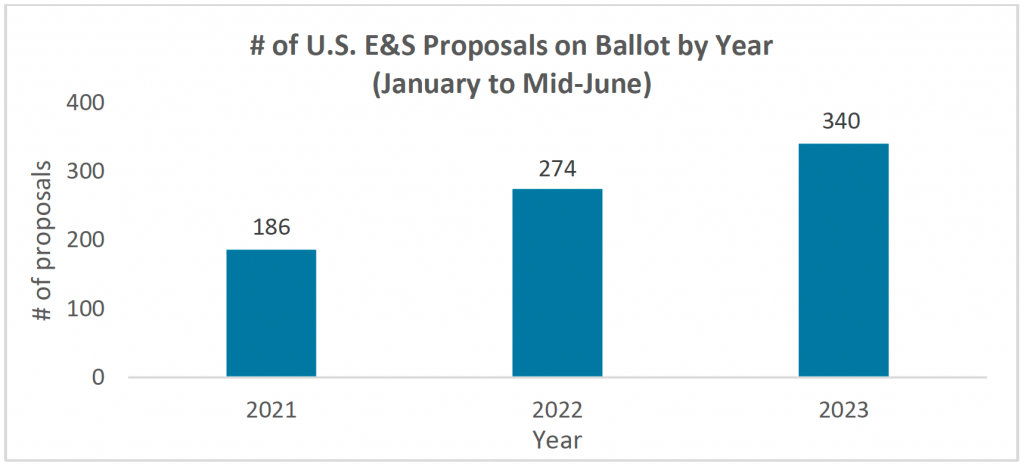

As of June 15, 2023, about 340 environmental and social (E&S) shareholder resolutions and 224 governance resolutions have appeared on U.S. company ballots in 2023. Since 2017, and extending to an all-time high number, E&S-related resolutions have accounted for the majority of the shareholder proposals submitted than traditional governance-related proposals. However, proxy season 2023 also witnessed a drop in average shareholder support levels for E&S resolutions as well as a low number of majority-supported resolutions. ISS also saw an uptick in so-called “anti-ESG” proposals. This recap summarizes key shareholder proposal trends in this year’s U.S. proxy season.

Governance-related Shareholder Proposals

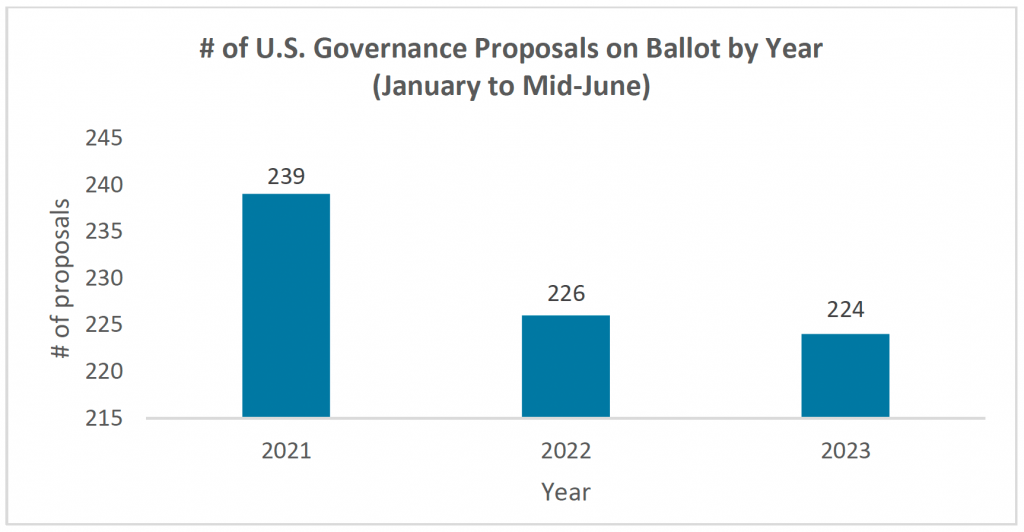

The volume of governance-related shareholder proposals at U.S. companies has fallen slightly in each year since 2021, due in part to some traditional retail shareholder proponents shifting their focus toward filing more environmental and social-related proposals.

