To mark the proceedings of RI Aotearoa New Zealand 2021 (#RIAotearoaNZ21), ISS ESG evaluates the potential portfolio impacts of new Kiwisaver screening policies.

From December 2021, investment service providers to New Zealand’s national superannuation scheme KiwiSaver will be banned from investing in companies associated with certain fossil fuels and controversial weapons.

In addition, the default provider must maintain an environmental, social and governance (ESG) policy, which must be disclosed on the default provider’s website and filed on a Disclosure Register. The annual report for the default scheme must include information on actions taken over the year in relation to the ESG policy and any changes in the ESG policy since the last annual report.

New Zealand’s Financial Markets Authority (FMA) has reported that as at 31 March 2020, there were 3,026,064 KiwiSaver members across 33 KiwiSaver schemes, and a total of $62 billion funds under management. 381,034 KiwiSaver default members (12.6%) were in default funds with total funds under management of $4 billion.

While it is common practice for large fund managers to provide clients with fossil fuel-free options, KiwiSaver products have traditionally been more mainstream, conservative offerings. This is despite several of the larger participants in the program such as BNZ, Westpac and ANZ offering more ESG-conscious products to their broader client base.

The decision has faced criticism in some quarters, but the obvious question must be whether or not the beneficiaries of the KiwiSaver scheme will notice anything in terms of portfolio returns? While past performance is of course no certain indicator of future performance, if the last five years’ benchmark is anything to go by, the new screens should have very little financial impact on KiwiSaver returns, except on the upside.

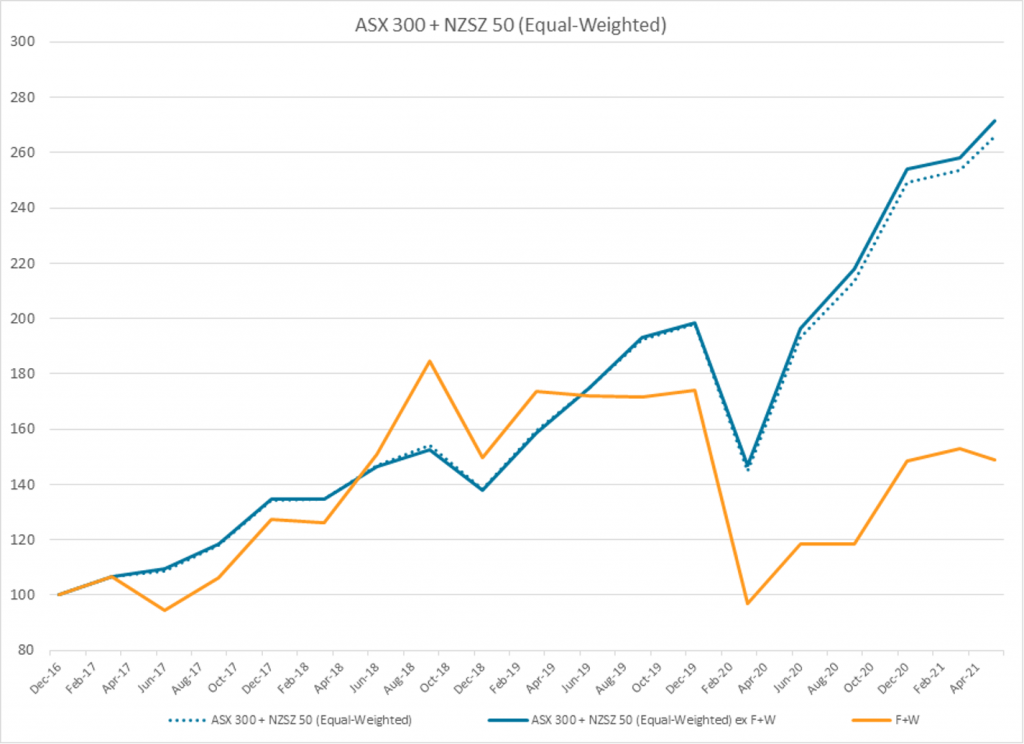

The following graph illustrates the performance of the S&P/ASX300 and the NZX50 combined, both before and after the removal of companies impacted by the KiwiSaver ESG screens. The yellow line represents a portfolio of just the companies that have been removed.

