According to CFA Institute, “Materiality is contextual; that is, [it] …depends on the investor’s objectives and time horizon and the specifics of the investment. Materiality is also dynamic: The materiality of a specific ESG factor may change over time.” ISS ESG supports global institutional investors with research and data that help inform investment decision making and recognizes that the responsibility to judge the materiality of information for investment decision-making lies with investment professionals, in line with their own organizations’ investment theses and responsibilities to their clients.

Institutional investors have different mandates, strategies, and points of view. In fact, those different and unique views are what give investment professionals their edge to outperform the market, across time horizons and strategies. As a leading global data and service provider, our goal at ISS ESG is to provide reliable, high-quality data to help our global institutional investors’ clients make better informed decisions and support them in executing their strategies and meeting their various mandates and objectives, across jurisdictions.

In response to our clients’ needs, the ISS ESG Corporate Rating solution employs a proprietary methodology with a holistic materiality interpretation with appeal to institutional clients across client preferences and approaches. This article defines the views on both impact and financial materiality that underpin this methodology and that are in line with our ESG Corporate Rating Survey results. In fact, in 2023, 67% and 66% of North American- and European-based investors, respectively, noted that “an approach integrating both financial and impact materiality” is relevant or highly relevant for ESG ratings.

Materiality Definition: It Comes Down to Time Horizons

Sustainability matters can be evaluated with an “inside out” or an “outside in” approach.

Inside Out – Impact Materiality

This definition draws from an impact orientation and considers how a company’s business activities affect a broad group of stakeholders and the environment – also referred to as ‘people and planet.’

Outside In – Financial Materiality

This is derived from a financial perspective and examines how nature, including a changing climate, and societal trends may create risks or opportunities for a company’s bottom line.

Over longer time horizons, there is a greater degree of overlap across approaches, as there is higher likelihood that regulation, reputational damage, or tort claims, among a combination of factors, can lead to more internalization of a company’s effects on ‘people and planet.’ Companies that are dependent on nature, for example—namely a natural resource or an ecosystem service—can see their own operations directly impacted by their practices that undermine those resources they rely on (for example, a beverage company that pollutes the water sources that they depend on). As such, understanding impacts can be important even if financial outcomes are investors’ only concerns.

Inside Out or Impact Materiality

Impact refers to business activities that have potential or actual effects on people or the environment. This includes own operations as well as those operations upstream or downstream in the value chain. Potential negative impacts might include damages that will likely result from greenhouse gas (GHG) emissions or expected human illness caused by pollution. Examples of actual negative impacts might include workplace injuries or identified instances of forced labor in a company’s supply chain. Impacts may also be positive. For instance, the manufacture of solar panels makes a positive contribution to renewable energy use.

Impact materiality indicates that a particular impact exceeds a quantitative or qualitative threshold from the perspective of users who are primarily concerned with an “inside out” view of a company’s business activities. There is no prescription for how financial market participants define impact materiality thresholds. However, certain criteria may be considered, and some regulators have stepped in to define the criteria set. The EU’s European Sustainability Reporting Standards, for example, indicate that evaluation of impact severity should consider both scale and scope (or the number of people or locations affected). In addition, for negative impacts, the ability to remediate such impacts may also be considered. For instance, workplace fatalities would likely be considered severe given their irremediable character. Finally, for potential impact, the likelihood of occurrence may also be taken into account.

Consider a fictional company, Global Corporation, Inc. Global Corporation makes and sells a variety of consumer and industrial goods worldwide. The company owns manufacturing plants, warehouses, data centers, and transportation equipment, all of which are powered by energy derived from fossil fuels. The company thus has a significant carbon footprint. Global Corporation is also being investigated for anti-competitive behavior by multiple competition authorities. The company’s material impacts that exceed most impact-focused investors’ threshold for severity due to their scale and scope might include greenhouse gas emissions and anticompetitive behavior.

Outside In or Financial Materiality

In the context of sustainability, financial risks and opportunities may stem from impacts, dependencies on nature, or other factors such as hazards related to climate change. This “outside in” perspective of sustainability examines whether such risks and opportunities may affect a company’s financial performance, its financial position, its cash flows, or its cost of capital.

Financial materiality indicates that a particular risk or opportunity exceeds a quantitative or qualitative threshold based upon the expected financial effects on a company. These thresholds are entity-specific, but general guidance is provided by accounting standard setters, regulators, and legal systems. The consensus is that any item, whether related to matters of sustainability or not, is material if its omission or misstatement would influence the decisions of a financial report user. In practice, the likelihood and the magnitude of potential financial effects are considered together when determining whether a specific risk or opportunity meets the materiality threshold.

