In a remarkable year of class action activity, investors across the globe agreed to settlements totaling over $7.4 billion[1] in 2022, a greater than 75% increase from 2021. (A substantive year in review for the U.S. market will be documented in the ISS Securities Class Action Services “Top 100 U.S. Class Action Settlements of All-Time” report published later this month.)

In this overview, ISS Securities Class Action Services reviews the largest shareholder-related settlements of 2022. A number of high-profile cases dominated the landscape, including Twitter and Teva in the United States, while the Steinhoff International mega-settlement commanded much of the attention overseas.

Top U.S. Shareholder Class Actions of 2022

Of the top ten U.S. settlements listed, three occurred in the Southern District of New York, while two occurred in the Northern District of California. Five other court venues were represented by one settlement each. Nine of the top ten U.S. settlements occurred in a federal court, while only one of the ten was resolved in a state court. All of the cases on this top ten list also settled after years of litigation, including some which resolved on the eve of trial.

A brief synopsis of the ten largest 2022 U.S. shareholder class action settlements are as follows:

Just moments before the scheduled start of a jury trial in September 2021, investors and Twitter agreed to a $809.5 million settlement, which was legally approved in late 2022. Investors had alleged – through an initial complaint filed in September 2016 – that the social media company misled shareholders during a six-month period in 2015 about growth prospects and user engagement. The company specifically promised investors that it would increase active users to 550 million in the intermediate term and to more than a billion in the long term, when in actuality, it purportedly had no basis for those numbers. The executives allegedly knew or deliberately disregarded that by early 2015: (a) the trend in user engagement growth was actually flat or declining; and b) new product initiatives were not having a meaningful impact on Monthly Active Users (MAUs) or user engagement. Resolved after more than six years since the initially filed complaint, this resolution becomes the 19th U.S. largest settlement of all-time (and second largest in the Northern District of California, behind the $1.05 billion McKesson HBOC settlement from 2013). Shareholders were represented by co-lead counsel firms Robbins Geller Rudman & Dowd and Motley Rice.

Teva Pharmaceutical

The $420 million settlement between Teva and investors resolves allegations that the company engaged in a generic drug price-fixing conspiracy that allowed it to drastically raise prices on generic drugs from 2013 to 2015 – as high as 1,000%. The Israeli drug manufacturer allegedly misled investors into believing that the company’s remarkable growth was due to fundamental business strategies. In truth, however, it was the company’s alleged collusive price-hikes that allowed it to reap more $2.3 billion in profits. The case follows sweeping criminal investigations by the U.S. Department of Justice and twenty state attorney generals into the pharmaceutical manufacturer for allegedly conspiring with five other competitors. In 2020, the U.S. Department of Justice formally charged Teva with three counts of conspiracy related to the alleged fraudulent scheme. The class action settlement was reached after the parties completed extensive fact and expert discovery and more than five years since the filing of the initial complaint in November 2016. The settlement ranks among the five largest securities settlements ever paid by a pharmaceutical manufacturer. Shareholders were represented by Bleichmar Fonti & Auld as lead counsel.

Luckin Coffee

The complex U.S. class action against the Chinese-based rival to Starbucks, which filed for bankruptcy in the Cayman Islands, was legally resolved in July 2022, resulting in a $175 million payout for investors. Shareholders had alleged that Luckin engaged in a widespread fraudulent scheme to falsify more than $300 million in revenues. The tech-focused coffee chain allegedly touted its meteoric growth in revenues to attract over a billion dollars in investment from both the United States and Asia as part of an Initial Public Offering and a Secondary Public Offering in May 2019 and January 2020, respectively. However, unbeknownst to investors, the company’s growth was allegedly a sham, as the sales were based on fabricated transactions with related parties linked to its former chairman and chief executive officer. After a series of public admissions by the company, Luckin’s American Depositary Shares (“ADSs”) plunged from an all-time high of $50 per share in January 2020 to under $2 per share before they were delisted from the NASDAQ exchange in June 2020. Once seen as one of China’s fastest growing companies, Luckin soon became the target of criminal and civil investigations by regulators on two continents and was forced into liquidation proceedings in the Caymans. While in liquidation proceedings, the class on behalf of ADS purchasers was provisionally certified for purposes of negotiating a settlement, and settlement terms were subsequently reached in September 2021. In addition to the company, the settlement resolves allegations against its officers and directors, as well as the various underwriters of the IPO and SPO, including Credit Suisse. Shareholders were represented by Bernstein Litowitz Berger & Grossmann and Kessler Topaz Meltzer & Check. The class action settlement is the second largest award ever to be paid by a China-based company.

