After a long wait, on August 25 the Securities and Exchange Commission (the “SEC” or the “Commission”) voted 3:2 to issue final rules implementing another mandate of the 2010 Dodd-Frank Act, which directed the agency to improve disclosure on the relationship between executive pay and financial performance. The SEC first proposed rules in early 2015 under then-Chair Mary Jo White, but the proposals languished for some time until the agency reopened the comment period in January 2022 under now-Chair Gary Gensler, and asked for comments on a meaningfully expanded version of the 2015 proposal.

The final rules apply to all companies, except emerging growth companies, registered investment companies, and foreign private issuers. Smaller companies are subject to scaled disclosure requirements and are permitted to provide only the last three years of compensation and performance. The rules become effective 30 days after publication in the Federal Register and companies must begin to comply with the new disclosure requirements in proxy and information statements for fiscal years ending on or after December 16, 2022, covering a period of up to five years.

Pay Figures

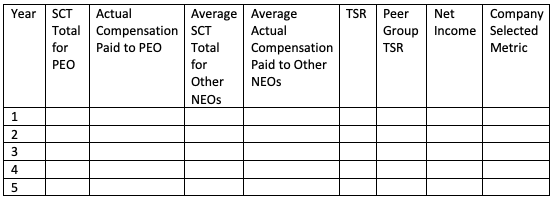

Companies will be required to provide a table – a template is given below – that will include the compensation of the principal executive officer (PEO), typically the CEO, and an average for the other named executive officers (NEOs). The compensation disclosures will take two forms: the Summary Compensation Table (SCT) total compensation figure and another figure showing “executive compensation actually paid.” The calculation mandated by the SEC to arrive at the “actually paid” compensation is complex, requiring revaluation of awards granted in the specified year as well as recording the change in value of unvested awards granted in prior year, among other adjustments, instead of simply recording profits on options exercised and vested value of other stock awards. The latter approach is typically referred to as “realized pay.”

In rejecting its initial emphasis on “realized pay,” however, the Commission has opted for what is often referred to as “realizable pay.” With this move, the Commission is seeking to allow investors to understand how any “gains” in the value of already awarded compensation correlate with actual company performance. This change addresses many of the criticisms made by pay experts that a five-year time performance period does not reflect typical vesting periods for performance stock, while at the same time providing investors with performance figures over a longer time period, one of their concerns.

While repetition of the SCT figure in the table seems duplicative, several commenters noted that it would help investors understand the difference between the two figures when evaluating a company’s compensation decisions.

Performance Metrics

The following financial performance measurements are required to be included in the table:

- The company’s total shareholder return (TSR);

- The TSR for the company’s peer group;

- The company’s net income; and

- A “company-selected measure,” which is a financial performance measure that the company believes represents the “most important” performance measure the company uses to “link compensation actually paid to the registrant’s NEOs to company performance for the most recently completed fiscal year.” See also below.

New Item 402(v) also will require companies to provide a clear description of the relationships between each of the financial performance measures included in the table and the executive compensation actually paid to a company PEO and, on average, to the other NEOs over the company’s five most recently completed fiscal years. Companies will also be required to include a description of the relationship between their TSR and their peer group TSR.

In addition, in-scope companies will be required to provide a list of three to seven financial performance measures that the company determines are its most important measures (using the same approach as taken for the company-selected measure). The final rules also allow companies to include nonfinancial performance measures including ESG metrics in a list of their three to seven “most important” metrics, but companies must disclose at least three (or fewer, if fewer financial metrics are used) “most important” financial performance measures.

Companies will be required to use Inline XBRL to tag their pay versus performance disclosure.

Template Table

Source: SEC

Commission’s Diverging Views and Agenda

Commenting on the rules, SEC Chair Gary Gensler said: “The Commission has long recognized the value to investors of information on executive compensation. Today’s rule makes it easier for shareholders to assess a public company’s decision-making with respect to its executive compensation policies.”

Commissioners Hester Peirce and Mark Uyeda dissented from the rule, the latter on largely administrative grounds and the former objected to the overly complex and prescriptive approach. Com. Peirce warned, “While not providing meaningful benefits, the Commission’s rulemaking will be costly for public companies and their shareholders…. this rulemaking could distort how public companies compensate executives and how investors evaluate companies’ compensation decisions.”

In stark contrast, Com. Caroline Crenshaw described the final rules as providing investors with “information about how corporate executives are paid. That is, quite simply, it.” Com. Jaime Lizárraga stated that the final rules, combined with other Dodd-Frank financial stability provisions, will “reduce the likelihood of future taxpayer bailouts.”

The SEC may fulfill yet another related Dodd-Frank mandate should it finalize its recently proposed changes to the executive compensation clawback rules. Also on the SEC’s agenda is a proposed rule – now in Final Rule stage – that would require institutional investment managers subject to section 13(f) of the Exchange Act to report how they voted on any shareholder vote on executive compensation or golden parachutes.

By: Paul Hodgson, Senior Editor, ISS Corporate Solutions