KEY TAKEAWAYS

- Investors in unlisted real estate need to apply a custom approach to environmental, social and governance (ESG) performance.

- Incorporating the best elements of multiple global frameworks is the key to ensuring a holistic ESG approach.

- The influence of unlisted real estate on the UN-backed Sustainable Development Goals (SDGs) is an integral factor when evaluating the sector’s ESG performance.

- The ISS ESG Real Estate Sustainability Evaluation Tool (RESET) can assist investors in evaluating real estate’s ESG performance and SDG influence.

ESG for Alternative Assets

Over the past few years, investors have witnessed dramatically increased activity within real estate, construction, infrastructure (RCI) and relevant industries. Such activity is expected to continue for most parts of the sector. The Chartered Alternative Investment Analyst (CAIA) Association reports that demand for alternative strategies has never been stronger. ISS ESG’s Industry Focus report provides an overview of the real estate market and discusses how the current economic environment is expected to impact the sector as a whole.

A recent surge in interest in ESG investment has accompanied this increased RCI activity. The Global Sustainable Investment Association reports that ESG assets surpassed $35 trillion in 2020, up from $30.6 trillion in 2018 and $22.8 trillion in 2016, reaching a third of current total global assets under management. Assuming 15% growth, which would be half the pace of the past five years, ESG assets could exceed $50 trillion by 2025.

Investors approaching this rapidly expanding world of ESG assets might wish to consider factors such as the physical nature of these assets; the performance of the company managing them; the conditions of the workforce involved in their upkeep; and the supply chain stakeholders involved.

Investors in listed real estate assets have access to an array of different services and data sources to assist them in applying sustainability factors to their portfolios. Investors in unlisted real estate face a more challenging task: they have to navigate overlapping and sometimes conflicting industry, regulatory, and consumer interests as they review potential assets on a case-by-case basis.

ISS ESG assists investors in their approach to unlisted real estate and ESG assets by grouping sustainability-focused investors according to four broad typologies and providing background and case studies for the key issues each will have to face. Related ESG investment strategies may also benefit from a single-use platform that can help stakeholders navigate the ESG performance of a real asset portfolio. For this purpose, ISS ESG provides the Real Estate Sustainability Evaluation Tool (RESET), which supports investors in navigating relevant standards and assessing unlisted real estate’s ESG performance.

ESG Risks Within the RCI Sector

Certain activities within the RCI industry have traditionally been associated with poor ESG performance. Climate change mitigation is a significant environmental challenge for the industry, given physical assets’ high share of contributions to global greenhouse gas (GHG) emissions. Another environmental concern is biodiversity loss resulting from RCI industry activities. For example, the loss of wetlands in the United States’ Mississippi River watershed, combined with high nutrient loads from intensive agriculture, has helped create a low-oxygen “dead zone” that cannot support animal life. At mid-summer, this dead zone extends about 16,000 square kilometers into the Gulf of Mexico.

Rapid economic growth, urbanization, and a growing population have increased resource consumption and consequently the release of waste into the environment. Less than 20% of global waste is recycled each year and rich countries often export recyclables to poorer nations. An estimated 92 million metric tons of textile waste is generated annually worldwide.

Other ESG concerns that arise when looking at the RCI sector include:

- Pollution, and associated negative impacts on human health;

- Business malpractice (including bribery & corruption); and

- Other unethical conduct that directly impacts social well-being.

Bringing ESG Compliance under One Umbrella

Addressing all these risks requires the establishment of clearly defined benchmarks for sustainability and other aspects of ESG performance in the RCI sector.

RCI-sector investments are currently expected to follow one or more of multiple sets of standards to demonstrate portfolio adherence to industry-appropriate sustainability performance. These standards include the:

- Global Real Estate Sustainability Benchmark (GRESB);

- EU taxonomy;

- Global Impact Investing Network (GIIN);

- UN-backed Sustainable Development Goals (SDGs);

- Global Reporting Initiative (GRI);

- Principles for Responsible Investment (PRI); and the

- EU’s Sustainable Finance Disclosure Regulation (SFDR).

