Introduction

The sustainable finance debt market is seeing strong levels of issuance, from a greater breadth of issuers, in 2024. Green bonds are experiencing strong momentum, with a growth in value of around 14% year-over-year in the first half of 2024 according to the Climate Bonds Initiative (CBI), and the uptake of transition bonds has added a new type of debt instrument to financial markets.

In the context of this evolving market, ISS ESG is launching a new Sustainability Bond Rating (SBR) in the first half of 2025 that will assess the ESG performance of the underlying bonds being issued. The current offerings in the market tend to be more focused on the issuers’ ESG performance, as opposed to the issuance itself. This is an important differentiator for someone investing in the sustainable finance market.

The sustainable bond market is moving further from a niche asset class to a wider audience of investors. With over 3,300 issuers and close to 17,000 bonds, combined with frequent new issuances, the universe of GSSS (Green, Social, Sustainable, Sustainability-Linked) bonds has become more established.

The Status of the Sustainable Bond Market

Types of Sustainable Bonds

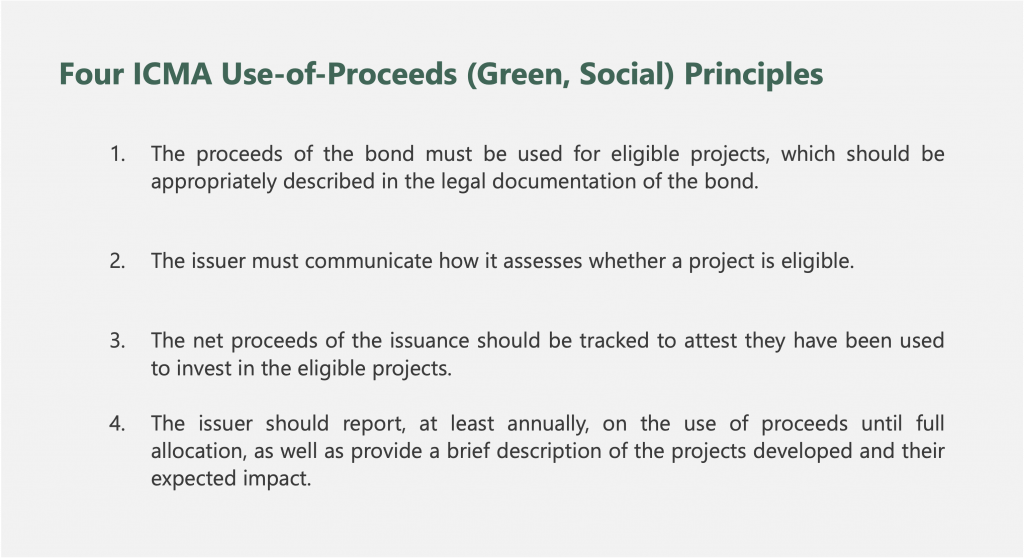

Sustainable bonds can be classified into two major categories. The first category is “Use of Proceeds bonds” (UoP), which are bonds whose proceeds ought to be used to either partially or fully finance or re-finance new or existing eligible green and/or social projects. In the case of UoP bonds issued by financial institutions, the proceeds are typically allocated to finance or refinance the provision of loans for the development of eligible projects.

The UoP bonds include green, social, and sustainability bonds (GSS bonds). As their name suggests, the proceeds of green bonds must be applied to finance projects with expected environmental benefits, which may include, for instance, projects in renewable energy, clean transportation, biodiversity conservation, and wastewater management. The resources raised through social bonds must be invested in projects that aim to address or mitigate a specific social issue or seek to achieve positive social outcomes, including affordable housing, food security, and the empowerment of vulnerable groups. Sustainability bonds are bonds where the proceeds should be used to finance a combination of both green and social eligible projects.

The second category is “Sustainability-linked bonds” (SLBs), where the financial or structural characteristics of the bond can vary depending on whether the issuer meets specific sustainability performance targets (SPTs) within a timeline, but whose proceeds do not need to be invested in projects with an expected positive environmental or social impact. SLBs have lower popularity, compared to UoPs, in 2024, with some question marks over quality and accountability. With generally quite small coupon increases (penalties) for missing SPTs, issuers lack both incentives to achieve and penalties for failing to achieve the commitments set out in the bond documentation.

