Key Takeaways

- Investors may use the aggregate ESG Country Rating or individual indicators to design an optimized sovereign portfolio that aligns with their investment strategy and risk appetite.

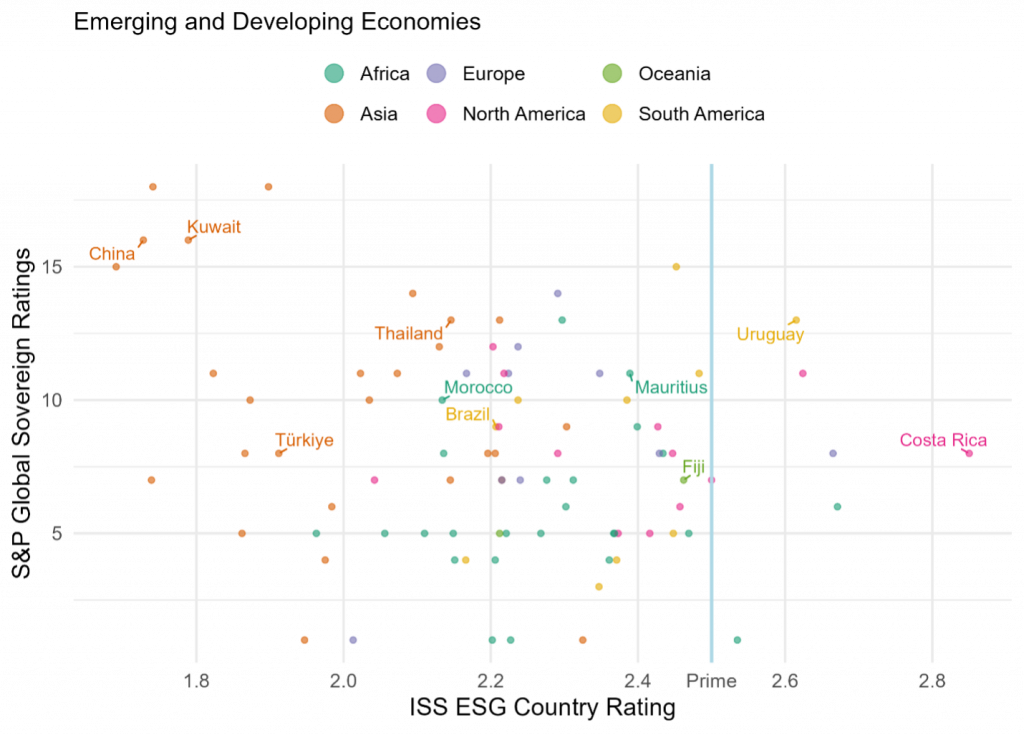

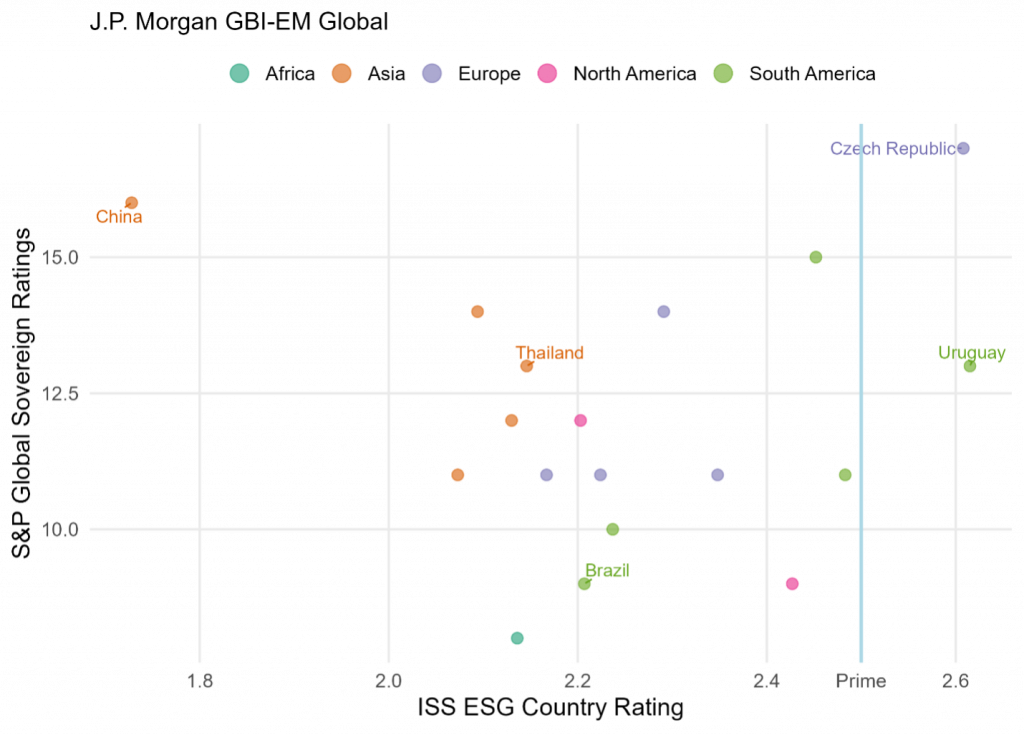

- By combining ISS ESG’s sovereign ESG rating with traditional credit ratings investors may gain a more comprehensive view of a country’s risk profile. For example, though Thailand and Uruguay have similar credit ratings, Uruguay has the ISS ESG Country Prime status, potentially offering a lower risk profile than Thailand.

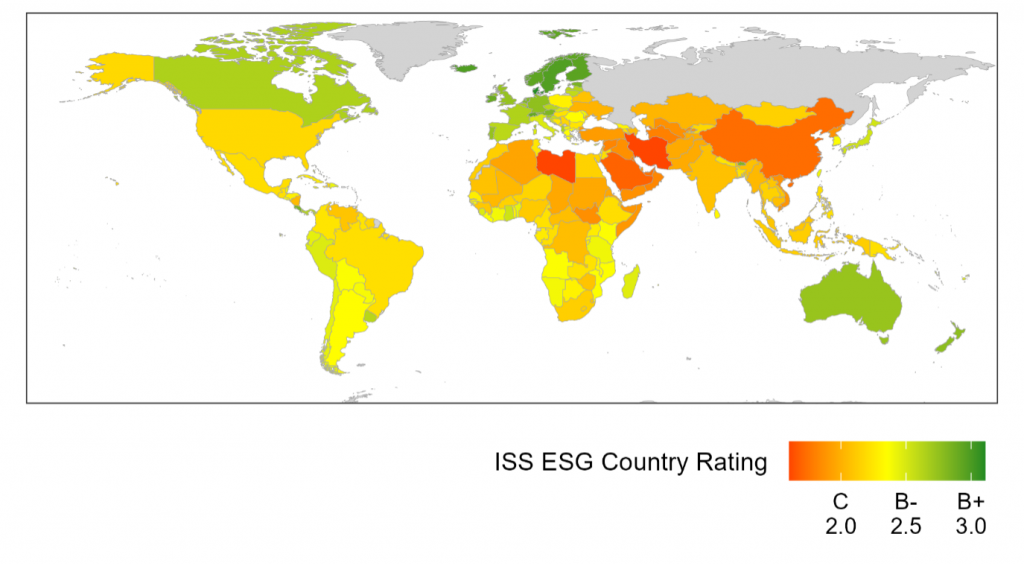

- Denmark, Iceland, Sweden, Luxembourg, and Finland score in the top five of the ESG Country rating, while Libya, Iran, Saudi Arabia, China, and Bahrain are in the bottom five.

- Impact-focused investors may use environmental or social indicators to allocate capital towards achieving Sustainable Development Goals.

After decades of globalization, recent developments suggest a possible shift towards fragmentation. For example, investors from sovereign wealth funds and central banks listed geopolitical tensions as the top short-term risk, according to a study by Invesco. In the long term, heightened geopolitical fragmentation and protectionism, along with climate change, were major concerns.

For investors navigating geopolitical uncertainties and trade complexities, the ISS ESG Country Rating can be a useful tool to evaluate geopolitical risk and deepen understanding of supply chain and sustainability issues. In this way, the Country Rating can serve as a complement to traditional credit rating tools.

Assessing Sovereign Sustainability Performance

Based on a holistic materiality framework, the ISS ESG Country Rating assesses sustainability performance of sovereign entities using a 12-point grading system from D- (poor) to A+ (excellent). Prime status is attributed to those countries that achieve or exceed the Prime threshold of B-/2.50, meaning they fulfil ambitious absolute performance requirements. Sovereigns with Prime status are able, on average, to adequately manage their ESG risks.

