Passive Products Take Majority of DC Managed Assets

ISS Market Intelligence has released the latest edition in the Windows into Defined Contribution series. The Q2 2024 edition explores the active and passive landscape across professionally-managed assets within the defined contribution (DC) space.

Passively-managed options have made substantial strides in increasing their market share throughout the investment management landscape. Assets under management in index products surpassed those of active strategies in the long-term mutual fund and ETF market in December 2023. While product trends in the defined contribution space often trail those of the retail and intermediary markets, data from the ISS MI BrightScope Defined Contribution Plan database demonstrates that passive strategies took a majority of managed assets even earlier among retirement plans, driven strongly by movement into collective investment trusts (CITs).

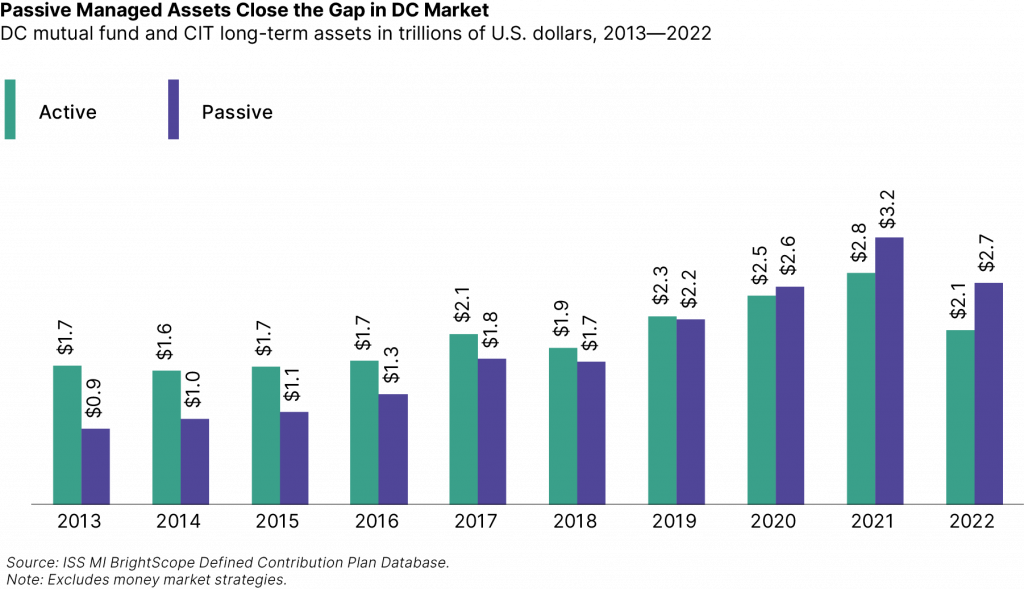

Certainly, the lower cost of passive options has been a key factor in their growth. The popularity of index investing in the long-term market has been strongest within ETFs, which provide additional structural cost savings alongside aggressively competitive management fees. The importance of cost is raised within the retirement space, where concerns about high costs can more easily lead to litigation. Assets in passive mutual funds and CITs have witnessed strong growth throughout the last decade, closing the market share gap with active funds on DC plans. They ultimately took the lead in 2020 and cemented that lead in the following years, as seen in the table below. (The BrightScope DC plan database is sourced from Form 5500 filings with the Department of Labor, which are made by retirement plans with at least 100 participants.)

The rising passive share has occurred across multiple vehicles. The largest shifts, however, have stemmed from CITs. The vehicle, like ETFs, has been able to build on passive’s cost advantage via structural features, eliminating the costs of registering with the SEC and offering customized fee schedules. CITs have accounted for a majority of passive DC assets since 2014 and grew to 61% by the end of 2022 for a total of $1.6 trillion in AUM.

This has come together in a rather top-heavy manner. The largest DC plans make the heaviest use of CITs, as they possess the requisite scale to negotiate the most attractive fee schedules with CIT providers. This representation among large plans has prompted a drastic shift in total assets while accounting for a much smaller portion of plans. At the market’s peak in 2021, a mere 5,885 plans featured an index CIT option, compared to over 58,000 DC plans that included a long-term active mutual fund option.

The full report is available to subscribers on the MarketSage research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Alan Hess, Vice President, U.S. Fund Research, ISS Market Intelligence