ISS ESG’s new Climate Transition Value at Risk (TVaR) analysis highlights issuers that are struggling to cope with changing demand and the likely introduction of a price on carbon. The solution also identifies those positioned to benefit, helping investors understand the potential financial impacts of the low carbon transition on their portfolios.

The energy transition can have severe consequences for issuers left behind on climate risk management, with more and more companies joining initiatives such as the race to zero. For example, almost $68 trillion of Assets Under Management (AUM) are already pledged to be managed in line with Net Zero scenarios via the Net Zero Asset Managers (NZAM) initiative and Net-Zero Asset Owner Alliance (NZAOA). At the end of 2021, around 90% of global emissions were subject to a Net Zero target, and according to the ISS ESG climate database approximately 4,700 companies are reported to have some form of greenhouse gas (GHG) reduction target.

Asset owners and managers are taking their Net Zero pledges more and more seriously, focusing on engagement and investment in climate solutions. Carbon pricing policies are commonly used as part of regional, national, and sub-national climate strategies. According to the International Carbon Action Partnership’s 2022 ICAP Status Report, jurisdictions making up 55% of global GDP are now using Emissions Trading Systems.

The World Bank notes that only 3.76% of global emissions are currently covered by a carbon price at or above the recommended $40–80/tCO2e range, however. If Net Zero pledges and emissions reduction targets are to be achieved, and global temperature increases kept to no more than 1.5°C above pre-industrial levels, this inevitably means a fast and deep transformation of the economy, bringing transition risks and opportunities to the fore.

Analysis from ISS ESG’s Climate TVaR solution shows that as much as 11% of listed companies’ market capitalisation may be at risk in a high transition risk scenario. Carbon prices and demand change inputs are based on the International Energy Agency’s (IEA) Net Zero Emissions by 2050 (NZE2050) scenario. The NZE2050 is one of the main scenarios providing guidance to both investors and policymakers. To make informed decisions, investors and lenders need to understand the financial impact of climate-transition risks. As the next section highlights, both the potential upside and downside to portfolio value should not be underestimated.

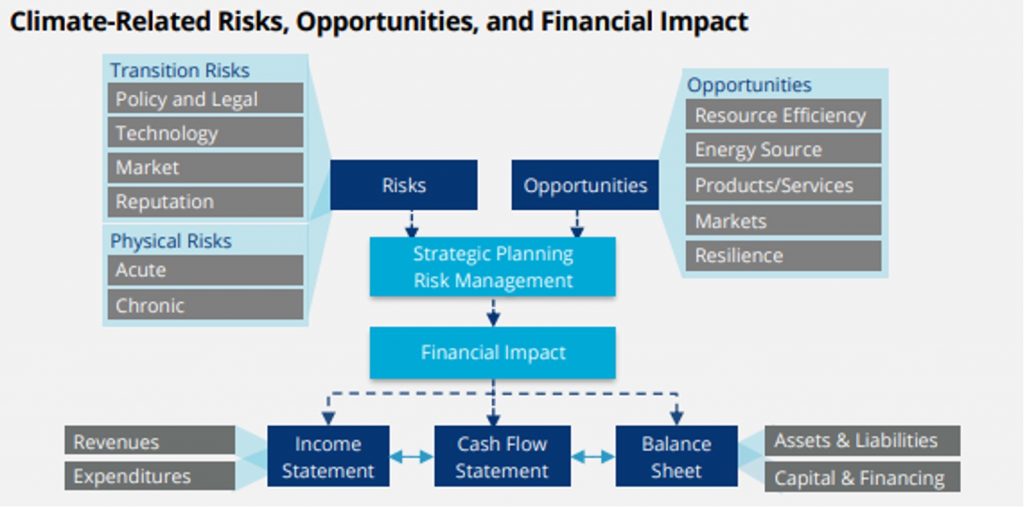

Figure 1: Climate-Related Risks, Opportunities, and Financial Impact

Source: TCFD Implementation Guidance Report, 2021

The Task Force on Climate-Related Financial Disclosures (TCFD) identifies four transition risk categories:

- Policy & Legal transition risks describe the additional costs or revenues that a company may experience because of changes in the policy environment.