Below the Prime threshold, investors may expect challenges, such as lack of respect for human and labor rights, a poor social security system disadvantaging a large proportion of a country’s population, and/or considerable environmental degradation and overexploitation. Materiality considerations are informed by international norms and conventions, such as the Charter of the United Nations and the Universal Declaration of Human Rights, as well as the United Nations Sustainable Development Goals (UN SDGs).

While traditional sovereign credit ratings assess the creditworthiness of a country, as measured in the long-term solvency of government bonds, by using macroeconomic factors, sovereign ESG ratings evaluate a country’s sustainability and ethical practices based on environmental, social, and governance factors such as carbon footprint, human rights and freedom, policies, and legislation. By combining sovereign ESG ratings with credit ratings, investors can benchmark their overall risk exposure to gain a more comprehensive view of a country’s risk profile.

With coverage of around 180 sovereign entities and 800+ sovereign and sub-sovereign bond issuers, including Hong Kong, Taiwan, and the European Union, the ESG Country Rating universe amounts to 100% coverage of global sovereign debt issued. Among the sovereign entities covered are all European Union (EU), Organization for Economic Co-operation and Development (OECD), and ASEAN member states, as well as major sovereign issuers from Africa, the Americas, Asia, Europe, and Oceania.

Based on the ISS ESG Country Rating as of January 2025, Denmark, Iceland, Sweden, Luxembourg, and Finland top the list for the highest overall ESG ratings, while Libya, Iran, Saudi Arabia, China, and Bahrain have the lowest ratings.

Table 1: Five Highest- and Lowest-Ranked Countries in the ISS ESG Country Rating

Source: ISS ESG Country Rating dataset

Complementing Traditional Credit Ratings

While social and governance scores for sovereigns may correlate with credit quality, meaning strong institutions and legal systems support the country’s ability to pay back loans, environmental policies and carbon footprints have largely been overlooked in sovereign debt products. Therefore, the ISS ESG Country Rating can help fill the gap by providing a comprehensive ESG performance view of sovereign and sub-sovereign states beyond economic and fiscal indicators. The Country Rating may also help countries promote sustainability by encouraging them to improve their ESG performance, potentially leading to better credit ratings over time.

