Preamble

ISS ESG’s Quarterly Engagement Update series highlights key trends that emerge through activities conducted on behalf of participating investors under its Collaborative Engagement Services. These services allow investors to participate in cost-effective joint outreach and dialogue with companies on material sustainability-related themes. They also support global investor compliance and reporting requirements with regard to voluntary and statutory stewardship frameworks, including the Principles for Responsible Investment, EU Sustainable Finance Disclosure Regulation, the EU Shareholder Rights Directive II, and stewardship codes across the globe.

The Collaborative Engagement Services leverage ISS ESG’s expertise, research, and data to identify key performance indicators for corporate ESG improvement and momentum that are aligned with recognised standards such as the United Nations Sustainable Development Goals (SDGs).

By engaging collaboratively, institutional investors can increase their focus on Environment, Social, and Governance (ESG) issues, and effectively communicate their concerns to investee company management. ISS ESG facilitates engagement on behalf of the participating clients to promote change through active ownership and dialogue. Engagement focus areas include enhanced disclosure, a push for improved sustainability performance, and mitigation of ESG risks.

ISS ESG’s Collaborative Engagement Services consist of two elements:

- The ISS ESG Norm-Based Engagement Solution (formerly known as ‘Pooled Engagement’) is based on outreach to a select universe of upwards of 100 public companies annually. Companies are identified based on their involvement in alleged violations of human rights, labour rights, and breaches of environment- and corruption-related recognised international standards, including the OECD Guidelines for Multinational Enterprises, the UN Global Compact, and the UN Guiding Principles on Business and Human Rights.

- The ISS ESG Thematic Engagement Solution – launched in 2022 – prioritises outreach to a select universe of 30-40 public companies per theme over a two-year engagement cycle. It focuses on companies identified as underperforming in the areas of Net Zero, Gender Equality, Water, and Biodiversity.

Collaborative Engagement Activity

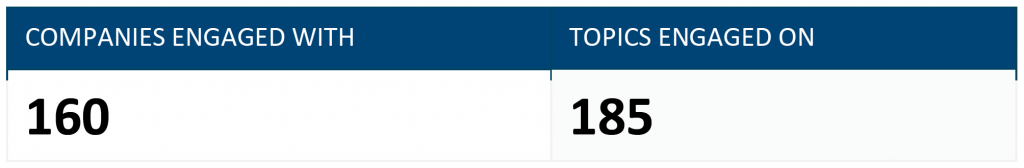

In Q1 2023, ISS ESG facilitated engagement on behalf of signatory investors with a total of 160 companies across 185 topics. ISS ESG conducted engagements with 56 companies under Norm-Based Engagement, and the Thematic Engagement solution facilitated engagement with 104 companies. Seven companies were engaged through both solutions.

Table 1: Collaborative Engagement Activity, Q1 2023

Source: ISS ESG

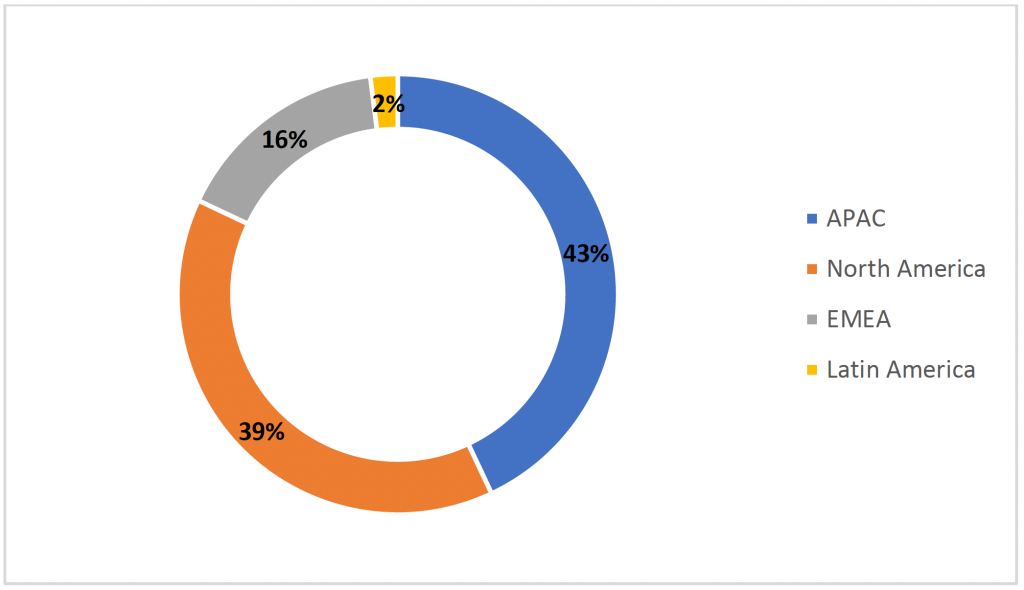

While the companies engaged with are spread out across all regions globally, most were domiciled in Asia-Pacific (APAC) (43%), North America (39%), and Europe, the Middle East, and Africa (EMEA) (16%).

