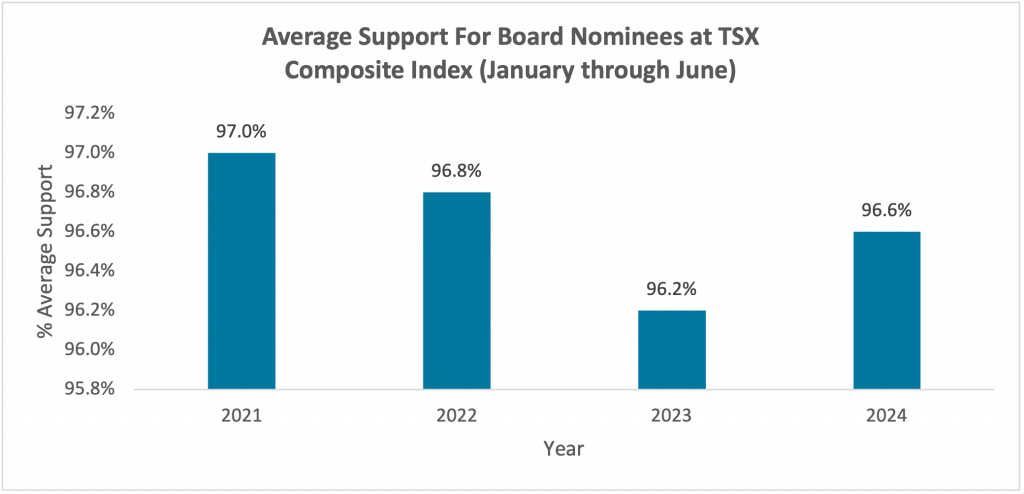

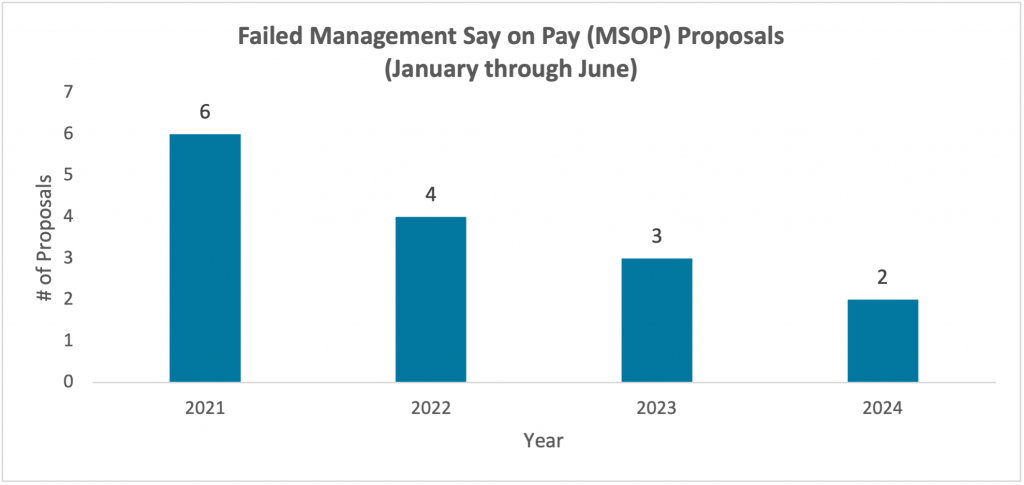

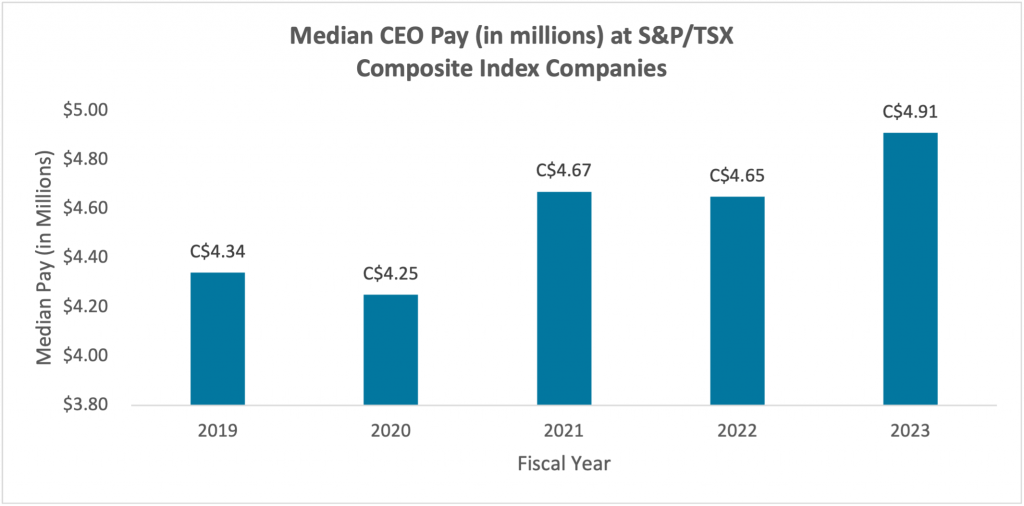

As of end of June 2024, average shareholder support for board nominees at S&P/TSX Composite Index companies ticked up, while no directors failed to receive majority support during the same period. With respect to executive pay, the number of failed say-on-pay resolutions edged down again this year, while median CEO pay levels for fiscal 2023 ticked up from fiscal 2022 levels. On the shareholder proposal front, the number of proposals rebounded from last year’s decline but fell short of 2022’s high watermark. Only one type of shareholder proposal garnered majority support at several companies.

Canada Director Elections

As of June 2024, average vote support at uncontested elections for board nominees at S&P/TSX Composite Index companies was 96.6 percent.

Source: ISS Governance Research & Voting

None of the directors at S&P/TSX Composite Index companies received less than majority support at uncontested elections during the first half of 2024. However, there were a few close calls, with six director nominees at four companies receiving vote support ranging between 50 percent and 60 percent. Low vote support for these directors appears to be driven by concerns surrounding the company’s compensation structure or lack of racial/ethnic diversity on the board.

Executive Compensation in Canada

Executive compensation and company performance seem to be in better alignment this year at many Canadian companies. Nevertheless, say-on-pay resolutions at two companies failed to garner majority support so far: Enerflex Ltd and First Majestic Silver Corp. The vote result at First Majestic Silver Corp was a particularly close one, with 49.2 percent of shareholders voting in favor of the say-on-pay resolution. Shareholders also seemed to indicate dissatisfaction with the company’s compensation structure by casting only 57 percent of vote support for the compensation committee chair.

Source: ISS Governance Research & Voting

Other noteworthy cases are GFL Environmental and Shopify. At GFL, the say-on-pay resolution garnered 64 percent vote support; however, excluding shares held by Dovigi Group and BC Partners, the company’s two largest shareholders in terms of voting power and parties to an investor rights agreement, remaining vote support for the resolution was about 28 percent only. At Shopify, the say-on-pay resolution received 69 percent vote support. In this case, excluding the founder/CEO’s over 40 percent voting power, 61 percent of the remaining shares were cast against the say-on-pay resolution.

Agnico Eagles Mines Limited has been on investors’ radar since its failed say-on-pay resolutions over the two prior years. This year, the company’s say-on-pay resolution received 96 percent vote support. The shift in shareholder sentiment occurred as the company incorporated certain changes to its compensation and governance structures following an extensive outreach effort in 2023 with some of its largest shareholders. These changes include the adoption of a policy of not paying special cash bonuses or one-time cash bonuses to executives; the elimination of option grants for executives at VP level and above; and a change in the compensation committee chair.

Meanwhile, median CEO compensation during fiscal year 2023 at S&P/TSX Composite Index companies increased relative to fiscal 2022, and notably reached the highest levels in the last five years after a slight decrease in fiscal 2022.

