KEY TAKEAWAYS

- Transportation infrastructure is an opportunity for investors through both listed equities and private markets.

- Listed transportation infrastructure companies vary greatly in terms of how their outcomes support the SDGs and how they manage industry-specific risks.

- Transportation infrastructure is an opportunity for investors through both listed equities and private markets.

- ISS ESG helps our clients evaluate the sustainability of listed infrastructure equity and advises clients involved in direct project finance with a set of UN Sustainable Development Goals (SDGs) mapping tools and Key Performance Indicators (KPIs).

One of the key elements of an economy’s energy transition towards a net-zero world is a renewal of transportation infrastructure. Mobility is also a driver of global prosperity, constituting essential infrastructure. In almost all cases, transportation infrastructure has a very long-term focus. What is built today can last for centuries. Consequently, incorporating environmental and social aspects into investment decisions is key to the creation of lasting impact and avoiding the risk of stranded assets.

Integrating environmental, social and governance aspects into infrastructure financing decisions has long been a trademark of multilateral lenders like the International Finance Corporation. And while China is leading the way in terms of sovereign spending on new infrastructure, the United States has also realized that infrastructure spending is crucial to remaining competitive. Moreover, the European Union places clean mobility in the center of its Green New Deal package and the EU taxonomy has built a classification system which differentiates between “green” and “brown” types of transportation infrastructure.

Public spending packages for transportation infrastructure require high amounts of investment, and many projects are funded not only through public spending but also leverage private capital.

Transportation Infrastructure – A Sector for Impact Opportunities

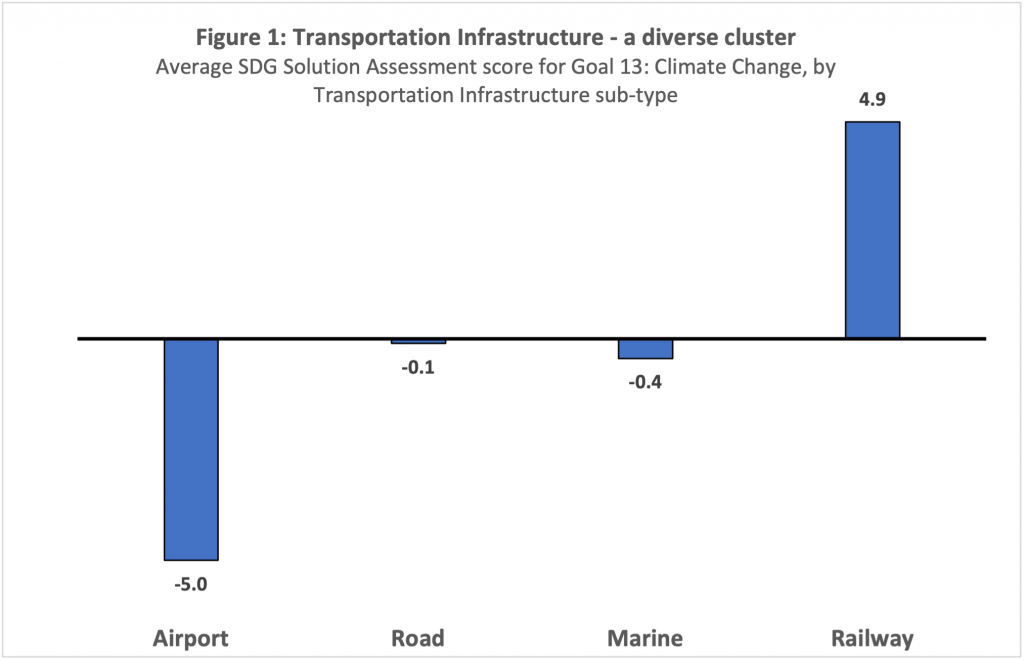

ISS ESG’s SDG Solutions Assessment, a measure of the contribution of a company’s products and services to the achievement of the SDGs, shows that transportation infrastructure varies greatly in overall impact. This is particularly relevant when looking at the potential for Goal #13: Take urgent action to combat climate change and its impacts.

Airports, for instance, support what is considered to be among the least energy-efficient forms of travel, with little potential for a greener alternative in the short to medium run.

Road transportation is more neutral in terms of different use cases. Though today mostly providing for travel supported by the internal combustion engine (ICE), electric cars and other alternative drives are gaining market share and many countries are already phasing out ICE vehicles. Some forms of road-based public transportation, like the operation of bus and coach lines, are among the most energy-efficient per passenger mile, while lorry transport allows for a high level of flexibility at the cost of higher emissions.

Source: ISS ESG

Rail, on the other hand, is a highly energy efficient way to transport freight and passengers. Today’s technology also allows for carbon-neutral operation, although in practice the national energy mix does not always provide sufficient electricity generated from renewable sources.

Marine transport is a critical facilitator of global trade, and recent cost spikes have highlighted the dependency on ocean freight of global supply chains. Marine transport offers a mixed sustainability outlook, however. Vessels carry vast amounts of containers and thus energy use and emission intensities per kilogram of goods transported are low compared to other forms of transport. One the other hand, shipping entails the emission of a high volume of emissions, including black carbon, nitrogen oxides, and nitruous- and sulphur-oxide emissions that are associated with acidification and particulate matter. The industry has only recently begun to respond to these issues. Moreover, specialized marine shipping infrastructure, like dedicated coal terminals, support (and can in turn be reliant on) a carbon-intensive economy.

