Responding to an Evolving Tobacco Industry

In recent years, the tobacco industry has been moving away from traditional tobacco products such as cigarettes and transitioning to alternative, or smokeless, products, such as e-cigarettes. “Next generation products” (NGPs), such as electronic cigarettes and vapes, largely appeal to youths because of their various flavours (e.g., cotton candy), concealable product design, and the perception of comparatively lower health risks.

Tobacco control measures are being implemented and expanded upon globally to counter these NGPs. In the second quarter of 2024, ISS ESG responded to these changes in the tobacco market by updating its tobacco methodology in the ISS ESG Corporate Rating to reflect the various social and environmental exposures of NGPs such as e-cigarettes.

In the updated methodology, a more stringent assessment approach towards responsible marketing policies, including health warning content and packaging and labelling standards, and the use of carcinogenic additives is now in place. To accurately capture the environmental impacts of e-cigs, topics and indicators were added to assess product design and material efficiency, respectively.

A new sustainable development goals assessment (SDGA) was also added to differentiate between NGPs and alternative nicotine products, such as oral nicotine pouches. While alternative nicotine products were not considered to significantly impact environmental sustainability targets, NGPs are now considered obstructions to both environmental (Preserving Marine Ecosystems, Preserving Terrestrial Ecosystems) sustainability and social (Ensuring Health) goals.

This article reviews the impact and risks of NGPs and how the updated ISS ESG methodology accounts for them.

The Growth of Next Generation Products

Historically, tobacco companies have generated strong cash flows as well as increasing revenues and consistent sales growth across different products or product groups. The industry has been moving away from traditional tobacco products such as cigarettes and transitioning to NGPs.

NGPs include electronic cigarettes (e-cigarettes or e-cigs), which can also be referred to as alternative nicotine products and vapes. E-cigs are handheld, battery-powered devices that vaporize liquids containing nicotine (e-liquids) using heated metal coils.

The tobacco industry produces flavoured vapes and concealable product designs that appeal to youths. According to WHO, approximately 37 million children aged 13-to-15 years old use tobacco products as of 2022. This age group also uses e-cigs at higher rates than adults (aged 18 or older).

Beyond public health concerns, NGP usage raises environmental issues as well. The non-profit CDC Foundation, which supports the work of the U.S. Centers for Disease Control and Prevention (CDC), estimates that nearly 11.9 million disposable e-cigs were purchased in March of 2023 in the United States: if lined up, the vapes sold and presumably thrown out annually would stretch more than 7,000 miles or 11,265 kilometres. By March 2023, disposable e-cigs accounted for 53.4% of total e-cig sales.

Investor Risks

Numerous risks could negatively impact the tobacco industry’s financial position, reducing profitability and long-term operational resilience. Tobacco control measures are globally becoming more stringent and expanding to more product groups, including NGPs.

The third goal of the United Nations Sustainable Development Goals (UN SDGs), Good Health and Well-Being, includes a target of reducing by one-third premature mortality from non-communicable (or non-transmissible) diseases (e.g., cancers) through prevention and treatment.

Under SDG 3, the World Health Organization (WHO) has developed the Framework Convention on Tobacco Control (WHO FCTC) in response to the “globalization of the tobacco epidemic.” It is a legally binding treaty that requires its signatories (i.e., Parties of the Treaty, countries or sovereign territories) to “implement effective legislative, executive, [and/or] administrative” tobacco control measures in accordance with the WHO FCTC’s objective.

The treaty’s primary objective is to “protect present and future generations from the devastating health, social, environmental and economic consequences of tobacco consumption and exposure to tobacco smoke.”

The provisions of the WHO FCTC provide guidance on the distribution, advertising, and marketing of tobacco products. Tobacco control measures include packaging and labelling regulation, product demand reduction and youth protection, and disclosure of content (i.e., ingredients).

Multiple low- and middle-income countries have strengthened tobacco control by implementing higher import/export or consumer taxes. In Europe, several countries (e.g., Germany, Hungary) prohibit or plan to prohibit various flavouring additives (e.g., menthol). Norway, Germany, and Portugal have taken a cautious approach to all novel tobacco and/or nicotine products.

As for NGPs, the WHO reports that 121 countries regulate the distribution of electronic nicotine delivery systems (ENDS), with 34 having banned sales. Also, the development of new products has led to more scrutiny of product design, content, and life cycle. The end-product cycles (e.g., disposal) would make the components and respective waste of ENDS (i.e., plastic casings, lithium batteries) subject to plastic and electronic waste regulation.

Investors should be aware of the current downward trend in tobacco use across both developed and developing markets. Currently proposed measures would greatly limit, if not prohibit, the sale of multiple product groups, the creation of new tobacco products, and the concentration of acceptable retailers/distributors and consequently the availability of products.

Overall, tobacco industry growth and revenue are expected to come under pressure from decreasing consumer demand flows, increasing costs, and limited market opportunities.

ISS ESG Methodological Developments

Measuring the Social Impacts of NGPs: Product Packaging and Labelling and Additive Use

Tobacco demand is directly and indirectly impacted by a variety of advertising and marketing practices, including product claims, youth or child protection efforts, and risk information. Product packaging, labelling, and design practices further influence attractiveness.

