Introduction

Global ESG regulation is experiencing a meteoric rise, and policymakers are seeking to crack down on “green washing,” as examined in Part 1 of this Thought Leadership series. Amid this growing yet fragmented global regulatory environment, ISS ESG has responded to client demand by developing a suite of market-leading solutions designed to assist financial market participants navigate the fast-moving and divergent requirements of global Environmental, Social and Governance (ESG) and sustainable finance regulation.

RSI Solution Mapped to Global Regulation

ISS ESG launched its Regulatory Sustainable Investment (RSI) solution earlier this year. The RSI solution covers four common pillars within ESG sustainable finance:

- Financially material ESG risks;

- Contribution to environmental or social objectives;

- Broad adverse sustainability impacts and do no significant harm (DNSH) within a sustainable finance context; and

- Good governance.

The solution is designed to give clients a flexible approach to implementing a data-driven sustainable investment strategy, as well as the ability to use the tool to assist with ESG-related regulatory reporting across the globe. Clients can look at an issuer holistically or take a more granular activity- or revenue-based assessment.

The solution provides the ability to choose which broad DNSH or adverse impacts are most applicable to a client’s investment strategy. Clients also can either take a norms-based approach looking at issuers’ involvement in and remediation of relevant controversies, a more forward-looking policies-based approach considering issuers’ policies on various topics, or a combination of the two.

The first offering of its kind in the market, the RSI solution has several use cases to assist financial market participants with the multiple regulatory challenges they face.

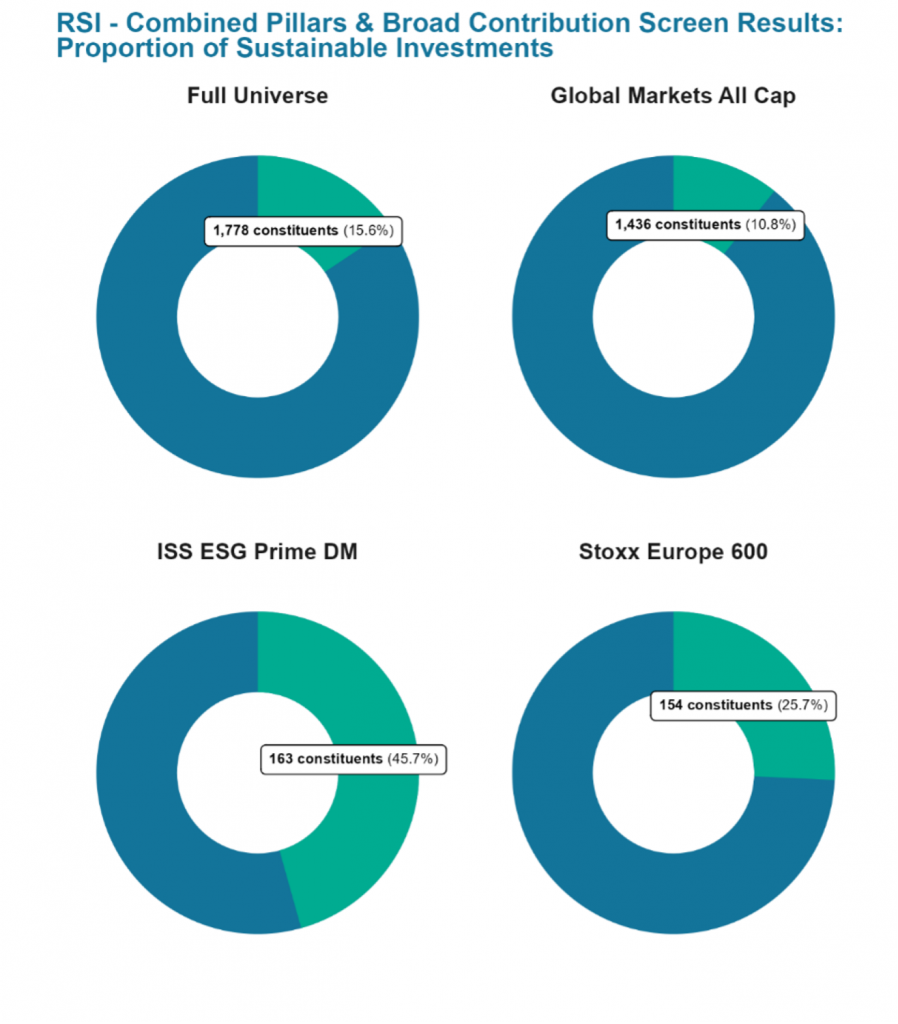

First, the RSI solution helps address a key regulatory requirement in various regions: to define and quantify the volume of sustainable investments within a portfolio, and address the associated reporting requirements.

