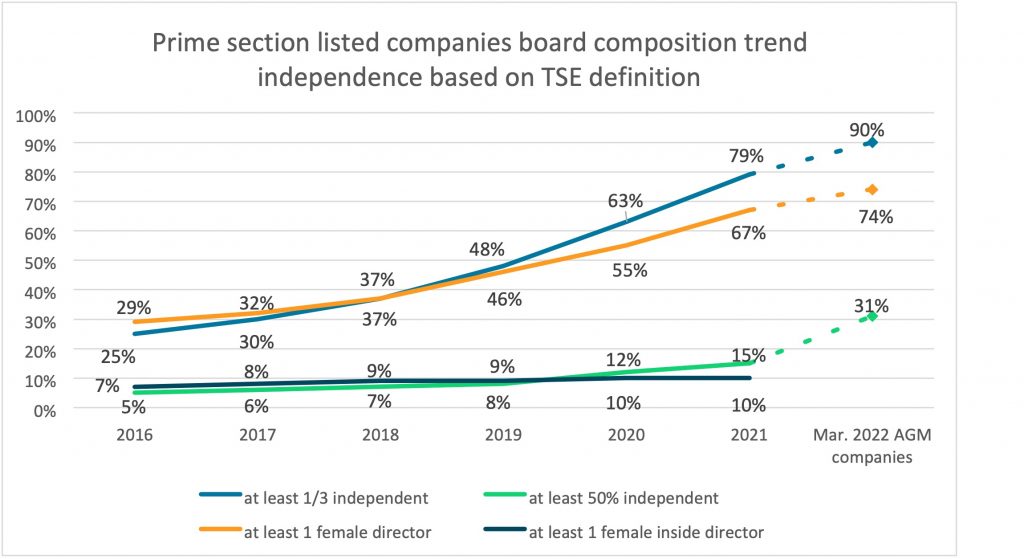

A recent ISS analysis of Japanese board composition finds a marked uptick in board independence and female board representation. At the close of Japan’s March 2022 “mini-season”, ISS found a 13percentage point jump in companies with at least a one-third independent board (based on the Tokyo Stock Exchange (TSE) classification), and a 12-percentage point increase in boards with at least one female director for companies listed on TSE’s Prime (the former First) listing section, compared with the same time in 2021 March.

Based on the 200+ companies listed on the TSE’s Prime listing section that held their 2022 AGMs during the March mini-season, the percentage of those companies where at least one third of board members were independent reached 90 percent, compared to 79 percent in December 2021 and 63 percent in December 2020 based on the 1800+ companies currently listed on the Prime listing section.

Furthermore, of the 200+ Prime-listed companies that held their AGMs in March 2022, 31 percent had at least 50 percent board independence representation.

More Japanese companies are also adding female directors to their boards. The number of boards of Prime-listed companies that held their AGMs in March with at least one female director rose to 74 percent, which is a significant increase when compared with 67 percent as of December 2021 and 55 percent as of December 2020 for the full 1800+ Prime-listed company universe.

Source: ISS Board Data

In the past few years, it was already the norm for blue-chip companies to have at least a one-third independent board and a female director, and increases in board independence and female board representation have been continuous. However, these trends were further accelerated by the 2021 revision of Japan’s Corporate Governance Code and the TSE’s listing section reform which took effect on April 4, 2022.

In February 2020, the TSE announced its plan to reform its five listing sections (First, Second, Mothers, JASDAQ Standard and JASDAQ Growth) to three sections (Prime, Standard and Growth). With the reform, the TSE required former First section listed companies to have better corporate governance practices (and more liquidity) in order to be listed on the Prime section. The Standard section is for former First section listed companies that decided not to meet the stringent requirements, and also for companies previously listed on the Second and JASDAQ sections that wanted to upgrade their listings. The Growth section is mainly for former Mother section listed companies.

In June 2021, in sync with the TSE’s listing section reform, Japan’s Financial Service Agency revised the Corporate Governance Code, which requires higher corporate governance standards for companies listed on the Prime section. The revised Code calls for at least one-third independent board for all companies and majority independent board for controlled companies listed on the Prime section. On the other hand, the requirement for Standard and Growth sections remained status quo, with a requirement of only two independent directors for non-controlled companies and one-third independent board for controlled companies. In addition to the higher board independence standard, Prime section listed companies are required to disclose the impact of climate changes based on the Task Force on Climate-Related Financial Disclosures (TCFD) framework, adopt majority independent advisory compensation and nomination committees, disclose some of their filings in English and use electronic voting system for institutional investors. The revised Code also calls for diversity – including gender, ethnicity and age diversity – at the board and workforce levels.