Separately, Luckin reached a $7 million partial settlement in the Supreme Court of New York with holders of convertible senior notes, and also agreed to pay $180 million in civil penalties to the SEC to settle similar accusations.

BlackBerry

After 8.5 years from the initially filed complaint in October 2013 – and just one day prior to jury selection for the scheduled trial – BlackBerry agreed to resolve its U.S.-based shareholder class action with a $165 million payout. The case stems from a six-month period in 2013 where BlackBerry is alleged to have misled investors by inflating the success and viability of its BlackBerry 10 line of smartphones. In truth –per the investor complaint – the platform was poorly received by the market and caused the company to write-down nearly $1 billion in charges related to unsold devices and lay off approximately 4,500 employees, totaling about 40% of its total workforce. U.S. District Judge Colleen McMahon had previously denied BlackBerry’s request to dismiss the action at summary judgment, stating “genuine issues of material fact” were evident. Shareholders were represented by Kahn Swick & Foti, as lead counsel.

Of note to investors, a separate shareholder class action in Canada is also being pursued against BlackBerry. The initial complaint in this case was filed on December 20, 2013 in the Ontario Superior Court of Justice.

NovaStar Mortgage

While a settlement was initially resolved in 2017, a last-minute appeal and a lengthy process caused this investor action to receive final settlement approval in June 2022. Allegations relate to the financial crisis from over a decade ago where a number of financial institutions – including Deutsche Bank Securities, RBS Securities, and Wachovia Capital Markets – misled investors within offering documents on various securities issued by NovaStar. Specifically, the material within the filings failed to disclose that loan collateral was not originated in compliance with company guidelines, as well as a failure to assess borrowers’ credit worthiness. Shareholders were represented by Cohen Milstein Sellers & Toll.

Granite Construction

Granite Construction’s $129 million settlement resolving allegations that it manipulated financial statements to overstate revenues in 2018 received final approval in May 2022. The complaint, initially filed in August 2019, specifically alleges that the construction company employed fraudulent accounting techniques in preparing financial reports in order to hide or understate significant cost overruns in four large infrastructure projects. After the lawsuit was filed, Granite launched an internal investigation and issued a restatement in February 2021 of all of its financial statements during the class period. The company and its former senior vice president also agreed to pay a $12 million civil penalty to the SEC related to the alleged fraud. The class action settlement was resolved following the depositions of three Granite fact witnesses and the preparation of an additional twelve. According to plaintiff’s motion for settlement approval, the settlement represents approximately 20-to-30% of the estimated range of recoverable damages, which is nearly 400% more than the median recovery in such cases. Bleichmar Fonti & Auld served as counsel for lead plaintiff representing the class.

Walgreens

After more than seven years of litigation, Walgreens, Inc. (now known as Walgreens Boots Alliance Inc.) and investors reached a $105 million settlement for alleged fraudulent conduct in 2014. The retail drug chain was alleged to have concealed or have failed to fully disclose the impact of generic drug price inflation and reimbursement pressures. The misstatements were made when the company set long-range goals for fiscal year 2016 as part of its merger with Switzerland-based pharmacy company Alliance Boots GmbH. The protracted litigation, which involved a bifurcated class certification and discovery process, was long-fought before it was resolved. Lead plaintiff filed an amended complaint more than three years after the consolidated complaint, and then at summary judgment, defendants filed a motion for partial reconsideration of the judge’s decision and won. As the parties began to prepare for trial, a settlement was agreed to in May 2022. Shareholders were represented by Kessler Topaz Meltzer & Check as lead counsel.