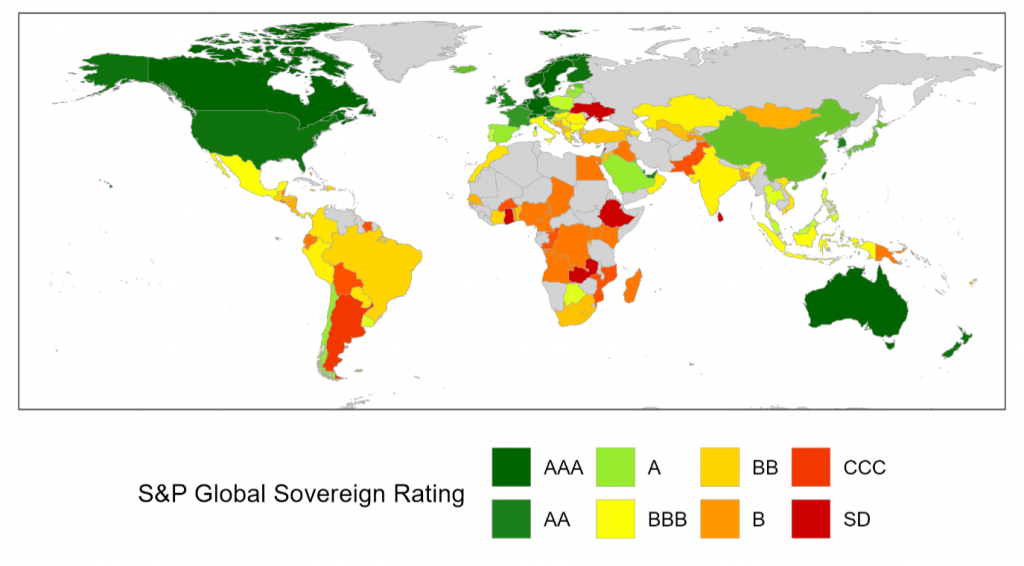

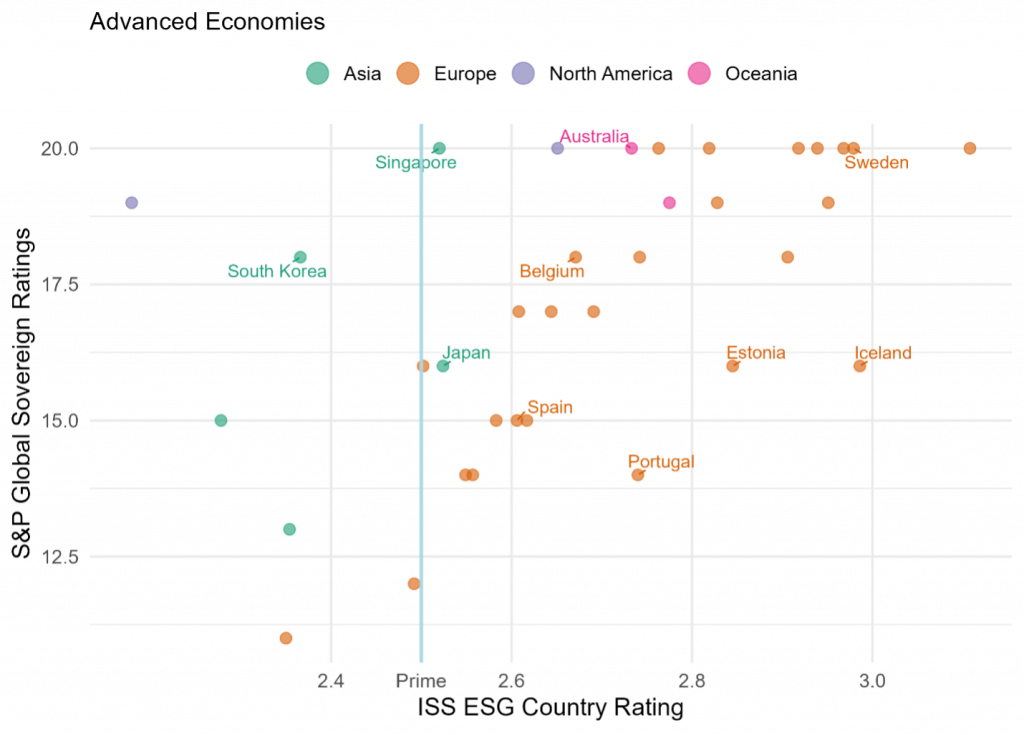

As shown in the figures below, the ESG rating and Sovereign credit, in combination, can contribute to decision-making by highlighting both traditional and evolving risks. The juxtaposition of ESG and credit ratings of countries in Figures 1 and 2 provides a broader risk profile of countries, which can improve sustainable investment decisions. For instance, while China receives an A+ S&P sovereign rating, its ISS ESG rating is below Prime, reflecting low Social and Governance scores.

Figure 1: ISS ESG Country Rating Total Score

Source: ISS ESG Country Rating dataset

Figure 2: S&P Sovereign Rating

Source: S&P Global Sovereign Risk Indicators, as of December 9, 2024

The following figures plot S&P Global’s Sovereign rating together with ISS ESG Country Ratings in three universes: advanced economies (Figure 3), emerging and developing economies from the IMF’s World Economic Outlook database (Figure 4), and the J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global (Figure 5), which is an investable emerging market debt benchmark.

Figure 3: S&P Sovereign Rating and ISS Country ESG Rating Sample: Advanced Economies

Note: The conversion of S&P Global’s credit ratings into a numerical scale is taken from Rosati et al. 2019.

Source: S&P Global Sovereign Risk Indicators 2024 Estimates, as of December 9, 2024; ISS ESG Country Rating dataset

Figure 4: S&P Sovereign Rating and ISS ESG Country Rating Sample: Emerging and Developing Economies

Note: Emerging and Developing Economies taken from the IMF’s World Economic Outlook database. The conversion of S&P Global’s credit ratings into a numerical scale is taken from Rosati et al. 2019.

