In 2025, the Textiles & Apparel industry will continue to be exposed to multiple challenges. It has had to grapple with cautious consumer spending and a quickly shifting geopolitical context. In addition, several jurisdictions are applying increasing regulatory pressure to address the growing environmental and social impacts of the industry. In a recent methodology update, the ISS ESG Corporate Rating for the Textiles & Apparel industry has been reviewed to reflect some of these trends and developments.

Challenges for the Textiles & Apparel Industry

An Uncertain Trade Environment

The fashion industry has been faced with low growth in recent years. International trade is also becoming increasingly volatile amid the prospect of new tariffs. With its complex global supply chains, the Textiles & Apparel industry is especially affected by this development. As China continues to be the world’s major exporter of apparel, accounting for 37.5% of total exports in 2023, tariffs on goods coming from China will likely require companies to rethink their sourcing strategies.

Fashion’s Environmental Impacts

The Textiles & Apparel industry is a major contributor to climate change, and the industry’s environmental impact is increasing. By conservative estimates, the greenhouse gas emissions of the industry amount to between about 2% and 4% of all greenhouse gas emissions. Assuming business-as-usual growth, industry emissions are projected to increase by more than 40% by 2030, when they would need to decrease by almost 45% to stay within a 1.5°C trajectory.

Reducing industry emissions may be especially challenging because global apparel production has grown significantly since the advent of fast fashion. Global fiber production has more than doubled since 2000 and reached an all-time high of 124 million tons in 2023. This is expected to rise to 160 million tons in 2030 if current trends continue. Polyester has contributed significantly to this growth, replacing cotton as the world’s most widely used fiber since the mid-to-late 2000s.

While polyester is affordable, versatile and easy-to-wash, its environmental impact is a concern: virgin polyester is petroleum-based and therefore comes from a non-renewable source, and its production is very energy intensive. Apparel made from petroleum-based fibres is also a major source of microplastic pollution of oceans and terrestrial ecosystems.

The industry faces a significant waste problem: with the rise of ultra-fast fashion, textiles and apparel products are discarded ever more quickly, and mostly end up in landfill at the end of their short lives. The development of scalable and affordable recycling technologies remains a challenge for the industry.

Of total fibers currently produced, roughly 8% come from recycled sources. Recycled polyester from PET (a type of polyester processed into plastic) bottles accounts for the large bulk of all recycled fibers.

While the production of recycled polyester from PET bottles uses fewer resources than virgin polyester, some experts do not regard it as a truly circular solution. A criticism of recycling polyester from bottles is that the fashion industry is using waste from the food and beverage industry without tackling its own waste problem. Further, this practice is impeding the circularity efforts of the beverages industry.

Plant- and animal-based materials, such as cotton and leather, and man-made cellulosic fibers such as viscose also come with high biodiversity risks and impacts related to land use, deforestation, water use, and chemical use.

Regulatory Momentum Increasing

There has been increasing momentum for sustainability regulations in several jurisdictions around the world, which will also significantly affect the Textiles & Apparel industry.

In 2022, the European Commission adopted the EU Strategy for Sustainable and Circular Textiles in the context of the European Green Deal. The strategy considers the entire lifecycle of textile products and includes the setting of design requirements for textiles to make them last longer and be easier to repair and recycle, as well as requirements on minimum recycled content.

As part of the strategy, the EU Commission has proposed mandatory and harmonized Extended Producer Responsibility rules for textiles in all member states, which make producers responsible for covering the costs for the management of textile waste and incentivizes the reduction of waste and the circularity of products. Further, EU policymakers have recently decided to introduce a direct ban on the destruction of returned or unsold textiles and footwear products, which will come into effect in 2026.

In the United States, California passed the California Responsible Textile Recovery Act in September 2024, a landmark bill that introduces Extended Producer Responsibility (EPR) for textile waste and thereby holds producers responsible for costs associated with a product’s entire life cycle, including waste management.

Introduced in 2022, the New York State Fashion Sustainability and Social Accountability Act (Fashion Act) aims to enforce stringent environmental and human rights due diligence among fashion companies, impacting those selling products in New York. If passed, it would require companies with over $100 million in global revenue to map their supply chains across four tiers, set science-based targets for reducing greenhouse gas emissions, and manage chemical usage transparently. Currently this act is in the senate committee.

At the same time, companies need to be mindful not to exaggerate sustainability claims, as there is an increased crack-down by regulatory bodies to avoid ‘greenwashing’. In the United Kingdom, the Competition and Markets Authority secured a settlement in March 2024 that commits the fashion retailers ASOS, Boohoo, and George at Asda to change the way they display, describe, and promote their green credentials.

Textiles & Apparel and the ISS ESG Corporate Rating

The ISS ESG Corporate Rating can assist investors concerned with ESG issues in the Textiles & Apparel industry such as described above. For example, the Rating contains a comprehensive section on supply chain management. Companies that have a better understanding of their supply chains are also able to react to shifts along global supply chains more effectively. Further, regulatory developments, existing and emerging disclosure standards, increasing stakeholder expectations, academic research, and scientific and technological developments are regularly considered in periodic methodology reviews of the ESG Corporate Rating. Recent methodology updates with implications for the Textiles & Apparel industry are discussed below.