Novo Nordisk

This $100 million settlement between the Denmark-based global healthcare company and investors who purchased American Depository Receipts received final approval in July 2022. According to the complaint, Novo Nordisk allegedly assured investors that the company’s sales and profits would continue to grow significantly, and it would not be subject to the same pricing pressures from pharmacy benefit managers that its competitors faced. However, in actuality, Novo Nordisk faced these exact pricing pressures, which was disclosed to the market beginning on August 5, 2016. After the conclusion of fact discovery and while the motion for summary judgment was fully briefed, the parties reached this settlement. Shareholders were represented by Bernstein Litowitz Berger & Grossmann and Robbins Geller Rudman & Dowd as co-lead counsel.

A separate shareholder action in Denmark with similar allegation also settled, but without any admission of liability or any financial benefits paid to investors.

Stamps.com

Founded in 1996, Stamps.com touts itself as a key service provider that enables small businesses, enterprises and online retailers to print U.S. Postal Service-approved postage, and to this day, continues to promote the United States Postal Service as its primary business partner. However, in a complaint filed in the Central District of California by shareholders back in May 2019, allegations stated the company touted a strong relationship with the USPS, when in reality, it was hiding a deteriorating affiliation with the Post Office, which led to an artificially inflated stock price. Specifically, the company is accused of failing to disclose that its reported revenue and earnings growth from May 2017 to May 2019 were in large part from improper and unsustainable business practices. When this news came to light, the company’s stock price plummeted to a close of $83.65 on February 21, 2019, a decline of over 57% from the previous closing price of $198.09. A $100 million tentative settlement was announced on June 4, 2021, with the official sign-off and approval of the settlement occurring on March 17, 2022. Shareholders were represented by lead plaintiff, the Indiana Public Retirement System, and lead counsel, Robbins Geller Rudman & Dowd.

Of note, in July 2021 the company also settled a $30 million derivative shareholder class action over insider trading allegations.

NCI Building Systems

The only top U.S. settlement within this report to resolve in a state court, this breach of fiduciary duty action is related to allegations Clayton Dubilier & Rice LLC, a private equity firm, secured a $2.6 billion merger of NCI with one of its companies, Ply Gem, at an unfair valuation. Investors specifically claimed in its initial complaint dated November 19, 2018 that Clayton Dubilier used its effective control of NCI to make it pay $1.2 billion for privately held Ply Gem Parent, LLC, three months after Clayton Dubilier paid $683 million for the same business – a $600 million windfall. The case partially survived a motion to dismiss before Vice Chancellor Laster in the Delaware Court of Chancery in February 2020 with Clayton Dubilier and the majority of the director defendants unable to escape the class action.

Top Non-U.S. Shareholder Class Actions of 2022

In addition, as ISS Securities Class Action Services noted in its “The Top 25 Non-North American Settlements” report published earlier this year, there have been significant settlements this year outside the United States, including a few that are about on par or greater than the largest U.S. securities class action lawsuit settlements in terms of size. A brief synopsis of the largest 2022 non-U.S. settlements are as follows:

Steinhoff International Holdings

The record-breaking settlement of €1.4 billion resolves the alleged widespread accounting fraud that led to a 95% decline in Steinhoff’s stock price and a €12.6 billion loss in market capitalization after December 2017 disclosures. The litigation involved suits by eleven different investor groups in three different jurisdictions: South Africa, the Netherlands, and Germany. After years of complex, cross-border negotiations, the parties were able to reach a global resolution through a novel legal procedure involving restructuring proceedings in the Netherlands and South Africa. Investors who traded in Steinhoff shares between 2 March 2009 and 5 December 2017 and filed claims by 15 May 2022 are expected to receive part of the settlement fund. The Steinhoff settlement becomes the largest of all-time outside North America, surpassing the Ageas SA/NV’s settlement in 2018. Steinhoff is also the first-ever investor settlement in South Africa and one of the few to be resolved across multiple jurisdictions.