Source: ISS ESG

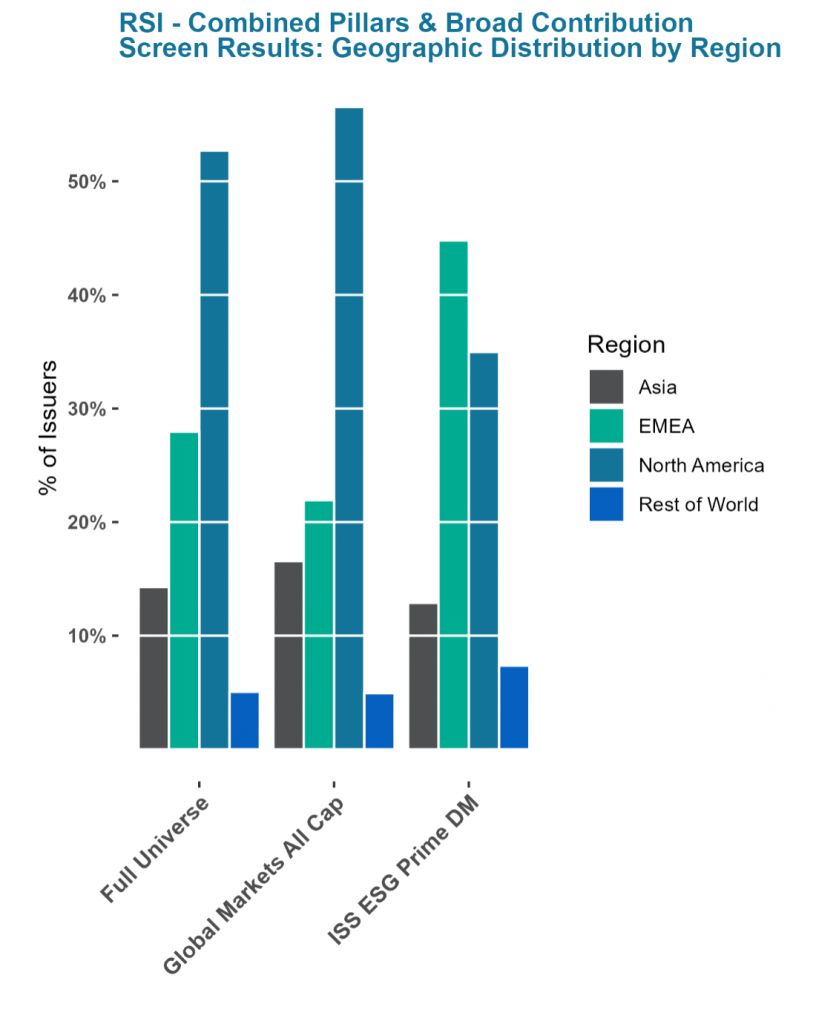

Second, the RSI solution can help clients optimize reporting and disclosure requirements across various global markets, including in North America, EMEA, Asia and the rest of the world.

