ISS Market Intelligence has released the latest edition in the Windows into Defined Contribution series. The Q2 2023 edition covers recent trends in the advisor-sold defined contribution (DC) market, focusing on the relative sales experienced by mutual funds and collective investment trusts (CITs).

Mutual funds face competition on many fronts, as alternative structures seek to take the market share held by this prominent legacy vehicle. ETFs have aggressively taken share in retail and intermediary markets. Within the defined contribution channel, collective investment trusts have assumed an increasingly important role, even going so far as to account for a plurality of DC assets as of the end of 2021. This has come primarily at the top end of the market, such as through plans with more than $1 billion in total assets. Recently released information from ISS BrightScope’s NEXUS consortium, which is sourced from 44 asset managers and recordkeepers and primarily covers advisor-sold activity in the small- to mid-sized plan market, underlines some of the difficulty the vehicle has had in moving down market.

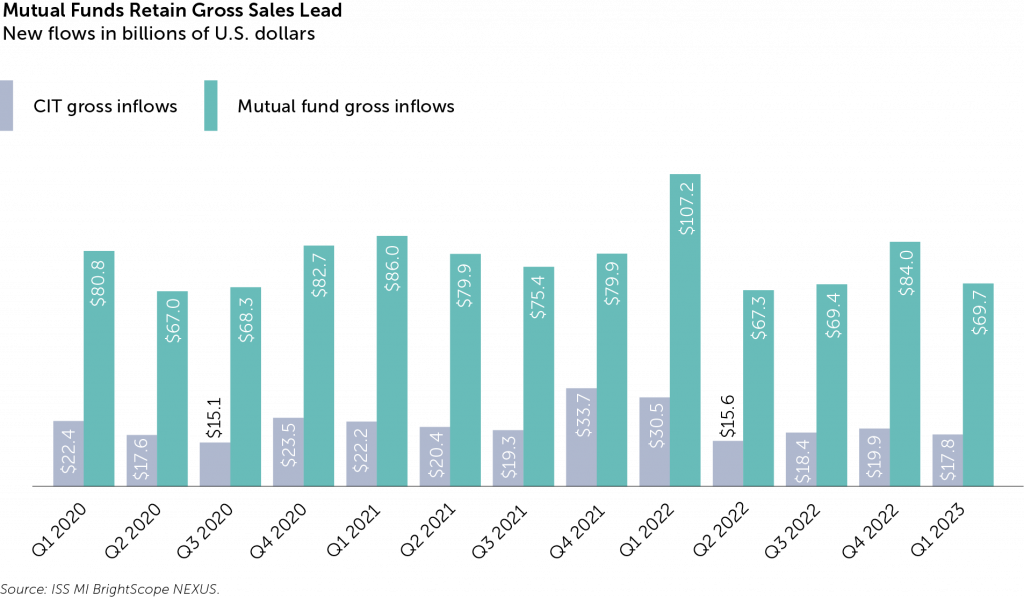

Among consortium members, mutual funds make up a larger portion of assets and gross inflows. The table below demonstrates that aggregate advantage for mutual funds, displaying quarterly gross inflows for funds and CITs since the beginning of 2020. The more fragmented nature of the advisor-sold market represented by NEXUS has helped mutual funds hold on as a default choice, as CIT providers must seek out a larger number of plans to account for the same level of assets. While CITs can provide lower fees for larger plans operating in a more consultant-driven market, many smaller plans may not meet the asset threshold to incorporate them. The large number of options for asset classes and investment styles offered by a multitude of players allows the mutual fund to still fit many DC use cases. CITs in the advisor-sold market have narrowed the sales gap on a net basis but encountered greater whipsaws in demand across 2022.

2022 Headwinds

Market developments in 2022 led to substantial declines in performance and prompted significant investor withdrawals. The open-end funds industry, for example, witnessed the sharpest period of active withdrawals in history. While retirement savers invest for the long-term and are frequently consistent contributors, the scale of losses on many account balances had a noticeable effect on investor and advisor behavior.

The second quarter of 2022 in particular weighed on both funds and CITs following the onset of the Federal Reserve’s campaign to raise interest rates. The two structures witnessed $20 billion-plus swings in quarterly net demand, but annual net flows strongly diverged between the two. Mutual funds were able to increase net flows from $36.5 billion in 2021 to $43.3 billion in 2022. Conversely, CITs fell from positive flows of $17.6 billion in 2021 to outflows of $10.4 billion over the past year. The composition of outflows suggested a tactical reallocation for funds, while CIT redemptions depicted a greater pullback in this market.

The full report is available to Simfund Enterprise subscribers for access on the Simfund research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence