“The pandemic brought with it a surge in savings for Canadians from of all walks of life. The deployment of these funds – over $230 billion in 2020 – is a challenge for deposits-takers across the country. How long will these deposits remain on balance sheets?”

Below is an excerpt from Investor Economics’ (part of ISS Market Intelligence) recently released Deposit Advisory Service feature story “Online banking, Low-interest Rates and Regulation”. The full report is available for subscribers to download from Investor Economics online library. For more information about this report or other IE offerings, please contact us.

Feature Story Highlights

- The current low-rate environment and high personal savings rates in the Canadian deposits marketplace has left persistent “dry powder” in the financial system through the middle of 2021.

- Term deposits, after experiencing a significant growth in the three years leading up to the beginning of 2020, have declined markedly – over $38 billion between December 2020 and June 2021.

- Tactics are changing and the launch of new ESG market-linked term deposits, combined with new systems and promotions for booking term products online have proliferated at the largest deposit-takers.

- Pressures are mounting on the excess demand deposit balances: record investment fund inflows, amid rising inflation, and surging equity markets will no doubt pose short-term headwinds on the large accumulation of personal deposits.

- The long-term future of demand accounts, lifted by the crisis, will be determined by a fulsome value proposition. Premium savings (and all savings) interest rates remain lower than ever before, and the place of these accounts on the product shelf is an open question as the yield curve ebbs and flows.

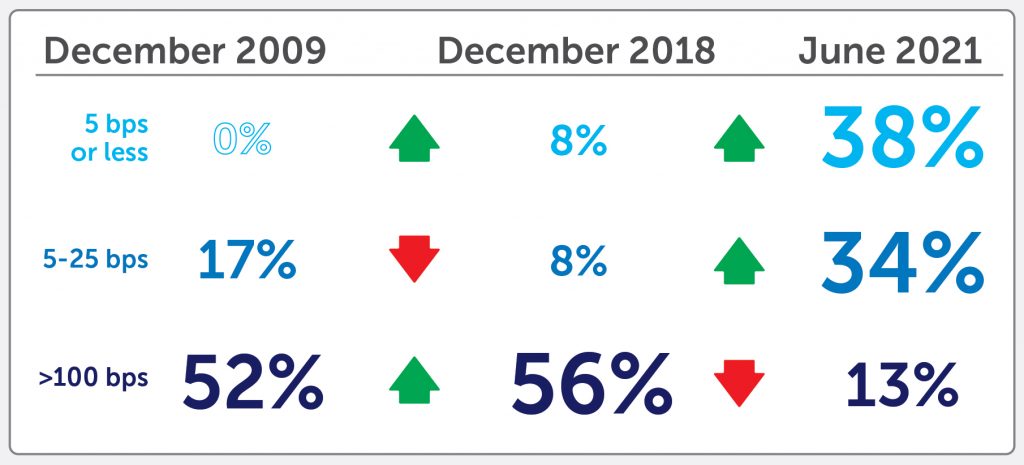

The following chart shows the comparative analysis of the over 100 premium savings accounts tracked by Investor Economics, when products were new in 2009, the “normal times” of 2018, and into today.

Proportion of Premium Savings Accounts Offering Interest Rates Between…

Report Key Takeaways

- Balance Segmentation of Premium Savings Accounts: The new savings have benefitted multiple ends of the income spectrum, raising balances in the lower balance accounts. These accumulated balances are vulnerable to consumption return and inflationary pressures.

- Term and Time-to-Maturity Segmentation of term deposits: The increasing use of 1-year products have left many balances vulnerable to clients declining to rebook. This risk continues as 2022 approaches, and many clients remain online.

- Brokered term deposits: Full-service brokers have abandoned term deposits quickly. The competitive dynamics between independent trust lenders and DSIBs have shifted back toward independents.

By Investor Economics, ISS Market Intelligence Team