The transition to a Net Zero economy will struggle if the underlying system of linear extraction is not transformed into a circular one. This is the conclusion of a report by the Ellen MacArthur Foundation (EMF), a key authority on the circular economy. Nevertheless, the circular economy and related metrics do not seem to play a role in many climate investment strategies.

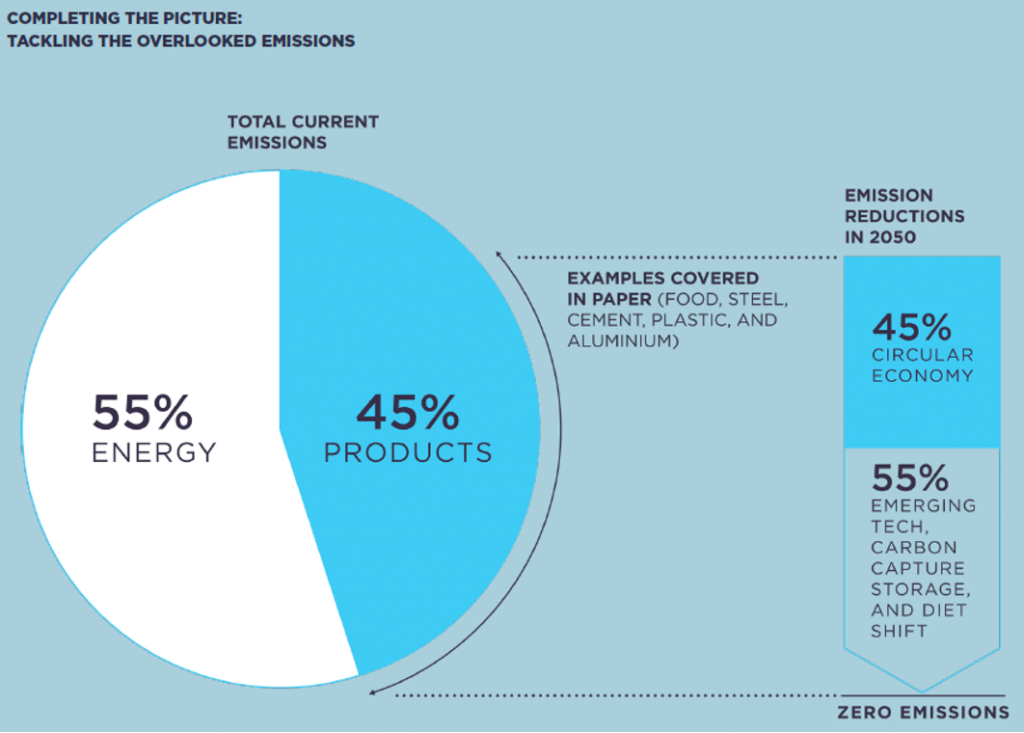

Avoiding the use of non-renewable resources is a key principle of a circular economy. According to EMF, almost half of the total reductions in greenhouse gas (GHG) emissions needed to limit global warming to 1.5°C above pre-industrial levels will have to be achieved by adopting a circular economy.

Source: Ellen MacArthur Foundation, Completing the Picture, p.10

The foundation makes the case that responses to tackle the climate crisis have focused on the transition to renewable energy and energy efficiency, at the expense of discussions around circular economy strategies. Although the concept of a circular economy has attracted more interest recently, with circular economy-themed investment opportunities on the rise, the link to fighting climate change has yet to be promoted.

