The Qatari Ministry of Economy and Commerce and the Emirati (UAE) Government have both amended their Commercial Companies Laws which came into effect on September 7, 2021, and on January 2, 2022, respectively[1]. The changes in Qatar are part of the Ministry of Economy and Commerce’s plan to modernize legislation in line with international best practices, to enhance the continual development in achieving the Qatar National Vision 2030. For the UAE, the changes involve several regulatory and legal reforms in line with the government’s project “The next 50” marking the UAE’s Centennial due 2071. The reforms aim to place proactive legislative frameworks that enhance the Emirati economic and investment environment, solidify commercial structures, and drive long-term economic growth for the coming 50 years in the UAE.

These revisions impacted the 2022 proxy seasons as many Qatari and Emirati companies included ballot items seeking to amend their bylaws to comply with the amended Laws.

Qatar

Among other things, the amendments concern board independence, ownership of shares by subsidiaries and requirements to disclose and report conflicts of interest.

Harmonizing the Law with the Corporate Governance Code

The Amending Law aligns the Companies Law with the 2016 Qatar Financial Markets Authority (QFMA) Board Decision No. 5, which issued the QFMA’s Corporate Governance Code.

Concerning the board of directors of Qatari joint stock companies, the Amending Law stipulates that one-third of the board members of a joint stock company shall be independent. Additionally, the majority of those are to be non-executive members and the bylaws may allocate one or more seats to minority shareholders and one seat to the company’s employees. It also stipulates that the majority of board seats shall not be dedicated to the company’s management and that executive board members may not receive any remuneration for their work as board directors.

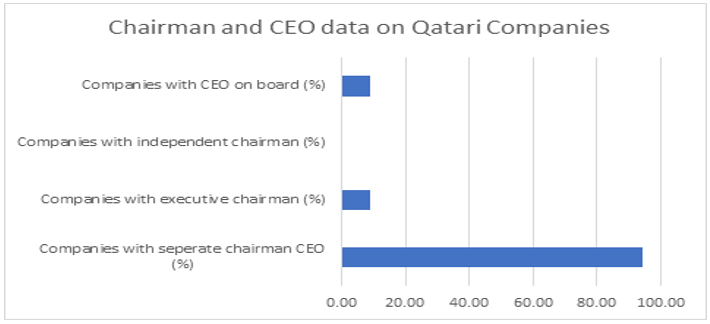

Source: ISS Governance Research & Voting

The revised law also requires that the board chair shall not hold an executive position in the company, reflecting an existing provision in the QFMA’s Corporate Governance Code. In addition, the board chair shall not be a member of any of the board committees, as specified in the Corporate Governance Code.

Source: ISS Governance Research & Voting

Rules addressing potential conflicts of interests

The Amending Law allows board chairs, other board members and senior executives to participate in competitive business activities, only if approved by the general meeting. Additionally, they are required to disclose any direct or indirect interest in transactions performed for the company. Approval by the general meeting is required if the transactions represent 10 percent or more of either the company’s market value or the value of its net assets, determined by whichever is less.

Non-executive director remuneration

According to the Amending Law, board members may receive remuneration if the company does not generate any profits, however, this must be stipulated in the company’s bylaws, and prior approval from the general meeting must be obtained. The Ministry may issue a decision setting a limit for such remuneration.

General Meetings

Invitations to general meetings of joint stock companies must be sent to shareholders at least 21 days before the meeting instead of the prior requirement of at least 15 days. Additionally, companies are no longer required to publish their meeting invitation in two daily newspapers, instead invitations must be published on the Qatar Stock Exchange’s website and the company’s website, and either be sent to shareholders by any method that confirms their acknowledgement of the shareholder meeting or published in a daily newspaper.

Under the Amending Law, shareholders may attend and vote in general meetings virtually, with rules issued by the Ministry regulating electronic attendance and voting.

Furthermore, shareholders may request to add items in the general meeting’s agenda if they hold at least 5 percent of the capital instead of the prior requirement of holding at least 10 percent of the capital. The board must include these agenda items, otherwise the proponent shall have the right to bring the matter to the floor of the General Meeting.