According to WHO FCTC Article 11, product labels should prohibit unsubstantiated health claims as well as descriptors that could misguide or misinform consumers of the health risks of a tobacco product (e.g., terms such as ‘light’ or ‘mild’). Labels should further provide information on mild, moderate, and extreme health risks as well as the risk of addiction. Providing accurate health information may be particularly relevant to e-cigs because they heat e-liquids into an inhalable vapor and therefore may be perceived as a safer method of consuming nicotine and cannabis.

To align with WHO FCTC Articles 9 and 10, marketing must not encourage a positive social image of tobacco products; promote excessive, routine, or daily use; or imply usage is related to confidence or popularity. Flavouring additives and cooling agents must be restricted, if not prohibited, to reduce the addictive potential of tobacco products and the production of “youth-friendly” flavours (e.g., cotton candy).

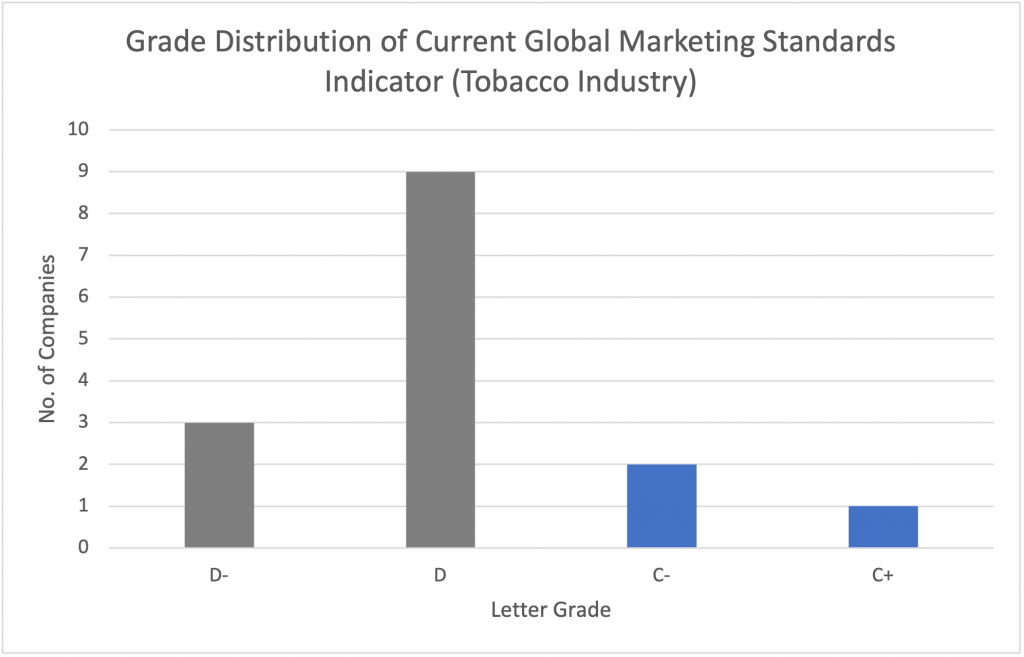

In the ISS ESG methodology, the ‘Global marketing standards’ indicator has been used in the past to evaluate product claims, sponsorship, and youth protection. Figure 1 shows the grade distribution of the current ‘Global marketing standards’ indicator.

Figure 1: Grade Distribution (within the Tobacco Industry) for the Current ‘Global Marketing Standards’ Indicator

Source: ISS ESG

Though limited to specific marketing aspects most relevant to tobacco control, the industry still largely underperforms, with the majority of companies being D- or D and only three companies being a C- or C+.

ISS ESG has recently moved beyond the ‘Global Marketing Standards’ indicator. In the future, ISS ESG will also assess companies’ marketing standards and additive usage guidelines in a more comprehensive way, to further address “next generation addiction” and align with efforts to reduce product demand and youth usage.

The Environmental Impacts of Electronic Cigarettes: Plastic, Hazardous, & E-Waste

NGPs can raise environmental concerns related to heavy metals and product degradability. All vapes include a plastic outer casing, a heating system, and a lithium-ion battery. Consequently, vapes are considered plastic waste, hazardous waste (since they contain nicotine), and electronic waste or e-waste (since they have a lithium battery).

Furthermore, lithium batteries require heavy metals, including cobalt, platinum, and gold: mining for these metals also raises environmental concerns. Further, NGPs require significant resources: the amount of lithium used in the disposable vapes sold annually in the United States is equivalent to the lithium needed to create 2,600 electric vehicle batteries.

Given the growing volume of global e-cig sales, ISS ESG has added life cycle assessments (LCAs) and the topic of material efficiency to its tobacco methodology. Companies are required to conduct LCAs that cover all relevant life cycle phases as well as aspects of production. Life cycle phases include raw material extraction, materials processing, and disposal; and production aspects include material use, the presence and content level of hazardous substances, and waste generation.

Conclusions & Moving Forward

As the tobacco industry continues to develop NGPs, the industry’s long-term profitability and operational resiliency may continue to face evolving social and environmental risks. Existing conditions indicate future market pressures that could reduce the industry’s growth in both developed and developing markets. Investors may want to consider the environmental and social risk profile of tobacco products and operations and potentially identify opportunities (e.g., regarding product development) that sufficiently address relevant risks.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By: Alex Wen, Analyst, Tobacco Industry Specialist, Consumer Sector, ISS ESG