Governance-related proposals requesting an independent board chair have been the most prevalent, with 79 proposals so far, though none received majority support so far this year. They have had an average overall support of 29.6 percent of votes cast, up slightly from 28.7 percent average support in 2022. There were also some new proposal topics in the governance space. About 15 companies received proposals seeking to require shareholder approval for any bylaw amendments imposing restrictions on director nominations by shareholders. Per reported vote results to date, this proposal has received average support of around 13 percent. We also saw a small number of proposals requesting companies amend their bylaws to forbid directors from simultaneously sitting on boards at any other companies. These proposals have not been well supported by investors. In fact, this proposal topic at Netflix received just 0.3 percent support of votes cast, which is one of the lowest levels of support for any shareholder proposal in several years.

On the compensation front, there were 16 shareholder proposals in 2022 specifically relating to shareholder approval of excess severance benefits, and so far in 2023 that number has increased to 39 proposals. Generally, the proposals requested that boards seek shareholder approval of executive pay packages that provide for severance or termination payments exceeding 2.99 times the sum of the executive’s base salary plus target bonus. This also includes the value of accelerated equity. As of June 15, 31 of the companies which received this type of proposal had held their annual meetings, with two proposals receiving majority support, compared to last year when 4 proposals received majority support.

However, a number of companies have already taken proactive steps to implement portions of the proposal, which appears to have placated some shareholders’ concerns on potentially excessive severance. In particular, a number of companies proactively reached out to shareholders and learned that they were largely interested in a cap on cash severance. In a number of cases, the companies instituted a policy that any cash severance granted in excess of the pre-determined limit would require a shareholder vote for approval or ratification. By doing so, these new policies appear to meaningfully mitigate the risk of excessive cash severance payments above market norms.

E&S Issues and Shareholder Proposals

2023 is shaping up to be another record year for the number of E&S-related shareholder proposals. ISS is tracking over 340 E&S-related shareholder proposals on ballot so far in 2023, which is an increase from the just around 300 proposals that made it to a vote in full year 2022.

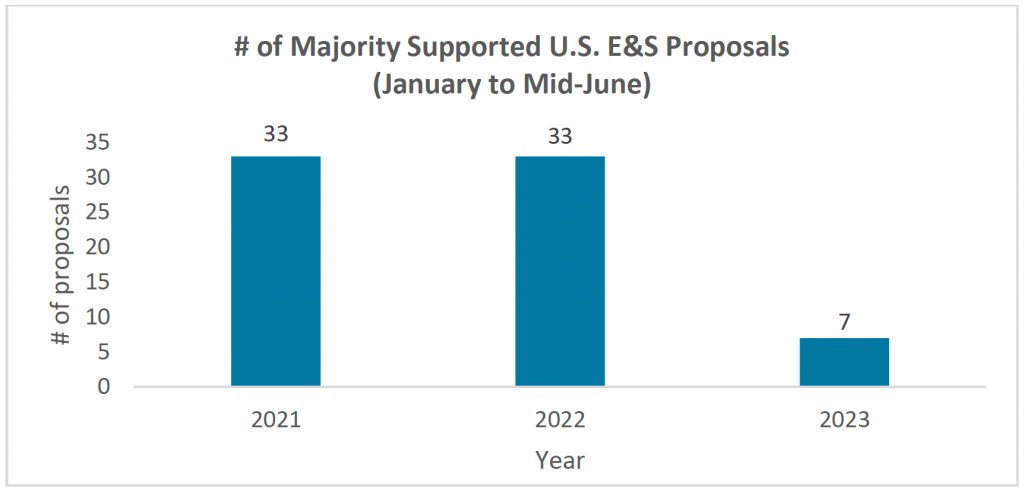

However, average support for E&S-related shareholder proposals has fallen significantly for the second year running, from 26 percent in 2022 to around 19 percent so far in 2023. This drop in support is also reflected in the lower number of majority-supported shareholder proposals, with only 8 as of mid-June this year compared to a total of 37 in full year 2022.

While we may see a few more proposals reach majority support at companies that have yet to hold their annual meetings or report their results, it is unlikely to reach the level of support seen last year.

