In 2010, ISS ESG’s head of Climate Solutions Max Horster started one of the first companies to measure the impact of climate change on investments. From investment carbon footprinting to climate scenario analysis, from climate-linked proxy voting to climate neutral investments via offsets: over the years, the team pioneered a wide range of today’s leading methodologies and approaches across all asset classes. In 2017, Max and his team joined ISS ESG to form the first climate specialist unit of a global ESG service provider. Today, they cover over 25,000 issuers on up to 600 individual climate-linked data points and have screened over USD 4 trillion of AUM on their climate risks and impact. On the occasion of its 10th anniversary, the ISS ESG Climate Team shares 10 lessons from 10 years of helping investors to tackle climate change.

Lesson 10: Climate Change is shaking up the debt world

Fossil fuel divestments, climate tilted equity strategies, climate engagement, climate voting: for the last 10 years the financial market’s climate focus has been predominantly on one sub group of financial market participants: investors. More specifically, equity investors. The logic is compelling: the owners of climate polluting companies have a responsibility, as well as the ability, to change the company’s profile. Ownership matters.

The result of this focus has been that a large part of the financial sector remained under the radar when it came to climate change – debt investors, and especially lenders. This is changing, and the scope of climate action in finance is widening at breathtaking speed, from equity to debt and from investors to financiers.

The argument behind this shift is also compelling, although not necessarily fully embraced yet. Equity investors can only impact the real economy if they engage or make use of their vote. Divesting alone does not directly move the needle on climate change. Lenders, on the other hand, can abstain from providing capital to climate-problematic business models. If many do that, it will drive up the cost of capital for these companies, which might force them to transition their business model. This logic of “debt denying” is understood since quite some time, but it is only now that it starts unfolding.

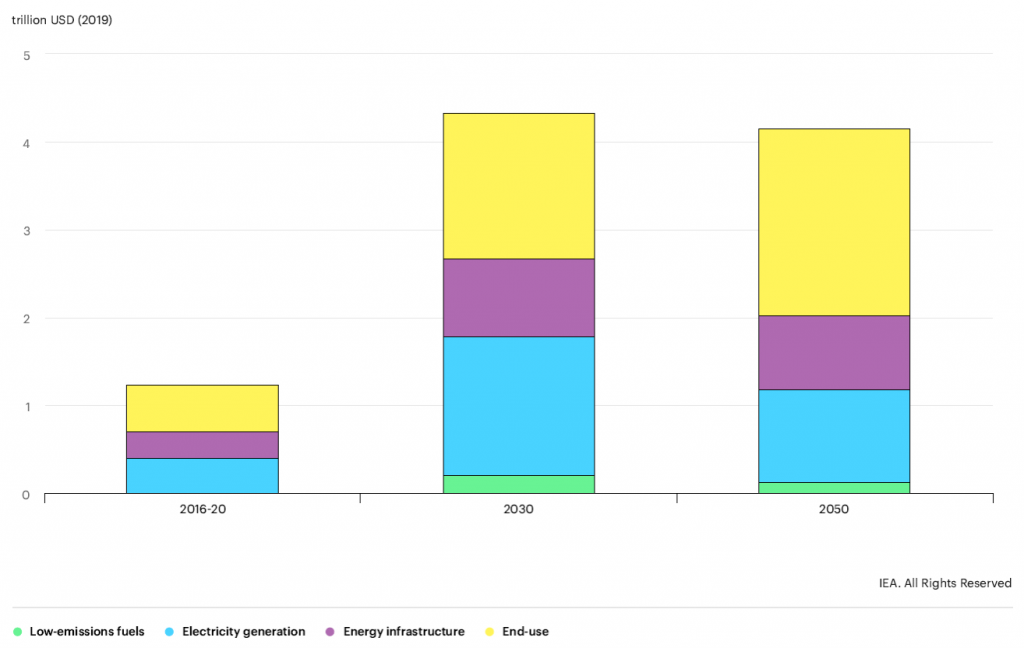

There is also a more positive aspect of action in this arena than simple denial. The transition to a climate-friendlier world needs capital. Public equity investors don’t provide such capital to the real economy, lenders do. So lending done right means financing the Net Zero transition. This puts the lender in focus. And, as the International Energy Agency has recently noted, it opens up enormous opportunities for investment in climate-friendly business:

