There is a renewed appetite for global action on climate change in the wake of last week’s summit hosted by U.S. President Biden. ISS ESG will this week be focusing on some of the latest tools and ideas in the climate investment space.

By the end of 2020, the global mean temperature was 1.2°C above preindustrial levels. At current warming rates, the world will breach the symbolic 1.5°C target of the Paris Agreement in January 2034. Rising temperatures are expected to disrupt the climate system and exacerbate extreme weather and climate events such as storms, extreme precipitation, droughts, wildfires, and heat waves.

Another unavoidable consequence of this warming is the rise of the global mean sea level. This rise is currently accelerating, due to the thermal expansion of ocean waters and influx from melting polar ice caps. The gradual change in mean sea level combined with extreme sea-level events such as tides and storm surges will increasingly expose global coastlines to inundation.

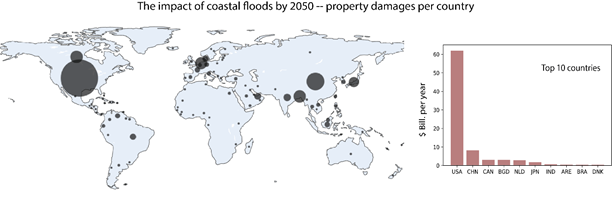

The financial impacts of coastal floods can be considerable due to the high concentration of property value along coastlines. A recent study by the World Resources Institute suggests that by 2030 the number of people affected by coastal floods will double, from 7 million to 15 million, and damage to properties will increase tenfold, from $17 Billion to $177 Billion. Countries with long coastlines (e.g., USA and China) or with large swaths of low-elevation coastal zones (Bangladesh, Netherlands) will experience the most property damages from sea-level rise (see Figure 1 above).

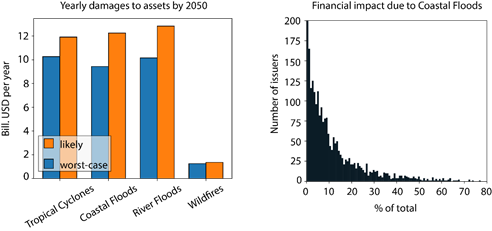

An analysis of the Solactive GBS Global Large and Midcap universe shows that, by 2050, coastal flood alone may yield a total of $12 Billion of damages to associated assets. Averaged across issuers, the impact of coastal floods contributes 10% of the total financial risk, but this figure varies widely from company to company (Figure 2).

Investors are increasingly interested in understanding the financial impact of physical risks on their portfolios. Coastal flooding is one of the hazards considered in ISS ESG’s physical risk assessment. The analysis examines a company’s future financial risks associated with exposure to extreme weather, climate, and sea-level events in a likely and worst-case emission scenario (RCP 4.5 and 8.5).

As sea level rise continues to accelerate, coastal inundation will rapidly become a major source of financial risk alongside tropical cyclones and river floods. It is thus essential for investors to consider coastal floods when performing a forward-looking physical risks analysis. Find out more about ISS ESG Climate solutions and the significant enhancements to the Climate Physical Risks and Climate Scenario Analysis.

By Simon Yang, Senior Associate, ISS ESG