E&S-related Proposal Focus Areas in 2023

The most common E&S-related shareholder proposal topics have been in the areas of climate change, political spending/lobbying, human rights, diversity, equity, and inclusion (DEI), and health/safety.

The topic that made it onto the ballot most so far this year was climate change, with the most common proposals asking companies to report on or to adopt greenhouse gas targets to reduce emissions in line with the goals of the Paris Agreement. Other common topics included requests for increased disclosure around climate lobbying, fossil fuel financing, methane emissions, and just transition plans. Climate proposals have so far had a decrease in average support this year, from 35 percent in 2022 to around 23 percent so far in 2023. There have so far been two majority-supported proposals, at New York Community Bancorp and Coterra Energy requesting reports on climate lobbying and methane emissions, respectively.

Political spending and lobbying proposals remained numerous this year, but some companies also received a new type of proposal asking them to adopt a policy requiring third party groups that they support to report their political expenditures. These proposals received less than 7 percent support on average. Only one political spending and lobbying proposal reached majority support this year. It was requesting additional lobbying disclosure at McDonald’s and passed with just over 50 percent support.

On the topic of diversity, equity and inclusion (DEI), shareholder proposals requesting racial equity or civil rights audits gained unprecedented high support from shareholders in the last two years, but this has also fallen so far in 2023. Last year, there were 8 racial equity audit proposals that gained majority support, but so far none have done so this year. 2023 has not only seen a decrease in support for proposals requesting equality or civil rights audits, but DEI proposals more broadly. Expeditors International had the only majority-supported proposal on this topic, which asked the company to report on the effectiveness of its DEI efforts and metrics.

Proponents continued to file proposals on a wide range of human rights and health/safety issues at companies, with a focus on freedom of association, operations in high-risk countries, forced labor, and COVID-19, among other topics. Notably, proponents filed a wider range of proposals this year focused on reproductive rights, particularly with more specific lenses on data privacy. Starbucks received a proposal that was majority-supported to commission a third-party assessment on the company’s commitment to freedom of association, and a proposal at Dollar General to oversee a workplace health and safety audit also gained majority-support. Lastly, Wells Fargo received a majority-supported proposal asking it to report on the prevention of workplace harassment and discrimination.

Lower Support Levels for E&S Shareholder Proposals

ISS is currently tracking lower levels of shareholder voting support pretty much across the board of major E&S topic categories this year. Several factors appear to be at play. Continuing a trend first seen in 2022, there was a rise in the number of E&S shareholder proposals voted on, in part due to the SEC’s change in approach toward the excludability of proposals making it more difficult for companies to omit shareholder proposals. This is likely to have contributed to the lower average support level, as more proposals made it onto ballots that were considered to be more prescriptive and/or less likely to lead to long-term shareholder value.

Additionally, 2023 saw a higher number of so-called anti-ESG shareholder proposals voted on. These proposals often question the concepts of traditional ESG factors and use rationales that tend to support so-called “anti-woke” and other more conservative or anti-ESG views; for example, asking for companies to do cost/benefit analyses on targets to reduce carbon emissions with the aim of proving they are not

beneficial, or conduct audits of their HR materials to make sure there is no discrimination against groups that may not be minorities, like white men. This year saw around 40 of these proposals being voted on, which is almost double the amount that made it onto ballots in 2022. Anti-ESG proposals have usually gained low levels of shareholder support (typically less than 5%), which is another contributing factor to the lower overall vote average this year. But, even if you exclude these proposals from the calculation, investor support still dropped overall for E&S-related proposals.

Anti-ESG proposals also signal a larger trend of politicization and polarization of corporate E&S issues in the U.S. There have been a number of state-level policies that limit the use of broadly labelled “ESG” factors by investors or restrict divestment from certain sectors. Companies have felt this pressure directly through anti-corporate rhetoric from policymakers along with the use of state government power to reward or punish companies for political purposes. This polarization likely contributed to the lower support for E&S shareholder proposals this year, as investors are having to navigate the complicated and evolving nature of the politicization of ESG factors in business. This year marked a turning point in politicization of ESG which will likely continue and maybe even grow in the coming years.

By: Robert Kalb, Hailey Knowles, U.S. Research, ISS Governance