The Italian parliament has passed new legislation aimed at countering the financing of companies involved in anti-personnel mines and cluster munitions. The new law, which came into force on the 23rd December 2021, is more comprehensive than a 2011 law that had introduced restrictions on the financing of companies involved in cluster munitions.

The purpose of this new law is to introduce a strict prohibition on the financing of companies involved in:

- anti-personnel mines;

- cluster munitions; or

- components of these weapons;

using a broad definition of involvement that captures activities such as production, development, assembly, repair, maintenance, use, storage, possession, promotion, sale, distribution, import, export, transfer and transport.

Early interpretations of the new law suggest that companies identified as involved in these activities are excluded from participating in public tenders or funding programmes, and the prohibition on their financing applies to authorized financial intermediaries such as banks, asset managers, investment companies and brokers. The law defines ‘financing’ as: “any form of financial support also made through subsidiaries, based in Italy or abroad, including, by way of example but not limited to, the granting of credit in any form, the issue of financial guarantees, the acquisition of shareholdings, the purchase or underwriting of financial instruments” issued by companies involved in anti-personnel mines, cluster munitions or components of these weapons.

The legislation further defines involvement in anti-personnel mines and cluster munitions in accordance with the technical definitions and the prohibitions of the two relevant international arms control instruments in this area – the Convention on Cluster Munitions and the Mine Ban Treaty – to which Italy is a States Party. The Bank of Italy and other financial market regulators in Italy are defined as supervisory bodies for authorized financial intermediaries’ compliance with this law. Duties of supervisory bodies and authorized financial intermediaries under the law are described as follows:

- “Within six months from the date of entry into force of this law, the supervisory bodies issue, in agreement with each other, specific instructions for the exercise of reinforced controls on the work of authorized intermediaries […] and publish the list of companies [involved in anti-personnel mines, cluster munitions or components of these weapons] and indicate the office responsible for the annual publication of the same list. […] As part of the tasks relating to the Financial Intelligence Unit for Italy (UIF), established at the Bank of Italy […] the controls of financial flows are extended to companies [involved in anti-personnel mines, cluster munitions or components of these weapons].”

- “Within ninety days of the publication of the list […] the financial intermediaries shall exclude from the products offered any component that constitutes financial support to the companies included in the aforementioned list.”

- “In order to verify compliance with the prohibitions […] the Bank of Italy may request data, news, deeds and documents from the authorized intermediaries […] and, if necessary, it can carry out checks at their headquarters. […] As part of the inspections and checks carried out by the supervised entities, the supervisory bodies also carry out specific checks to evaluate the activity related to the compliance function in relation to the prohibitions set out in this law.”

While the above information is compiled directly from Italian government sources, ISS ESG is not a legal advisor and therefore recommends financial institutions review the new legislation carefully and seek legal counsel concerning the identification of requirements to update respective compliance processes relating to business activities in Italy. ISS ESG has contacted relevant authorities in Italy requesting information regarding their process to identify companies involved in anti-personnel mines and cluster munitions, with the intention of providing further details to its clients about potential compliance implications as they come to hand.

Beyond Italy: Compliance challenges for investors?

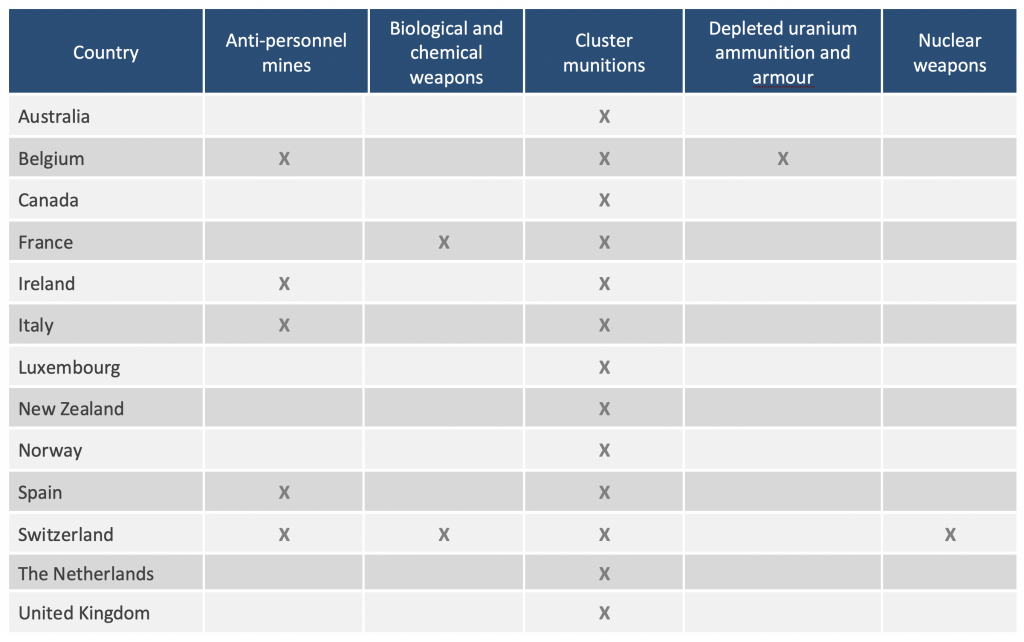

The financing of companies involved in controversial weapons is not explicitly prohibited by international arms control treaties. However, several such treaties prohibit ‘assistance’ in the development, production, and stockpiling (among other things) of controversial weapons, which is widely interpreted as including the financing of companies involved in the development, production, stockpiling and so on of these weapons. In this context, and in addition to Italy, dozens of other countries have either introduced legislation explicitly prohibiting the financing of companies involved in controversial weapons or expressly confirmed in an official statement that they consider such financing to be prohibited under respective international arms control treaties – see Table below.

While these countries typically introduced financing prohibitions in connection with their national ratification of respective international treaties – specifically in the context of the Convention on Cluster Munitions – they have not necessarily explicitly regulated financing for all types of weapons that are prohibited in their jurisdictions. However, many financial institutions with business in these jurisdictions appear to apply their compliance processes and investment policies regarding companies involved in controversial weapons not only for those types of weapons where an explicit legal prohibition exists, but for all types of weapons that are prohibited or considered controversial in the country.

Selection of countries with financing prohibitions (explicit legislation or official statement):

Source: ISS ESG Controversial Weapons Research (a complete list of countries with financing prohibitions is available to clients)

In alignment with these countries’ references to international arms control treaties as the normative framework to regulate the financing of companies involved in controversial weapons, ISS ESG’s Controversial Weapons Research assesses corporate involvement in controversial weapons using criteria set out in respective arms control instruments such as the Convention on Cluster Munitions and the Mine Ban Treaty. These conventions serve as the primary normative framework regarding anti-personnel mines and cluster munitions for many financial institutions, and they provide a robust basis for defining screening criteria for corporate involvement in controversial weapons more generally.

ISS ESG monitors developments concerning national financing prohibitions on companies involved in controversial weapons and provides relevant updates, analyses and comprehensive overviews to its clients.

The adoption of this new regulatory framework in Italy – one of the 10 largest economies in the world – is an illustration that while the immediate focus of the responsible investment community has been on issues such as climate change, momentum continues to grow around key traditional topics such as the financing of controversial weapons.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Controversial Weapons Research to assesses companies’ involvement in banned or controversial weapons.

By Henning Weber, Head of Weapons Research, ISS ESG. Lawrence Dermody, Senior Analyst, ISS ESG.