Source: S&P Global Sovereign Risk Indicators 2024 Estimates, as of December 9, 2024; ISS ESG Country Rating dataset

Figure 5: S&P Sovereign Rating and ISS ESG Country Rating Sample: J.P. Morgan Government Bond Index-Emerging Markets

Note: The conversion of S&P Global’s credit ratings into a numerical scale is taken from Rosati et al. 2019.

Source: S&P Global Sovereign Risk Indicators 2024 Estimates, as of December 9, 2024; ISS ESG Country Rating dataset

One interesting contrast highlighted in both Figures 4 and 5 is that while Thailand and Uruguay have the same credit rating, Uruguay has an ESG Prime status, potentially offering a lower risk profile than Thailand.

Applying the Ratings

The ESG rating dimensions, Environment, Social, and Governance, consist of specifically defined categories: Political System and Governance; Human Rights and Fundamental Freedoms; Social Conditions; Natural Resources; and Climate Change and Energy. These categories are further split into several topics and ultimately indicators. Depending on the investment strategy, time horizon, and materiality of ESG issues, investors can choose to use either the aggregated ESG rating score or individual datapoints to create performance assessments and custom ratings with their own weights.

Example: The Environmental Dimension in the Country Rating

The concept of sustainable development aims to balance economic growth with environmental protection. Over half of the world’s GDP, approximately $44 trillion, is moderately or highly dependent on nature and its services. Key industries such as construction, agriculture, and food and beverages rely heavily on natural resources. However, industrialization and deforestation can lead to pollution, loss of biodiversity, and climate change. While the exploitation of natural resources can temporarily increase GDP, it can also deplete a country’s wealth if not managed sustainably.

For investors who are concerned with the long-term growth of countries and sustainability of their portfolios, the ESG Country Rating’s environmental dimension score can provide a holistic picture of a country’s environmental performance and footprint, drawing on the condition of its natural resources and its climate change performance and use of energy, as well as its production and consumption patterns.

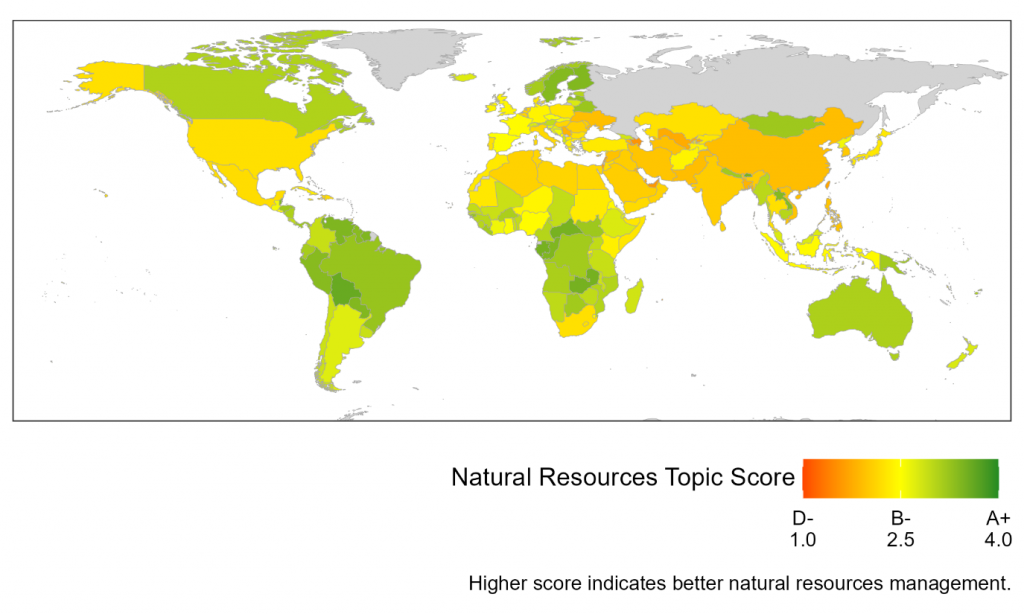

Figure 6 shows the natural resources topic score, which assesses a country’s availability, protection, and use of its natural resources with regards to land use, biodiversity, and water. As shown in the figure, Latin American countries outperform Asian countries in natural resources management.

