This week FC Market Insights looked into why so many investors are bullish on UK equity funds and the story of how they performed since the start of the pandemic:

Ever since the Brexit referendum, which took place five years ago last week, the UK equities market has underperformed relative to other developed stock markets. The uncertainty over Brexit negotiations and the future of UK-EU trade relations caused many investors and fund managers to reduce their exposure to British stocks. However, in recent months, there’s been a growing sense of optimism around UK stocks and many British investors have been pouring money back into UK equity funds. In the first quarter of 2021, platform inflows to IA UK All Companies exceeded £310m a figure only reached once before in the last three years (in 2020Q1).

Though it isn’t the first time we’ve heard that UK stocks are poised for high returns in the near future, this time the rationale behind it seems stronger than ever. The UK-EU trade deal announced at the end of last year has put a lot of the Brexit angst to rest and the government’s successful vaccination rollout puts Britain in a good position for a strong economic recovery. Small companies, many of which had a challenging 2020, have benefitted hugely from these two developments. The FTSE SmallCap Index, constituted of small UK listed companies, has outperformed most benchmarks by a considerable margin over the last 6 months. Funds within the UK Smaller Companies IA sector have seen quarterly inflows rise to £56m, the highest figure on record.

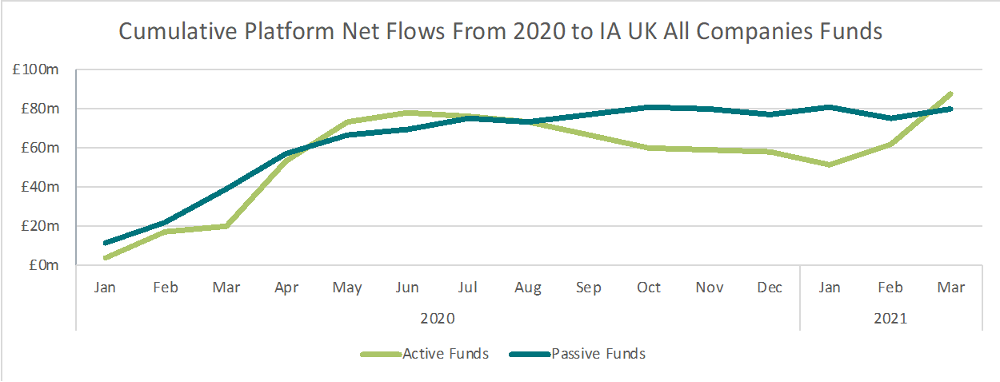

Since the stock market rally started in November, value stocks have made a surprising resurgence. Whereas growth stocks were the big winners directly after last March’s market sell-off, large tech stocks, cyclical and value stocks have been the best performers since the vaccine announcements. A high proportion of UK companies fall into the category of value or cyclical stocks (banking, energy, industrial, etc.) and this is another reason that there is more optimism around UK equities this year. In 2020, we saw net flows to IA UK All Companies funds peak in April once asset prices started to rebound. £52.0m was brought in that month in aggregate flows, £33.3m of which went to actively managed funds. However, in July net flows to active funds within the sector dropped into negative territory as many investors wound down their exposure to UK equities as fears over a no-deal Brexit mounted. In the second half of the year, active funds within IA UK All Companies saw £20.1m leave in net flows whereas passive funds saw net flows remain positive. However, In the last two months of 2021Q1, we saw a reversal of this trend. Whereas passive funds within the sector saw net flows fall into negative territory, active funds saw aggregate sales exceed £35m. This is excellent news for many fund managers; British investors are bullish about UK equity funds and are entrusting active managers to find the best returns for their investments in the sector. As we move further along the economic recovery, it will be interesting to see how long this trend persists.

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team