Source: ISS ESG, ISS EVA data

As can be seen, the performance difference is minor, and the index performs better in the absence of the companies in question.

Of course, KiwiSaver products don’t just invest locally – it is essential to consider the potential impacts of the new screens on global returns.

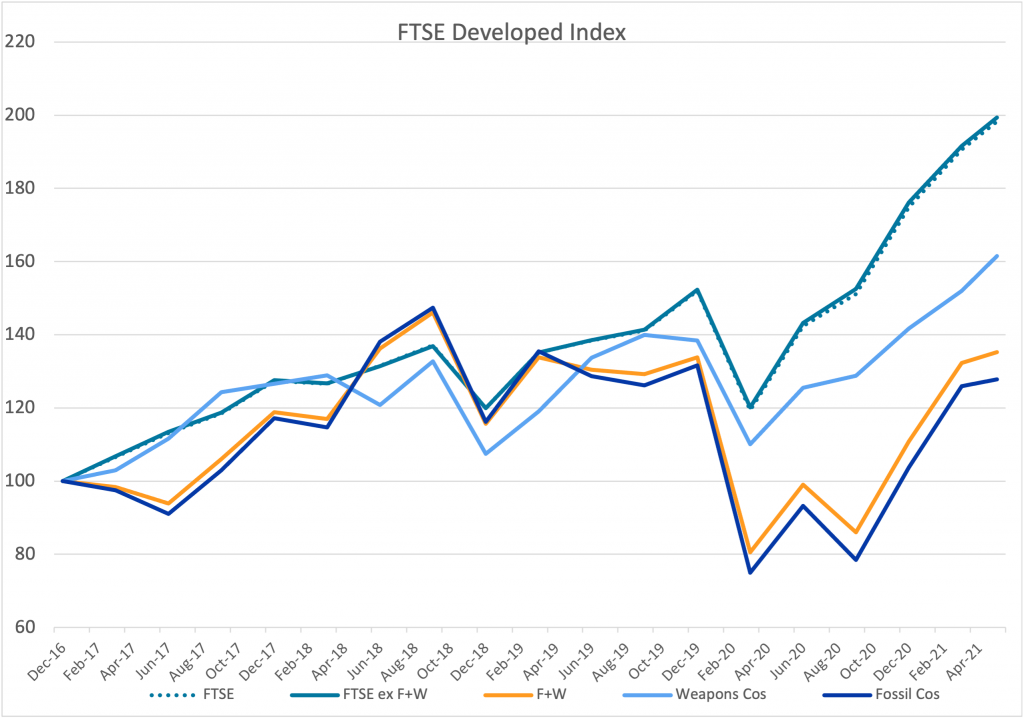

The following graph illustrates the performance of a common global index before and after the application of the ESG screens for fossil fuels and controversial weapons, demonstrating again that there is a minor difference in the performance on the upside. Interestingly, the data here shows that the bulk of the underperformance is associated with screened fossil fuel companies.

Source: ISS ESG, ISS EVA data

It seems clear that a combination of relatively poor performance from the industries being excluded and the relatively small total number of excluded companies combine to mean that the application of the KiwiSaver exclusion policies need not hurt beneficiary returns, and indeed may contribute to better performance in the longer term.

This finding is supported by other recent work by ISS ESG that demonstrates the benefits that ESG investing can bring, through the combination of economic and ESG factors in our ESG Matter II paper; through the application of diversity policies at company board level; and most applicably in this instance, through the use of screening in the management of screened indices.

It is right to question the impact of government policy on KiwiSaver performance – in this instance it appears likely that the outcomes will be favourable to beneficiaries.

By Bjorn De Smedt, Associate Director – Account Executive Australia & New Zealand, ISS. Casey Lea, Executive Director, ISS EVA