- Technology risks include the potential changes in the relative demand for low carbon technologies versus fossil fuel technologies.

- Market risk often includes shifting customer behavior and changes in input costs.

- Reputation risks typically refer to increased stakeholder concerns about or stigmatization of a sector/company.

Systematically quantifying the potential impacts on companies’ financial performance of the transition to a low carbon economy provides key insights for investors looking to understand climate exposures in their investment portfolios. The ISS ESG Climate TVaR combines scenario inputs covering Policy, Technology, and Market transitions risks and opportunities, with company-specific exposure data. The analysis quantifies the potential financial impact of both transition risks and opportunities on companies and portfolios.

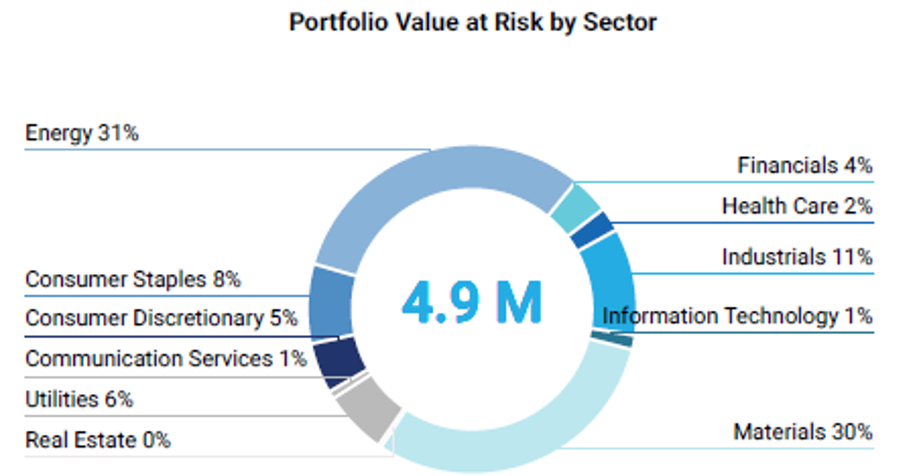

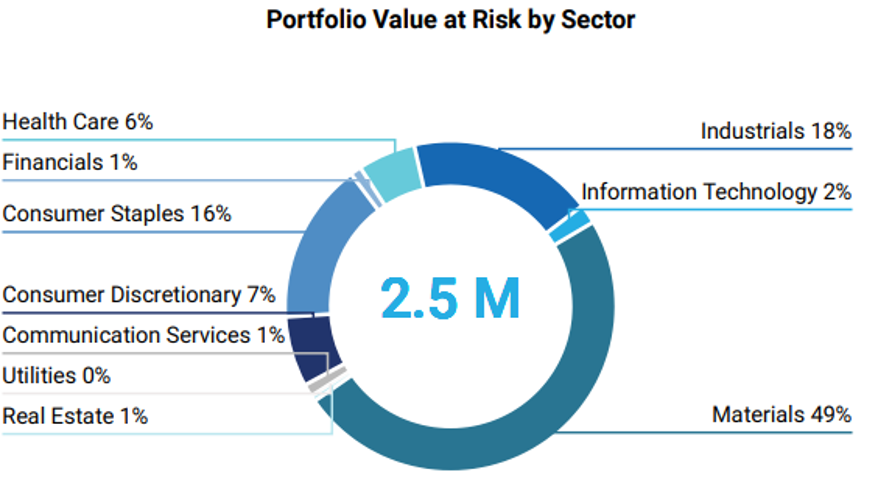

The following figures compare a large-cap global index (“the Index”) and its Paris-Aligned counterpart (“the PAB Index”). In line with expectations, the Portfolio TVaR of the PAB Index is found to be smaller than that of the Index, at almost half the value (Figure 2 below). Measuring the contribution to overall performance, the majority of the negative impact on the Index’s TVaR comes from the Materials and Energy sectors, with 31% and 30% contributions to TVaR, respectively. The PAB Index sees Materials as the single largest contributor, at 49%, followed by Industrials (18%) and Consumer Staples (16%).