Figure 1: Regional Distribution

Source: ISS ESG

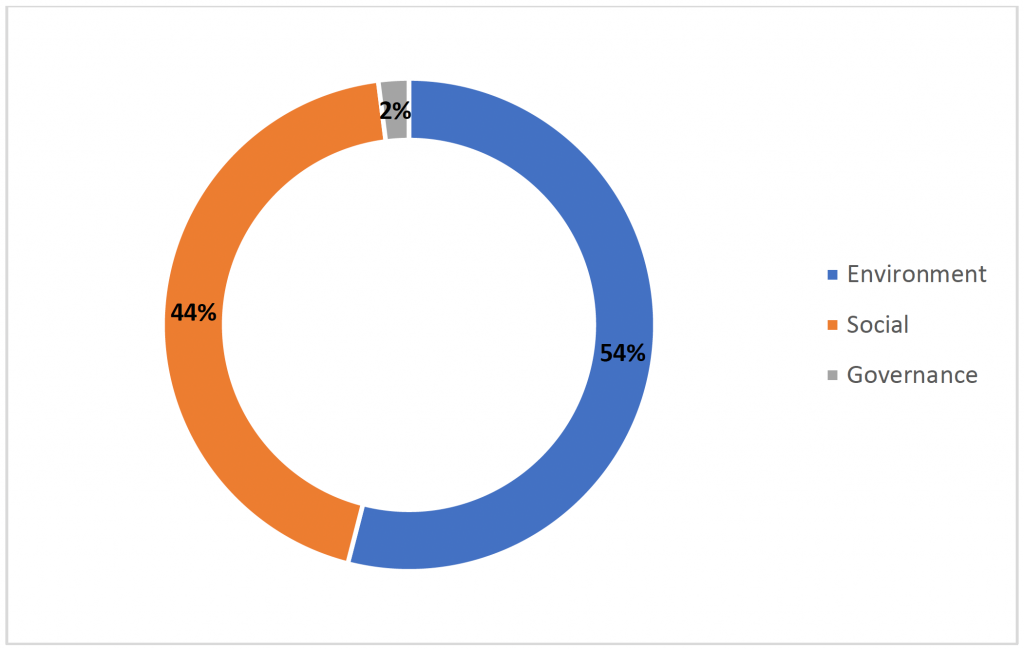

Across the 185 topics that ISS ESG facilitated engagement on during Q1 2023, there was a relatively even distribution between Environment topics (54%) and Social topics (44%), while only 2% of the topics concerned the Governance pillar.

Figure 2: ESG Breakdown

Source: ISS ESG

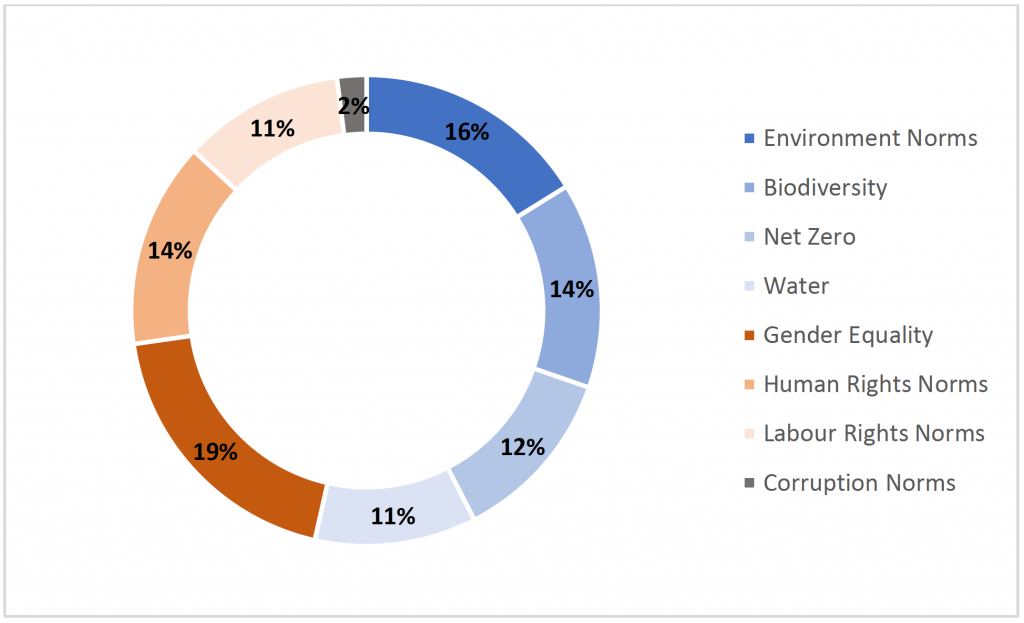

A closer look at the ESG breakdown shows that among Environment topics, most engagement facilitated by ISS ESG during Q1 2023 related to Environment Norms under Norm-Based Engagement, followed by Biodiversity, Net Zero, and Water under Thematic Engagement. Within the area of Environment Norms, the most common sub-topic was related to pollution and failure to assess environmental impacts.