Managing Risks

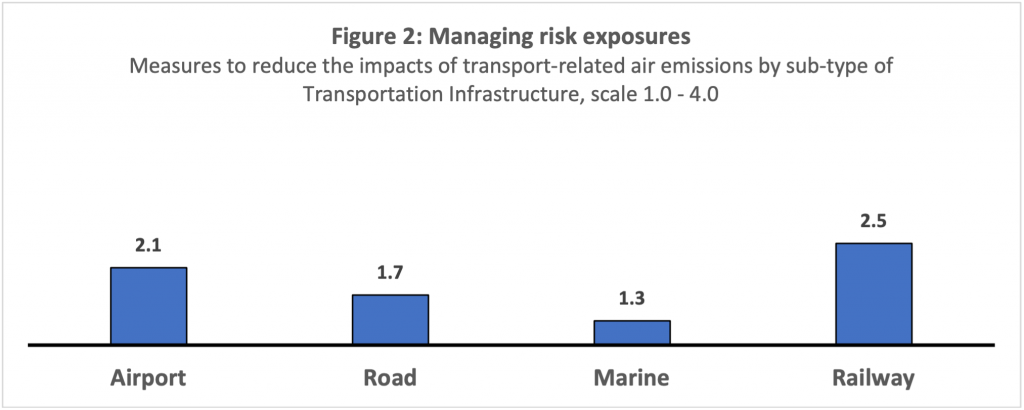

While the environmental and social impacts of a given type of transportation infrastructure will vary, operators are able to mitigate negative impacts by improving their active risk management. Figure 2 shows the results of an assessment of how operators are tackling transport-related air emissions, a key factor when determining a company’s climate change risk, which itself is a key topic for infrastructure operators.

Source: ISS ESG

While Figure 1 showed that airports are assessed as offering obstacles to the achievement of SDG 13: Climate Change, Figure 2 above points to the fact that airports are taking active steps to tackle the issue. Airport operators tend to be more transparent than other types of transport-related companies, and some have even begun to monitor their scope 3 emissions, showing that direct emissions from the operation of the airport is negligible. For example, Airport Zurich numbers from 2019 (pre-COVID-19) show most air emissions are caused from the operated aircraft. This is underlined by the increasing number of airports joining the Airport Carbon Accreditation programme, which mandates that higher level accreditation be associated with the inclusion of emissions from all aircraft’s full flights (i.e. cruise, climb and descent) in airport emissions reporting.

While 80% of reporting airports are implementing measures that go beyond first steps in terms of addressing air emission impacts from transport, this can only be said for 40% of reporting road operators. Notably none of the assessed marine port operators are able to make this claim, despite international efforts including amendments to the MARPOL Convention and resolutions by the Marine Environmental Protection Committee.

The performance of road infrastructure is mostly linked to the development of alternative drives, although only one third of assessed companies are engaged in either environmental-related toll initiatives or the provision of infrastructure for electric vehicles (or both).

Rail operators, however, are clear leaders in terms of energy-efficiency, with most operators demonstrating steps or strategies to increase the share of electrified tracks to help tackle climate emissions, as renewable energy comes online.

While the above information is based on industry averages, it should be noted that overall grades will also vary from company to company. ISS ESG analysis and data helps clients identify those listed operators which are on track to meet upcoming regulatory requirements and are therefore future-proofed as a net-zero world approaches.

This report has focused on climate-related impacts, but it is important to note that for a truly holistic view of sustainability for the transport industry, there are further key issues to be considered such as labor rights, biodiversity, and governance issues like corruption.

Direct Investing in Infrastructure

Infrastructure assets can be a lucrative investment area, since they tend to provide non-cyclical and stable cash flows for investors. In a market dominated by public enterprises, investment opportunities in listed equities are limited. There is currently a large appetite for infrastructure development requiring significant investment, so we can expect to see increased opportunities for public and private joint initiatives. As shown above, the ESG challenges for transportation infrastructure assets vary greatly, however.

Direct investors in infrastructure projects, led by regulatory requirements, market standards and their own sustainability aspirations, are increasingly willing to manage their ESG risks more systematically. This is trend should be supported by the fact that many ESG-related practices, such as safety due diligence reviews, are industry standard, and that high-risk projects have faced ESG risk management industry standards such as the Equator Principles for many years.

ISS ESG’s bespoke service offers SDG mapping and scoring on ESG-related KPIs for more than 80 types of infrastructure, including airports, ports, road and railway assets, and advises clients on specific projects with regard to sustainability challenges.

Conclusions

Transportation infrastructure is at the center of large spending packages throughout the world, and there are potentially many opportunities for leveraging private capital. Through the lens of the UN SDGs, business models and transport types vary greatly in their positive and negative impact. Managing ESG risks adequately will continue to be a key variable in the investment equation, however, as infrastructure can carry outsized sustainability risks, including that of being a stranded asset.

For equity and direct investors alike, using ESG data and research and integrating it systematically into investment decisions provides an opportunity to contribute to the development of modern and sustainable transportation infrastructure at the same time as securing stable financial returns.

Explore ISS ESG solutions mentioned in this report:

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Anja Schuch, Sector Specialist Transportation Infrastructure, ISS ESG. Hendrik Leue, Head of Bespoke and Advisory Research, ISS ESG.