Subsidiaries of joint stock companies

The Amending Law states that subsidiaries of a joint stock company may not own any shares in that joint stock company.

United Arab Emirates (UAE)

The new 2021 Companies Law incorporated most of the amendments introduced by the 2020 Federal Decree-Law No. 26 to the previous 2015 Companies Law[2]. The amendments presented new provisions regarding nominal values of public company shares, issuance of shares at discounts, board remuneration, introduction of corporate vehicles, and a range of other issues.

Non-executive director remuneration

Under previously law, if the company generates profits, a maximum of 10 percent of net profits may be allocated towards total board members’ remuneration. According to Article 101 of the New Companies Law, however, if the company incurs losses or generates marginal profits where 10 percent of net profits allocated towards total board remuneration pushes individual director pay below the AED 200,000 mark, each board member may instead be paid fees not exceeding AED 200,000 at the end of the fiscal year. In the latter case, the profit-based remuneration and the flat director fees (of up to AED 200,000) may not be combined. Such framework should be reflected in the company’s bylaws and the payment of the fees in these cases is subject to shareholder approval.

Founders’ subscription to shares in a public-joint company

The new Companies Law abolished the previous 30 percent minimum and 70 percent maximum requirement for the founders’ contribution in the capital of the company before opening the initial public offering (IPO). Instead, the founders’ stake in the company’s capital shall be set as stated in the prospectus of the IPO and be subject to the requirements of the Securities and Commodities Authority (SCA). Additionally, founders may subscribe for any unsubscribed shares by the end of the subscription period under the regulations to be set by the relevant authorities. Pursuant to the previous law, the founders’ subscription was capped at 70 percent of the share capital and in the case that any unsubscribed shares remained at the end of the subscription period, the incorporation would have been revoked.

Shares nominal value

For public companies, the determination of the nominal value of their shares is no longer restricted by law stipulating a minimum of AED 1 and a maximum of AED 100. Instead, companies shall fix the face value of their shares in their articles of association.

Issuance of shares at discount

Additionally, companies can now issue shares at a discount when the market value of the share falls below its nominal value, following guidance that was not stated in the previous law. Companies are then allowed to create a negative reserve in the companies’ accounts, which is to be compensated by future profits before making any distributions of profits.

Introduction of SPACs and SPVs

The new law introduced new forms of corporate vehicles, including Special Purpose Vehicles (SPVs) and Special Purpose Acquisition Companies (SPACs) for the purposes of acquisition and merger. The SPACs are established for the sole purpose of acquisition and merger operation, subject to the regulations as set in the resolution issued in January 2022 by the SCA.

Recent and upcoming changes by the Emirati Securities and Commodities Authority (SCA)

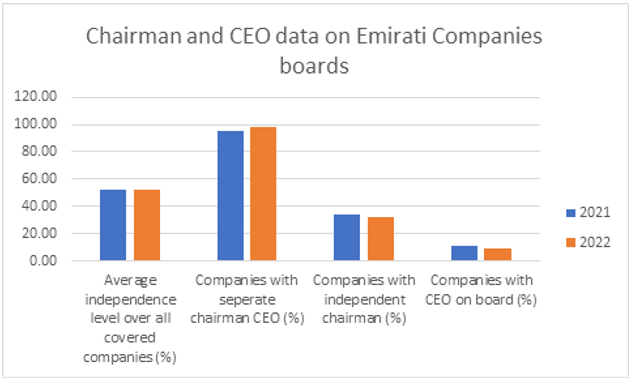

In 2022, following the publication of the new Companies Law in September 2021, the Emirati Securities and Commodities Authority (SCA) issued a decision No. 6/R.M amending two articles of the 2020 governance guide. The revisions address board independence and the appointment of shareholder representatives by public companies.