The Circular Economy: Potential for Emissions Reductions in the Food Industry

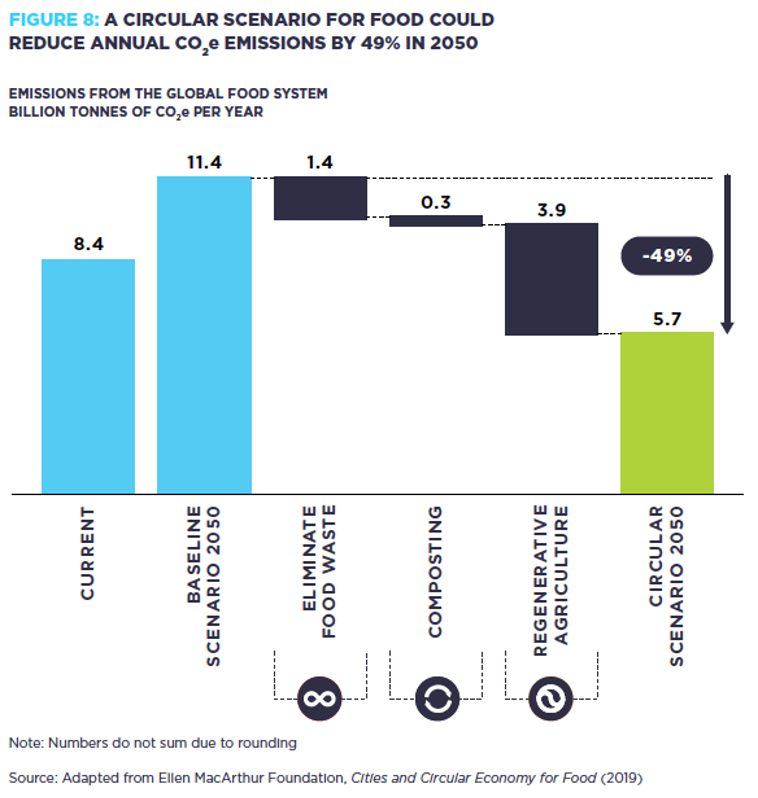

EMF highlights the potential for the circular economy to driver emissions reductions in two areas, industrial materials and the food system, and quantifies the impact of strategies such as ‘product reuse’ or ‘eliminating food waste.’ With our current food system accounting for a third of global GHG emissions, these strategies need to play a crucial part in the solution to climate change. According to EMF, a circular scenario for food could reduce annual CO2e emissions of the food system by 49% in 2050.

Source: Ellen MacArthur Foundation, Completing the Picture, p.41

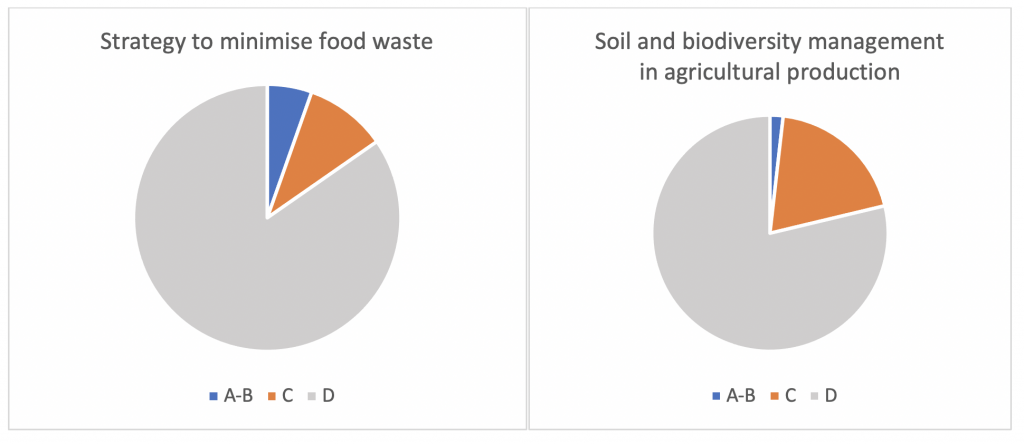

The ISS ESG Corporate Rating assesses these key circular economy strategies for reducing carbon emissions in food-related industries. The relevance of minimising food waste is captured for the entire value chain, assessing a food company’s strategies for its own operations, suppliers, and consumers. Food waste and losses in the early stages of the value chain, such as during harvesting, storing, and transportation, are scrutinised, as are measures to match food supply with demand and packaging to prevent food waste during and post distribution.

On the topic of composting and regenerative agriculture, ISS ESG’s Corporate Rating looks for food companies to promote sustainable soil and biodiversity management in agricultural production along the value chain, including prevention of soil erosion, balancing use of fertilisers, and preservation of soil fertility over the long term. As of March 1, 2022, only a very small share of companies have strategies and measures in place to transform the food industry (Food Products, Beverages, Restaurants) into a circular one (A being the top and D the lowest score):

Source: ISS ESG

The circular economy strategies outlined above often require dedicated products from solution providers. But how can investors identify these and measure their impact on GHG emissions reductions?

One example that stands out is Chr. Hansen, a global bioscience company based in Hørsholm, Denmark, that develops natural solutions for the food, beverage, nutritional, pharmaceutical, and agricultural industries. Chr. Hansen’s contribution towards a circular economy is captured in ISS ESG’s SDG Solutions Assessment that measures how companies’ product portfolios contribute to or obstruct the UN Sustainable Development Goals (SDGs). Chr. Hansen’s product portfolio is considered to significantly contribute to the objective of ‘sustainable agriculture’ by offering biological yield enhancers.

