Below is an excerpt from ISS ESG’s recently released paper “Russia Sanctions: How Far Will They Go?”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- The Russian invasion of Ukraine has pushed the EU, US, UK, and other countries to impose new, far-reaching sanctions measures targeting the Russian Government, the Central Bank, state-owned entities, Russian oligarchs, and the Russian financial and banking system.

- This has led intitutional investors such as government pension funds in Europe and state pension funds in the US to divest their Russia exposures.

While they have negatively impacted the Russian economy, the sanctions measures’ long-term effects remain to be seen. The imposition of additional sanctions measures could destabilize international energy and financial markets.

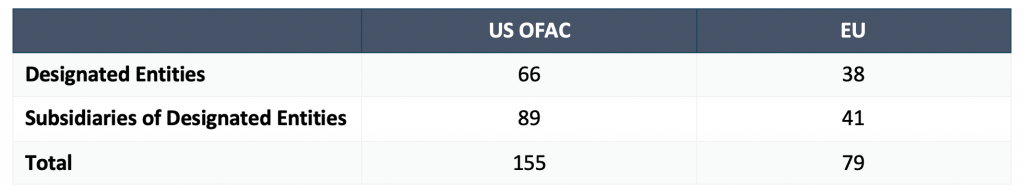

The following table presents a breakdown of the entities that ISS ESG has flagged under the Russia and Ukraine sanctions programs of the US Office of Foreign Assets Control (OFAC) and the EU:

Explore ISS ESG solutions mentioned in this report:

- ISS ESG’s Sanctions and Sovereign Solutions can help investors manage risks associated with evolving sanctions related to the Russia-Ukraine conflict.

By Stefanie Julia Aquino, Analyst, ESG Research. Lady Anne Marie Espinosa, Analyst, ESG Research. Rainier Quilao, Associate Vice President, ESG Research.