Below is an excerpt from ISS-Corporate’s recently released article “Shareholder Proposals on Nature: Resurgence and New Frameworks”. The full article is available on the ISS-Corporate online library.

Corporate impacts and dependencies related to nature have garnered considerable attention in recent years, with growing interest also reflected in shareholder proposal campaigns focused on nature-related issues. The landmark 2022 COP 15 summit that established the Kunming-Montreal Global Biodiversity Framework, the launch of the Taskforce on Nature-related Financial Disclosures (TNFD) in 2021, and the inclusion of Biodiversity and Ecosystems as key reporting standard under the European Sustainability Reporting Standards (ESRS) per the EU Corporate Sustainability Reporting Directive (CSRD) are among the key drivers for the reframing of the discussion around nature and renewed interest in environmental impacts and relevant disclosures.

With the 16th Conference of the Parties to the Convention on Biological Diversity (COP 16) currently underway, ISS-Corporate reviewed nature-themed shareholder proposals during the past decade to identify key trends and developments related to nature in corporate shareholder engagements.

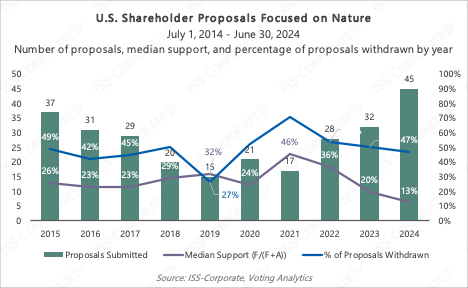

Resurgence in Nature-Related Shareholder Proposal Volume, High Rate of Withdrawals, but Lower Support

Proposals focusing on environmental impacts have long held a meaningful position on the agenda in shareholder engagements dealing with sustainability risks. Until recently, as climate change-related proposals dominated the conversation, the volume of other environmental proposals subsided. However, the past three years have seen a resurgence on nature-related shareholder proposals, with a record number of 45 submitted requests at U.S. companies in the twelve months leading to June 30, 2024. Support levels peaked in 2021, with voted proposals reaching a median level of support of 46% of votes cast. In the same year, 71% of submitted proposals were withdrawn by proponents, indicating successful engagements and likely commitments by companies to improve disclosures or practices.

While volumes have risen in recent years, support levels have dropped significantly, with median support among voted proposals standing at 13% of votes cast in 2024, primarily due to companies already substantially addressing the proponents’ requests. However, nature-related proposals continue to gain traction off the ballot, as withdrawal rates remain high, with 47% of proposals withdrawn in 2024.

By: Donald F. Grunewald, Director of Litigation Analysis, ISS SCAS