Figure 6: Natural Resources Topic Score

Source: ISS ESG Country Rating dataset

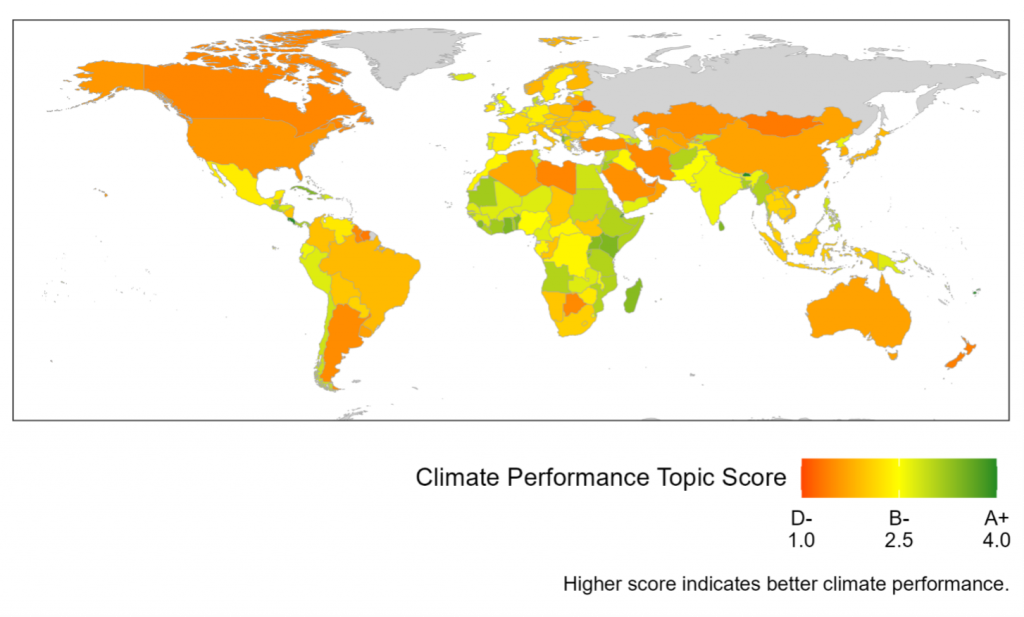

Figure 7 highlights the climate performance topic score, which shows a country’s performance on climate by assessing its national and international climate policy, ratification of the Kyoto Protocol and the Paris Agreement, and its greenhouse gas emissions intensity per capita and per GDP, as well as the future development trend of its carbon dioxide emissions.

Figure 7: Climate Performance Topic Score

Source: ISS ESG Country Rating dataset

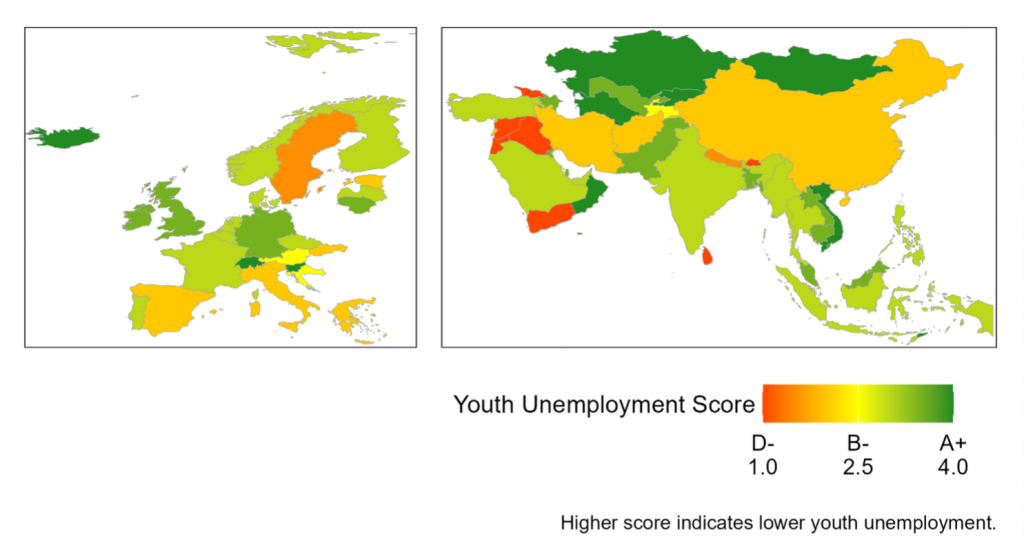

Example: SDG Goal 8: Youth Unemployment in Advanced Economies

UN SDG Goal 8 aims to promote inclusive and sustainable economic growth with full and productive employment and decent work for all. Certain indicators can help investors assess country performance on SDG Goal 8.

