in investment approach that many UK investors have embraced since the start of the pandemic. The performance of all assets, but stocks in particular, has been hugely impacted by the ability of countries to control the spread of the virus and to keep businesses open in the last 18 months. Investors recognise that being overly exposed to one region poses heightened risks in the age of the pandemic and so the popularity of geographically diversified funds has risen substantially.

Among the top 10 IA sectors by Q2 inflows, IA UK Gilts saw the highest relative increase in sales (+40%) followed by IA North America (+23%) and IA Europe Excluding UK (+19%). Q2 was a strong quarter for American stocks. The news coverage of indices like the S&P 500 breaking records would have led to increased inflows to IA North America funds. The US’s rapid vaccine rollout in the first half of the year put the country in a great position for a strong and rapid economic recovery. Europe, on the other hand, had a slower start to their vaccination campaign but it picked up steam in the second quarter of the year. The improving prospect of a fast European economic recovery would have played a big role in the increasing inflows to IA Europe Excluding UK.

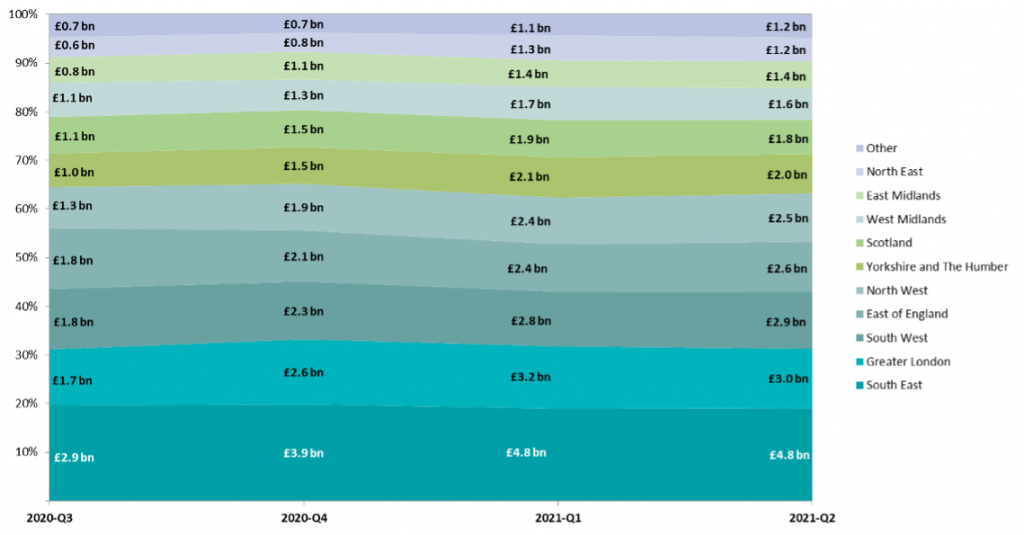

Greater London Sees Big Drop in Inflows

Despite financial adviser sales falling overall from Q1 to Q2, there were some regions that saw significant inflow increases over the quarter. The East of England saw the highest nominal quarterly increase (£154m) followed by the South West (£90m). On the other hand, the West Midlands, the region which had seen the highest quarterly increase from Q4 to Q1 in financial adviser sales, saw inflows drop by £140m in the second quarter. Only Greater London saw a greater fall in inflows from the first quarter of the year as its total sales dropped £174m.

Report Scope

Financial Adviser Highlights data includes OEICs, SICAVs, ETFs & Unit Trusts’, transactions via UK platforms.

L&P Product Types were excluded.

Some transactions were reported against firms’ headquarters and may distort locations’ authenticity. Ongoing enhancements to data collection & accuracy may result in slight changes in overall figures compared to previous reports.

By Kevin O’neill