Growing Market

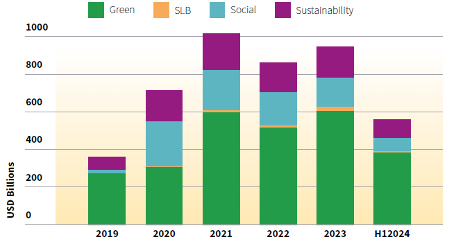

According to the Climate Bonds Initiative, the sustainable debt market surpassed US$5 trillion in the first half of 2024, reaching US$5.7 trillion, en route to a record year of issuance. Green bonds dominated the market (Figure 1), accounting for over 60% of new issuance up to June.

Figure 1: New Issuance in Sustainable Debt Market

Source: Climate Bonds Initiative

The largest green bond sale in the first half of 2024 was by the Italian government, which totaled €9 billion (circa US$9.5 billion). Social bonds had a strong Q1 but a slower Q2, leaving new issuance to be flat year-over-year in the first half of 2024. Sustainability bonds had a relatively strong start to the year, up 10% year-over-year in the first half, with the largest issuance coming from the International Bank of Reconstruction & Development (IBRD), at $5 billion. Issuance of SLBs is down 47% year-over-year in the first half, as their overall exposure in the GSSS market continues to decline.

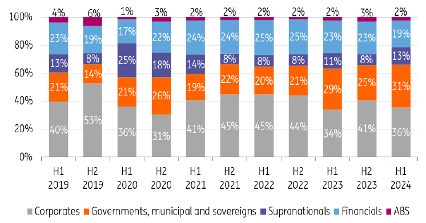

Government agencies, municipal, sovereign, and supranational entities have been the largest issuers in the global GSSS market (Figure 2).

Figure 2: New Issuance by Issuer Type

Source: Bloomberg NEF, ING Research

The public sector share in the total market grew from 29% in the second half of 2022 to 44% in the first half of 2024. Sustainability risks and climate change mitigation have helped drive greater government participation. Corporates remain the largest contributor to overall issuance, accounting for 31% to 53% of total issuance.

Corporate Green issuance is expected to continue to grow, with increasing capital expenditure related to climate transition plans that need to be financed. According to CDP, the number of companies setting climate transition plans has increased by 44% year-on-year to approximately 5,900 in 2023, with around 8,200 companies said to be creating a climate transition plan by 2025.

In 2024, there has been an increase in Transition bonds whereby companies can finance decarbonization strategies that are not seen as traditionally green. This is particularly relevant for emission reduction projects in hard-to-abate sectors. Japan has been the dominant issuer of such Transition bonds so far in 2024, following the introduction of the Japan Climate Transition Bond Framework.

