Key Takeaways

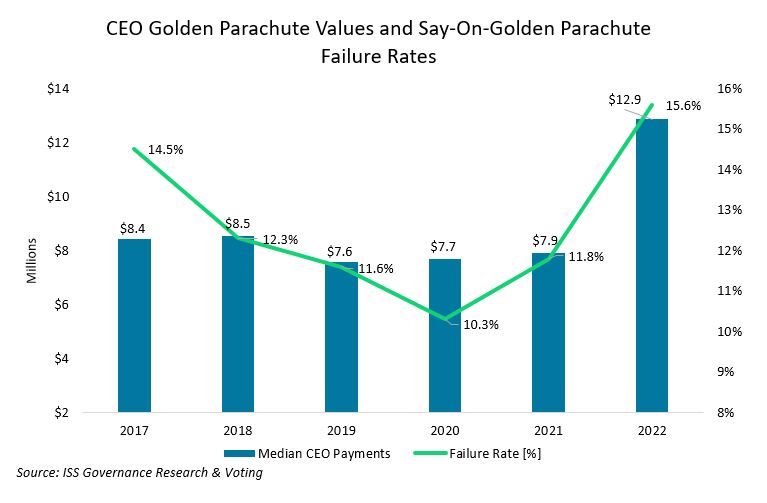

- The U.S. golden parachute vote failure rate remained relatively steady from 2017-2021 but increased significantly in 2022.

- The median CEO golden parachute value also increased significantly, from $7.9 million in 2021 to $12.9 million in 2022.

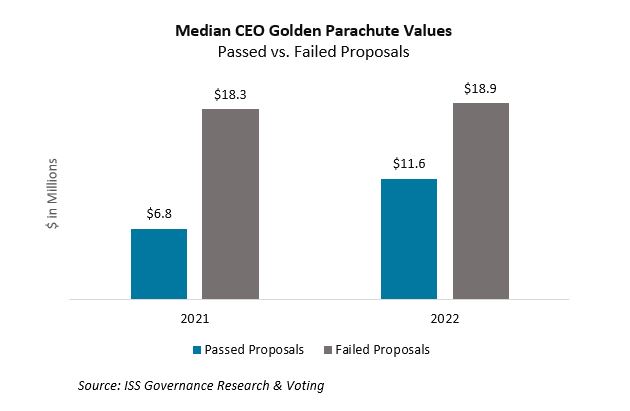

- Median total golden parachute values for failed proposals were considerably higher than passing proposals.

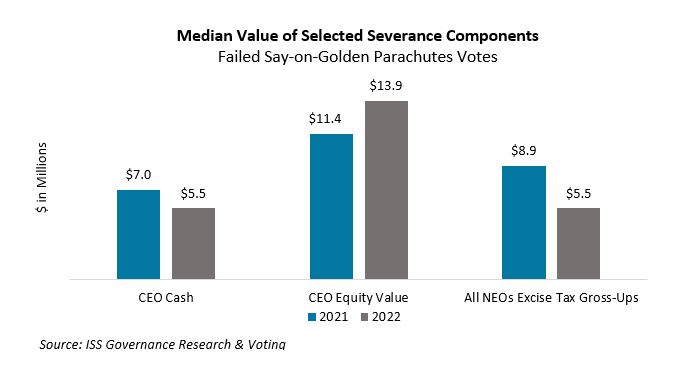

- Equity values represented a higher proportion of total CEO parachute values for failed golden parachute proposals at 63.4% of total payment in 2022 compared to 52.9% in 2021.

Introduction

A U.S. say-on-golden parachute proposal is an advisory shareholder vote on compensation that becomes payable to Named Executive Officers (NEOs) as a result of a change-in-control event. These votes typically accompany a merger, business combination, or other transaction, and they provide shareholders a say on transaction-related executive compensation payments, similar to a say-on-pay vote at an annual shareholder meeting. Like a say-on-pay vote, the golden parachute vote is advisory in nature and its passage is generally not required for the underlying transaction to occur.