Source: ISS ESG

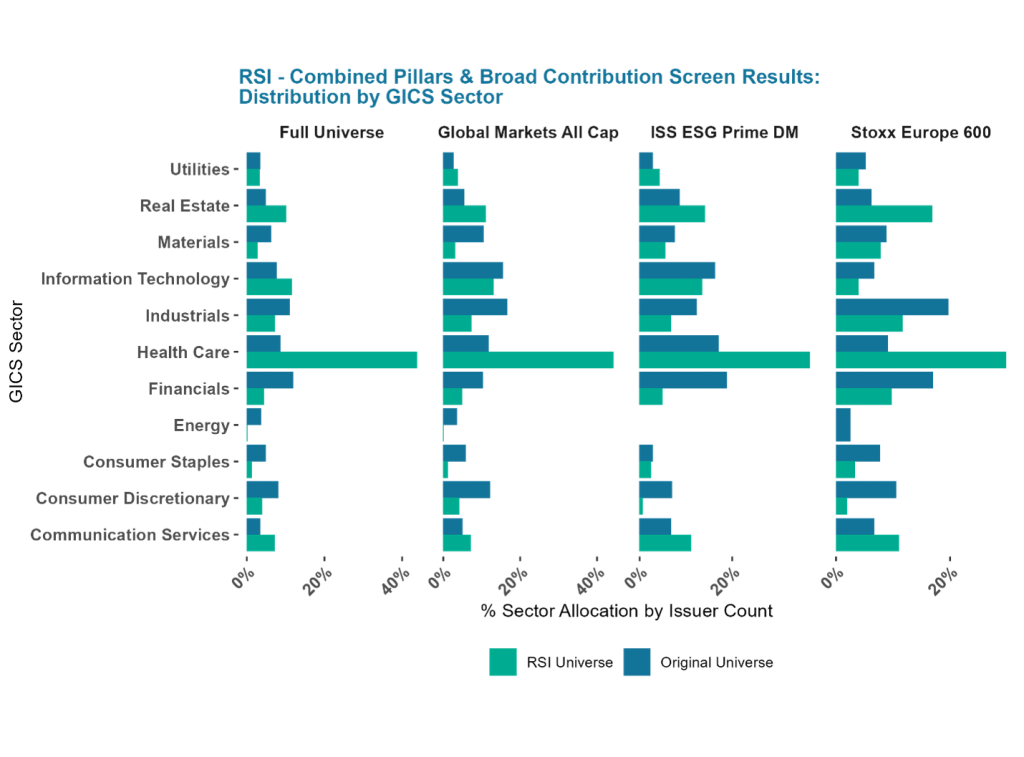

Finally, the RSI solution is useful for clients looking to develop and enhance their sustainable investment strategy, as well as those launching new products, including ETFs and indices.

Source: ISS ESG

Clients engage with the solution through a combination of issuer-level data, preset implementation options to screen portfolios and the ability to customize or create their own from scratch, and our interactive portfolio management tool – Policy Profile view. The solution has already been successfully used, alongside our EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR) products, to support the Article 2(17) requirements within regulatory submission documents to the relevant authorities in pursuance of the launch of an Article 8 UCITS fund. Together, the EU Taxonomy, SFDR, and recently launched RSI solutions provide support across the key regulatory areas affecting our clients in Europe.

Stewardship & Engagement

As active ownership strategies are increasingly scrutinised by regulators, ISS ESG continues to enhance its Collaborative Engagement Services. These services support investors in fulfilling their fiduciary duty to protect their assets and meeting their stewardship requirements, while also building momentum to amplify positive impact and report on their active ownership activities and outcomes.

ISS ESG’s Norm-Based Engagement Solution has supported investors with their active ownership activities for more than 10 years, facilitating dialogue with issuers on around 1,000 different ESG topics across a range of Sustainable Development Goals, based on involvement in controversies. Investors are also provided with opportunities, through the Thematic Engagement Solution launched earlier this year, to add a more proactive approach to their stewardship strategy by engaging companies on material sustainability themes, including Net Zero, Biodiversity, Water, Gender Equality, the Circular Economy, and Modern Slavery.

ISS ESG has prioritised ESG themes that are thematically aligned with key mandatory Principal Adverse Impact indicators within the SFDR, and that support investors with regular, detailed, and outcomes-based reporting. In addition to the Pooled Engagement tool that provides real-time information on controversy-based engagements, clients also benefit from quarterly and annual reports containing both analysis and comprehensive data across a range of key metrics.

Conclusion

With the increased adoption of sustainable finance and ESG regulation globally, as well as the obvious fragmentation and divergence among many of these regimes, we are seeing confusion and concern arising among clients, partners, and key stakeholders. One common characteristic of these regimes, however, is that most if not all of them are at least somewhat ‘principles’ based. Affected financial market participants must thus engage in a certain amount of interpretation, which of course brings with it significant levels of subjectivity. This situation creates an opportunity, a challenge, and a threat to the status quo (depending on your current position!).

Given this situation, the ‘toolkit’-style RSI solution has received a very warm reception. The solution’s customization and flexibility characteristics, alongside the option to leverage a one-click implementation option, means that RSI has broad applicability regardless of users’ levels of ESG adoption and integration. RSI has been designed with global regulation in mind, which with the global nature of markets and most investment strategies makes it very attractive. Last, there is an immediate and urgent use case in the form of SFDR Art 2 (17). In the coming Part 3 of our Regulatory Solutions content series, we will look at this specific use case in more detail.

Explore ISS ESG solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

By: Thomas Harding, Head of Regulatory Solutions, ISS ESG. William Cowper, ESG Product Manager, ISS ESG. Anna Warberg, Head of Stewardship & Engagement, ISS ESG.