Although the Code is not a hard law and companies have the option to explain the reason for their noncompliance, most Japanese companies have traditionally chosen to comply. According to the Exchange, 88 percent of companies listed on the First section complied with more than 90 percent of the Code requirement as of 2020.

Despite the stringent requirements, more than 80 percent of former First section listed companies opted for the Prime section listing among which were many small- and mid-cap companies. While some companies chose the Prime section to keep their access to capital, others chose the Prime section primarily to keep their “top” listing status on the TSE. In the Japanese business community and the society at large, being on the First section is a “status” which makes it easier to access new businesses and recruit talented employees, especially in rural areas where many of small/mid cap companies operate.

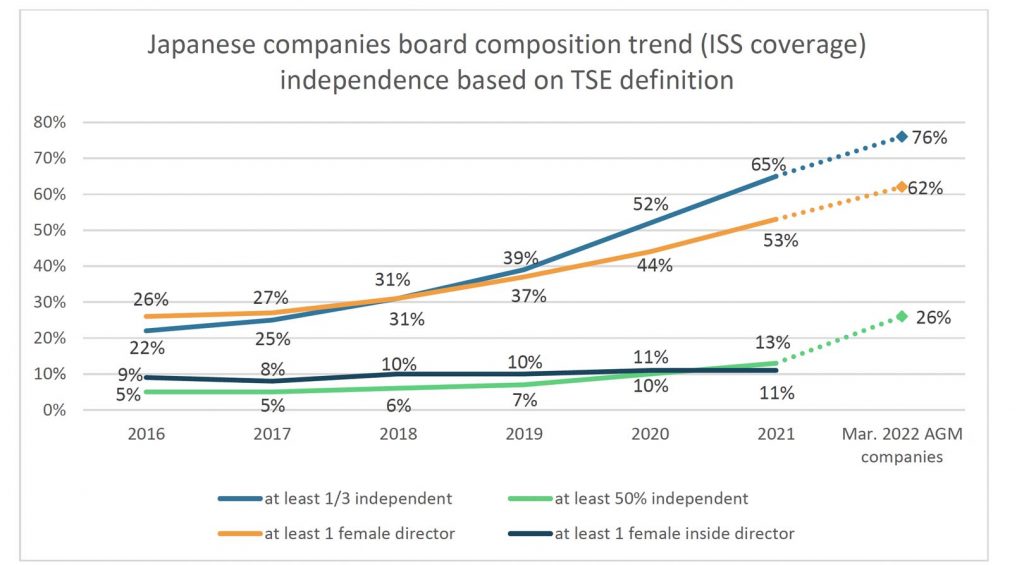

Because many small/mid companies opted for the Prime section, the reform has an impact on Japanese listed companies across all sizes. Based on all 400+ companies under ISS coverage that held their AGMs in March (including small- and mid-sized companies in the non-Prime listing sections), the percentage of companies where at least one third of board members are independent (based on TSE definition) was 76 percent, and 62 percent of companies had at least one woman on their board.

Source: ISS Board Data

Following the Code revision and listing reform, many institutional investors updated their proxy voting policies this year, introducing stricter voting policy for outsider and female representation on boards. Requirement for at least 1/3 outsider/independent board at Japanese companies is the norm among institutional investors and many investors now have a gender diversity policy in their proxy voting guidelines.

Historically, the March mini-season has always been a leading indicator for what investors should expect for the upcoming Japanese June main AGM season. While we expect overall board independence to improve, it will remain to be seen whether the small number of Prime-section-listed, blue-chip companies still not in compliance with the revised Code on board independence, such as Keyence, Oriental Land, Central Japan Railway and Sumitomo Realty & Development, will comply with the Code or decide to explain the reason for their non-compliance. We also expect an improvement on the gender diversity front, but most of the increase will likely come from appointment of female outside directors. Even at Prime listing companies, boards with female inside directors remain largely unchanged from 9 to 10 percent since 2018 and it is difficult to foresee a major shift in this area for the 2022 main Japanese proxy season.

By Taketoshi Yoshikawa