The U.S. is the Largest Green Bond Issuer in 1H 2024

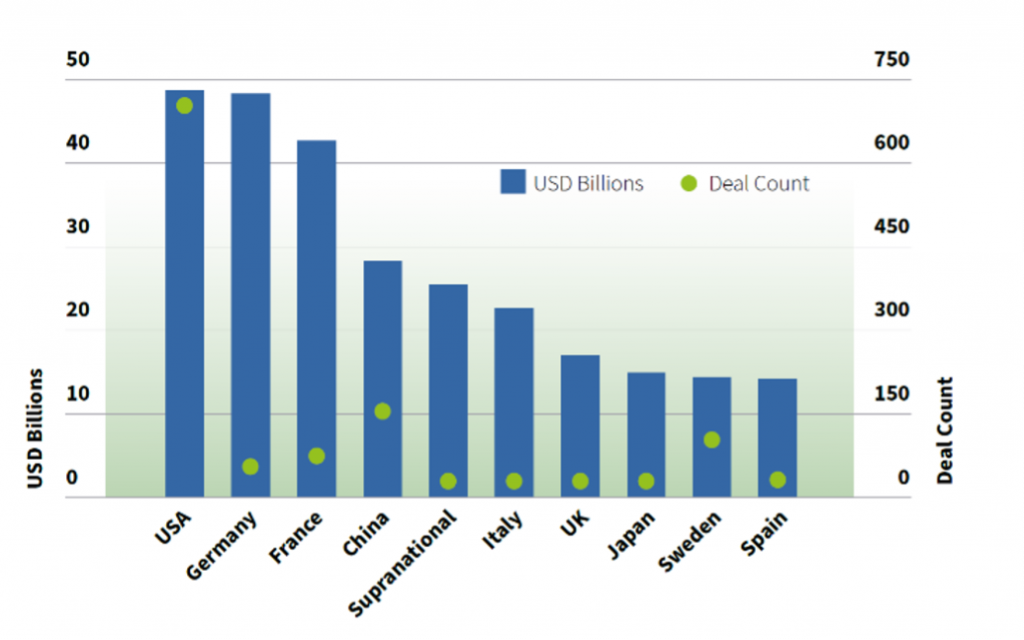

Europe as a region has traditionally been the largest issuer of green bonds, and this remained the case in the first half of 2024, accounting for 62% of new issuances. On a country basis, the United States made the largest contribution of $47.6 billion in the first half of 2024, reflecting an increase of 57% year-over-year (Figure 3).

Figure 3: Issuance by Geography in 1H 2024

Source: Climate Bonds Initiative

The United States was followed by Germany and France with issuance volumes of $47.2 billion and $41.1 billion, respectively. The deal count tends to be high in the United States relative to other countries, which suggests a greater number of deals at a lower average level of value. The Inflation Reduction Act (IRA) in the U.S. spurred over $200 billion of investment in clean energy manufacturing, driven by tax incentives and government programs.

ISS ESG’s Ambition

ISS ESG Launch of the Sustainability Bond Rating

ISS ESG has been laying the foundations for a Sustainability Bond Rating (SBR) through 2024, with the product launch scheduled for the first half of 2025. A new dedicated SBR team, headed by experienced management, will rate a sustainable bond’s performance through a comprehensive rating methodology, covering over 200 data points.

The bond’s ESG impact and ESG risk exposure will be assessed for the global labelled debt market. Coverage will include global corporate, sovereign, and government agencies issuances, spanning all regions and industries.

ISS ESG SBR evaluates the labelled bonds’ sustainability performance using a twelve-point grading system, which allows for comparability with other ISS ESG solutions, such as the ESG Corporate Rating and the ESG Country Rating.

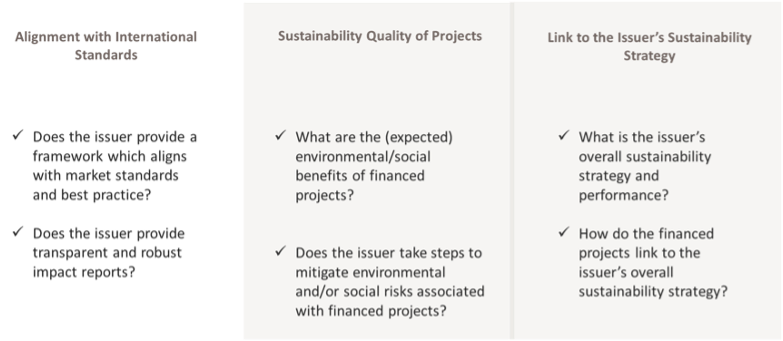

One of the most important characteristics of ISS ESG SBR is its ability to conduct assessment at the issuance (bond) level, as opposed to the issuer level. This allows investors to draw key insights on how aligned Green, Social, Sustainability, Transition, and Sustainability-linked fixed income securities are with international standards, as well as the securities’ ESG and climate impact (Figure 5). The rating will also be agnostic to the Second Party Opinion (SPO) provider.

Figure 5: ISS Approach to Assessing UoP Bonds

Source: ISS ESG

The labelled debt landscape is a complex one, with a lack of standardization of frameworks. During the development of the ISS ESG SBR methodology, discussions on points beyond those outlined above took into consideration a variety of events, such as issuer disclosure practices (e.g., publishing multiple frameworks with several bonds under each framework or reporting project allocation on a portfolio basis) or varying levels of alignment with regulatory frameworks such as the EU Taxonomy. In addition, project disclosure post-issuance tends to be more granular than what is found in the initial issuance framework and highlights the importance of the ongoing annual verification process.

One size does not fit all, even within UoP bonds: varying levels of alignment to regulatory frameworks or issuers disclosure practices do not allow for standardization in the process of bond rating. A more nuanced approach is necessary. This is where the focused methodology across ISS’ data and research teams sets guidelines and parameters to give investors the most relevant information for making investment decisions.