New Methodology

The methodology review of the Textiles & Apparel industry took place in the second half of 2024 and led to some changes at the key issue and topic level. The five key issues for Textiles & Apparel are deemed most material for the industry and account for most of the overall weight of Rating indicators.

Box 1: Key Issues of the Textiles & Apparel Industry

Source: ISS ESG

Climate Change

As the Textiles & Apparel industry is a major contributor to greenhouse gas emissions and therefore is heavily exposed to climate transition risks, climate change has been added to the five key issues of the industry.

Responsible Sourcing

Another major focus of the methodology review has been the responsible sourcing of raw materials. To account for the increasing use of petroleum-based synthetics such as polyester, the assessment approach has been adapted and now differentiates more strongly between whether a company makes use of textile-to-textile recycled fibers or sources recycled fibers derived from PET bottles. The methodology also assesses whether a company has a strategy in place to promote the use of bio-based, renewable synthetics.

Regenerative Agriculture

While the EU Regulation on Deforestation-free Products does not directly apply to apparel and footwear producers in the first place, there is increased scrutiny around the social and environmental risks and impacts of raw material sourcing along the value chain. Related methodology changes therefore include extending due diligence requirements to avoid deforestation to additional raw materials such as rubber.

Most companies in the industry rely heavily on agricultural raw materials, such as cotton, as input material. The topic of regenerative agriculture has therefore been added, in line with the Corporate Rating approach in the Food Products industry.

Circular Economy

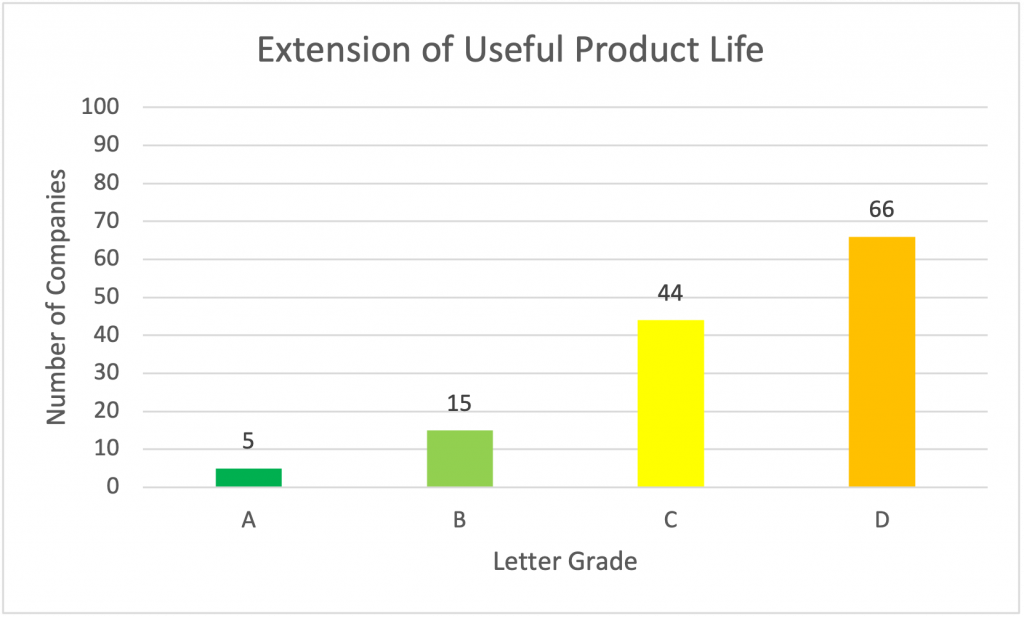

The concept of the Circular Economy has long been one of the key issues in the industry. The related Corporate Rating indicator “Extension of useful product life” assesses whether companies integrate Circular Economy principles such as reusability, recyclability, and longevity in design guidelines, use textile-to-textile recycled materials in their products, support the development of circular infrastructures, provide repair services to their customers, or develop alternative business models based on the rental or sale of used products.

To reflect the current regulatory changes and recent controversies, the indicator will also assess, going forward, whether a company takes measures to avoid the destruction of unsold inventory. Having a strategy in place on Circular Economy not only prepares companies for regulations such as the EU Strategy for Sustainable and Circular Textiles, but also creates opportunities for upcoming business models and materials innovation. Further, smarter inventory management to reduce the number of unsold products can not only reduce overproduction and related waste emissions but may also contribute to higher profitability.

As Figure 1 below depicts, a substantial majority of companies in the industry score low on this indicator. The average industry grade is C- (on a scale from A+ to D-).

Figure 1: Distribution of Textiles & Apparel Companies by Extension of Useful Product Life Score

Notes: Figure covers 130 Textiles & Apparel companies.

Source: ISS ESG

Conclusion

Textile and apparel brands are under pressure to meet increasing regulatory expectations while at the same time having to grapple with a difficult market environment and potential supply chain disruptions. The ISS ESG Corporate Rating can help investors to identify companies that are well prepared not only to manage the challenges but also to grasp the opportunities related to these developments.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By:

Lisa Häuser, Vice President, Corporate Ratings Research, Consumer Sector, ISS ESG

Piyush Ujawane, Analyst, Corporate Ratings Research, Consumer Sector, ISS ESG