Below is the executive summary of the ISS STOXX Natural Capital Research Institute’s recently released report on deforestation and its investment implications. To download a copy of the full report, please click here.

Forests Are at the Center of the Nature Loss Conversation

The scientific community is once again raising the alarm on the rapid and severe deterioration of the earth’s natural systems and the implications this will have for the stability of our planet, economic activity, and human wellbeing. Institutional investors are taking note and are increasingly aware of the “twin crises” of biodiversity loss and climate change and the fact that these crises are interconnected, and one cannot be solved without addressing the other.

Land use change has been identified as the most important impact driver of nature loss. Deforestation – defined as any activity that causes a loss and subsequent conversion of forested land – is therefore central to the biodiversity and climate change conversation. Tropical forests, in particular, are the most essential carbon sequestration and biodiversity agent, as they hold around 70% of the global forest carbon sink power and are home to around 67% of all land-based biodiversity.

Further, there are other impact offshoots associated with forest loss. For example, deforested land rapidly degrades due to factors such as low soil fertility and water stress, leading to more land being deforested to replace land that is no longer usable for agriculture. This cycle of deforestation to soil degradation to further deforestation is vicious, increasing biodiversity loss, water stress, and exponential carbon emissions through destruction of carbon sinks and release of stored carbon.

Given the imperative of protecting forests to address the world’s most pressing environmental challenges, the inaugural flagship study of ISS STOXX’s Natural Capital Research Institute is focused on deforestation, particularly of tropical forests.

This report is set to answer the question:

How are global institutional investors exposed to deforestation risks in their investment portfolios, and how can they assess and mitigate those risks—and related impacts and dependencies—while capitalizing on nature-based opportunities?

Deforestation Poses Investment Risks: Physical, Transition, and Systemic

Similar to climate risk, nature risk can be broken down into physical, transition, and systemic risks. Physical risk is an adverse physical change in the environment (i.e., loss of forest cover or land degradation). Transition risk is associated with the misalignment of actions of one economic actor, such as a government, with another, such as businesses or civil society (i.e., regulatory, market, or reputational risks). Last, systemic risk is the risk that an event would lead to destabilization of a critical system, in effect causing an irreversible tipping point (i.e., desertification).

ISS ESG research shows that while all these risks are becoming more evident to investors, transition risk is the most urgent, with regulation putting pressure on companies and investors to rapidly reduce their exposure to commodities from newly deforested areas in their supply chains. The most prominent effort is the European Union Deforestation Regulation (EUDR), set to be implemented by the end of 2025 for large enterprises and by 2030 for micro and small enterprises.

Nature-Related Data to Assess Deforestation Risks

Institutional investors can be exposed to deforestation risk through portfolio companies with activities associated with deforestation-prone commodity production or that are dependent on deforestation-related commodities or through exposure to countries and sectors that are historically known to be connected to deforestation.

Investors can assess deforestation risks in their portfolio using various data sets that can be organized in three types: i) dependencies data; ii) impact data; and iii) company performance data:

- Dependencies data: Companies’ dependencies on forests, and/or the ecosystem services that this biome provides, to ensure operations, profitability, and access to raw materials, among other inputs.

- Impact data: Portfolio companies’ activities with an impact on forests that contribute to the deterioration or depletion of natural capital.

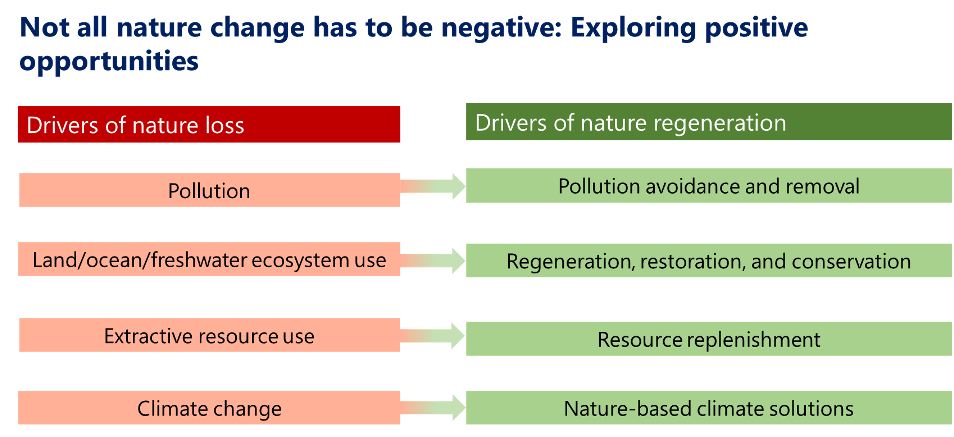

- Performance data: Companies’ policies and measures in place to assess, disclose, and mitigate deforestation-related risks, dependencies, and impacts. A sub-set of performance data that goes beyond risk mitigation into the realm of innovation and new products and processes that promote restoration, regeneration, and a just transition can be considered ‘opportunity’ performance data (see Figure 1)

