Key Takeaways:

- Commodities are an essential part of multi-asset portfolios, but coverage of relevant environmental, social and governance (ESG) issues is in its infancy.

- The development of responsible investment strategies for commodities investment requires access to multi-dimensional data sets, as ESG challenges can vary across commodities and investment vehicle structures.

- ISS ESG works with clients to evaluate the sustainability of commodities portfolios using carbon footprinting tools, country- and company-level ESG data, as well as bespoke risk scoring methodologies.

Debate on a renewed commodities ‘supercycle’ gained traction throughout 2021. While there is debate about whether we are observing the start of an enduring trend for higher commodity prices or a temporary outfall from COVD-19-related supply chain disruptions, the discussion has focused investors’ attention on the importance of direct commodity investing from a portfolio diversification perspective. By November 2021, the Bloomberg Commodity Index hit a record high, with almost all types of commodity showing solid gains.

Commodity investing raises questions for responsible investors, however. Is it possible to structure this aspect of their investment portfolio according to their ESG policies at the same time as ensuring their investments are ‘2050-ready’? Global industry body the Principles for Responsible Investment (PRI) has so far tackled commodity investing by focusing on key sectors, forming a practitioners’ group with a relevant agenda as recently as this year.

There are nevertheless a range of strategies that investors can employ to reduce ESG-related risks associated with commodity investment, and even an opportunity for positive outcomes with some commodities such as lumber and specific minerals judged to be potential enablers of a low-carbon future.

A multi-dimensional approach to commodity investing

When building portfolios incorporating commodity-based securities, it is important that responsible investors are able to identify the specific commodities involved. By their very nature commodities merit a multi-dimensional review of their ESG characteristics, as each type will have varying physical properties, production processes, supply chains, and use cases. The following elements can be considered part of a comprehensive ESG evaluation:

- Sourcing risks associated with physical origin & location;

- Supply chain related ESG risks;

- Usage in products and services; and

- Carbon foot printing over life cycle.

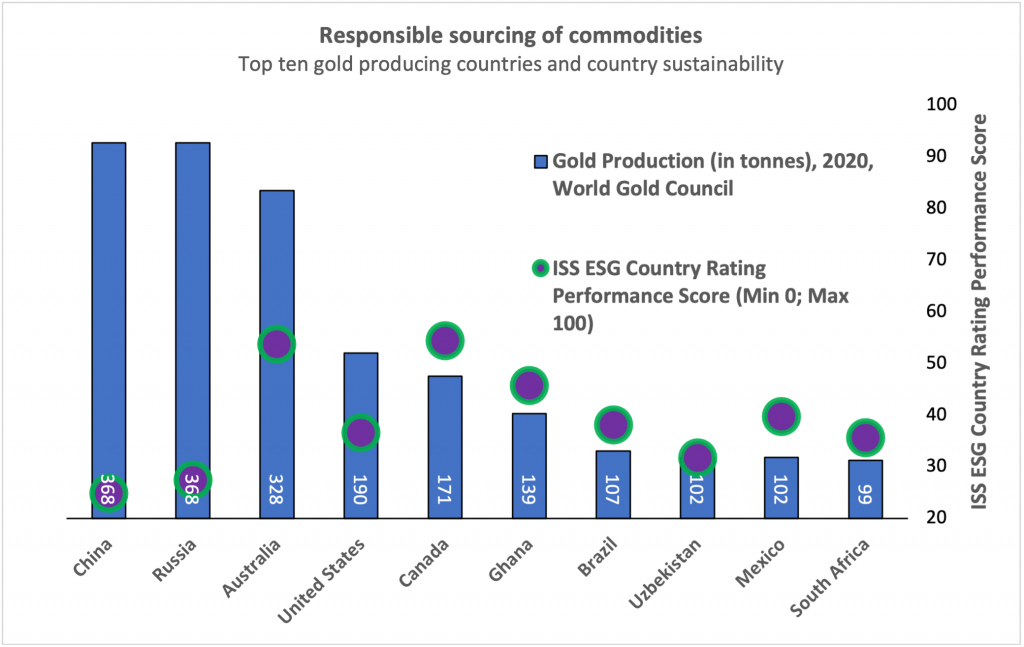

Starting with (a) above, investors should consider the risks associated with the physical sourcing of commodities. Using as gold an example, the top ten producing countries very widely in terms of their sustainability performance.