Figure 2: Portfolio Value at Risk contribution by sector for a EUR 100m investment in the “Index” (left) and “PAB Index” (right)

Source: ISS ESG Climate Impact Report

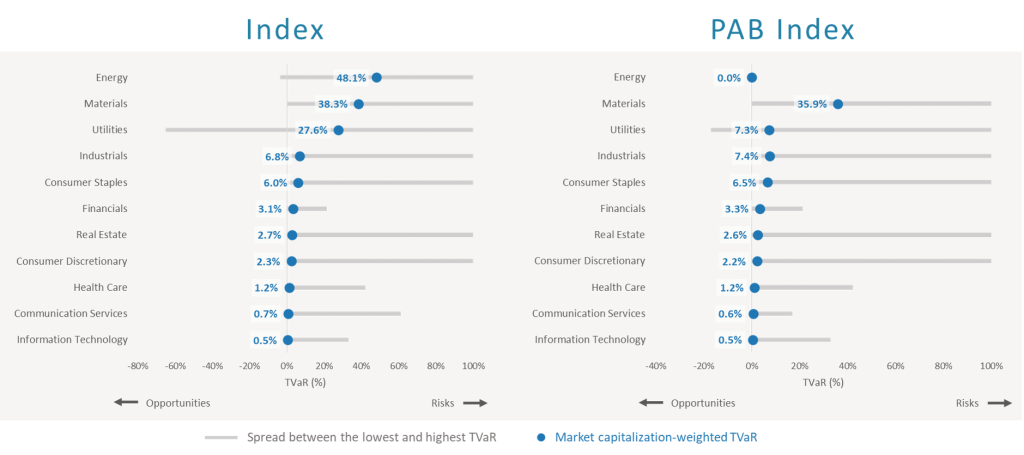

Both indices see a wide range of TVaR, and therefore, potential financial impact at the issuer level. Figure 3 displays the spread between the highest and lowest issuer-level TVaR seen per sector and the respective market capitalization-weighted averages for the two indices.

Negative TVaR is seen for companies that might experience a potential positive share price performance, seizing opportunities in a high transition risk scenario. Entities with a positive TVaR, falling on the right side, are projected to experience devaluations, and in some extreme cases, bankruptcy. While the PAB Index appears to have missed issuers with high potential upsides within the Utilities sector, the market-cap weighted average TVaR at 7.3% is, in fact, lower than that for the index, where 27.6% of market-cap on average is at risk (noting that market cap-weighted values do not reflect relevant ownership ratio or portfolio weight).

Figure 3: Market-capitalization-weighted average and spread of TVaR per sector for the “Index” (left) and “PAB Index” (right)

Source: ISS ESG

Linking potential transition impacts back to the financial health of investees is providing a long-awaited angle in investment portfolios’ climate analysis. The TCFD’s 2021 Guidance on Metrics, Targets, and Transition Plans Report, as well as the International Sustainability Standards Board’s (ISSB – consolidating the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (IIRC and SASB)) proposed IFRS Sustainability Disclosure Standards, reinforce the focus on disclosing quantified climate-related financial impacts. Investors can expect to see improving quality of climate-related disclosure from corporates, allowing for ever more sophisticated analysis while at the same time helping investors prepare to make such disclosures themselves.

Achieving Net Zero would likely require a carbon pricing mechanism to be introduced across most economies. A typical global index could see a wide range of potential financial impacts in such scenarios, ranging from an upside in share price of around 60% for companies in the Utilities sector, to possible bankruptcies across other sectors. Identifying hot spots early can help protect portfolios from downsides and inform potential engagement processes, thereby ensuring that investees are equipped to meet the future financial burden of carbon pricing as well as other transition risks.

ISS ESG’s TVaR solution helps investors assess their portfolios’ exposure to climate-related transition risks and opportunities. It provides forward-looking returns-based analysis, leveraging financial data and modelling via ISS ESG’s EVA solution, company-specific exposure data, and scenario inputs. When paired with the existing Physical Value at Risk analysis, the new service will assist investors navigate the increasingly complex requirements of global climate initiatives.

By Neda Todorova, Senior Associate, Climate R&D, ISS ESG. Benoit Billard, Analyst, Climate R&D, ISS ESG.