The golden parachute disclosure rules require that companies disclose in tabular form an estimation of the total value of the NEOs’ cash severance, accelerated equity, continuing perquisites or benefits, pension or other non-qualified deferred compensation, excise tax payments, or any other payments (such as a retention bonus or a transaction bonus). Cash severance payouts and equity acceleration benefits may take many forms including:

- Single trigger: cash severance or equity vesting occurs automatically upon a change in control;

- Double trigger: a qualifying termination must occur in connection with a change in control in order for payouts to be made or equity vesting to occur; or

- Modified single trigger: a voluntary resignation in connection with a change in control may trigger cash payouts or equity vesting.

Companies disclose how each NEO’s cash severance is determined, which is typically calculated based on a multiple of annual base salary and/or annual bonus. Companies also disclose the outstanding equity awards held by executives, which can also have single-, double-, or modified single-trigger vesting provisions. The treatment of performance equity awards is also disclosed, including whether the award was prorated and at what performance level the equity will vest.

While a merger proxy includes details regarding the golden parachutes of all named executive officers, the analysis below focuses on the CEO’s golden parachute arrangements, as these are typically the largest component of a company’s golden parachute payments and receive greater scrutiny from investors.

Golden Parachute Failure Rates

Recent Golden Parachute Failure Rates Increased Amid Spike in Golden Parachute Magnitude

The number of US corporate change-in-control transactions that came to a vote with a golden parachute proposal has remained stable from 2017 to 2022, ranging from 146 to 178 proposals, with the exception of 2020 which had only 87 proposals (undoubtedly due to the start of the COVID pandemic). From 2017 to 2021, median CEO golden parachute values did not significantly fluctuate, ranging between $7.5 million and $8.5 million. The say-on-golden parachute failure rate dropped to a low of 10.3% in 2020 but remained between 11.6% and 14.5% during the rest of that timeframe.

2022 saw a shift in both areas, however. Golden parachute values spiked in 2022, with the median CEO golden parachute up to $12.9 million, a 62% increase over the prior year’s value of $7.9 million. Along with the increase in CEO golden parachute value, the failure rate on say-on-golden parachutes also increased to a six-year high of 15.6%, compared to the prior year’s value of 11.8%. Shareholders appear to be mindful of the total golden parachute magnitude and may be voting against golden parachute proposals on this basis.

Golden Parachute Values for Failed vs. Passing Votes

Median Total Golden Parachute Values Were Considerably Higher for Failed Votes

The median total CEO payment values for failed say-on-golden parachute proposals in 2021 and 2022 were similar at $18.3 million and $18.9 million, respectively, but in both years proposals that passed had significantly higher than median total CEO payment values ($6.8 million and $11.6 million in 2021 and 2022, respectively). This stark contrast in median values strongly suggests that golden parachute pay magnitude is an important voting factor for a significant number of investors.

Equity Values in Golden Parachutes

Equity Values Comprised a Larger Percentage of Golden Parachutes in 2022

A breakdown of pay components for failed say-on-golden parachute proposals indicates that equity value represented a larger proportion of total CEO parachute payments in 2022 compared to the prior year. The median value of accelerated equity for CEOs increased by 22%, from $11.4 million in 2021 to $13.9 million in 2022. Equity values for 2022 accounted for 63.4% of the total CEO payments in such cases compared to 52.9% in 2021.

Meanwhile, the median value for CEO cash severance payments among failed proposals reduced 20.5% year-over-year, from $7.0 million in 2021 to $5.5 million in 2022. In addition, the median value of excise tax gross-ups payable to all NEOs at companies with failed golden parachute proposals reduced from $8.9 million in 2021 to $5.5 million in 2022. Excise tax gross-ups, which are payments to executives to cover any excise tax triggered by an excess parachute payment, can lead to substantial increases in potential termination payments. Shareholder opposition to excise tax gross-ups has led most companies to eliminate them and are considered a problematic pay practice. The year-over-year decrease in the value of such payments may be a positive indication that companies are continuing to move away from this practice.