Source: IEA, Clean energy investment in the net zero pathway, 2016-2050, IEA, Paris https://www.iea.org/data-and-statistics/charts/clean-energy-investment-in-the-net-zero-pathway-2016-2050

All of this is not new. It has been tried and tested in a sandbox that is still just a small, but exploding part of the debt world: green bonds and their offspring. What started as an idea by the Worldbank to raise capital ringfenced for green projects in 2010 has become a whole new asset class 10 years later, reaching a cumulative volume of $1.05 trillion at end of 2020. The green bond market has moved beyond a focus on the refinancing of green activities, and has now evolved into supporting the achievement of debt issuer’s social, sustainable and even COVID-19 relief agendas. We are seeing new and creative approaches to leverage the dynamics of debt with a purpose.

The first generation of green bonds saw considerable discussion on real world impacts, and more recent issuances have widened and deepened this conversation. The widening comes in the form of coverage of topics: social bonds, blue (ocean protecting) bonds and other sustainable bonds follow the logic of raising capital for ring-fenced purposes. The deepening is methodological – how to operationalize real-world betterment in exchange for less costly capital?

There are, in essence, two approaches. One that makes capital cheaper if a company already achieves or will achieve better climate performance, and one that makes companies agree to additional payments to bondholders if they don’t achieve certain targets. In the latter approach, the capital raised is no longer tagged to a specific use of proceeds, but available for general corporate purposes, with KPIs committed to and the coupon of the bond linked to their achievement. For example, LafargeHolcim has opened up the sustainable debt market to the cement industry in 2020 by tying its bond issuance with an ambitious science-based decarbonization target, followed subsequently by other companies in its sector.

Green bonds are of course only a small proportion of the overall debt market, even if we take into account next-generation diversified impact-focused bonds. While listed debt provides a certain level of transparency, it is the opaque world of international bank loan books which, behind their impenetrable walls of banking secrecy, we might find the finance needed for global action on climate change. One can observe quite a bit of product development here that aligns with green bonds. Take green lending for example – the space is small but growing. Even if 2020 appeared to be a quieter year for sustainable syndicated loans, close to $200 billion was raised that year, with loans going into both dedicated ring-fenced specific use of proceeds as well as KPI-linked structures.

The urgency of the climate emergency means that the time for voluntary bank action has passed, however. Integrating climate change considerations into lending practices is rapidly becoming mandatory around the world. The European Central Bank (ECB), for example, is rolling out climate stress tests for potentially thousands of banks. Frank Elderson, an executive board member at the ECB, emphasizes how serious they are:

“Where we see that banks are not managing their exposures to climate-related risks in an adequate manner, we can and will draw on the full supervisory toolkit at our disposal to correct that situation.”

And there is no place to hide – Banque de France has just concludes a climate stress test pilot and the Bank of England is also launching a “climate biennial exploratory scenario” for its supervised institutions in 2021. Authorities in Australia, Brazil, Canada, Hong Kong and Singapore have announced climate stress tests for banks and insurers in 2021 and 2022.

While stress tests are typically framed as proving stability of the institution and ultimately the financial system, many of the climate stress test draft methodologies have a climate impact angle baked in. The question will be not just how far climate change effects and regulation might impact the bank’s stability, but also how far a bank impacts the climate system’s stability.

With Net Zero pledges proliferating globally, there is a chance that corporate access to capital will require climate transparency in the future. This will not only accelerate the business of Green Bonds &Co. – it will also revolutionize banks’ lending practices. Or, as the most famous (albeit not green) of all bonds, Bond himself, would characterize climate effects on the debt and lending world: it will be “shaken, not stirred”.

By Dr. Maximilian Horster, Head of Climate Solutions, ISS ESG. Mélanie Comble, Senior Associate, ISS ESG