Among Social topics, most of the engagement related to Gender Equality, followed by Human Rights Norms, and Labour Rights Norms under Norm-Based Engagement. Within Labour Rights Norms, the most common themes were union rights and workplace discrimination. Within the area of Human Rights Norms, the most common sub-topics were indigenous rights, the right to life, and consumers’ right to privacy.

Figure 3: ESG Topics Breakdown

Note: Due to rounding, the total percentage in the ESG Topics Breakdown graph adds up to 99%.

Source: ISS ESG

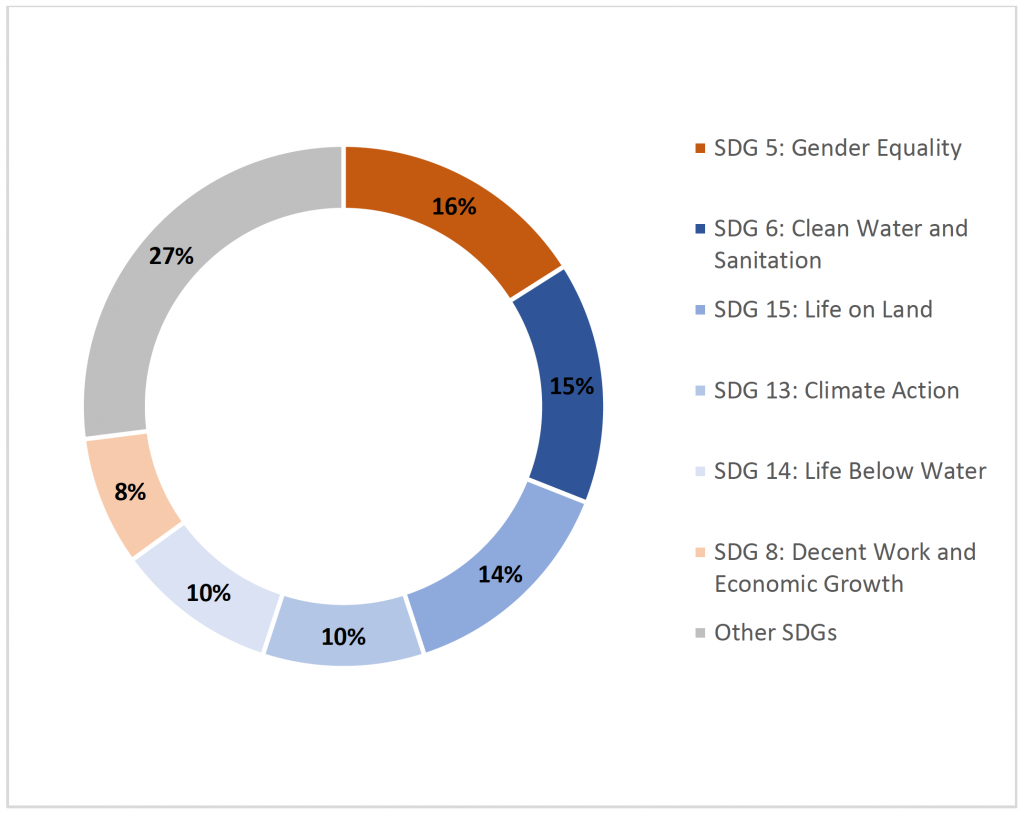

The topics that ISS ESG facilitated collaborative engagement on in Q1 2023 covered 13 of the UN Sustainable Development Goals (SDGs). The most common SDGs included SDG 5 – Gender Equality, SDG 6 – Clean Water and Sanitation, SDG 15 – Life on Land, SDG 13 – Climate Action, SDG 14 – Life below Water, and SDG 8 – Decent Work and Economic Growth.

Figure 4: SDG Breakdown

Source: ISS ESG

Future Action

For more than a decade, various soft and hard law initiatives have combined with investor demand to foster active ownership approaches generally, and engagement specifically, both of which have grown worldwide. These trends have encouraged more common frameworks for investment stewardship for investors seeking changes in the companies they invest in.

ISS ESG’s Collaborative Engagement Services, including Norm-Based Engagement and the Thematic Engagement Solution, are available to support investors in this important area of their stewardship practice. ISS ESG has also published a range of Thought Leadership material covering ESG engagement, including Stewardship Excellence: Engagement in 2021 and Sustainability Engagement in the Asia Pacific: A Look Back Over the Past Decade. ISS ESG Engagement Managers have also shared insights on corporate engagement in several webinars and articles on themes such as Net Zero, Water, Biodiversity, Gender Diversity, and Modern Slavery, as well as in a March 2023 webinar dedicated to Trends in ESG Engagement.

Explore ISS ESG solutions mentioned in this report:

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

Authored by:

Sana Cheruvallil, ESG Engagement Co-ordinator, ISS ESG

Vyankatesh Padmanabhi, ESG Engagement Co-ordinator, ISS ESG