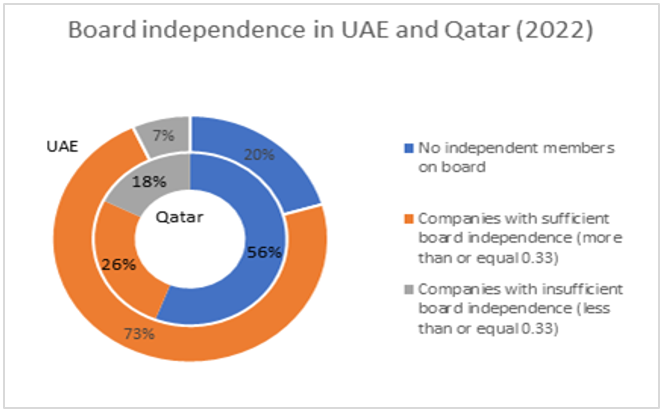

Board Independence

In February 2022, the required minimum threshold for board independence in public companies was reduced to one-third through an SCA decision with no rationale provided. This amendment reversed the previous increase from one third to a majority of board independence that had been introduced by the 2020 corporate governance.

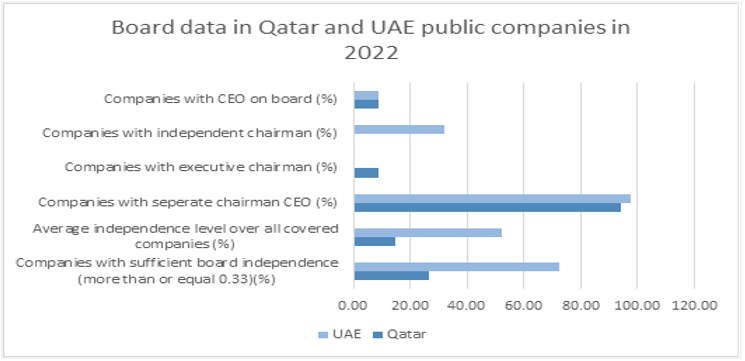

Source: ISS Governance Research & Voting

Appointment of shareholder representatives

Per the recent decision of the SCA to amend the governance guide (decision No. 6/R.M), companies are no longer obliged to appoint representatives whose fees are paid by the company (such as law firms or financial analysts) to attend general meetings and vote on the decisions on behalf of shareholders. Shareholders may still delegate a third party to attend and vote on their behalf at the company’s general meeting by way of a power of attorney with a signature approved by either the notary public; commercial chamber of economic department in the State; any bank or licensed company in the state (where the shareholder holds an account; or any other licensed entity to perform attestation works as provided by the 2020 governance guide.

Source: ISS Governance Research & Voting

Gender diversity

In March 2021, for the first time, the SCA made it mandatory for public companies to have at least one woman on their board of directors, and the governance guide was amended accordingly. In the past, the governance guide had stipulated a minimum of 20 percent female representation on company boards. However, this was following a comply or explain approach, and many companies would simply disclose reasons justifying why they had not achieved this percentage in their annual corporate governance reports. The mandatory rule seeks to address this issue.

Upcoming changes to the 2020 governance guide

In June 2022, the SCA announced the opening of a comment period on a draft decision modifying the governance guide for public-joint companies. The SCA invited relevant parties to review the published draft, available on the SCA’s website, and provide input/comments on the proposed amendments by mail. According to the press release, the proposed decision to amend the governance guide is part of the authority’s efforts to improve the governance of joint-stock companies in line with the best international standards and practices and to ensure the protection of the rights of stakeholders. The draft version published on the website is identified as preliminary, with provisions that may be amended upon finalization.

Notes:

[1] Emirati companies are required to comply with the provisions of the new law by Jan. 2, 2023, unless postponed by a decision of the government. No similar information is available for Qatari companies.

[2] and its subsequent amendments notably the most recent Federal Decree-Law No. 26 of 2020 issued by the Emirati government in November 2020 amending several provisions of the 2015 Commercial Companies Law

By: Nada Bushnak, Associate, ISS Governance

May Hosny, Senior Associate, ISS Governance