Figure 1: Nature-Based Opportunities

Source: ISS ESG Research adapted from TNFD LEAP Approach

Case Study I: Nature Action 100 Portfolio Dependencies and Impact Assessments

Dependencies Analysis

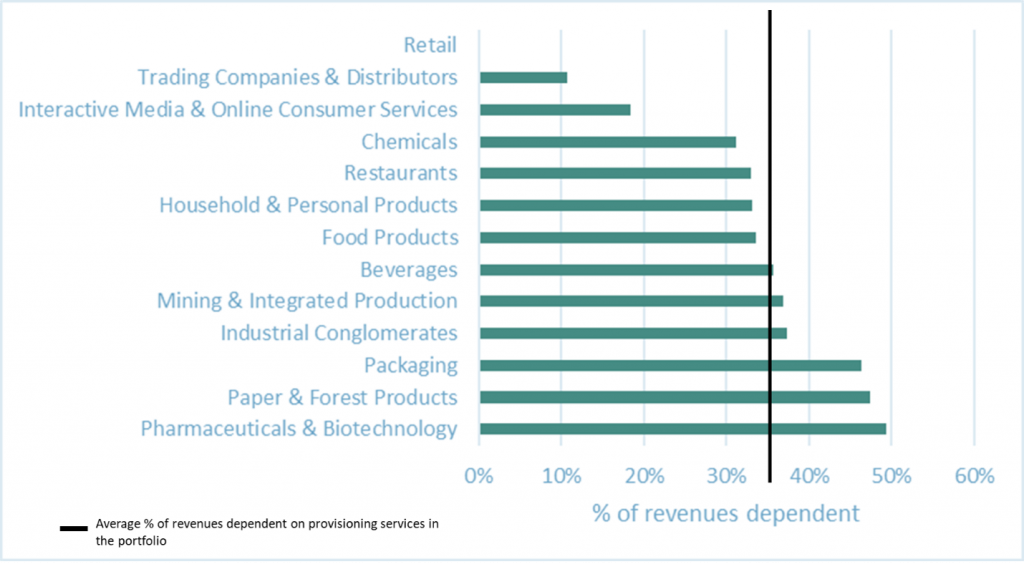

When the portfolio is analyzed through ISS ESG’s Biodiversity Impact Assessment Tool looking at ecosystem services, more than 50% of the portfolio is revenue-dependent on regulation & maintenance services such as climate regulation and erosion control, 33% of the portfolio is revenue dependent on provisioning services such as surface water, and even cultural services show a small amount of revenue dependency.

Although the tool demonstrates that Nature Action 100 is revenue-dependent on regulation & maintenance services, when layering financial materiality into the analysis, it becomes apparent that a lack of quantity or quality of provisioning services would lead to a greater disruption to business operations.

Looking at provisioning services alone, the industries most exposed include Pharmaceuticals & Biotechnology, Paper & Forest Products, and Packaging.

