The world over, the perfect investment storm appears to be upon us. Rising interest rates are putting pressure on bond prices, while equities’ appeal diminishes as recessionary indicators turn red. Persistent inflation increases the cost of holding of cash. Where will investors turn for their long-term investment needs? Or alternatively, will this potent confluence of negative factors lead to decision-making paralysis across the investor spectrum?

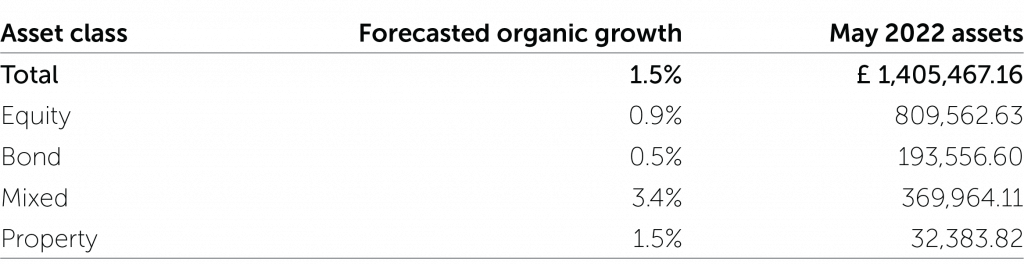

Our previous article called for a 12-month organic growth rate of 1.5% for the UK-domiciled funds market arrived at with the help of our Flowspring analytics tool. A sunny forecast all things considered. Beneath the forecast is the assumption that “savers are gonna save”. And while investors will face uncertainty in the short-term, the below fund class forecast points to the solution that investors will pursue for weathering the macro storms—diversification, both at the asset class level and geographically.

Mixed assets are therefore expected to experience the highest rate of organic growth, with a preference for funds with 60%+ in equity. Bolstering the growth of diversified investment solutions is a broader and continued shift by financial advisory firms to outsourcing investment decisions, as they focus their value proposition on planning specialties. Traditionally, mixed asset and fund of fund solutions have been the simplest method to accomplish this. Today, however, financial advisory firms and advisors on the investment industry frontlines have a new option for outsourcing investment decisions: a relatively recent arrival on the UK scene solution—the Model Portfolio Solution (MPS). Expect the MPS to feature in an incoming story, one where we consider how it may change the retail fund landscape and leverage our global data and intelligence banks to glean the potential path which this type of a “pre-assembled advice” solution might take in the UK.

Projected Asset Directionality of Fund Flows in the UK

12-month UK fund organic growth rates (flows as percentage of beginning assets) and assets in millions of pounds by main asset class

UK domiciled fund AUM is from Simfund. ETFs, Money Market and non-classified funds are excluded.

Whether the above comes to pass will be significantly influenced by the magnitude and the global reach of the recession—should it come to pass—as well as how today’s investors and advisers behave in the face of uncertainty. Although there is not currently the expectation of a full-blown financial crisis, the industry should reflect on the fact that many global markets recorded a cash-on/risk-off sentiment in the post-2008-crisis environment which led to many clients missing out on the subsequent and record-breaking bull run. Equities may not be the belles of the ball at first glance, but one wonders where else clients will find an appealing inflationary hedge story.

Although no crystal ball exists for predicting funds flows, it should not prevent us from theorising about how key trends and investor behaviours might manifest across the investment fund landscape. For this author, the need and the desire for growth among the four-headed demographic Hydra cohorts will drive organic fund growth, channeling demand to diversified investment solutions with an equity orientation. Those managers—be it asset managers, discretionary fund managers or advisors—best able to articulate and differentiate how their investment propositions can both protect investors today and advance them towards their financial goals look set to win over the next 12 months.

Want to learn more about how ISS MI can help your firm capitalise on the diversification opportunity ahead, visit https://www.issgovernance.com/market-intelligence/

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence