This week FC Market Insights looked at the sectors that brought in the highest netflows throughout 2020:

Net flows to funds through platforms last year grew to £1.56bn, up 7% from 2019. The pandemic affected financial markets in a complex set of ways, threatening many sectors and creating opportunities for others. UK savers adapted their investment approaches during 2020 to protect their savings and to capitalise on the developing financial trends. Despite all this, the four fund sectors that UK investors moved the most money into, on aggregate, remained the same as in 2019 (though not in the same order).

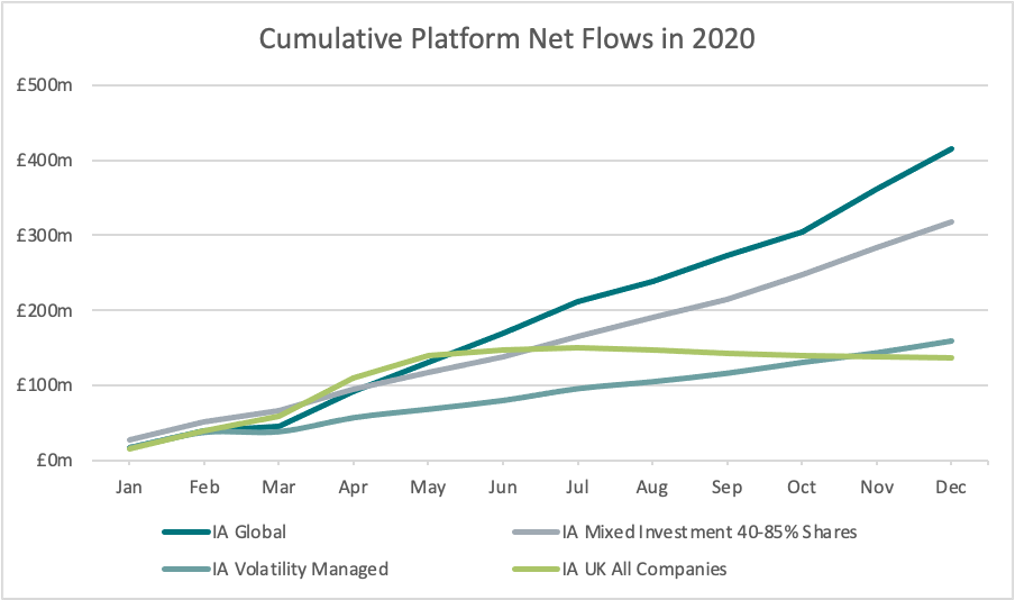

IA Global was the sector that brought in the highest net flows in 2020 (£415m), a significant increase relative to the £224m from 2019. In the early months of the pandemic, UK investors seemed to prioritise UK-focussed and mixed investment funds over global funds. In March and April, net flows to IA Global funds were the third-highest by sector. As an individual country’s ability to control the virus became a key differentiator in economic and financial performance, the appeal of global funds surged in June as many UK savers looked to diversify their holdings geographically. The Covid-19 vaccine announcements in November caused net flows to swell again as IA Global funds attracted £111m in net flows in the last two months of 2020 alone.

IA Mixed Investment 40-85% Shares, a sector that normally brings in the highest net flows of any sector, fell to second in 2020. However, the more noteworthy net flow trends from last year relate to the UK All Companies IA sector. By April and May, it was the sector that had brought in the highest cumulative net flows in 2020, this figure peaked at £150m in July. From August onwards, net flows fell into negative territory and stayed there until the end of the year. Aggregate sales even remained negative in November when the vaccine announcements caused stock prices globally to increase. The then-growing uncertainty surrounding the Brexit EU-UK trade deal caused many investors to wind down their exposure to the UK market to minimise the impact of a potential no-deal scenario. In 2021, a growing sense of optimism has emerged around British stocks. The threat of a no-deal Brexit collapsed once the EU and UK signed their Brexit trade deal in late December, and the government’s vaccine rollout programme is on track to make the UK one of the first countries to put the pandemic in the rearview mirror. This all bodes well for the UK’s stock market which is deemed to be very cheap compared to US stocks. So will UK savers buy into the hype surrounding UK equity funds in 2021? Our next Financial Clarity Market Insights will be looking specifically at developing retail investment trends from the first quarter of the year, so stay tuned!

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team