Figure 2: Nature Action 100 Portfolio Revenue Dependency on Ecosystem Services

Source: ISS ESG Biodiversity Impact Assessment Tool, December 2024

Impact Analysis

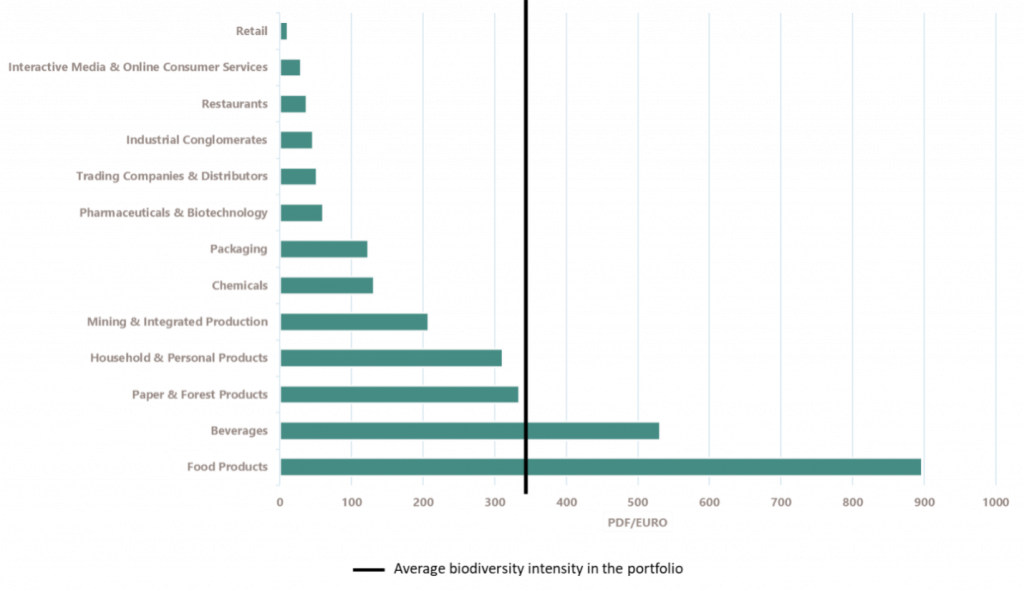

The Biodiversity Impact Assessment Tool shows that over 84% of the portfolio has a high-to-very-high revenue-adjusted impact on biodiversity, as measured by PDF (Potentially Disappeared Fraction of Species) impact metric. Across the portfolio, land transformation accounts for over 90% of the impact driver. Within the Nature Action 100 Portfolio, Food Products and Beverage industries have the largest biodiversity impact intensity.

Figure 3: Nature Action 100 Portfolio: Biodiversity Intensity by ESG Rating Industry

Source: ISS ESG Biodiversity Impact Assessment Tool, December 2024

Case Study 2: Funnel for Engagement

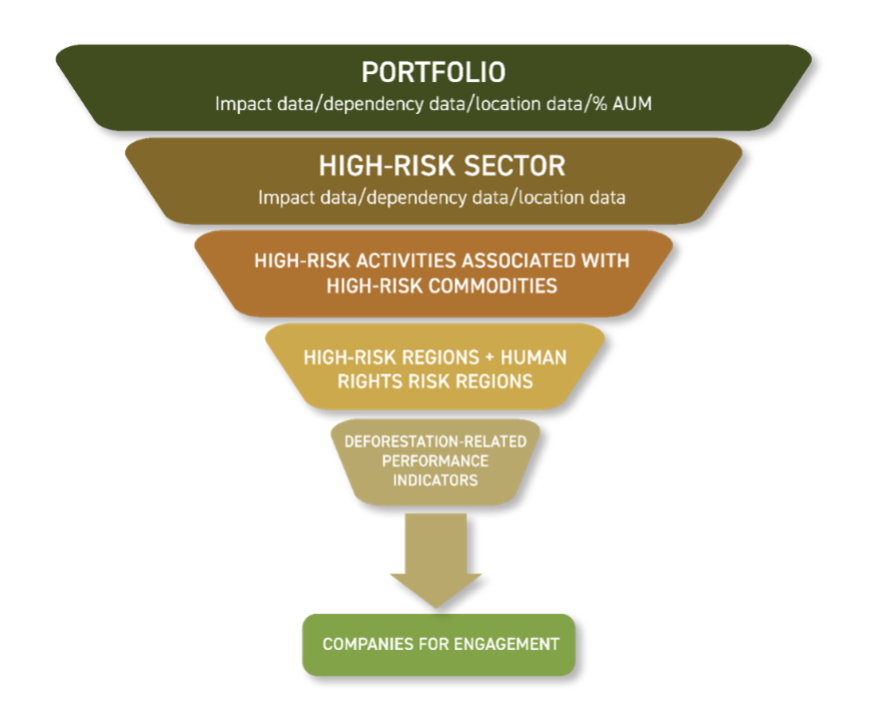

Just as deforestation does not have a one-size-fits-all solution, deforestation risk exposure analysis cannot be done using a one-size-fits-all approach.

Deforestation risk can also be assessed using a ‘funnel’ approach. This starts by understanding the composition of companies within a portfolio, and then filtering by high deforestation-risk sectors, activities, and regions. Once those companies are identified, an investor can assess companies against performance indicators that will provide insights into how well those companies are prepared to mitigate and manage deforestation-related risks and impacts (see Figure 4). This funnel approach can help inform an investors’ engagement strategy.

Figure 4: Deforestation Risk Exposure Funnel

Source: ISS ESG Research, adapted from Deforestation-free Finance, Ceres, FAO, and WWF

Nature-Related Impact and Dependencies Increasingly in the Spotlight

In the context of the rapid deterioration of nature and the increasing recognition of businesses’ impact and dependencies on natural resources and the ecosystems services they provide, investors are looking to assess their portfolios’ exposure to nature loss, particularly around transition and, increasingly, physical risk. Data that can help investors with these assessments are available today. With better and more granular company disclosure in the pipeline and new technologies available that allow supply chain visibility with geospatial location data, investors are set to progressively incorporate nature data into their decision-making process. This paper can be used as a guide to investors that are ready to start this journey.

Explore ISS ESG solutions mentioned in this report:

- ISS ESG’s Biodiversity Impact Assessment Tool helps investors assess the impact of companies’ business and supply chain activities on biodiversity.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By:

Caitlin Harris caitlin.harris@iss-stoxx.com, Senior Associate – Natural Capital Research Institute, Forest, Land and Agriculture Research Lead

Mirtha Kastrapeli mirtha.kastrapeli@iss-stoxx.com, Managing Director – Global Head of Natural Capital and Head of ISS STOXX’s Natural Capital Research Institute