For example, consider one of the underlying datapoints of the Social Conditions category, the youth unemployment score (Figure 8). The youth unemployment indicator assesses the share of the labor force aged 15 to 24 who are without work but available for and seeking employment. This indicator is graded on a twelve-point scale from D- (poor) to A+ (excellent).

As shown in Figure 8, the youth unemployment score in Western European countries obtained below average status, particularly in Romania, Sweden, Greece, and Italy.

Figure 8: Youth Unemployment Score

Source: ISS ESG Country Rating dataset

High youth unemployment can lead to lower personal income, savings, and investment, which can reduce national income and GDP. A similarly poor youth unemployment score is indicated in China as well, potentially signaling an economic slowdown.

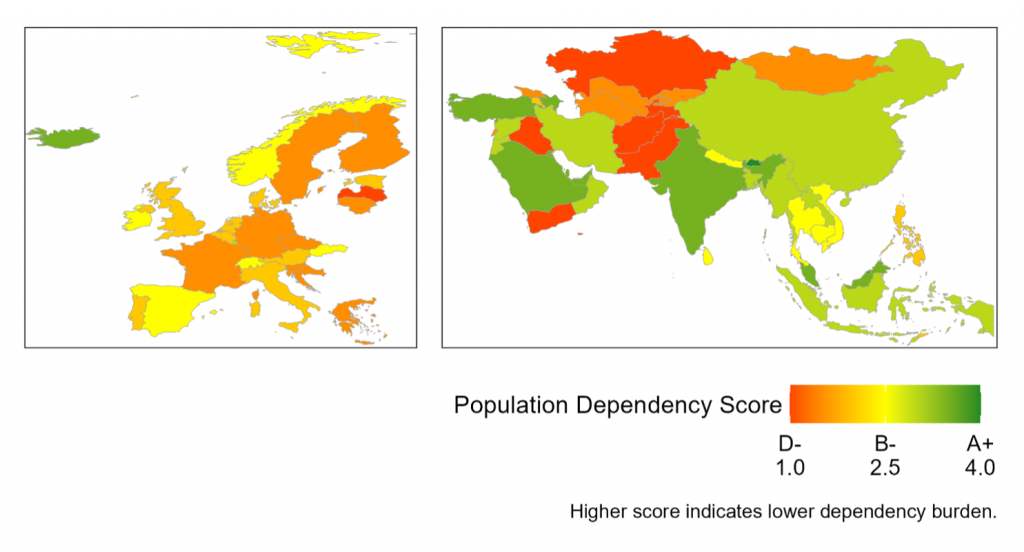

A separate indicator highlights an ongoing trend in Europe: population dependency score (Figure 9). This indicator assesses the number of dependent people younger than age 15 or older than age 64 as a percentage of the working-age population (those aged 15-64). The indicator implies the dependency burden that the working-age population bears in relation to children and the elderly. A rise in the dependency burden and thus a decline in the working-age population is seen across all of Europe, as seen in Figure 9.

Figure 9: Population Dependency Score

Source: ISS ESG Country Rating dataset

Increased social expenditure related to aging, in the form of pensions and healthcare, is likely to result in additional pressures on the social security and public healthcare systems.

In practice, a high youth unemployment rate combined with high population dependency on the working-age population raises ESG concerns. Significantly reducing the proportion of youth not in employment, education, or training (NEET) is one of the key targets for SDG Goal 8.

Impact-focused investors can use social indicators such as those mentioned above to help pinpoint where to allocate capital to support achieving sustainable development goals.

Building More Resilient Portfolios during Uncertain Times

While a country that exhibits a high credit rating might be less exposed to near-term solvency risks, its exposure to long-term ESG risks could be higher due to factors such as environmental exploitation and unsustainable consumption patterns. Hence, the ISS ESG Country Rating may allow investors to better manage these risks and identify those countries where the ESG risk profile is not adequately priced into financial markets.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By:

Moe Phyu, Associate, ISS ESG (moe.phyu@iss-stoxx.com)

Hernando Cortina, CFA, Managing Director, ISS ESG (hernando.cortina@iss-stoxx.com)