Source: ISS ESG, World Gold Council

This graphic highlights that the two major gold producing counties, China and Russia, have a relatively weak track record with regard to sustainability in general, according to the ISS ESG Country Rating. In commodity markets where the country of origin cannot be readily traced, country sustainability factors can still be used to develop aggregate results for the commodity as a whole, weighting the ESG risk profile to reflect the fact that commodities are sourced from regions with a range of ESG risks.

Location-specific risk is only the first step, however. More granular data can be accessed from a production point of view that takes into account the ESG credentials of producers of a given commodity.

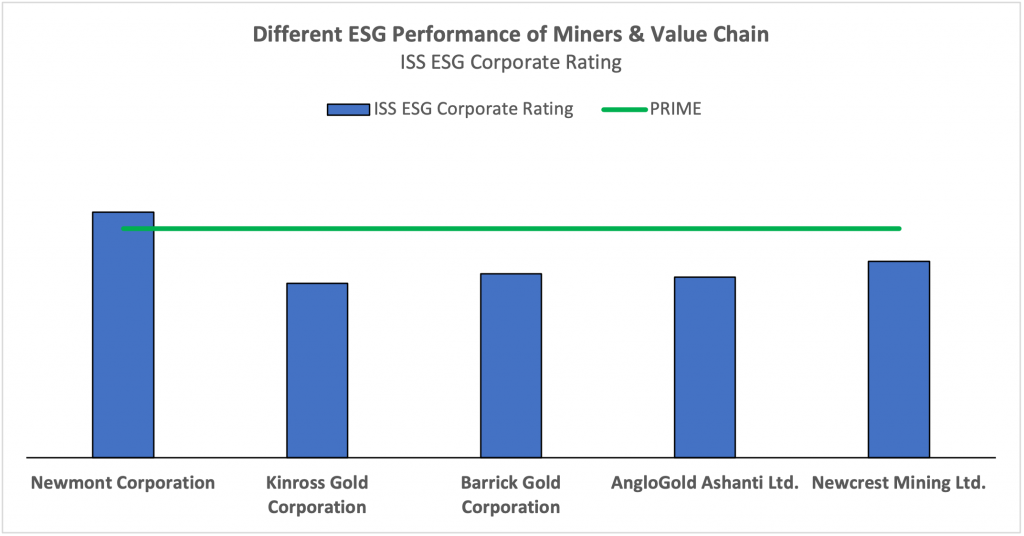

Source: ISS ESG

The above graphic illustrates the overall ESG performance of five of the largest gold producing mining companies, according to the ISS ESG Corporate Rating. There are clear differences in ESG performance even at this aggregate level, with only one large gold producer exhibiting a ‘Prime’ sustainability performance. These results can be further broken down into more granular corporate level data such as supply chain indicators, human rights risk, or environmentally sound mining and processing criteria, allowing for further differentiation between individual companies. This company performance data can also be augmented by the use of controversy data so as to determine whether a given commodity producer is in breach of global norms.

Combined with solid data on production by company, commodity-specific ESG risks can be used to derive a score informed by both location and corporate data (producers and processers).