Source: ISS Governance Research & Voting

Canadian Shareholder Proposals

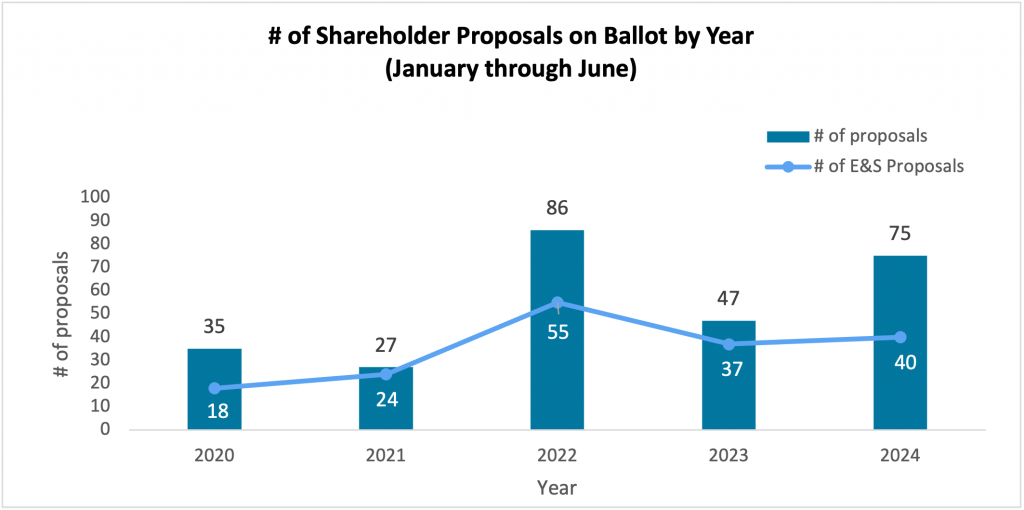

There was an influx in shareholder proposals that made it to a vote this year in Canada, after a temporary dip in 2023.

Source: ISS Governance Research & Voting

While the total number of shareholder proposals voted on increased, this year also marked a record number of withdrawn proposals in the last five years, indicating a high level of engagement between Canadian companies and proponents.

The total number of shareholder proposals requesting say-on-climate votes that made it onto the ballot almost doubled since 2023. While in previous years this proposal primarily targeted the major Canadian banks and some other financials, the universe of targeted companies was expanded this year to include non-financials like AtkinsRealis, Bombardier, Cascades, Quebecor, and Saputo. However, average vote support for this proposal dropped from approximately 19 percent in 2023 to 13 percent in 2024 so far, with the highest vote support of 20.3 percent at iA Financial. Average vote support at Canada’s major banks was approximately 16 percent.

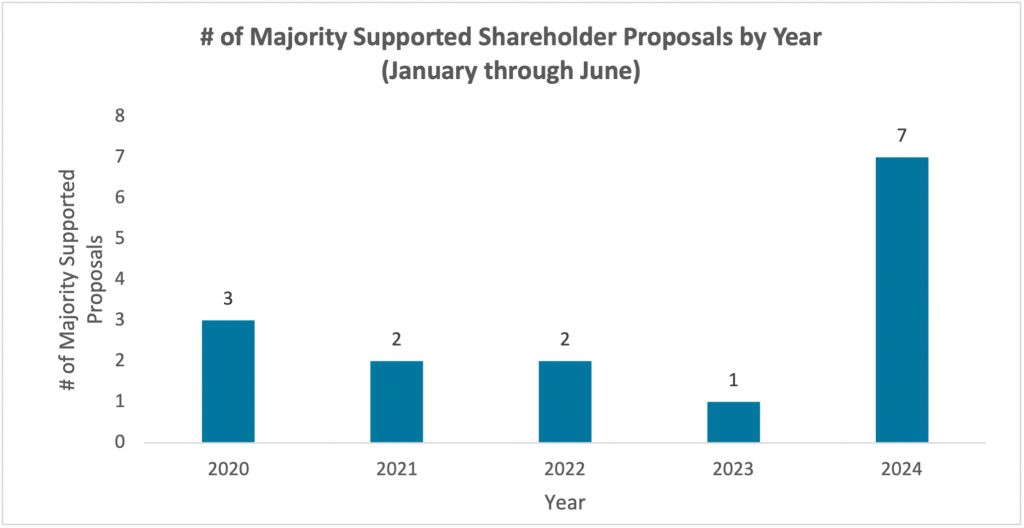

The only type of shareholder proposal that received majority support this year was a request for companies to hold in-person annual meetings, with virtual meetings as a complement. This proposal was voted on at the annual meetings of thirteen companies and received majority support at seven of those companies.

Source: ISS Governance Research & Voting

Four of the six companies where the proposal did not receive majority support are controlled companies. However, despite that, total average shareholder support for this proposal was approximately 42 percent.

Lastly, we continued to also see so-called anti-ESG shareholder proposals in Canada this year which mostly took the shape of disclosure requests, which were largely intended to be critical of climate, DEI, or other corporate E&S-related initiatives. Vote support for these proposals remained low.

High-Profile Canadian Meetings

Gildan Activewear was one of the most talked about meetings in Canada this year. The entire incumbent board resigned prior to the meeting. Glenn Chamandy was reinstated to the board with approximately 84 percent vote support, while the seven other dissident nominees received vote support ranging from 83 to 99 percent. It appears to be the most consequential outcome since the 2012 proxy fight at Canadian Pacific Railway.

It also may have been the most expensive proxy contest in Canadian history, with severance payments to outgoing board members and two executives, costs incurred from the company’s sale process which was later scrapped, as well as legal costs from lawsuits launched by Gildan against Browning West, a five percent shareholder of the company that led the efforts to replace a majority of the company’s board of directors.

By:

Shehrbano Khan