Labelled Bonds Standards

With sustainable bonds being a relatively recent innovation in debt markets, very few jurisdictions have a regulatory or self-regulatory framework for sustainable bonds such as those introduced in India, China, and Japan.

Two complementary and often-used international standards to classify a bond as sustainable have been developed by two private sector-led institutions, the International Capital Market Association (ICMA) and the Climate Bonds Initiative (CBI). ICMA’s Executive Committee is composed of 24 organizations, with an equal distribution among investors, issuers, and underwriters. CBI’s Board is made up of associations representing institutional investors and environmental non-governmental organizations. The ICMA standard was used to classify bonds as sustainable issuances, with 93% of total sustainable bond issuances worldwide in 2023 being classified under ICMA. ISS ESG SBR aligns with both the ICMA and CBI standards.

Issuers may also refer to local or regional taxonomies for sustainable activities or to their own classification for eligible projects. The most-often-used taxonomies are the ones from CBI, the European Union, and the People’s Republic of China’s central bank and securities regulator.

The development of taxonomies is expected to have a noticeable impact on the labeled bond market. In the case of APAC, this reflects the region’s growth in the adoption of mechanisms to promote green and transition finance instruments, as further explored in ISS STOXX’s recently released Anchor Report titled 2024 Global Regulatory Update.

Source: International Capital Market Association (ICMA)

As different types of projects are associated with differing environmental and social risks, the types of projects that are considered relevant in ISS ESG SBR vary by assessed question. Therefore, for every datapoint, the SBR methodology specifies the types of projects that are considered relevant to that datapoint. The categorization of projects is based on ICMA’s UoP categories.

SDG Mapping

Pursuant to the ICMA Principles, UoP bond documentation shall disclose the specific projects/assets/activities that will be financed with the proceeds of the issuance. In the context of UoP, these project/assets/activities are known as Eligible Project Categories, as they describe the areas to which the resources can be allocated.

Disclosure of eligible project categories are part of the “Use of Proceeds” core component of the ICMA Principles. This means that issuances aligned with the ICMA Principles will follow a standard disclosure structure, which facilitates identification of the eligible project categories assigned to those issuances within the bond documentation.

ISS ESG SBR establishes the bond’s potential impact on the UN SDGs in its eligibility criteria. Focusing on the bond’s eligibility criteria makes it possible to establish rules on how each type of project/activity may contribute to or obstruct the achievement of each of the UN SDGs.

Issuer Sustainability Strategy

ISS ESG SBR also assesses a bond’s contribution to the sustainability strategy of its issuer and assesses measurable sustainability targets. At the core of these assessments lie two questions. First, can the issuance be an effective mechanism to advance the issuer’s predefined sustainability priorities? Second, are these sustainability priorities relevant to addressing the key issues affecting the issuer’s industry, key stakeholder groups, and operating environment, or are they an isolated initiative linked to weaker ESG-related claims?

As additional context, ISS ESG SBR also presents high-level scores drawn from the issuer’s ESG Corporate or ESG Country Rating to provide investors with full visibility of the issuer’s ESG performance based on ISS ESG’s rating solutions, which allows for the interoperability of the products.

Conclusion

With the launch of its new Sustainability Bond Rating (SBR) in 2025, ISS ESG will provide a comprehensive assessment of a labelled bond’s ESG performance, answering the currently unaddressed need for asset-level data and ratings. The ISS ESG SBR’s methodology takes into consideration globally accepted frameworks and standards applicable to sustainable fixed income instruments, supporting investors to make informed decisions on worldwide issuances, regardless of type of issuer, trading markets, or local and regional regulatory initiatives.

In future papers, ISS ESG will describe the mechanics of assessing a Green, Social, Sustainable, Sustainability-Linked (GSSS) bond and examine how a labelled bond trades in the market relative to a traditional (vanilla) bond from the same issuer, discussing the concept of ‘Greenium’ or ‘Green-Premium’ (reflected through trading at a lower yield).

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

By:

Gavin Thomson, Co-Head of Traditional Research

Héctor Páez, ESG Methodology Team Lead – Regulatory Solutions and Fixed Income

Ria Modh, ESG Methodology Specialist – Regulatory Solutions and Fixed Income