Problematic Equity Practices

Problematic Equity Practices Topped the List of ISS Benchmark Policy Concerns identified in 2022

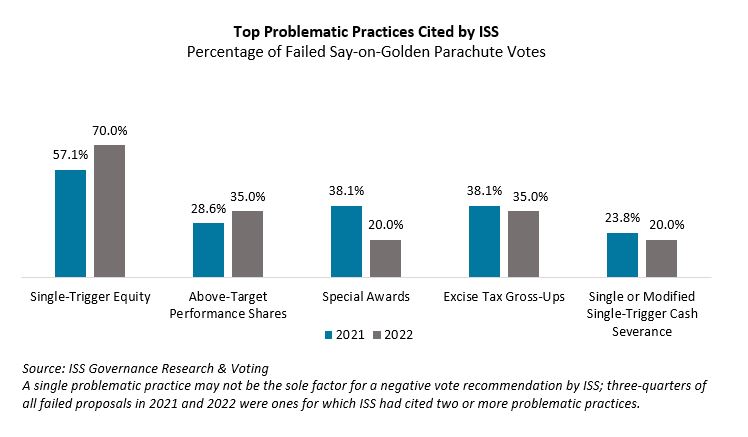

ISS recommended votes “against” 34.4% of all golden parachute proposals under U.S. Benchmark Policy in 2022, an increase from 28.7% in 2021. Single-trigger equity acceleration was the most commonly identified concern in recommending against golden parachute proposals that ultimately failed to receive majority support, in both 2021 and 2022. The percentage of all failed votes with single-trigger equity vesting increased significantly year-over-year, from 57.1% in 2021 to 70% in 2022. In each case, single-trigger equity vesting was not the sole concern identified; ISS cited multiple concerns in three-quarters of all failed golden parachute proposals in both 2021 and 2022.

The second most common problematic practice identified by ISS in 2022, at 35% of all failed votes, was the acceleration of unvested performance shares above target levels, without a compelling rationale – i.e., cases where vesting was not based on actual performance and insufficient rationale was disclosed for above-target vesting. Of the seven cases where above-target acceleration of performance shares was cited as problematic in 2022, six of those were in conjunction with single-trigger equity vesting. The 35% of 2022’s failed votes where above-target acceleration of performance shares was cited by ISS represented an increase over 2021, when 28.6% of all failed votes cited this reason. Such above-target vesting, particularly at maximum levels, can significantly elevate overall golden parachute payouts.

Excise Tax Gross-Ups, Special Awards and Problematic Cash Severance Provisions

Additional Concerns Included Excise Tax Gross-Ups, Special Awards, and Problematic Cash Severance Provisions

The payment of excise tax gross-ups continued to be a common concern cited by ISS in both 2021 and 2022 golden parachute proposals that failed. Many investors have disfavored this practice for years, leading most companies to adopt policies that prohibit gross-ups. In 2022, ISS cited excise tax gross-ups as a concern in 35% of all golden parachute proposals that failed, down slightly from 38.1% in 2021. Problematic special awards, which included transaction or retention bonuses that were outsized or paid on a single-trigger basis, were cited less often as a concern in 2022, at only 20% of all failed votes compared to 38.1% in 2021. Finally, single-trigger or modified single-trigger cash severance (not including special awards) were cited in 2022 at 20% of all failed proposals, a slight decrease from 23.8% in 2021.

Conclusion

The 2022 spike in the median CEO golden parachute value coincided with an increase in the say-on-golden parachute failure rate. The magnitude of golden parachute payments appears to be a significant factor in many investors’ voting decisions, further highlighted by the stark difference in median golden parachute values between failed and passing proposals. For failed proposals in 2022, the average value of cash-based payments declined while equity values represented a higher proportion of total CEO parachute payments compared to 2021, and problematic equity acceleration emerged as a more prevalent concern. Concerns identified in 2022 point to potential issues with single trigger acceleration, coupled in some cases with above-target acceleration of performance shares; in other words, the conditions in which CEOs would receive a significant portion of their golden parachute payments – on a single-trigger basis with potentially enhanced amounts – likely played a role in the increase in the say-on-golden parachute failure rate in 2022. The treatment of equity in severance packages, coupled with increasing magnitude, remains an area of significant concern for many shareholders and that ISS will continue to monitor.

By: Jolene Dugan, Chris Scoular