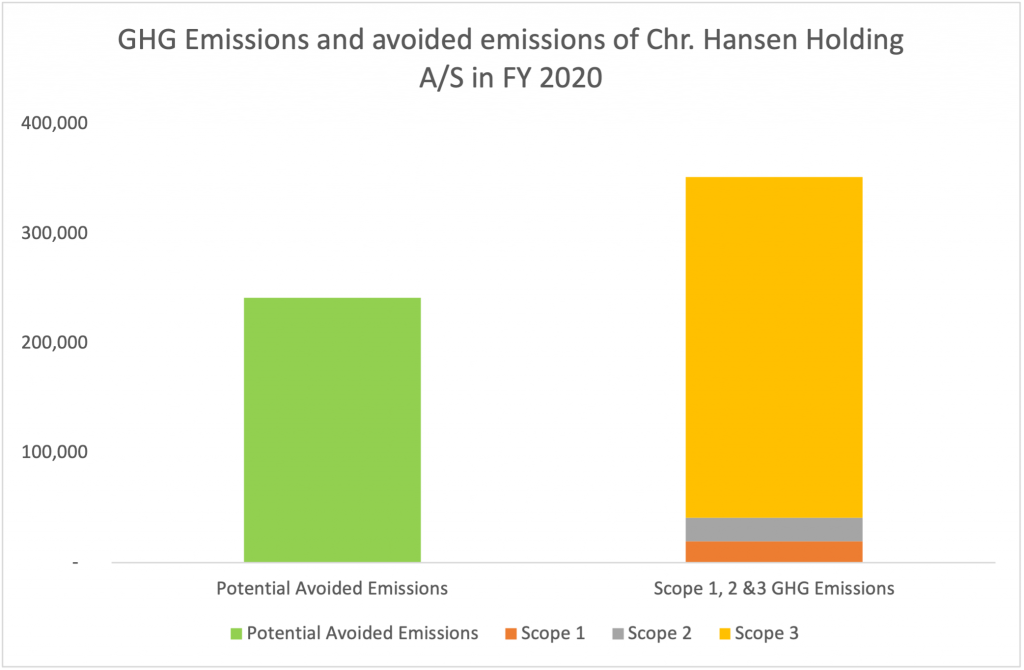

Further, according to an impact study the company conducted, Chr. Hansen’s bioprotection solutions can extend the shelf life of dairy products, thus avoiding food waste and in turn, GHG emissions that would otherwise originate from the production of additional dairy products. ISS ESG recalculated these Potential Avoided Emissions by applying a more conservative baseline than the company’s impact study. While there are various challenges inherent in calculating avoided emissions, the data suggests that potential avoided emissions from Chr. Hansen’s bioprotection products could amount to more than two-thirds of the company’s total GHG emissions (Scope 1, 2 & 3) in the fiscal year 2019/2020 as disclosed by the company.

Sources: ISS ESG, Chr. Hansen

Current Climate Investment Strategies May Suffer from Carbon Tunnel Vision

Given its enormous potential for reductions in GHG emissions, it is surprising how notably absent the concept of a circular economy seems to be from many investor-level Net Zero frameworks and climate investment strategies. A case in point is the latest edition of the Net Zero Asset Owner Alliance’s Target Setting Protocol, which only mentions ‘circular business models’ as one of several approaches to reduce emissions in the ‘Constructions and buildings’ sector. The less detailed guidance documents of the alliance’s equivalents for asset managers and banks seem to not take notice of the circular economy’s opportunities, risks, and overlaps with Net Zero at all.

On the regulatory front, the European Union’s taxonomy for sustainable activities already includes activities at the intersection of the circular economy and climate change mitigation, such as manufacturing of secondary aluminium, bio-based chemicals, or recycling of plastic waste. And the EU’s delegated act on the circular economy is still to be published, although it is expected this year.

The regulation on climate benchmarks, another part of the EU’s Action Plan on Sustainable Finance, seems to take a narrower view. Climate performance is operationalized by GHG emissions and fossil fuel exclusions, but the regulation stops short of requiring a ‘green to brown ratio’ that could facilitate the direct integration of circular economy solutions into climate indices. Even the original proposal by the EU’s Technical Expert Group (TEG) limited ‘green activities’ to energy-related activities.

Overall, the impression remains that current ESG investing practices may suffer from carbon tunnel vision if climate change is considered an issue separate from the wider ESG sphere instead of a part of it. This seems to be especially true if a climate investing strategy focuses narrowly on operational GHG emissions without considering the climate impact of investee’s product portfolios. In an extreme case this may lead to portfolio managers being forced to exclude providers of climate solutions if the companies’ GHG emissions exceed a predefined emissions threshold.

Certainly a rapid decarbonization of all parts of the global economy – including the operations of climate solution providers – is needed to remain within planetary boundaries. Nevertheless, an inflexible focus on the GHG emissions of a particular sub-system – for example, a single company or portfolio – may not be able to capture the full picture. Solutions to the wicked problem of climate change have benefitted from systems thinking in other disciplines, and this may well be what current climate investing strategies need more of.

Of course, this is easier said than done. A starting point, however, can be the use of multiple metrics instead of reducing and thereby oversimplifying a complex issue into a single number. This would allow for the identification of more synergies and opportunities, and more contradictions.

As shown in the example of Chr. Hansen’s bioprotection solution above, investors may benefit from looking at the GHG emissions avoided by the company’s products next to its GHG emissions when assessing the company’s overall climate performance. Similarly, a climate investing strategy embedded in an investor’s ESG strategy may also consider company assessments in line with the SDGs and dedicated circular economy datapoints to derive a truly holistic picture with less blind spots.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Lukas Lohrer, Climate Analytics Consultant, ISS ESG. Yuka Manabe, Senior Associate, Bespoke Research & Advisory Solutions, ISS ESG