Relevant green building frameworks are frequently regionally focussed – significant global examples include:

- Building Research Establishment Environmental Assessment Method (BREEAM);

- Leadership in Environmental and Energy Design (LEED);

- Energy Star;

- National Australian Built Environment Rating System (NABERS);

- WELL Building;

- Comprehensive Assessment System for Built Environment Efficiency (CASBEE); and

- DGNB – the abbreviation for the German Sustainable Building Council.

Standards such as the EU taxonomy and SFDR were developed to mitigate climate risks in the first instance. Green building certification standards such as BREEAM and LEED help investors evaluate their assets’ performance on relevant project-critical indicators such as water, energy, materials, air quality, and innovation. Organizations such as the GIIN and the PRI have helped build common language and principles for sustainable investments and impact investing. A single platform that brings all material aspects of ESG compliance together under one umbrella is lacking, however.

Introducing the Real Estate Sustainability Evaluation Tool (RESET)

Multiple frameworks can result in investors being highly cautious about adopting ESG approaches. The ISS ESG Alternative Research Team has addressed this situation by building a methodology that allows direct investors in real estate to manage their sustainability obligations, in keeping with 14 compliance bodies that define sustainable real estate for financial institutions.

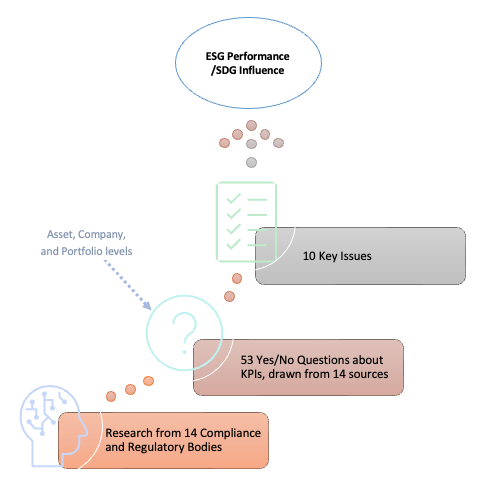

The ISS ESG Real Estate Sustainability Evaluation Tool (RESET) is an easy-to-use instrument providing outputs relevant to ESG performance, SDG influence, GRESB mapping, and more. It covers close to 120 material topics, organized under 53 specific indicators and 10 key issues (Figure 1).

Figure 1: RESET Flowchart

Source: ISS ESG Data

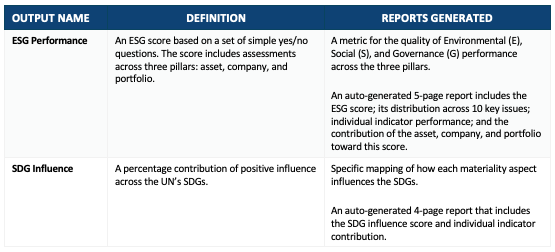

RESET also allows for customization by organizational needs. Institutions can re-organize the 53 indicators to include only those relevant to their specific investment/s. Table 1 sets out the key outputs from this process.