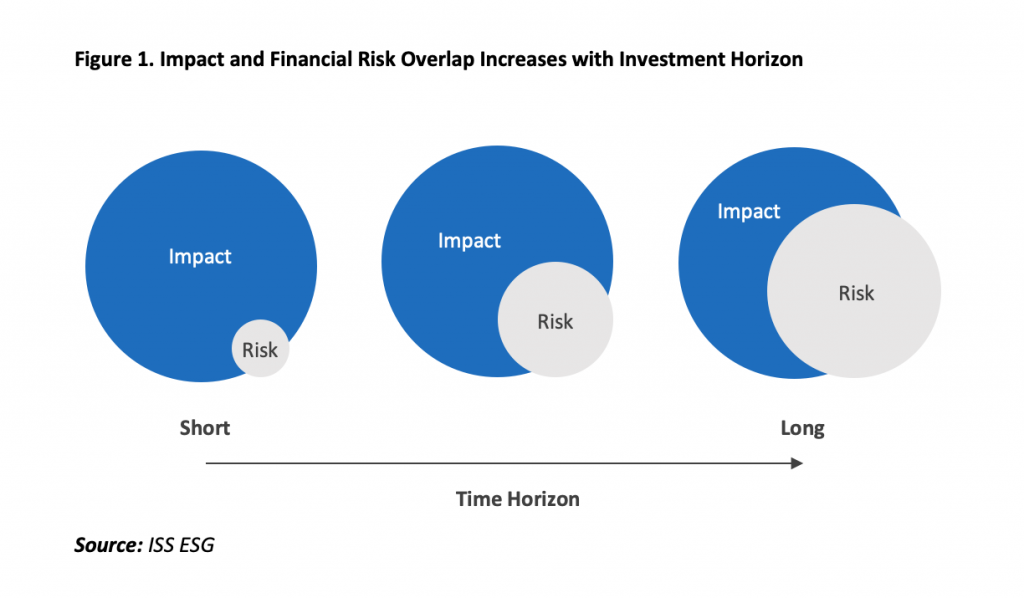

Impact and Financial Materiality Overlap Increases with Investment Horizon

Over short and medium time horizons, the total number and aggregate magnitude of impacts tend to be larger than for financial risks, as Figure 1 illustrates. For Global Corporation, its financially material risks over a shorter time horizon, perhaps 1-3 years, might include workplace accident risk, cyber risk, and certain physical risks from climate change.

Accident risk and cyber risk derive from impacts that are highly internalized by law in much of the world, making them more likely to be financially material even for shorter-term investments.

An increase in regulation to ensure that supply chains are free of human rights abuses may result in material financial risks over a medium-term horizon if new laws take full effect. For example, forced labor incidents may lead to financial consequences under the EU’s Corporate Sustainability Due Diligence Directive that takes full effect in 2029. As a result, the size of the impact and financial risk of forced labor in the supply chain might be comparable over the medium term.

Over longer time horizons (or at least a full market cycle), there may be an even stronger overlap of sustainability issues whose impact and financial risk have similar magnitude. For the fictional Global Corporation, the climate transition risks of its GHG emissions may become financially material if more locations where the company operates have some type of carbon pricing. In addition, anti-trust issues can take many years to resolve, but the longer-term consequences can be substantial, including forced divestitures that can damage enterprise value.

As the International Sustainability Standards Board (ISSB) also acknowledges in the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, an “entity’s ability to generate cash flows over the short, medium and long term is inextricably linked to the interactions between the entity and its stakeholders, society, the economy and the natural environment throughout the entity’s value chain…. the entity’s dependencies on those resources and relationships and its impacts on those resources and relationships give rise to sustainability-related risks and opportunities for the entity.”

ISS ESG Solutions Offer Insight and Analytics to Both Impact and Financial Materiality

ISS ESG provides a full suite of data that enables users to gauge impacts, risks, and opportunities related to sustainability matters over various investment horizons. Our Cyber Risk Score, for example, represents the relative likelihood of a company suffering a material cybersecurity incident within the next 12 months, while our Climate Solutions help gauge both current and future physical risks.

Future risk exposure to supply chain due diligence regulations can be calibrated with our Modern Slavery Scorecard, and longer-term financial risks from the transition to a more sustainable economy can be evaluated using our Climate Solutions, ESG Corporate Rating, SDG Solutions Assessment, SDG Impact Rating, Governance Qualityscore, and ESG Country Rating. Finally, our Economic Value Added (EVA) offering can be paired with our sustainability data sets to conduct scenario analyses and gauge the totality of sustainability risks and opportunities.

Explore ISS ESG solutions mentioned in this report:

- Assess and manage cyber risk across your ESG investments with ISS Cyber Risk Score.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Identify, evaluate and act on modern slavery risks and their impact on investments with the Modern Slavery Scorecard.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- ISS ESG’s Governance QualityScore supports investors as they consider governance in their quality analyses and incorporate unique compensation, board, and shareholder responsiveness data into management assessments.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Understand the F in ESGF using the ISS EVA solution.

By:

Amber Daniels, Executive Director, Global Multi-Sector Head, ISS ESG Research

Joe Arns, CFA, Executive Director, Global Head of Strategy and Scalability, ISS ESG Research

Mirtha Kastrapeli, Managing Director, Global Head of Natural Capital and Head of Consumer Sector, ISS ESG Research

Roberto Lampl, Managing Director, Global Multi-Sector Head, ISS ESG Research