Hypo Real Estate

Investors’ private settlement of €190 million with Hypo Real Estate – legally resolving claims pending since 2009 – makes history as the largest shareholder-related resolution on record in Germany. The case stems from allegations that the commercial real estate lender falsely assured investors that it was not significantly impacted by the 2007-2008 global financial crisis. However, when the company announced a €390 million write-down on toxic assets for the fourth quarter of 2007, its stock price declined by more than a third. Due to continuing financial woes, the company would later receive a massive government bailout in October 2008, before approving a complete nationalization a year later. The case proceeded under the German Capital Markets Model Case Act with a model case for the over 100 institutional investors before the German Federal Court of Justice. In February 2021, nearly eleven years after the proceeding was commenced, the Court released its decision, resolving all major substantive issues in the model case. Following the Court’s decision, the parties reached a settlement, the exact details of which remain confidential. The investor group was represented by the law firm DRRT and its attorney Christian Wefers served as model plaintiff.

Canadian Imperial Bank of Commerce

Canada’s largest settlement of 2022 took over 13 years to resolve, as the initial complaint was filed back on July 22, 2008. Allegations against the Toronto-based banking and financial services company stated a failure to disclose exposure and risks associated with its U.S. subprime mortgage investments. The company specifically misled investors through its quarterly financial filings and public statements throughout the class period. Ultimately, the bank admitted to $4.9 billion in losses stemming from the financial crisis. This resolution is large enough to qualify within the top ten all-time largest Canadian class action settlements.

Crown Resorts

Australia’s largest settlement of 2022 was resolved in April when the Federal Court of Australia officially signed-off on the $125 million agreed upon amount. Shareholders alleged the gambling and entertainment company breached its disclosure obligations by illegally promoting VIP gaming services in China, which had shockingly led to 19 employees being arrested. On news of the arrests, Crown’s stock price fell 14% on unusually heavy trading volume. Sixteen individuals were ultimately convicted, serving time in a Shanghai prison. Maurice Blackburn served as lead attorneys in this action. This case became the seventh largest shareholder-related settlement of all-time in Australia.

Of note, a separate class action is currently active against Crown Resorts, where shareholders are alleging poor compliance practices with anti-money laundering obligations.

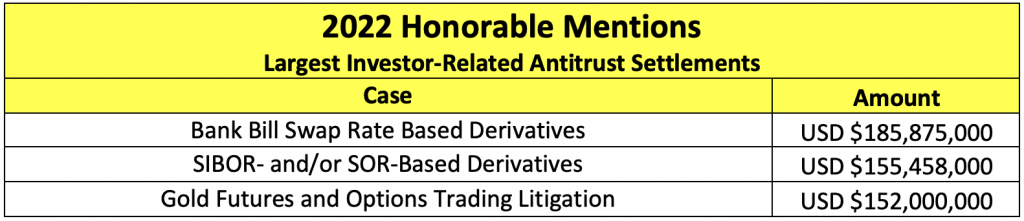

Honorable Mentions – Largest Investor-Related Antitrust Settlements of 2022

Circling back to the United States, investors also successfully resolved six complex U.S. antitrust actions, including three settlements surpassing the $150 million threshold. All three of these cases were litigated in the Southern District of New York. The common theme amongst all these actions is that defendants were alleged to have manipulated various forms of currency and/or pricing. For example, in the SIBOR/SOR action, a number of big banks were alleged to have created a scheme to manipulate Singaporean interest rate benchmarks. And within the Gold Futures and Options Trading actions, investors alleged five big banks conspired to manipulate prices for gold-based derivatives contracts to their benefit. Similarly, in the Bank Bill Swap Rate-Based Derivatives action, several banks were alleged to have manipulated a short-term interest rate used as a benchmark to price certain types of Australian derivatives. The complicated components of antitrust actions often lead to a longer lifecycle of litigation; in fact the six cases that settled in 2022 average 5.7 years from the initially filed complaint through to the settlement date.

As all of the above large settlements indicate 2022 provided damaged investors with significant opportunities to recover lost assets resulting from securities-related fraud. ISS Securities Class Action Services will continue to report on key cases of interest to the investment community… including the ultimate claim disbursements of the above noted 2022 settlements.

Note:

[1]This figure includes traditional shareholder-related class actions across the globe, as well as investor-related antitrust settlements.

By: Jeff Lubitz, Managing Director, ISS Securities Class Action Services, and Jarett Sena, Director of Litigation Analysis, ISS Securities Class Action Services