Table 1: RESET ESG Performance Outputs

Source: ISS ESG Data

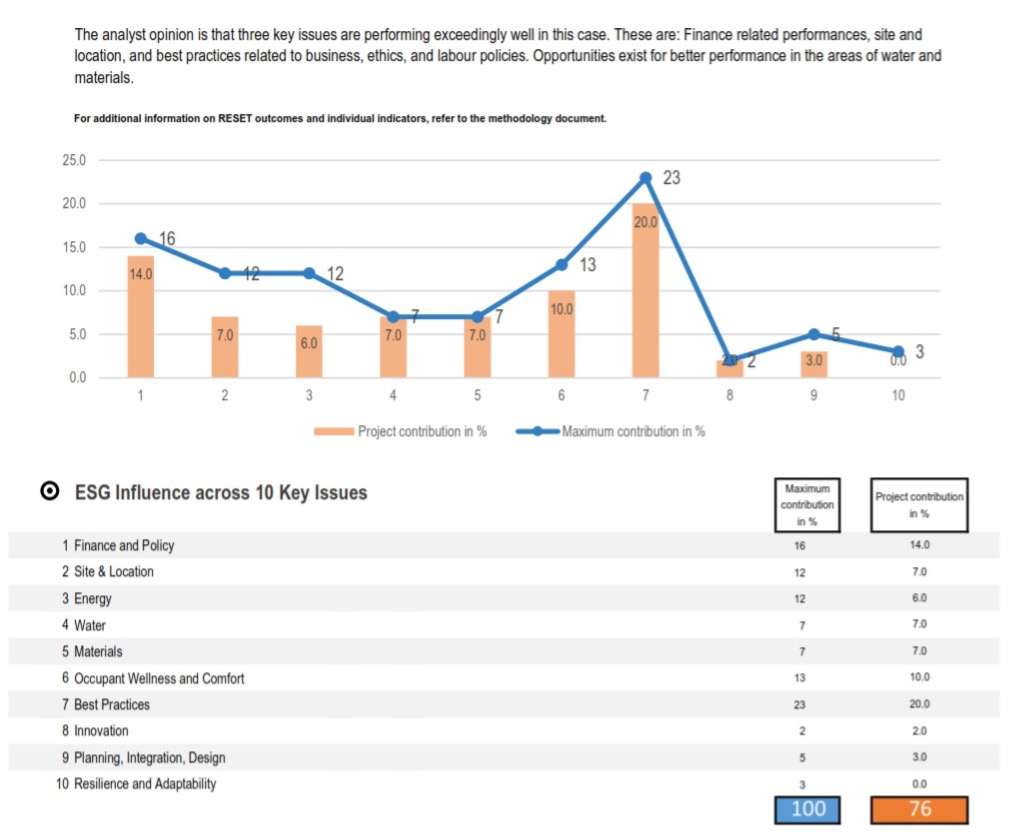

Figure 2 shows a sample ESG Performance report auto-generated through the RESET tool.

Figure 2: RESET ESG Performance Output Sample

Source: ISS ESG Data

Figure 3 shows a sample SDG Influence report auto-generated through the RESET tool.

Figure 3: RESET SDG Influence Output Sample

Source: ISS ESG Data

Use Cases

RESET can be used for the following purposes, depending on investors’ needs:

- Direct Real Estate: Applying ESG assessments specifically to financial products and mitigating companies’ sustainability risks during due diligence processes.

- Alternative Assets: Creating a baseline for implementing an ESG strategy across portfolio companies to guide and strengthen their sustainability efforts.

- Reporting: Collecting data and documentation for global compliance and sustainability benchmarks.

- Risk Assessment: Evaluating ESG risks of all real estate income types during the credit risk assessment process.

- ESG Alignment for All Real Estate Financial Functions: Any other real estate function; RESET allows for customizations without affecting methodology or output.

Conclusion

The RCI sector has seen significant advancement in the development of regulatory bodies that strive to build defined ESG assessment frameworks, but the financial materiality aspects of such assessments are currently under-explored and under-represented.

The public market contains multiple solutions for ESG materiality assessment. The private market lacks a systematic approach to materiality assessment, however. A single system that allows for wide coverage of all use cases could be useful to investors.

The ISS ESG RESET tool meets this current market need through a wide breadth of research conducted across the market. RESET is versatile and offers a deep understanding of ESG alignment for RCI sector portfolios. RESET also has the potential to tap into the strengths of currently available technologies: AI, blockchain, and open data systems are some tools that can support RESET with robust data management.

To explore how RESET can help assess your portfolio, reach out to the Alternative Research Team at ISS ESG: alternative-research@iss-esg.com.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- ISS ESG’s Biodiversity Impact Assessment Tool helps investors assess the impact of companies’ business and supply chain activities on biodiversity.

By: Namrata Doshi, Head of Alternative Research, ISS ESG