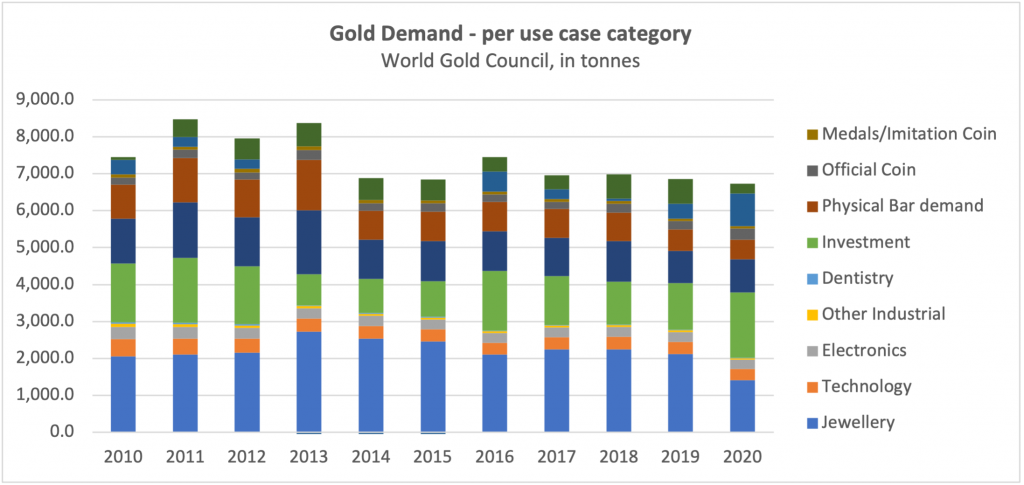

ESG risks for commodities investors are not only associated with the production phase, however. As data from the World Gold Council shows, use cases can also vary widely when it comes to determining environmental and social impacts.

Source: World Gold Council

Gold is famous as a store of value and for investment, as well as it’s refinement into jewelry. These usages are, by and large, neither positive or negative contributors to the achievement of the UN Sustainable Development Goals (SDGs). ISS ESG’s SDG Solutions Assessment allows investors to determine whether a corporate activity is in line with this globally accepted definition of sustainable development, and notes that there are some technological use cases in medicine, engineering and dentistry where gold is associated with positive impacts. And as the graphic above shows, use cases can also vary over time and as research & development produces new applications for existing materials. And as evident in the case of lithium, some positive use cases nevertheless entail challenging sourcing and supply chains.

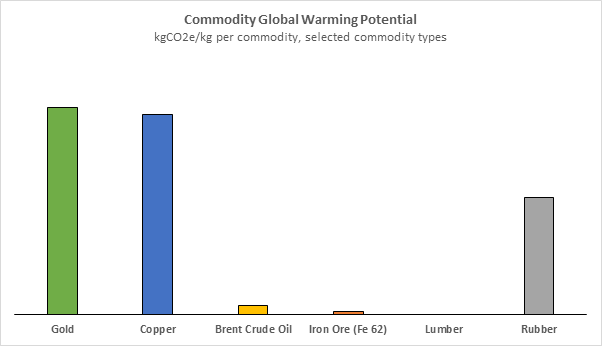

Another avenue for investigation is a commodity’s life cycle carbon inventory. Adequately factored into a model, this helps to estimate whether the all-important Net Zero targets can be reached with a given commodity portfolio, as different commodities each carry very different emissions profiles.

Source: Ecoinvent

As shown above, gold entails a relatively high carbon footprint per kilogram produced. This is due to the very energy-intensive refinement processes involved in its production. While crude oil is of course ultimately burned releasing carbon dioxide, per kilogram it entails less carbon emissions. Gold production in 2020 was just above 3,000 tonnes, however, whereas crude oil production in 2020 was 4,165 million tonnes, according to BP (approximately 24 Sydney Harbors). The idea here is not to compare commodities against each other, but to evaluate the intensity of a given commodity portfolio.

Sourcing commodities more responsibly

While each of the above strategies can help to build ESG-aligned commodity portfolios, investors are also increasingly able to invest in differentiated types of a commodity. For example, physical gold investments can made by investing in bullion that has been the subject of established ethical guidance, such as that offered by the London Bullion Market Association, or incorporated credible sustainability practices with regard to the circular economy and climate change such as those proffered by recycled carbon-free gold.

Conclusions

The evaluation of commodity related ESG risks is not yet standard practice in the market, and so it can be challenging for investors to steer multi-asset portfolios towards positive ESG outcomes. Sophisticated responsible investors are increasingly working to incorporate more of such data and metrics into their investment decisions, however.

ISS ESG’s bespoke research team is well-placed to assist investors in assessing their holdings with regard to ESG risks and opportunities in this market sector, as well as help investors to build strategies for future-proof and sustainable commodity portfolios.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Extend your ESG policies to your fixed income portfolio with the ISS ESG Country Rating and the ISS ESG Country Controversy Assessments.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By Hendrik Leue, Head of Bespoke and Advisory Research, ISS ESG